General Discussion

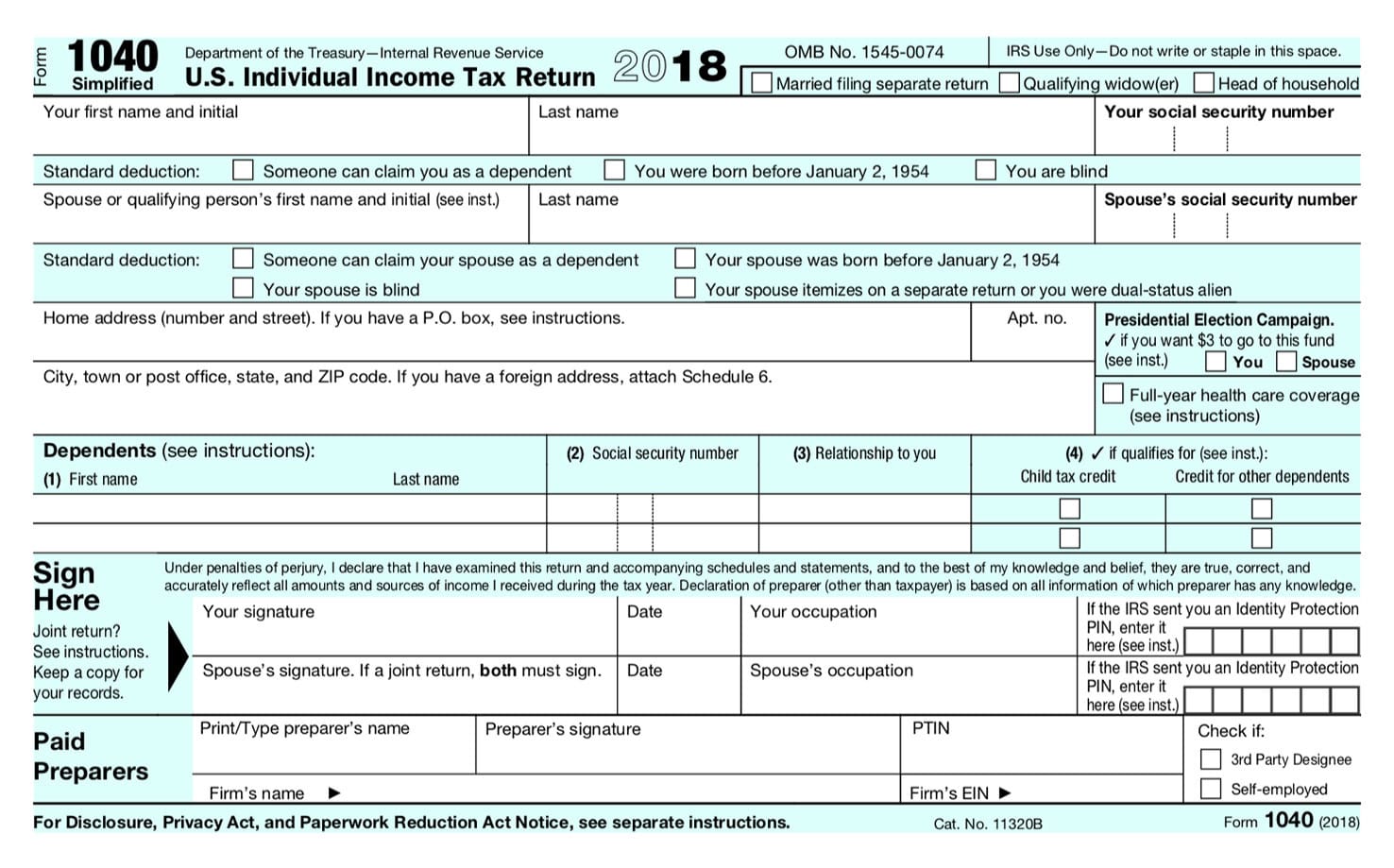

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDid I get the wrong IRS web site..Is the 1040 form now so

abbreviated its the size of a W-2 form instead of a 1040?

Xipe Totec

(43,888 posts)progree

(10,890 posts)For Tax Year 2018, you will no longer use Form 1040A or Form 1040EZ, but instead will use the redesigned Form 1040 (https://www.irs.gov/pub/irs-pdf/f1040.pdf ) . Many people will only need to file Form 1040 and no schedules.

However, if your return is more complicated (for example you claim certain deductions or credits, or owe additional taxes) you will need to complete one or more of the new Form 1040 Schedules. Below is a general guide to what Schedule(s) you will need to file, based on your circumstances. See the instructions for the Schedules for more information.

More: https://www.irs.gov/forms-pubs/about-form-1040

INdemo

(6,994 posts)for deduction like over 65,must use separate form or income from pensions other than Soc Security,must use separate form

Soc Security 'work sheet as always is confusing.

To me this small 1040 form is more confusing by having to add all the other forms even though one ues the Standard deduction.

progree

(10,890 posts)Last edited Tue Jan 8, 2019, 02:18 AM - Edit history (2)

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Page 2:

I had read the RepubliCONs, who have always talked about making tax returns the size of a postcard, actually pretty much succeeded at that (a very very busy large 2-sided postcard), if you count only Form 1040. But they added 6 new forms in order to get the same information as the old 1040 had. And Schedule A and B and C and D and all that are still around.

Clever RepubliCONs.

INdemo

(6,994 posts)They pay a CPU their $200hr fee to file their taxes along with their insider trading incomes.

PJMcK

(21,994 posts)On the other hand, my CPA charges a lot!

(wink)

brooklynite

(94,327 posts)The 1040 is a much abbreviated form. However, there is now a Schedule 1,2,3,4 and 5 where some of the former 1040 material goes.

https://www.irs.gov/pub/irs-dft/f1040s1--dft.pdf

https://www.irs.gov/pub/irs-dft/f1040s2--dft.pdf

https://www.irs.gov/pub/irs-dft/f1040s3--dft.pdf

https://www.irs.gov/pub/irs-dft/f1040s4--dft.pdf

https://www.irs.gov/pub/irs-dft/f1040s5--dft.pdf

progree

(10,890 posts)https://www.irs.gov/pub/irs-pdf/f1040s2.pdf

https://www.irs.gov/pub/irs-pdf/f1040s3.pdf

https://www.irs.gov/pub/irs-pdf/f1040s4.pdf

https://www.irs.gov/pub/irs-pdf/f1040s5.pdf

https://www.irs.gov/pub/irs-pdf/f1040s6.pdf

Links from https://www.irs.gov/forms-pubs/about-form-1040

DeminPennswoods

(15,265 posts)a 2 page 1040 and put them on 6 seperate forms. ![]()

Response to DeminPennswoods (Reply #11)

progree This message was self-deleted by its author.

DavidDvorkin

(19,465 posts)Maybe for most people. For me, it means filling in a lot of additional schedules.

hlthe2b

(102,119 posts)progree

(10,890 posts)Last edited Tue Jan 8, 2019, 02:16 AM - Edit history (2)

But the Form 1040 I'm looking at doesn't have any line numbers or a place to put income?

Form 1040: https://www.irs.gov/pub/irs-pdf/f1040.pdf

Schedule 1: https://www.irs.gov/pub/irs-pdf/f1040s1.pdf

Schedule 1 Line 22: "Combine the amounts in the far right column. If you don’t have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23"

WTF! There's no Line 6 or Line anything on Form 1040.

Later: On Form 1040, I didn't scroll down past the blank half page to get to page 2. ![]() Pics of the whole thing are in post 2 above

Pics of the whole thing are in post 2 above

https://www.democraticunderground.com/?com=view_post&forum=1002&pid=11636243