General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forumsrandys1

(16,286 posts)it is an 89 yr old woman who needs food stamps, and if she is Black then that just makes it much worse.

They are the problem, the POOR are the problem, remember Scott Walker in WI agreeing with the Woman who has THREE BILLION dollars that paying people good wages is a big problem, allowing them collective bargaining rights was the problem in AMERICA

ARE

YOU

ANGRY

YET?

SomethingFishy

(4,876 posts)It's all part of the income inequality problem. Corporations are out of control... or more to the point, gaining too much control.

randys1

(16,286 posts)that for profit companies should provide necessities, charge as much as they want, and if you cant pay for your water, fuck you and die

I fear america wont grow up and grow out of their stupid capitalism ideas until they suffer great pain

MADem

(135,425 posts)You are calling municipal entities "corporations" and you're being called on it.

A town's water department is NOT Verizon. They don't have the same charge, structure or purpose.

And it has nothing to do with "Wall Street" when someone doesn't pay their water bill.

mike_c

(36,269 posts)As publicly held companies, these corporations have a fiduciary responsibility to maximize the investment returns of shareholders, any one of which could sue them for paying taxes if legal tax avoidance strategies exist, which of course they do, because the greedy one percenters have insured that they exist.

It's easy to decry this as "immoral" or even as somehow "illegal," but that's useless. In fact, we have created a situation in which morality and legality have been turned on their heads to serve the greed and self interest of the wealthy. In the economic system within which these corporations operate, it is immoral to do anything other than to maximize profits. They're doing nothing wrong at all-- instead, they are paragons of success.

Sanders is right, but he doesn't tell the whole story. The only way to resolve this problem is to change the meaning of business success.

Richardo

(38,391 posts)Suddenly, shareholder value is INCREASED by paying taxes.

Armstead

(47,803 posts)I think i would be very legally defensible for a large corporation to, say pay a living wage to employees, or to play be the same tax rules as everyone else.

mike_c

(36,269 posts)...from last year: http://www.washingtonpost.com/blogs/wonkblog/wp/2013/09/09/how-the-cult-of-shareholder-value-wrecked-american-business/

Take the simple example of outsourcing production overseas. Certainly it makes sense for any one company to aggressively pursue such a strategy. But when every company does it, so many American workers wind up losing their jobs or having their pay cut that they can no longer buy even the cheaper goods produced overseas. The companies may also find that government no longer has sufficient tax revenue to educate workers or invest in the roads and ports and airports through which their goods are delivered to market.

Economists have a name for such unintended spillover effects — negative externalities — and normally the right fix is some form of government action. But one of the hallmarks of the era of shareholder capitalism is that every tax and every regulation is reflexively opposed by the business community as an assault on profits and shareholder value. By this logic, not only must corporations commit themselves to putting shareholders first — society is expected to do so as well.

mike_c

(36,269 posts)In 1970, Nobel Prize-winning economist Milton Friedman wrote an article in the New York Times Magazine in which he famously argued that the only “social responsibility of business is to increase its profits.”

Then in 1976, economists Michael Jensen and William Meckling published a paper saying that shareholders were “principals” who hired executives and board members as “agents.” In other words, when you are an executive or corporate director, you work for the shareholders.

I think it would be interesting to devote a thread to this topic.

mylye2222

(2,992 posts)is going to sell one of our most important firm , Alstom, to GE.......Shame on this tax evader's firm, and shame on my so -called Socialist govt.

Boom Sound 416

(4,185 posts)That is all

Indydem

(2,642 posts)This is just fucking stupid. A ploy to get us worked up over something that is, deeply irrelevant.

78 Billion dollars seems like a lot of money, right? We should be fucking OUTRAGED that they have so much money! They haven't paid any taxes! OUTRAGE!!!!

Well then there is math. Math is science. It's root is in logic. So let's do some.

"Since 2008" is 5 years. $78b /5 and we have $15.6b per year.

Now we apply the 35% federal income tax rate for corporations: $5.46b

So if we were to tax these corporations at their maximum tax rate, we would have enough to fund the government for about 12 hours.

The budget deficit for 2013 was $680b. So taxing these corporations at their maximum level would have reduced it by about .8%.

But what does that mean? Well that means that it doesn't FUCKING MATTER how much 3 corporations paid in taxes.

This is just to get you worked up about something. Are you going to fall for it?

Boom Sound 416

(4,185 posts)But they still want it and if I don't pay I go to jail.

I'll take their 12 hours. Thank you much

Signed,

I Give A Fuck

pbmus

(12,422 posts)This is the most ridiculous argument I have ever heard ...

![]()

![]()

![]()

![]()

Indydem

(2,642 posts)Precisely.

Herps a derp derp.

Derp derp.

Cerridwen

(13,252 posts)Here is one report about 288 companies and their effective tax rate over a 5 year period. (far more at the link provided below)

In summary:

The table on this page summarizes what the 288 companies paid (or didn’t pay) in effective U.S. income

tax rates on their pretax U.S. profits.

•

The good news is that 62 companies (about a fifth of the companies in this report), paid effective five-

year tax rates of more than 30 percent. Their average effective tax rate was 33.6 percent.

•

The bad news is that even more companies, 67, paid effective five-year tax rates between zero and 10

percent. Their average effective tax rate was 1.5 percent.

•

Even worse news is that 26 companies paid less than zero percent over the five-year period. Their effective tax rate averaged –5.1 percent.

From this link: http://www.ctj.org/corporatetaxdodgers/sorrystateofcorptaxes.pdf

From this site: http://www.ctj.org/corporatetaxdodgers/sorrystateofcorptaxes.php

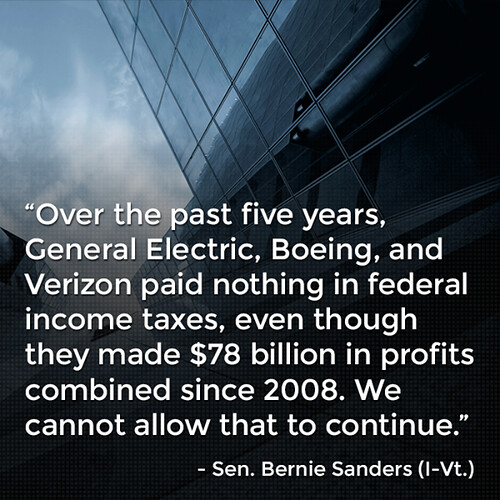

The image in the OP is the bumper sticker version for those who can't be bothered to look around for the complete picture.

pbmus

(12,422 posts)I say when a corporation sells something in the USA, the company pays taxes on that sale ... that is the only way to stop this insanity.![]()

Cerridwen

(13,252 posts)I'm glad I don't have high blood pressure but my gut isn't doing too great right now.

<big snip>

This is known as a “tax inversion.”

From a forbes article:

http://www.forbes.com/sites/matthewherper/2014/04/28/if-pfizer-escapes-u-s-taxes-by-buying-astrazeneca-will-congress-be-forced-to-act/

Edit to add: thank you for the additional information. Want an antacid?

pbmus

(12,422 posts)Ikonoklast

(23,973 posts)Lochloosa

(16,061 posts)JDPriestly

(57,936 posts)The amount owed should be greater than you figure.

May I ask? Who is paying the taxes if these large corporations (and the OP names only a few of the corporations that don't pay the taxes they should)? Do you think our government does even as well as it does on the taxes of the many Americans making minimum wage?

Are you suggesting that a disproportionate share of taxes collected are paid by companies, often small businesses, that do all their business in the US and have a hard time hiding profits overseas. That would include your plumber's little company, your medical doctors who gets their pay from billing you and other patients, the car repair shop and other small businesses that don't have accounts in the Caymans.

Does it seem fair to you that GE, which last I heard owned MSNBC pays nothing, while the companies of your plumber. electrician. doctor or lawyer pay lots?

AtheistCrusader

(33,982 posts)the few companies in the OP's infographic.

A LOT more. Obviously nobody wants to just tax those companies at a higher rate, we want the tax code repaired such that NO company can escape its fair share.

So, no, I'm not falling for it, as the infographic shows it, I'm looking to the principle behind it.

yodermon

(6,143 posts)It's principle.

yodermon

(6,143 posts)Large, profitable U.S. corporations paid an average effective federal tax rate of 12.6% in 2010, the Government Accountability Office said Monday.

<snip>

U.S. corporate tax collection totaled 2.6% of GDP in 2011, according to the Organization for Economic Cooperation and Development. That was the eleventh lowest in a ranking of 27 wealthy nations.

The Senate's Permanent Subcommittee on Investigations has hauled several corporate executives to Capitol Hill over the past year for testimony on their tax practices.

A report released by the subcommittee last month charged that Apple (AAPL) used a complicated system of international subsidiaries and cost-shifting strategies to avoid paying taxes on some $74 billion in income from 2009 to 2012.

In September, the subcommittee heard from Microsoft (MSFT) and Hewlett-Packard (HPQ), whom Levin called "case studies of how U.S. multinational corporations... exploit the weaknesses in tax and accounting rules and lax enforcement."

A subcommittee report at the time alleged that Microsoft had saved nearly $7 billion off its U.S. tax bill since 2009 by using loopholes to shift profits offshore. H-P, the report said, avoided paying taxes through a series of loans that shifted billions of dollars between two offshore subsidiaries.

Armstead

(47,803 posts)SleeplessinSoCal

(9,082 posts)Ex-Im is going to be a major deal come budget time and likely lead to a government shut-down.

WASHINGTON -- Congress is gearing up for another government shutdown, this time over a minor federal agency that most Americans have never heard of: the Export-Import Bank.

Ex-Im, as it's known in Capitol Hill parlance, provides cheap loans to foreign companies who want to buy U.S.-manufactured goods, particularly Boeing airplanes. The agency has limited macroeconomic significance, but its very existence has ignited a holy war within the Republican Party, where hardliners view the bank as an exercise in corporate welfare.

http://www.huffingtonpost.com/2014/06/26/government-shutdown-export-import-bank_n_5531851.html

Scuba

(53,475 posts)General Electric announces 400 layoffs in upstate New York

GE Healthcare initiates new round of Milwaukee-area layoffs

Verizon To Lay Off 1,700 Workers After Paying CEO $22 Million Last Year

Verizon Wireless to close five service centers, affecting 5,200 workers

OnlinePoker

(5,716 posts)Earnings before tax 2011 - $5.393 Billion, Taxes 2011 - $1.382 Billion, Net Earnings 2011 - $4.011 Billion, Tax Rate 25.6%

EBT 2012 - $5.910 Billion, Taxes 2012 - $2.007 Billion, Net Earnings 2012 - $3.903 Billion, Tax Rate 34%

EBT 2013 - $6.232 Billion, Taxes 2013 - $1.646 Billion, Net Earnings 2013 - $4.586 Billion, Tax Rate 26.4%

Page 22 - https://materials.proxyvote.com/Approved/097023/20140227/AR_195723/#/34/

I don't know about the other 2 companies.

Dustlawyer

(10,494 posts)corporations, for a few measly million, bought the DC politicians that write the tax code, the regulations, the budgets of the regulatory agencies that enforce (NOT) the regulations, and award the contracts (except military contracts where they provide post military employment)! They got the judges elected and they own the media who redirect our anger to the defenseless using OUR airwaves!

People, in order to make this stop we have to (I will borrow a word from the Rude One's vocabulary)

WAKE THE FUCK UP

DEMAND COMPLETE CAMPAIGN FINANCE REFORM AND PUBLICLY FUNDED ELECTIONS!!!

Sanders / Warren 2016!!!!!

littlemissmartypants

(22,549 posts)Romulox

(25,960 posts)Tax breaks? Who cares? We GAVE OVER $10 TRILLION to the banks during that same time. ![]()

Nye Bevan

(25,406 posts)"We got back every dime used to rescue the banks," he told the crowd gathered Oct. 18 in Victory Park. "We made that happen."

.....

Not all of the banks who received TARP money have repaid the loans. In fact, 400-plus banks are still on the government’s red list -- more than have completed the payments -- and, according to the GAO, some may never pay the money back.

But, the fact remains, due to interest, dividends and other revenue streams, the government has received more money back ($266.7 billion, according to the Treasury) than it handed out to banks under the bailout law ($245.2 billion). We rate this claim Mostly True.

http://www.politifact.com/new-hampshire/statements/2012/oct/25/barack-obama/barack-obama-says-banks-paid-back-all-federal-bail/

Romulox

(25,960 posts)Go ask your local Goldman Sachs for an interest free loan and let them explain it to you. ![]()

I totally agree with Bernie.

"

"