Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 5 June 2014

[font size=3]STOCK MARKET WATCH, Thursday, 5 June 2014[font color=black][/font]

SMW for 4 June 2014

AT THE CLOSING BELL ON 4 June 2014

[center][font color=green]

Dow Jones 16,737.53 +15.19 (0.09%)

S&P 500 1,927.88 +3.64 (0.19%)

Nasdaq 4,251.64 +17.56 (0.41%)

[font color=red]10 Year 2.60% +0.03 (1.17%)

30 Year 3.44% +0.02 (0.58%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)...The US press and newscasts make it appear that Europeans have voted against poor immigrants and foreigners. What they voted against was the super-rich, the oligarchy. The “foreigners” being opposed include the United States insisting on drawing NATO into its wars in Libya,Iraq, Syria and Afghanistan – and now, subsidizing Ukraine to confront Russia. The “nationalist” parties voted against the EU constitution written by the oligarchy to favor the banks against labor. It is a neoliberal constitution that prevents governments from running budget deficits of more than 3% of GDP – except of course to bail out banks and bondholders. It centralizes foreign policy in a US- and NATO-appointed bureaucracy of “technocrats.”

The US press characterized Sunday’s May 25 vote opposing this bureaucratic circumventing of democracy as a vote against “democratic Europe.” This is an Orwellian description of what happened....Already in 2005, France and the Netherlands rejected the EU constitution. The EU’s response was to impose the right-wing Lisbon Treaty by fiat, not permitting any vote on membership. When Greek Prime Minister Papandreou sought a referendum, he was quickly replaced by a technocrat. Likewise in Italy, when Prime Minister Berlesconi sought a referendum, he was quickly removed by an EU “technocrat.” This is not democracy. It is oligarchic extremism. And yet the anti-EU voters seeking to recover power for their national governments to run budget deficits to lower the unemployment rate below its current 10.5% is called extremist. The underlying issue on May 25 was whether voters would support more economic austerity and privatization sell-offs. It is obvious that they didn’t.

They also didn’t want a new Cold War with Russia, or yet more contributions to NATO to support US unipolar world. So when the nominally Socialist parties joined with the right-center to support more financial austerity, and centralization of Eurozone policy in the hands of unelected bankers, they suffered a resounding defeat. Neocons and neoliberal pundits have tried to focus on the “poison” message of the right-wing parties. But the real story is the inability of the left to provide an alternative.

A century ago the socialist, labor and social democratic parties had an economic program. It included progressive taxation, taxation of land and natural resources, and public infrastructure investment so as to prevent monopolies from occurring. This included a public banking system. Today, the left wing has reversed all these policies. Tony Blair led the British Labour Party to make a right-wing run around the Conservatives, even to the point of privatizing railways and the Public/Private Partnership giveaway to the City of London. In America, Bill Clinton abolished Glass Steagall and deregulated derivatives trade. Then Barak Obama achieved what a Republican president could not have done: He is leading the fight for the Trans-Pacific Partnership to dismantle financial regulation altogether, along with public environmental regulation. He has escalated the Cheney-Bush military policy seeking to grab foreign oil and gas resources, most recently in Ukraine where Secretary of State Kerry’s and Joe Biden’s families have taken a kleptocratic position in that poor country’s gas resources.

So where is the left?

Today’s political situation is much like 1968, when George Wallace – a “southern cracker” – was the only candidate talking about economic policy and urged withdrawal from Vietnam. He was shot.

The vote against what Marine LePen calls “the Brussels Monster” was against the capture of the EU bureaucracy by NATO neocons and neoliberals opening the immigration floodgates to what threatens to be a wave of “Ukrainian plumbers” and other refugees from America’s most recent attempt to tear up a nation Syria-style, Libya-style or Iraq-style. The vote also was against the TTIP, the Transatlantic Trade and Investment Partnership.

MORE

Demeter

(85,373 posts)Thomas Piketty’s contentious thesis about ever-increasing inequality rests on the surprisingly conventional premise that aggregate wealth grows faster than overall income. Financiers and public officials have peddled virtually the same idea for decades in claiming that stocks and homes will always keep ahead of GNP and inflation.

Unfortunately, this is a fantasy.

The Dow-Jones index would have to close at about 2,000,000 on December 31, 2099, Warren Buffett has pointed out, just to match its 5.3% nominal gain of the 20th century (when it rose from 66 to 11,497).

Worse, because the belief that wealth grows faster than incomes is now so deeply embedded, it threatens our financial security, helps inflate bubbles, and by promoting a perverse redistribution of income, undermines the legitimacy of profit-seeking enterprise.

Comparing the growth rates of income and wealth is rather like comparing apples and unicorns.

Incomes are in the here and now: hard cash which we can all spend right away on things and experiences that we desire. Wealth reflects hopes and dreams—expectations in economists’ argot—projected from nebulous current facts. People might hope to use their wealth to buy things in the future, but it can’t work for everyone at once. We couldn’t all spend all our wealth tomorrow, the way we do our incomes—who would suddenly conjure up all the stuff we would want to purchase?

Moreover, unlike total income, which is simply the sum of everyone’s earnings, total wealth isn’t the sum of everyone’s expectations.. Rather, the value of the assets in which our wealth reposes reflects a few transactions and the expectations of their specific buyers and sellers. All apartments and houses are appraised at values set by the prices of the few that are actually sold. Thus during the Japanese housing bubble in the 1980s, the grounds of the Imperial Palace were claimed to be worth more than the value of all the real estate in California, when neither the Imperial Palace ground nor all the real estate in California was actually being sold.

MORE

Tansy_Gold

(17,847 posts)You buy some cheap land.

You sell one parcel of that cheap land at a hugely inflated price to your friend with money he borrowed from you.

You revalue all the rest of your land at the hugely inflated price.

You take that inflated value to the bank and borrow against it.

You take that money and you buy more cheap land.

Rinse, repeat, until you have enough money to start giving it away to your friends, relatives (sons-in-law) in the form un unsecured loans.

Is that "creating wealth"? Of course not.

That's why Piketty is full of shit.

Warpy

(111,174 posts)which is nuts to those of us who experienced at least the tag end of the New Deal and the dismantling of it ever since.

The New Deal gave us low inequality and a huge, stable middle class with class mobility up and down across the wealth spectrum. That latter is why the 1% couldn't wait to dismantle it, the thought of their children pissing the family fortune away and becoming middle class was too much for them to bear.

Government likely has only a small role in determining national capital and foreign investment capital. Its effect on the distribution of that capital can be profound.

Tansy_Gold

(17,847 posts)Piketty is the capital D Democrats' answer to Arthur Laffer?

Warpy

(111,174 posts)I find myself getting really annoyed with him about that distribution thing. He doesn't seem to think it's a problem.

Then again, it's my bedtime reading so I'm only a third of the way in.

He's pointed out that the purchasing power of capital is pretty much where it's been for a long time and that capital is held less and less in farmland and more and more in industrials and now financial institutions.

Maybe he'll even get to the point about how money differs from actual wealth.

Tansy_Gold

(17,847 posts)Did you forget the ![]() tag?

tag?

And yes, that was ![]() , too.

, too.

Demeter

(85,373 posts)...San Francisco, the heart of the tech industry, now has the fastest-growing income inequality in the country, a gap on par with Rwanda’s. This has led to range of protests, including those that have begun targeting public tech symbols like Google’s commuter shuttle buses.

The connection between inequality and the tech industry may be fair: Innovation tends to make things more efficient, so fewer people can accomplish more work (in the Bay area, the WhatsApp texting service sold for $19 billion with 55 employees, while the Gap, worth about the same, has 136,000 employees).

So, what did the wealthy and influential attendees at Code — which was held at a secluded and exclusive beachfront resort — think about income inequality, the housing shortage, and whether tech was to blame or not? The responses were varied, but the most common answer — no surprise, perhaps — was that tech wasn’t the cause of San Francisco’s income gap, but rather the best solution.

For DogVacay, one of Science’s investments, for example, Jones said the company’s highest-rated dog-sitters were people who had never worked in the industry before. “People like enthusiasts who are just doing it because they enjoy it,” he said.

Scott Cook, one of the founders of Intuit, also mentioned new taxi services like Lyft as potential boons for a new middle class.

“There are so many new employment opportunities for people now … the tech community being the backbone building that industry, and tech community being the customers,” he said. “You need wealth to create wealth.”

SHOWING ONCE AGAIN HOW DETACHED FROM REALITY SILICON VALLEY, MY BETE NOIR, IS...MORE DRIVEL AT LINK

Demeter

(85,373 posts)Much of America’s drinking water and wastewater infrastructure needs attention, but critics worry that a new funding bill could be a pipeline to government-subsidized privatization... A major piece of legislation funding the development and improvement of water-related infrastructure passed Congress last week for the first time in nearly a decade, and President Barack Obama is expected to sign the bill soon.

Yet public interest groups warn that a key provision in the law would complicate public investment in drinking water and wastewater systems in big cities and small towns alike. The end result, they say, would be to strengthen privately-managed or -owned water systems while leaving the federal government to take on the risk of these investments — essentially subsidizing water privatization.

“This law will facilitate the privatization of water systems and prioritize funding for privatized systems,” Mary Grant, a researcher for the water program at Food & Water Watch, a watchdog group here, told MintPress News.

“The basic problem is that it will only fund up to 45 percent of project costs, but also stipulates that the rest cannot be made up through the use of tax-exempt bonds. Yet such bonds are the primary way in which local governments fund infrastructure projects, so why would they try to make use of this funding?”

MORE GOTCHAS AT LINK

Demeter

(85,373 posts)

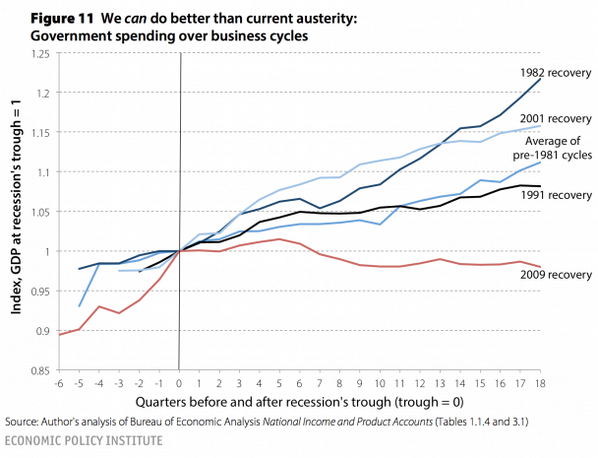

By starving the economy of the government spending that generally helps kickstart a recovery, growth continues to be tepid. The lack of demand in turn results in corporate America sitting on a record amount of cash assets both domestically and abroad.

“Corporations hold liquid assets equal to all the money the federal government spent in 2013, 2012 and three months of 2011,” David Cay Johnston reported in Al-Jazeera America.

Why are they hoarding? Because in the absence of consumers being willing to spend, companies are trying to make a profit on their taxes, Johnston argues.

We May Never Recover From Underinvestment

The lingering underperfomance of the economy (starved of government spending, as you can see from Paul Krugman’s chart above) can be measured in multiple ways, but 6 million missing workers is probably the clearest metric.

Republicans in Congress are adding to the number of Americans out of work by letting the unemployment rate rise as much as .5 percent when they let emergency benefits for the long-term unemployed expire. Cuts to medical research inhibit long-term innovation, competition and development of new treatments. Kids being kicked off Headstart costs parents while denying kids the long-term benefits of the program.

Worst of all, we’re missing incredible opportunity to invest in our crumbling infrastructure as interest rates are near zero and millions of Americans are out of work.

Republicans campaigned and won on their vision of cutting spending in the midst of an unemployment crisis in 2010. The effects of that victory linger on lost opportunity and a future where even more senseless cuts will be necessary.

xchrom

(108,903 posts)JEFFERSON CITY, Mo. (AP) -- Lawmakers in many states have been trying to boost their post-recession economies by cutting income taxes, curbing aid to the long-term jobless or holding down the minimum wage. Some have pursued all of these steps.

Whether such policies will spur businesses to expand as hoped isn't yet clear. But collectively, the actions could ease the financial burden for the states' most affluent residents while reducing the safety net for those at the bottom.

The shift may also contribute to a trend that is prompting growing national concern: the widening gap between the richest Americans and everyone else. The divergence has developed over four decades and accelerated in recent years.

Economic statistics show that incomes for the top 1 percent of U.S. households soared 31 percent from 2009 through 2012, after adjusting for inflation, yet inched up an average of 0.4 percent for those making less. Many economists are sounding alarms that the income gap, greater now than at any time since the Depression, is hurting the economy by limiting growth in consumer spending.

xchrom

(108,903 posts)BEIJING (AP) -- Global stocks were lackluster Thursday after a payroll processor said U.S. employers slowed hiring last month and investors looked ahead to a European Central Bank meeting.

Oil declined but stayed above $102 per barrel after U.S. government data showed a fall in stockpiles of crude and rising supplies of refined fuels.

In Europe, France's CAC-40 rose 0.1 percent to 4,505.12 and Germany's DAX was down 0.1 percent at 9,916.43. Britain's FTSE 100 fell 0.2 percent to 6,803.17. Dow Jones and S&P 500 futures were little changed.

Investors were waiting for Thursday's monthly meeting of the ECB following suggestions by bank president Mario Draghi of possible additional stimulus. That could include a rate cut or other measures to spur economic recovery and avoid deflation.

xchrom

(108,903 posts)BERLIN (AP) -- German factory orders rebounded in April, rising by a stronger-than-expected 3.1 percent compared with the previous month with help from a surge in demand from other countries in the eurozone.

The increase reported Thursday by the Federal Statistical Office was more than double the 1.4 percent rise economists had forecast. It followed a surprise 2.8 percent fall in March.

Domestic orders were unchanged over the previous month but the statistical office says demand from abroad rose 5.5 percent - led by a 9.9 percent increase in orders from the other 17 countries that use the euro.

The German economy, Europe's biggest, has accelerated this year. It grew by a robust 0.8 percent in the first quarter compared with the previous three-month period.

xchrom

(108,903 posts)BRUSSELS (AP) -- Leaders of the G-7 group of major economies are turning their attention during the concluding day of their summit to spurring growth and jobs in an attempt to reinforce a rebound from the global financial crisis.

And after President Barack Obama's new effort to curb greenhouse gas pollution, the seven leaders are set to show their determination to find a global deal on climate change in Paris next year. They will also seek ways to increase energy security, which has become especially touchy for the European Union because of its dependence on Russian gas.

The seven have kept the threat of further sanctions against Russia over its involvement in the Ukraine crisis on the table but also sought renewed cooperation to end the standoff.

xchrom

(108,903 posts)DETROIT (AP) -- Delegates to the United Auto Workers convention have elected Dennis Williams as the union's new president.

Williams is the union's current secretary-treasurer. He'll replace the retiring Bob King.

Williams tells Detroit radio station WWJ that he is looking forward to the union' challenges including contract talks with the Detroit Three automakers next year. He soundly defeated Ford worker Gary Walkowicz (WALK-oh-wits) on Wednesday. Williams will be inaugurated on Thursday.

Delegates to the convention that is held every four years also elected three vice presidents who will lead contract talks with General Motors, Chrysler and Ford - Cindy Estrada, Jimmy Settles and Norwood Jewell. Gary Casteel will replace Williams as secretary-treasurer.

All ran unopposed.

xchrom

(108,903 posts)BEIJING (AP) -- The International Monetary Fund urged China on Thursday to make a priority of containing financial risks that stem for its rising debt.

Beijing should avoid launching more economic stimulus unless growth drops well below this year's official target of 7.5 percent, said the IMF's first deputy managing director, David Lipton, after meeting Chinese officials.

Rising debts owed by local governments and uncertainty about largely unregulated informal lending have fueled concerns China's economic slowdown might cause a rise in defaults and hurt its financial system.

Chinese authorities have begun tightening controls. Lipton said Beijing still has room to prevent an abrupt slowdown in economic growth but risks are rising and regulators need to do more.

xchrom

(108,903 posts)Damn, UK home prices are going nuts.

From WSJ:

Mortgage lender Halifax said the value of homes purchased by its own mortgage customers hit £184,464 ($308,922) in May, the highest price since April 2008. That marks a 3.9% increase from April—the largest monthly gain since October 2002—and an annual gain of 8.7%.

Everything in the UK is hot these days, from PMI data to real estate to labor gains. And the real estate boom, which has been discussed for awhile, now seems to be accelerating.

Read more: http://www.businessinsider.com/uk-home-prices-are-going-nuts-2014-6#ixzz33lOXa2Fz

xchrom

(108,903 posts)The State Oil Company of the Azerbaijan Republic (SOCAR) announced on May 24th that it had entered a joint venture (JV) agreement with a Russian state-owned energy firm, Rosneft.

The agreement enables SOCAR and Rosneft to co-operate on the exploration and production of oil and gas projects within Azerbaijan, Russia and in third countries.

Commenting on the JV, Rovnag Abdullayev, the chief executive officer of SOCAR, and Igor Sechin, the executive chairman of Rosneft, said that the deal would facilitate co-operation in the development of the energy sector in Siberia and Russian areas of the Caspian Sea, along with energy infrastructure.

The establishment of the JV follows an agreement signed between both parties in mid-August 2013 to increase their co-operation.

Read more: http://www.businessinsider.com/azerbaijan-politics-quick-view-socar-signs-deal-with-russian-energy-firm-2014-6#ixzz33lPGMuPi

xchrom

(108,903 posts)WASHINGTON (Reuters) - For the first time in six years, the share of people who either have a job or are looking for one is on the rise in a majority of U.S. states, a sign one of the deepest scars of the economic crisis could be healing.

Most states have experienced sharp declines in labor force participation since the 2007-2009 recession, but a Reuters analysis of government data found a reversal could be underway.

The data bolsters Federal Reserve Chair Janet Yellen's view that America has ample room to create jobs without causing uncomfortably high inflation and it buttresses arguments for keeping interest rates low. If Yellen is wrong, the Fed's easy money policies could lead employers to bid up wages for scarce talent, stoking price increases.

Anecdotal reports suggest that in many parts of the country, demand for labor appears to be growing enough to get people who had dropped out of the workforce to restart their job hunts.

Read more: http://www.businessinsider.com/r-welcome-back-dropouts-data-suggests-americans-rejoining-workforce-2014-05#ixzz33lQJKCi7

Demeter

(85,373 posts)Whoopee. I may slit my wrists in the excitement.

xchrom

(108,903 posts)Red flags flutter from every building and lamppost, surrounded by a sea of giant cranes scarring the skyline. Wherever one looks, buildings are under rapid construction. Car showrooms full of gleaming Western luxury vehicles wait silently, ready to be driven off the forecourt by the small segment of newly affluent Vietnamese with tens of thousands of dollars in disposable income. Funded by Western and Japanese banks, ultra-modern airport terminals rise among the paddy fields, as urban expansion explodes across a countryside still dominated by small farmers tending six acre plots.

Emblazoned with the symbol of proletarian unity and emancipation, it's clear that the worker's hammer crossed with a peasant's sickle, sown into the corner of each red flag, is a long way from the national guiding principle of the Vietnamese Communist Party, in a country which has strayed very far from Ho Chi Minh Thought.

Embalmed in his mausoleum since his death in 1969, Ho Chi Minh was very much a proponent of national development, though it seems unlikely that the much-venerated leader of the Vietnamese resistance to first French, then American rule, would recognize much of the program of the party he helped found in the 1920s.

By the 1980s, the Vietnamese Communist Party had begun the process of instituting a "socialist-oriented market economy." Its policy of Doi Moi ("Renovation"

xchrom

(108,903 posts)Let's be clear: Jean-Claude Juncker is no friend of Germany. More to the point, the man is only friendly to the Germans so long as they are willing to cover the debts of their neighbors without grumbling too loudly. But as soon as Berlin suggests that other countries first take a look at their own spending before asking for German help, Mr. Juncker becomes indignant. Those well-behaved Germans, who he has praised in the past for doing so much for unity on the Continent under Helmut Kohl, quickly become barbarians in his eyes, unwilling to learn anything from the past.

Here are a handful of examples. During the peak of the euro crisis, there came a point when German parliament didn't immediately rubber stamp a part of some bailout package, preferring to take its time to clarify some details. An indignant Juncker railed: "Part of the problem is acting as if Germany is the only virtuous country in the world, as if Germany is having to foot the bill for all the other countries. That's very insulting to the others." When Germany insisted that countries requiring aid commit to stricter budget discipline, he stated: "Why does Germany bestow itself the luxury of constantly deciding domestic policy for others when it comes to the issue of the euro? Why does Germany treat the euro zone as if it were some kind of franchise in its own chain?" When Germany rejected the idea of euro bonds, he had this to say: "This method of erecting taboo areas in Europe and not even considering the ideas proposed by other people is a very un-European way of taking care of European business. Germany's thinking is a bit simplistic."

Disregarding the Electorate

Word has it that Jean-Claude Juncker now wants to become European Commission president. The only person at the moment who has the power to stand between him and this goal is the German chancellor. On the flip side, support for the former Luxembourg prime minister is greatest in places that have the most to gain from his rise. So it's worth recalling just how this man thinks -- a man who is being peddled as the only obvious candidate by interested parties.

Juncker is basing his claim on the results of the European election, which this time was allegedly not only about voting to determine the distribution of seats in the European Parliament, but also the nomination for the far more important post of the European Commission president. The deception started at the very beginning. And it was Juncker, of the conservative Christian Democrats, and his co-candidate Martin Schulz, of the center-left Social Democrats, who unleashed this illusion that the election would be about more than filling the seats in parliament. They did so to position themselves for more powerful offices. The fact that this fiction is now being maintained doesn't make it any less of a fiction.

Demeter

(85,373 posts)the show is fixed. Entertaining, but completely choreographed.

xchrom

(108,903 posts)The European Central Bank cut its deposit rate below zero and said it would announce further measures later today as policy makers try to counter the prospect of deflation in the world’s second-largest economy.

ECB President Mario Draghi reduced the deposit rate to minus 0.10 percent from zero, making the institution the world’s first major central bank to use a negative rate. Policy makers also lowered the benchmark rate to 0.15 percent from 0.25 percent. Draghi will hold a press conference at 2:30 p.m. in Frankfurt.

“They have to do something to address weak inflation,” Nick Matthews, senior economist at Nomura International Plc in London, said before the decision. “Investors are expecting them to keep alive the option of more unconventional measures like quantitative easing.”

Draghi has said a worsening in the medium-term outlook for prices would justify broad-based asset purchases, and with inflation stuck well below the ECB’s goal for the past eight months and revised staff forecasts due today, that’s a scenario that remains possible. While he’s unlikely to announce a QE program immediately, he may keep the option alive by providing insight into how a plan could overcome the practical challenges it faces in an 18-nation currency union.

DemReadingDU

(16,000 posts)and put money in home safe.

Demeter

(85,373 posts)xchrom

(108,903 posts)When JPMorgan Chase & Co. (JPM)’s Jamie Dimon got a 74 percent raise in January, U.S. Attorney Preet Bharara fumed. He had forced the bank just weeks before to pay $1.7 billion for enabling Bernard Madoff’s Ponzi scheme. And yet Dimon was being rewarded.

Now, five months later, Bharara’s frustration is directed at another bank.

In the next few weeks, BNP Paribas SA (BNP) could face criminal charges and a fine of up to $10 billion for doing business in sanctioned countries such as Iran and Sudan. That penalty would far exceed the fines incurred by six other banks that escaped criminal charges for similar offenses since President Barack Obama took office in 2009 -- and would be the largest-ever criminal penalty in the U.S.

The potential severity in BNP’s case stems in part from Bharara’s determination to punish banks that have repeatedly evaded harsher penalties by warning that a wave of unforeseen consequences could result, the egregiousness of BNP’s conduct and the bank’s apparently slow response to the U.S. investigation during its early stages, according to two people familiar with the matter. The case has strained relations between the U.S. and France, with French President Francois Hollande set to confront Obama today at a Paris dinner over what he says is a threat to his country’s financial system.

Demeter

(85,373 posts)Any man who fights criminals is a winner to me.

Not native born....best we can do is US Atty General, I guess. Purge the job of any lingering shade of John Mitchell....

Preet will be our featured topic this Weekend....which is also Euchre Night (one week early).

xchrom

(108,903 posts)U.S. stock-index futures advanced as the European Central Bank lowered interest rates to boost the economy and promised more policy decisions later today.

Sprint Corp. advanced 1.6 percent in early New York trading after people with knowledge of the matter said it is nearing a price agreement for a potential acquisition of T-Mobile US Inc. Twitter Inc. added 1.8 percent after Pacific Crest Securities started coverage of the shares with a rating similar to buy.

Futures on the Standard & Poor’s 500 Index (SPX) expiring this month rose 0.2 percent to 1,928.8 at 7:56 a.m. in New York. The benchmark equity gauge gained 0.2 percent yesterday to an all-time high amid better-than-estimated data on service industries. Dow Jones Industrial Average contracts increased 40 points, or 0.2 percent, to 16,758 today.

“The ECB decision comes in broadly as expected and volatility is picking up in the markets,” Ion-Marc Valahu, a co-founder and fund manager at Clairinvest in Geneva, wrote in an e-mail. “We’ve just got one piece of the puzzle. We will get more details when Draghi speaks at the press conference in 45 minutes.”

xchrom

(108,903 posts)BNP Paribas SA (BNP)’s settlement talks with the U.S. over sanctions violations have headed out of the ballpark, compared with previous punishments levied by the Obama administration in such cases.

The U.S. has been said to seek more than $5 billion or even $10 billion during talks in the past month -- a penalty higher than the combined $4.9 billion levied against 21 other banks for transactions tied to sanctioned countries since President Barack Obama took office.

An accord of such a magnitude, described by people familiar with the talks, would eclipse BP Plc’s (BP/) record $4 billion settlement of criminal allegations last year. Prosecutors are pressuring the BNP Paribas parent company to plead guilty to moving funds for clients in violation of sanctions against Sudan, Iran and Cuba, the people have said, asking not to be identified because the negotiations are confidential.

“I think law enforcement is seeing that a $1 billion, $2 billion or $3 billion fine is not necessarily material or fatal to these organizations,” James Odell, a former general counsel at a UBS AG unit, said in an interview. “If the number is seen as insignificant, there’s going to be a lot of backlash.”

xchrom

(108,903 posts)After 17 years, the timing is finally on Kenya’s side as the government readies its first Eurobond sale, betting the nation’s growth prospects and resurgent demand for emerging-market debt will keep borrowing costs contained.

Investors may demand a yield of about 7 percent to buy the securities, less than the 7.48 percent yield on similarly rated Zambian bonds, according to Raza Agha at VTB Capital Plc in London. Aly-Khan Satchu at Rich Management Ltd. in Nairobi sees a range between 7.5 percent and 8 percent, depending on whether Kenya sells $2 billion or $1.5 billion.

“We are still living through another six to nine months of an environment which is very, very beneficial for issuers given the high demand for emerging markets,” Yerlan Syzdykov, who helps oversee the equivalent of about $5.4 billion as head of emerging markets bond and high yield at Pioneer Investments, said in an interview in London yesterday. “A lot of countries, especially in sub-Saharan Africa, will use this as an opportunity to tap the market.”

East Africa’s largest economic growth will probably accelerate to 6.3 percent this year, from 5.6 percent in 2013, driven partly by tea and cut flower exports, according to International Monetary Fund estimates. African dollar debt returned 8.3 percent this year, with the average yield dropping to a one-year low of 5.06 percent last week, JPMorgan (JPM) Chase & Co. indexes show. Gains have been fueled by speculation central banks in Europe and the U.S. will keep monetary policy accommodative.

xchrom

(108,903 posts)Home sellers are lowering their expectations as buyer demand cools.

None of the 100 largest U.S. metropolitan areas had increases of more than 20 percent in residential asking prices last month -- the first time in almost two years that’s happened, San Francisco-based Trulia Inc. (TRLA) said in a report today. That compares with seven metro areas, including Las Vegas, Phoenix and California’s Silicon Valley, that had such year-over-year gains in May 2013.

“Big price increases mean there are fewer bargains to be found, and the closer prices get to where they should be, the less prices will rise,” Jed Kolko, chief economist at the property-data provider, said in a telephone interview. “I’d be surprised if we see markets getting back to 20 percent-plus gains. More inventory should be coming onto the market, investor activity is declining and affordability is worsening.”

Nationally, asking prices gained 8 percent last month from a year earlier, the slowest pace in 13 months, amid damped demand from both traditional buyers and investors, Trulia said. Prices in Las Vegas and the California cities of Sacramento and Oakland rose about 15 percent, about half the year-earlier gain.

xchrom

(108,903 posts)With the arguments for and against Scottish independence heating up before a referendum in three months’ time, dealers and strategists say there’s money to be made by betting on the fortunes of the pound.

Deutsche Bank AG, the world’s second-biggest foreign-exchange trader, recommends clients position themselves for more volatility in the currency before the Sept. 18 ballot by buying derivatives that profit from price swings. Pacific Investment Management Co., manager of the world’s biggest bond fund, said Scottish independence is more relevant to currency traders than bond investors.

“Buy volatility into the referendum,” Oliver Harvey, a foreign-exchange strategist at Deutsche Bank in London, said in a June 2 phone interview. “Then, if there is a yes vote, there would be a more directional trade to sell sterling.”

While the lead enjoyed by the unionist “Better Together” campaign has narrowed in recent months, opinion polls still point to a defeat of the nationalists seeking to end the 307-year-old U.K. The pound is at the crux of the debate, with the British government and opposition Labour Party both ruling out a formal currency union with an independent Scotland, leading to uncertainty about what legal tender the new country would adopt.

xchrom

(108,903 posts)High-frequency traders and dark-pool operators should do “some soul-searching” and develop new ideas to improve their industry amid a probe, according to a top official in the New York attorney general’s office.

Chad Johnson, head of the state’s Investor Protection Bureau, told a conference yesterday that while Attorney General Eric Schneiderman examines trading practices, Wall Street should help by suggesting ways to change for the better. It would be a mistake to think concerns about stock-market fairness are just bad publicity or extreme language used by critics, he said.

“There’s more here than a public-relations issue, and the discussion ought to focus on the substance,” Johnson said at the event hosted by Sandler O’Neill & Partners LP. “There are real issues to work through, and we should do that without focusing on these kinds of rhetorical points.”

Schneiderman’s office opened a broad investigation into whether U.S. stock exchanges and alternative venues such as dark pools provide high-frequency traders with improper advantages, Bloomberg News reported in March. His staff has spoken with executives at exchanges and subpoenaed high-frequency traders.

Demeter

(85,373 posts)If they wanted "substance", they would shut the whole scam down.

Demeter

(85,373 posts)Click on it for real-time market data.

http://tools.investing.com/market_quotes.php?