Economy

Related: About this forumTell me, future boy, who's President of the United States in 2017? Weekend Economists 10/23-25/15

Dr. Emmett Brown: Then tell me, future boy, who's President of the United States in 1985?

Marty McFly: Ronald Reagan.

Dr. Emmett Brown: Ronald Reagan? The actor? Then who's vice president? Jerry Lewis? I suppose Jane Wyman is the First Lady!

Marty McFly: Whoa. Wait, Doc!

Dr. Emmett Brown: And Jack Benny is secretary of the treasury.

Marty McFly: Doc, you gotta listen to me.

Dr. Emmett Brown: I've had enough practical jokes for one evening. Good night, future boy!

Marty McFly: No, wait, Doc. Doc. The-the-the bruise on your head, I know how that happened. You told me the whole story. You were standing on your toilet and you were hanging a clock, and you fell and you hit your head on the sink. And that's when you came up with the idea for the flux capacitor.

Marty McFly: which is what makes time travel possible.

If there is anything iconic in films from the 80's, it's a toss-up between Star Wars (still in production) and Back to the Future. I have a personal fondness for BTTF because the story goes back to my birth year in the first episode. And the second goes forward to October 21, 2015, this year and month! Has it been that long, already? If this is the future, why are we so unhappy?

Well, the following weekend thread will delve into that question and others, while reveling in the creative genius of:

Steven Spielberg, Kathleen Kennedy, and Frank Marshall served as executive producers. In the film, teenager Marty McFly (Fox) is sent back in time to 1955, where he meets his future parents in high school and accidentally becomes his mother's romantic interest. Marty must repair the damage to history by causing his parents-to-be to fall in love, and with the help of eccentric scientist Dr. Emmett "Doc" Brown (Lloyd), he must find a way to return to 1985.

Zemeckis and Gale wrote the script after Gale mused upon whether he would have befriended his father if they had attended school together. Various film studios rejected the script until the financial success of Zemeckis' Romancing the Stone. Zemeckis approached Spielberg, who agreed to produce the project at Amblin Entertainment, with Universal Pictures as distributor. The first choice for the role of Marty McFly was Michael J. Fox. However, he was busy filming his television series "Family Ties" and the show's producers would not allow him to star in the film. Consequently, Eric Stoltz was cast in the role. During filming, Stoltz and the filmmakers decided that the role was miscast, and Fox was again approached for the part. Now with more flexibility in his schedule and the blessing of his show's producers, Fox managed to work out a timetable in which he could give enough time and commitment to both.

Back to the Future was released on July 3, 1985, grossing over $300 million worldwide, becoming the highest-grossing film of 1985. It won the Hugo Award for Best Dramatic Presentation, the Saturn Award for Best Science Fiction Film, and the Academy Award for Best Sound Effects Editing, as well as receiving three additional Academy Award nominations, five BAFTA nominations, and four Golden Globe nominations, including Best Motion Picture (Musical or Comedy). Ronald Reagan even quoted the film in his 1986 State of the Union Address.

In 2007, the Library of Congress selected it for preservation in the National Film Registry, and in June 2008 the American Film Institute's special AFI's 10 Top 10 designated the film as the 10th-best film in the science fiction genre. The film marked the beginning of a franchise, with two sequels, Back to the Future Part II (1989) and Back to the Future Part III (1990), as well as an animated series, theme park ride, several video games and a forthcoming musical.

I hadn't heard about a musical....must investigate!

Demeter

(85,373 posts)&list=PL96478722DF7FF45E

Demeter

(85,373 posts)Teenager Marty McFly is an aspiring musician dating girlfriend Jennifer Parker in Hill Valley, California. His father George is bullied by his supervisor, Biff Tannen, while his mother Lorraine is an overweight alcoholic.

One night, Marty meets his scientist friend, "Doc" Brown, late evening at a shopping mall. Doc unveils a time machine built from a modified DeLorean and powered by plutonium stolen from Libyan rebels. Doc demonstrates the navigation system with the example date of November 5, 1955: the day he conceived the machine. A moment later, the Libyans kill him. Marty escapes in the DeLorean, but inadvertently activates the time machine, and arrives in 1955.

There, Marty encounters the teenage George, bullied by classmate Biff. After Marty saves George from an oncoming car and is knocked unconscious, he awakens to find himself tended by an infatuated Lorraine. Marty goes in search of the 1955 Doc, to help him get back to 1985. With no plutonium, Doc explains that the only power source capable of generating the necessary 1.21 gigawatts of electricity is a bolt of lightning. Marty shows Doc a flyer from the future that recounts a lightning strike at the town's courthouse the coming Saturday night. Doc formulates a plan to harness the power of the lightning, while Marty sets about introducing his parents, to ensure his own existence, but he antagonizes Biff and his gang in the process. Marty attempts to warn Doc about his death in the future, but Doc refuses to hear it, fearing to alter the future.

When Lorraine asks Marty to the upcoming school dance, Marty plans to have George "rescue" Lorraine from Marty's inappropriate advances. The plan goes awry when a drunken Biff attempts to force himself on Lorraine. George arrives to rescue her from Marty, but finds Biff instead. George knocks out Biff and Lorraine follows George to the dance floor, while Marty plays music with the band.

As the storm gathers, Marty arrives at the clock tower, but a falling branch disconnects the wire Doc has run from the clock tower to the street. As Marty races the DeLorean toward the clock tower, Doc climbs across the clock to reconnect the cable. The lightning strikes on cue, sending Marty back to 1985, only to watch Doc being killed and himself escaping to 1955. However he finds Doc is protected by a bullet-proof vest. Doc takes Marty home and departs to 2015.

Marty awakens the next morning to find his family changed: George is a self-confident, successful author, and Lorraine is physically fit. Biff is now George and Marty's obsequious subordinate. As Marty reunites with Jennifer, the DeLorean appears with Doc, dressed in a futuristic outfit, insisting they accompany him in the future, and he conveys them there at once.

President Ronald Reagan, a fan of the film, referred to the film in his 1986 State of the Union Address when he said, "Never has there been a more exciting time to be alive, a time of rousing wonder and heroic achievement. As they said in the film Back to the Future, 'Where we're going, we don't need roads'." When he first saw the joke about him being president, he ordered the projectionist of the theater to stop the reel, roll it back, and run it again.

THAT EXPLAINS THE GOP REFUSAL TO FUND INFRASTRUCTURE, ESP. ROAD REPAIR!

Demeter

(85,373 posts)Former Secretary of State Hillary Clinton is testifying Thursday before the House Select Committee on Benghazi, which is investigating the 2012 attack on the diplomatic compound in Benghazi, Libya.

And before she even got a word in during the event, which is being televised live, the top Republican and top Democrat on the committee gave lengthy and passionate speeches about its work.

Rep. Trey Gowdy (R-South Carolina), the committee chairman, started with a fiery statement ripping into Clinton and rejecting her accusation that his investigation is a partisan sham to try and tear down her presidential campaign.

"Chris Stevens, Sean Smith, Glen Doherty and Tyrone Woods served our country with courage and with honor. They were killed under circumstances most of us could never imagine. Under cover of darkness, terrorists poured through the front gate of our facility and attacked our people and our property with machine guns, mortars and fire," Gowdy began, according to his prepared remarks.

Gowdy called particular attention to Clinton's controversial and exclusive use of a personal email server at the State Department, which he said had hindered previous investigations into the 2012 attack.

"This committee is the first committee, the only committee, to uncover the fact that Secretary Clinton exclusively used personal email on her own personal server for official business and kept the public record — including emails about Benghazi and Libya — in her own custody and control for almost two years after she left office," he said.

"You made exclusive use of personal email and a personal server. When you left the State Department you kept those public records to yourself for almost two years. You and your attorneys decided what to return and what to delete. Those decisions were your decisions, not ours."

TOO BAD THEY DIDN'T STOP RIGHT THERE....

http://www.businessinsider.com/trey-gowdy-hillary-clinton-elijah-cummings-benghazi

Demeter

(85,373 posts)Every so often, I feel that I have cause to remind a writer of the famous New Yorker story about the writer who heard about a bird in the woods, said to be extinct. So he went to report on the story, found the local who thought they’d heard the bird’s song, bought some yellow waders, hired guides and a boat, and set out through the swamps and the Spanish moss and the dripping and the stinging insects in search of the bird. Long-form story short, they never found the bird. So what’s the point of a story where you don’t find the bird?

But now I feel that I’ve ended up writing the same sort of story. I didn’t find the bird. I thought I’d do a survey of other email scandals, and come to some sort of conclusion: That Clinton was uniquely bad or, alternatively, better than expected, or even uniquely good. Or maybe dynasties — Bush, Clinton, Romney — don’t pay a price, and others do. Instead, I just find a chaos of improvisation, with all the players mixing public and private together just as promiscuosly as Clinton did. Of course, just because everybody does it doesn’t make it right.

Anyhow, I’ve summarized my results, in the first section, in the form of a table. In a second section, I’ve included gory detail on each scandal, which you should read, at least for amusement purposes, even though or since it shows how dispiritingly similar the current Clinton email scandal is, in its grimy banality, to past email scandals, even if that’s not the story right now. (Of course, this would imply the suckitude of the press, but then you knew that.) In the final section, I’ll try to put the whole mess in context, and provide a policy suggestion, even if nobody will adopt it.

Summary of Past Email Scandals

I looked at five email scandals, where scandal is defined as either culminating in or commingled with criminal prosecution, or being the subject of a “media firestorm”: George W. Bush’s gwb43.com scandal, Mitt Romney’s email destruction, Scott Walker’s email destruction, John Kitzhaber’s attempted email destruction, and Hillary Clinton’s. Here are the results:

Table I

Scandal date[1] Party Official Server Location Server Owner Messages Destroyed Public/Private Mix Political Price

Hillary Clinton 2015 D Secretary of State Hillary Clinton’s home Hillary Clinton 31,830 Y None

John Kitzhaber 2015 D Governor Unknown State of Oregon 0 Y None

Scott Walker 2014 R Governor Walker’s office Walker aides 0 Y None

Mitt Romney 2011 R Governor State House The State, and then Romney aides 100.00% Y None

George W. Bush 2007 R President Chattanooga, TN Republican National Committee 22,000,000 Y None

NOTES

[1] Scandal date refers to when the scandal began, as opposed to when the actions that led to the scandal took place. For example, Romney destroyed his email in 2007 .

[2] This is what people keep saying. But I’ve never seen an original source. This from the (ugh) Daily Caller uses IP geolocation to urge that the server is located in Manhattan. However, I wonder if that’s the backup server. Because surely Hillary’s contractors would have advised off-site backup?

[3] The hard drives holding the server were seized by investigators.

[4] The servers was destroyed and, ingeniously, the aides purchased their laptops from the state.

The essential column is, I think, the rightmost....

http://www.nakedcapitalism.com/2015/10/200pm-water-cooler-10222015.html

Response to Demeter (Reply #4)

Demeter This message was self-deleted by its author.

Demeter

(85,373 posts)...The whole circus is a classic GOP move: they take an actual scandal – in this case, why was the US involved in Libya – and turned their investigation into a complete farce. Lost in the minute details of that one night in Benghazi is the much more critical question of why we ever decided to bomb Libya and remove Gaddafi in the first place, given the chaos and destruction that has followed. While Clinton’s Benghazi emails have been a hallmark of this presidential campaign, everyone seems to either forget or conveniently ignore that Clinton was the driving force behind yet another military intervention disaster by the US. And yet even in a more than five-hour hearing about the country, only one or two questioners even brought the subject up...

...The few lines the Republicans landed are maybe the ones that show how deeply involved Clinton was in the lead-up to the military intervention in Libya; though insiders know how involved she was, I’m not sure many Americans knew she was such a driving force behind military interventions, and perhaps more influential than Defense Secretary Robert Gates. But I also think, to my disappointment, that her involvement will be considered a positive thing by a lot of people (albeit not many Bernie Sanders supporters); Mark Penn was probably not wrong in 2008 when he counseled her that she needed to appear to be a certain kind of tough, and being involved in war planning shows that. It’s just he was wrong that her strength was all that she needed to show....

Demeter

(85,373 posts)Back to the Future Part II is a 1989 American science-fiction adventure comedy film directed by Robert Zemeckis and written by Bob Gale. It is the sequel to the 1985 film Back to the Future and the second installment in the Back to the Future trilogy.

The film stars Michael J. Fox, Christopher Lloyd, Thomas F. Wilson and Lea Thompson and continues immediately following the original film. After repairing the damage to history done by his previous time travel adventures, Marty McFly (Fox) and his friend Dr. Emmett "Doc" Brown (Lloyd) travel to 2015 to prevent McFly's future son from ending up imprisoned. However, their presence allows Biff Tannen (Wilson) to steal Doc's DeLorean time machine and travel to 1955, where he alters history by making his younger self wealthy.

The film was produced on a $40 million budget and was filmed back-to-back with its sequel, Part III. Filming began in February 1989 after two years were spent building the sets and writing the scripts. Two actors from the first film, Crispin Glover and Claudia Wells, did not return for the final two. While Elisabeth Shue was recast in the role of Wells' character, Jennifer, Glover's character, George McFly, was not only minimized in the plot, but was obscured and recreated with another actor. Glover successfully sued both Zemeckis and producer Bob Gale, changing how producers can deal with the departure and replacement of actors in a role. Back to the Future Part II was also a ground-breaking project for effects studio Industrial Light & Magic (ILM); in addition to digital compositing, ILM used the VistaGlide motion control camera system, which allowed an actor to portray multiple characters simultaneously on-screen without sacrificing camera movement.

Back to the Future Part II was released by Universal Pictures on November 22, 1989. The film grossed over $331 million worldwide, making it the third-highest-grossing film of 1989.

Demeter

(85,373 posts)a 1990 American science fiction Western comedy film, and the third installment of the Back to the Future trilogy. The film was directed by Robert Zemeckis and starred Michael J. Fox, Christopher Lloyd, Mary Steenburgen, Thomas F. Wilson, and Lea Thompson. The film continues immediately following Back to the Future Part II. While stranded in 1955 during his time travel adventures, Marty McFly (Fox) discovers that his friend Dr. Emmett "Doc" Brown, trapped in 1885, was killed by Biff Tannen's great-grandfather Buford. Marty decides to travel to 1885 to rescue Doc.

Back to the Future Part III was filmed in California and Arizona, and was produced on a $40 million budget back-to-back with Back to the Future Part II. Part III was released in the United States on May 25, 1990, six months after the previous installment. Part III earned $244.5 million worldwide against a budget of $40 million, making it the sixth-highest-grossing film of 1990.

Demeter

(85,373 posts)Some have called it a U-turn; others have described it as a shambles. But John McDonnell’s volte face was the right thing to do, even though it meant losing face, big time. On the eve of the Labour party conference, McDonnell surprised detractors and supporters alike by saying that Labour should vote for George Osborne’s new fiscal charter, which requires the country to run budget surplus in “normal times”. Now McDonnell says his party should vote against it. Admittedly, even when proposing to vote in favour of Osborne’s charter, McDonnell advocated a different vision of fiscal responsibility from what the chancellor was proposing. McDonnell pointed out that running a budget surplus means taking demand out of the economy, so there is an economic illiteracy in wanting to run one more or less permanently. He also argued that surplus should be run only on the current (consumption) component of the budget, and that deficit could – and should – be run on the capital (investment) component of it. His view was that if you borrow to invest, the debt will more than pay for itself in the long run as the investment matures and raises the economy’s output, and thus tax revenue.

The shadow chancellor was also insistent that, even while reducing the deficit, he would do it in a more equitable way. Rather than mainly squeezing the most vulnerable groups, as the Conservatives have been doing, the fiscal gap would be closed by raising taxes on the top earners and, especially, being much tougher on tax avoidance and tax evasion. However, these are all part of the fine print. Once you accept that you have to run a budget surplus in order to be “responsible”, you have, as an anti-austerity politician, already lost the debate. You win a political debate by making people accept your vision, not by pointing out that you offer them better terms in the fine print – which they are unlikely to read anyway.

So if McDonnell is going to win the economic debate, he needs to change its terms. He has to start by doing another U-turn on the statement: “We accept we are going to have to live within our means, and we always will do – full stop.”Because this is simply wrong. This view assumes that our means are given, and we cannot spend beyond them. However, our means in the future are partly determined by what we do today. And if our means are not fixed, then the very idea of living within them loses its meaning. For example, if you borrow money to do a degree or get a technical qualification, you will be spending beyond your means today. But your new qualification will increase your future earning power. Your future means will be greater than they would have been if you hadn’t taken out the loan. In this case, living beyond your means is the right thing to do...More importantly, unlike individuals, a government has the ability to spend “money it does not have”, only to find later that it had the money after all. The point is that deficit spending in a stagnant economy will increase demand in the economy, stimulating business and making consumers more optimistic. If enough businesses and consumers form positive expectations as a result, they will invest and spend more. Increased investment and consumption then generate higher incomes and higher tax revenues. If the tax take increases sufficiently, the government deficit may be eliminated, which means that the government had the money that it spent after all.

If Labour wants to re-establish its credentials for economic management, it needs to start by rejecting the “living within our means” mantra. The idea may have as much obvious appeal as other examples of homespun philosophy, but it is one that is more fitting for 18th-century household management than for the management of a complex 21st-century economy. Unless the Labour party changes its foundational belief in the virtue of the government living within its means, British voters will never be convinced of the finer points of Keynesian economics, or of the ethics of inequality, that John McDonnell is trying to make.

Demeter

(85,373 posts)Congress is heading into another big brawl over the federal budget deficit, the national debt, and the debt ceiling. Republicans are already talking about holding Social Security and Medicare “hostage” during negotiations—hell-bent on getting cuts in exchange for a debt limit hike.

Days ago, U.S. Treasury Secretary Jacob Lew asked whether our nation would “muster the political will to avoid the self-inflicted wounds that come from a political stalemate.” It’s a fair question. And there’s only one economically sound answer: Congress must raise the debt ceiling, end the sequester, put more people to work, and increase our investment in education and infrastructure.

Here are the three reasons why Republican deficit hawks are wrong. (Please watch and share our attached video.)

FIRST: Deficit and debt numbers are meaningless on their own. They have to be viewed as a percent of the national economy.

That ratio is critical. As long as the yearly deficit continues to drop as a percent of the national economy, as it’s been doing for several years now, we can more easily pay what we owe.

SECOND: America needs to run larger deficits when lots of people are unemployed or underemployed – as they still are today, when millions remain too discouraged to look for jobs and millions more are in part-time jobs and need full-time work.

As we’ve known for years – in every economic downturn and in every struggling recovery – more government spending helps create jobs – teachers, fire fighters, police officers, social workers, people to rebuild roads and bridges and parks. And the people in these jobs create far more jobs when they spend their paychecks. This kind of spending thereby grows the economy – thereby increasing tax revenues and allowing the deficit to shrink in proportion. Doing the opposite – cutting back spending when a lot of people are still out of work – as Congress has done with the sequester, as much of Europe has done – causes economies to slow or even shrink, which makes the deficit larger in proportion.

This is why austerity economics is a recipe for disaster, as it’s been in Greece. Creditors and institutions worried about Greece’s debt forced it to cut spending, the spending cuts led to a huge economic recession, which reduced tax revenues, and made the debt crisis there worse.

THIRD AND FINALLY: Deficit spending on investments like education and infrastructure is different than other forms of spending, because this spending builds productivity and future economic growth.

It’s like a family borrowing money to send a kid to college or start a business. If the likely return on the investment exceeds the borrowing costs, it should be done.

Keep these three principles in mind and you won’t be fooled by scare tactics of the deficit hawks. And you’ll understand why we have to raise the debt ceiling, end the sequester, put more people to work, and increase rather than decrease spending on vital public investments like education and infrastructure.

http://robertreich.org/

Demeter

(85,373 posts)It's a practice that systematically criminalizes poverty.

...Kennedy v City of Biloxi discloses that between September 2014 and March this year, at least 415 people were put in jail under warrants charging them with failure to pay fines owed to the city. According to court records, none of these 415 people had the money available when they were locked up...

Debtors’ prisons were abolished in the United States almost two centuries ago. The informal practice of incarcerating people who cannot pay fines or fees was also explicitly outlawed by the US supreme court in 1983 in a ruling that stated that to punish an individual for their poverty was a violation of the 14th amendment of the US constitution that ensures equal protection under the law.

In that judgment, the nation’s highest court ordered all authorities across the country to consider an individual’s ability to pay before jailing them or sentencing them to terms of imprisonment. Yet the plaintiffs in the Biloxi lawsuit all found themselves carted straight to jail without any prior legal hearing and with no representation by a lawyer – a fast-tracking to detention that the complaint argues is a flagrant abuse of the supreme court’s ruling, now more than 30 years old.

...The pattern of judicial behavior outlined in Kennedy v City of Biloxi is replicated throughout the US as local authorities seeking new revenue sources jail their poor citizens, allegedly as a way of intimidating them to hand over money they do not have. In 2010, the ACLU exposed similar practices they say are akin to modern-day debtors’ prisons in Georgia, Louisiana, Michigan, Ohio and Washington. Lawsuits have followed, with Georgia and Washington both being sued this year.

At its most extreme, the incarceration of poor debtors can cost them their lives...

MORE

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Donald Trump has opened the floodgates to lies about immigration. Here are the myths, and the facts.

MYTH: Immigrants take away American jobs.

Wrong. Immigrants add to economic demand, and thereby push firms to create more jobs.

MYTH: We don't need any more immigrants.

Baloney. The U.S. population is aging. Twenty-five years ago, each retiree in America was matched by 5 workers. Now for each retiree there are only 3 workers. Without more immigration, in 15 years the ratio will fall to 2 workers for every retiree, not nearly enough to sustain our retiree population.

MYTH: Immigrants are a drain on public budgets.

Bull. Immigrants pay taxes! The Institute on Taxation and Economic Policy released a report this year showing undocumented immigrants paid $11.8 billion in state and local taxes in 2012 and their combined nationwide state and local tax contributions would increase by $2.2 billion under comprehensive immigration reform.

MYTH: Legal and illegal immigration is increasing.

Wrong again. The net rate of illegal immigration into the U.S. is less than zero. The number of undocumented immigrants living in the U.S. has declined from 12.2 million in 2007 to 11.3 million now, according to Pew Research Center.

Don't listen to the demagogues who want to blame the economic problems of the middle class and poor on new immigrants, whether here legally or illegally. The real problem is the economic game is rigged in favor of a handful at the top, who are doing the rigging.

We need to pass comprehensive immigration reform, giving those who are undocumented a path to citizenship.

Scapegoating them and other immigrants is shameful.

And it's just plain wrong.

http://robertreich.org/

Demeter

(85,373 posts)Demeter

(85,373 posts)Next year, residents will vote on replacing the Affordable Care Act with ColoradoCare, a single-payer plan that works like a cooperative. In a purple state like this, it just might work...In November of next year, the state OF COLORADO will have the opportunity to lead the way again—this time, by opting out of Obamacare and replacing it with ColoradoCare, a universal health care system governed by those who rely on it. Proponents presented far more than the requisite 99,000 signatures required to put the initiative on the 2016 ballot in Denver today, though they must be verified in the coming weeks.

ColoradoCare proposes a single-payer model that covers every Colorado resident. A tax on income and employers would replace insurance premiums, but the revenue wouldn't be subject to the whims of legislators; instead, it would go directly to a fund overseen by trustees whom the recipients choose. In this respect, it would be a cooperative-like system accountable to everyone in the state, independent from the rest of the government and enshrined in the constitution.

Proponents argue that ColoradoCare will mean better, more accountable care at a lower cost. Opponents, including the Koch brothers-funded Advancing Colorado, say it will be the Obamacare rollout on steroids. But by combining conservative irritation with the Affordable Care Act with liberal ambition toward universal coverage, it may actually have a chance in a purple state like Colorado.

Colorado, also, has a history of building practical, cooperative infrastructure. When energy companies failed to bring power to the state’s rural areas quickly enough, communities set up electricity co-ops to power themselves. Credit unions are plentiful. Cooperative business models accommodate both community-mindedness and the state’s libertarian streak.

MORE

Demeter

(85,373 posts)Perhaps Saturday will bring some solidly economic happenings, but in the meanwhile, it's back to old email newsletters....what do I do when I run out of those? After all, I've only got about 500 left....that's down considerably from this time last year!

MattSh

(3,714 posts)and my wife's sitting it out. Good for her. She's sat out every election since the coup. And I can't vote here, even if I wanted to, which I don't...

I mean at some point, isn't the act of voting a recognition of the legitimacy of the system? And if the government took power by illegitimate means, and then actively suppressed those who expressed views in opposition of the leaders of the new government, and especially views that you tend to agree with, then what is the purpose of voting for people whose positions vary only in the degree in which they are willing to screw you over in service of the new leadership? And the variance in screwing you over ranges from "most of the time" to "all of the time?"

Now, just how different is the methods of operation of the US government and the government in Ukraine? Not much, I would argue. I would argue that there's only one real hope in the upcoming US presidential election. Will there not be suppression of those with views you tend to agree with? Do you think the system will allow Bernie within range of the bully pulpit? Or will he be gone before March? Will you, by November 2016, be faced with a choice between someone who will screw you over "most of the time" and someone who will screw you over "all of the time?" And I'd likely argue that the choices in the Ukraine election tomorrow will be more palatable than the US presidential choice in 2016.

At least here in Ukraine, when you face the unpalatable, you can drop out of the system. I remember friends of my wife who in 2005 emerged from the underground economy because they thought the Orange Revolution might bring about some real change. But within 6 months, their business retreated back to the underground economy where it has remained the last 10 years. Dropping out of the system in the USA is not nearly as easy. Except if you're already doing pretty well to begin with.

I often pass by a place where people go to register their businesses. And it's been quite busy lately, even with the highly depressed economic conditions that currently exist here. And I was wondering why. Well duh! It's also the place where people go to deregister their businesses too. No doubt there were quite a few who were forced out of business by the current economy. But I have no doubt that there were a good number looking to drop out of the system and go underground.

Many many businesses stayed underground in the time of "he who should not be mentioned" (Yanukovich). And it was no mystery why. When it came time to get revenue for the government and his cronies, you couldn't get it from the oligarchs. Just like in the USA. So he put the squeeze on small and mid-sized businesses instead. Then came the coup, which had much support from many of the same businesses. So who gets squeezed now? Why, the average Joe, the poor and the middle class, pensioners, the invalid, those on a fixed income. Hey, just look how quickly the Ukraine economy became "westernized." It's a miracle, I tell you! And because all of the regular people get squeezed, just look at who else gets squeezed. The small and mid-sized businesses! Blowback! Funny how that works...

MattSh

(3,714 posts)The funny thing is, even her father is saying he'll sit it out. He's easily manipulated by the media, which is highly controlled over here. And even he's seeing through the BS. (Or at least until today's last minute media blitz). He is half Ukrainian, which makes him more open to the pro-Ukrainian crowd and their message. That makes my wife 1/4 Ukrainian, but don't dare bring that up.

Yes, the Russian vs. Ukraine thing is big among some people over here. Some Ukrainians see the hidden hand of Russian suppression behind every misfortune that they might encounter. Or imagine.

antigop

(12,778 posts)Excellent question, Matt!

Why am I reminded of this clip?

Demeter

(85,373 posts)hamerfan

(1,404 posts)Days Of Future Passed by the Moody Blues (the full album, and it's a good one)

Demeter

(85,373 posts)I've always had a soft spot for the Moody Blues.

Demeter

(85,373 posts)Martin Shkreli (born April 1, 1983) is an American hedge fund manager and entrepreneur, specializing in healthcare businesses, and is a co-founder of MSMB Capital Management and the founder of Turing Pharmaceuticals AG. He is a co-founder and was the chief executive officer of Retrophin LLC, a biotechnology firm founded in 2011. In September 2015, Shkreli was criticized when Turing Pharmaceuticals obtained the manufacturing license for Daraprim, and raised its price by 5,455 percent (from $13.50 to $750 per tablet). After initially defending the price increase, Shkreli said an unspecified lower price would be established.

Early life

Martin Shkreli, the son of Albanian and Croatian immigrants, was born in Brooklyn, New York on April 1, 1983. He grew up in a working-class community in Brooklyn. Shkreli skipped several grades in school and received a degree in business from New York's Baruch College in 2004.

Career

In 2000, Shkreli was a college intern and then clerk at Jim Cramer's Cramer, Berkowitz, & Co.

After four years at Cramer Berkowitz, he held jobs at UBS and Intrepid Capital Management before starting his first hedge fund, Elea Capital Management, in 2006. Shkreli launched MSMB Capital Management (named after the two founding Portfolio Managers, Martin Shkreli and Marek Biestek) in 2009.

In 2011, Shkreli filed requests with the U.S. Food and Drug Administration (FDA) to reject a new type of cancer diagnostic from the manufacturers Navidea Biopharmaceuticals and an inhalable insulin therapy for diabetes from MannKind Corporation, while publicly short-selling the companies' stocks. Both companies' stock values immediately dropped following Shkreli's interventions, and the companies had difficulty launching the products as a result. The FDA subsequently approved both therapies.

Retrophin

Retrophin Inc. was created in 2011 and run from the offices of MSMB Capital as a portfolio company with an emphasis on biotechnology, to create treatments for orphan diseases. In September 2014 Retrophin acquired the rights to Thiola, a drug used to treat the rare disease cystinuria. Shkreli resigned from the company in October 2014 after Retrophin's Board decided to replace him that September with Stephen Aselage. Shkreli then left Retrophin and started Turing Pharmaceuticals.

Retrophin filed a $65 million lawsuit against Shkreli in August 2015, claiming he breached his duty of loyalty to the biopharmaceutical company in a long-running dispute over his use of company funds, and alleging that he "committed stock-trading irregularities and other violations of securities rules". The lawsuit includes the claim that Shkreli threatened and harassed a former MSMB employee and his family. Shkreli and some of his business associates have been under criminal investigation by the U.S. Attorney for the Eastern District of New York since January 2015 with respect to their Retrophin activities, and Shkreli has invoked his Fifth Amendment right against self-incrimination in order to avoid testifying during civil depositions.

https://en.wikipedia.org/wiki/Martin_Shkreli

Demeter

(85,373 posts)Wishes for safety in the storm for our neighbors to the South.

Meanwhile, a river of water from Patricia has jumped onto the jet stream and is drowning us from 4000 kilometers away (or 2500 miles, roughly). Well, it's been a dry fall, and the leaves are falling off and peak color has come and gone already, so it's all good.

The Kid and I are going to see Night at the Museum, the final episode of the series, as well as Robin Williams' and Mickey Rooney's last screen appearances...what times we live in! Dick van Dyke turned 90 this month, and is reportedly still going strong...

Demeter

(85,373 posts)Every word Robin Williams said in the movie is foreshadowing...I cried for the Lost Boy.

Demeter

(85,373 posts)Yves here. This article by Carolyn Sissoko, who has long been providing savvy commentary about derivatives and complex financial products, does an impressive job in a new post, in a clear, non-technical manner, of addressing an issue that the financial press has seldom presented properly: that of the moaning among dealers and investors about the scarcity of “safe assets” meaning Treasuries and other high quality bonds. You’d think the demand came from end investors, like widows and orphans or their functional equivalents, such as foundations and endowments.

In reality, as we’ve discussed earlier, the demand in fact came from the need to secure derivative positions. As we wrote in 2012:

This massive fail results from the refusal to deal with the derivatives problem head on. For some peculiar reason, economists and regulators have bought the idea that financial “innovation” is always and ever good and should therefore be given free rein. Even though the crisis would seem to have proven decisively otherwise, no one seems willing to question the value to anyone other than banksters of the continuing growth of over-the-counter derivatives markets. And the ever rising “need” for more collateral is the direct result of the explosive growth of the derivatives market. This chart from ECONNED is somewhat dated but gives you an idea:

MORE

antigop

(12,778 posts)More info here...

Demeter

(85,373 posts)I take it's still in production...the special effects would have to be awesome!

Demeter

(85,373 posts)http://www.ft.com/cms/s/0/c5a3c5bc-77fb-11e5-a95a-27d368e1ddf7.html#ixzz3pWQffOpQ

Investors have had plenty of reasons to worry about oil prices this year. Now there is another: Timothy Massad, chairman of the US Commodity Futures Trading Commission, revealed on Wednesday that there have been 35 bizarre “flash crashes” in American oil markets this year. Yes, you read that right: according to CFTC researchers, on three dozen occasions prices for West Texas Intermediate crude have gyrated so dramatically that they have been defined as flash crashes. This means prices swung 200 basis points in less than an hour, before recovering at least 75 basis points. Even if the definition is a little arbitrary, these swings are clearly becoming far more frequent — and not just in oil markets. Investors were shocked this year when a flash crash in US equities caused the price of some exchange traded funds to plummet for a brief period. Almost exactly a year ago, similar convulsions erupted in the Treasuries market. However, the CFTC research shows the problem extends well beyond these eye-catching episodes: flash crashes are now affecting even hitherto dull commodities sectors, such as corn.

Why? Ask a banker, and they will be tempted to blame regulation. The argument is that reforms introduced after the 2008 crisis have made banks so risk averse that they are reluctant to act as market makers, standing ready to buy or sell when investors want to trade — which means liquidity vanishes in a crisis, making prices swing.

But Mr Massad points to another culprit: algorithms such as those used by high-frequency traders. This is the vital piece of the puzzle. In the past few years, use of automated computer programs has expanded so fast that the CFTC says they are now involved in 50 per cent of all trades for metals and energy futures, and 67 per cent of Treasury futures. If the markets were like the spaceship in the movie, 2001: A Space Odyssey, it would be Hal, the craft’s wilful computer, at the controls. The crucial point is that these automated trading programs — like Hal — lack human judgment. When a crisis erupts and prices churn, computers do not simply “take a long coffee break”, as Mr Massad says, and wait for common sense to return; instead they tend to accelerate trading, fuelling those flash crash swings. MORE

OBVIOUS TO ANYONE WHOSE INCOME DOESN'T DEPEND ON IT, IT'S TIME TO SHUT HAL DOWN, AND ALL HIS LITTLE ALGO OFFSPRING

Demeter

(85,373 posts)Demeter

(85,373 posts)I gathered from her expression that she was used to the question. “Do you have a background in business, Mr. Carr?”

I nodded, and she went on. “In the Atlantic Republic, if I understand correctly—and please let me know if I’m wrong—when a company spends money to buy machines, those count as assets; that’s how they appear on the books, and there are tax benefits from depreciation and so on. When a company spends the same money to do the same task by hiring employees, they don’t count as assets, and you don’t get any of the same benefits. Is that correct?”

I nodded again.

“On the other hand, if a company hires employees, it has to spend much more than the cost of wages or salaries. It has to pay into the public social security system, public health care, unemployment, and so on and so forth, for each person it hires. If the company buys machines instead, it doesn’t have to pay any of those things for each machine. Nor is there any kind of tax to cover the cost to society of replacing the jobs that went away because of automation, or to pay for any increased generating capacity the electrical grid might need to power the machines, or what have you. Is that also correct?”

“Essentially, yes,” I said.

“So, in other words, the tax codes subsidize automation and penalize employment. You probably were taught in business school that automation is more economical than hiring people. Did anyone mention all the ways that public policy contributes to making one more economical than the other?”

“No,” I admitted. “I suppose you do things differently here.”

“Very much so,” she said with a crisp nod. “To begin with, if we hire somebody to do a job, the only cost to Mikkelson Manufacturing is the wages or salary, and any money we put into training counts as a credit against other taxes, since that helps give society in general a better trained work force. Social security, health care, the rest of it, all of that comes out of other taxes—it’s not funded by penalizing employers for hiring people.”

“And if you automate?”

“Then the costs really start piling up. First off, there’s a tax on automation to pay the cost to society of coping with an increase in unemployment. Then there’s the cost of machinery, which is considerable, and then there’s the natural-resource taxes—if it comes out of the ground or goes into the air or water, it’s taxed, and not lightly, either. Then there’s the price of energy. Electricity’s not cheap here; the Lakeland Republic has only a modest supply of renewable energy, all things considered, and it hasn’t got any fossil fuels to speak of, so the only kind of energy that’s cheap is the kind that comes from muscles.” She shook her head. “If we tried to automate our assembly line, the additional costs would break us. It’s a competitive business, and the other two big firms would eat us alive.”

“I suppose you can’t just import manufactured products from abroad.”

“No, the natural-resource taxes apply no matter what the point of origin is. You may have noticed that there aren’t a lot of cars on the streets here.”

“I did notice that,” I said.

“Fossil fuels here don’t get the government subsidies here they get almost everywhere else, and there’s the natural-resource taxes on top of that, for the fuel that’s burnt and the air that’s polluted. You can have a car if you want one, but you’ll pay plenty for the privilege, and you’ll pay even more for the fuel if you want to drive it.”

I nodded; it all made a weird sort of sense, especially when I thought back to some of the other things I’d heard earlier. “So nobody’s technology gets a subsidy,” I said.

“Exactly. Here in the Lakeland Republic, we’re short on quite a few resources, but one thing there’s no shortage of is people who are willing to put in an honest day’s work for an honest wage. So we use the resource we’ve got in abundance, rather than becoming dependent on things we don’t have.”

“And would have to import from abroad.”

“Exactly. As I’m sure you’re aware, Mr. Carr, that involves considerable risks.”

I wondered if she had any idea just how acutely I was aware of those. I put a bland expression on my face and nodded. “So I’ve heard,” I said.

IF YOU HAVE SOME TIME, PERUSE THE BLOG...IT'S QUITE CREATIVE, ALMOST BERNIE-LIKE.

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)Didn't know he grew a beard

Demeter

(85,373 posts)Source: Kennebec Journal

Confronted with disappointing data from around the world, economists are whispering a word that hasn’t seemed like a real possibility in years: recession.

It starts with the slowdown in China, which is already straining the global recovery. The world’s second-largest economy has lost its appetite for the raw materials that fueled its industrial boom, leaving the smaller countries that supplied it with resources stumbling in its wake. Slower growth abroad translates into weaker foreign currencies and a stronger U.S. dollar, which makes American goods harder to sell in the global marketplace.

A growing chorus of prominent economists and analysts are arguing those dynamics could tip the world – and the United States along with it – into recession within the next two years. The fear is showing up in the recent wild swings in financial markets, rare outside of broader economic downturns. The pace of U.S. job growth has slowed substantially compared to last year. And though the economic expansion has never quite reached many workers, it has actually lasted longer than the postwar average.

“The global economy is uncomfortably close to the edge,” said David Stockton, senior fellow at the Peterson Institute for International Economics.

<more>

Read more: http://www.centralmaine.com/2015/10/23/economists-start-warning-about-risk-of-a-new-u-s-recession/

DemReadingDU

(16,000 posts)I didn't think we ever got out of the previous recession,

Just some fancy manipulation has gone on to make stats look better than they really are.

Demeter

(85,373 posts)when the banksters and their stockholders could sleep at night again.

Demeter

(85,373 posts)...a chill in economic activity is already evident across a broad swath of the nation’s heartland stretching from the Gulf of Mexico to the Canadian border, as prices of commodities sink...a sudden plunge in demand for commodities...The fall in prices for a variety of products, including crude oil, iron ore and agricultural crops like corn and soybeans is reminiscent of the collapse of the technology boom in 2000 or the bursting of the housing bubble nearly a decade ago. And behind the pain and anxiety are headwinds blowing from China and other emerging markets, where growth is slowing and demand for the raw materials that drive the global economy has dried up.

Even as the American economy continues to plow ahead, nerves are increasingly on edge. Investors and banks that lent eagerly to energy and mining giants when prices were high are worried about whether they will be repaid if prices stay low...

For the farm belt, which largely sidestepped the damage wreaked by the financial crisis and the Great Recession, the economic turnabout has been especially sharp. The Agriculture Department forecasts that farm income, adjusted for inflation, will fall 54 percent from where it was two years ago — the third-lowest level since the 1980s. Corn, the most valuable crop in the country, has fallen to $3.78 a bushel from $7.50 three years ago.

“I think a lot of farmers are starting to realize that these price levels may not be temporary,” said Nathan Kauffman, the Omaha branch executive with the Federal Reserve Bank of Kansas City, Mo.

Still, for all the rising fears across the nation’s midsection, the end of the long boom in commodities cuts both ways. Unlike the housing bust, which benefited no one but a few prescient short-sellers, the price collapse has a countervailing positive impact for consumers and some other businesses.

The 37 percent drop in gasoline prices since the summer of 2014 is the equivalent of a $100 billion tax cut (NO IT ISN'T!), providing much-needed relief while wages remain stuck. Food prices, too, have declined, with chicken costing 8 percent less than a year ago, according to the Bureau of Labor Statistics. Milk is cheaper, and prices of goods from abroad, like coffee, are down...Airlines are rejoicing at lower prices for fuel, which makes up 40 percent of their costs. For the first time in years, airlines can buy new planes, invest in new facilities and give bonuses to employees, while paying dividends to shareholders. With gasoline prices low, automakers are raking in healthy profits from selling shiny new pickup trucks and sport utility vehicles.

“There are winners and there are losers,” said Nariman Behravesh, chief economist at IHS, a research firm that tracks the economy. “But there is no question that there are pockets of real pain out there.”

Commodity producers are used to regular booms and busts, but the so-called supercycle driven by China’s once insatiable appetite for raw materials has been extraordinary by any standard. Edward L. Morse, Citigroup’s global head of commodities research, likens China’s boom to the three decades after World War II when Europe was rebuilt, or the Gilded Age industrialization of the United States in the half-century after the Civil War.

MUCH MORE LAMENTATION AT LINK

Demeter

(85,373 posts)...More- or less- recent events, though, show us once more why we’re right to insist on inflation being defined in terms of the interaction of money-plus-credit supply with money velocity (aka spending). We’re right because the price rises/falls we see today are but a delayed, lagging, consequence of what deflation truly is, they are not deflation itself. Deflation itself has long begun, but because of confusing -if not conflicting- definitions, hardly a soul recognizes it for what it is.

Moreover, the role the money supply plays in that interaction gets smaller, fast, as debt, in the guise of overindebtedness, forces various players in the global economy, from consumers to companies to governments, to cut down on spending, and heavily. We are as we speak witnessing a momentous debt deleveraging, or debt deflation, in real time, even if prices don’t yet reflect that. Consumer prices truly are but lagging indicators. The overarching problem with all this is that if you look just at -consumer- price movements to define inflation or deflation, you will find it impossible to understand what goes on. First, if you wait until prices fall to recognize deflation, you will tend to ignore the deflationary moves that are already underway but have not yet caused prices to drop. Second, when prices finally start falling, you will have missed out on the reason why they do, because that reason has started to build way before a price fall. A different, but useful, way to define -debt- deflation comes from Andrew Sheng and Xiao Geng in a September 24 piece at Project Syndicate, China in the Debt-Deflation Trap:

That’s of course just an expensive way of saying that after a debt bubble must come a hangover. And how anyone can even attempt to deny we’re in a gigantic debt bubble is hard to understand. Our entire economic system is propped up, if not built up, by debt.

MORE

Demeter

(85,373 posts)at the "other" university in my neighborhood. Taking the Kid and our honorary auntie out for a live treat.

With sulfa drugs fueling my recovery, I am making improvements in health, slowly. It's hard to remember what normal felt like, after 10 weeks, let alone hope to achieve it again. Just doing a little housework leaves me exhausted, still.

Demeter

(85,373 posts)Socialist mayor to fulfill campaign promises by “printing” money.

Over the next six months, Barcelona’s left-wing city council plans to roll out a cash-less local currency that has the potential to become the largest of its kind in the world. The main goal of the project, according to a council spokesperson, is to boost economic opportunities for local businesses and traders. The idea is for local stores and residents to be able to exchange euros for the new currency at a one-to-one parity, and use it to purchase products and services at a discount or with other kinds of incentives. But it doesn’t end there: the new parallel currency may also be used to pay certain subsidies, taxes and local services such as public transport, reports El País. Municipal workers could also receive part of their salary in the new money.

Barcelona will not be the first European city to launch such a scheme. Local currencies are all the rage these days. There could be as many as 3,000 forms of local money in use around the globe, says Community Currencies in Action, a global partnership promoting such schemes that is part-funded by the European Union’s Regional Development Fund. Which begs the question…Why’s the EU Promoting Parallel Local Currencies Around the World? According to the official blurb, it is to support local small and medium-size enterprises (SME) as well as offer new tools for social inclusion and environmental protection. This comes from an organization that has so far shown scant regard for SMEs, social inclusion and environmental protection. Perhaps there are somewhat less altruistic motives behind the EU’s agenda — motives such as encouraging people to embrace cashless currencies. As I warned in The War on Cash in 10 Spine-Chilling Quotes, the war on cash has moved from one of words to actions. As such, is it pure coincidence that most of the local community currencies that have been launched so far are in purely digital format, as would Barcelona’s? Perhaps that explains why local currencies have captured the interest and support of organizations like the Long Finance Group, whose sponsors include the City of London Corporation, and which recently echoed the Bank of England’s calls for the UK government to adopt a purely digital currency in order to save the national economy (no, seriously).

The EU could also have another hidden motive in promoting community currencies: strengthening regional identity, at the obvious expense of national identity. Strong regional identity certainly helps with uptake, which is why you often find the most successful community currencies taking root in regions with a proud traditional heritage. Europe’s biggest experiments with local currency to date include the Chiemgauer in the German state of Bavaria (total amount in circulation: €521,000), the Eusko in France’s Basque region (€370,000 euros), the WIR in Switzerland, and the Brixton Pound in South London (€150,000). The Chiemgauer, like many local parallel currencies, has a built-in “value loss” of 8% per year – a sort of automatic inflation – to induce people to spend this money as fast as possible before it corrodes away. That’s why it’s sometimes called the “rusting money.” It’s a heck of a lot worse than the negative deposit rates at some German banks (the hated “punishment interest“). Convert this money into euros to avoid this loss? No problem, just pay a penalty fee of 5%. So users – consumers and SMEs – get screwed, but they’re submitting to it voluntarily and can’t bitch about it

...With a metropolitan population of 3.2 million people, Barcelona would be far and away the largest city council in the West to trial such a scheme. The council is also proposing using the currency to pay some salaries, social benefits and public services, which could propel the amount in circulation well into the millions, if not billions of euros...Predictably,the opposition to the scheme in Madrid is fierce. In June, the Bank of Spain’s deputy governor Fernando Restoy delivered a shot across the bow by warning that the scheme proposed by Barcelona’s activist mayor, Ada Colau, was “impossible” as well as “undesirable.” To launch its own currency Barcelona City Council would have to go directly against the wishes of both national regulators and the central government. It would hardly be the first time in history that it had. Indeed, many of the leading figures of Catalonia’s pro-independence movement, including the region’s premier, Artur Mas, have already called for mass civil disobedience of Madrid. And there are few more potent acts of disobedience than the creation of one’s own currency...

MORE

DemReadingDU

(16,000 posts)Coming Christmas 2015

Christian Bale, Steve Carell, Ryan Gosling, Brad Pitt

edit to add

Christian Bale is ex-neurologist and Scion Capital founder Michael Burry, who is blind in one eye and has Asperger’s syndrome;

Steve Carrell is hedge fund manager Steve Eisman;

Ryan Gosling is Deutsche Bank trader Greg Lippmann;

and Brad Pitt is Ben Hockett, one of the founders of Cornwall Capital.

http://www.wired.com/2015/09/the-big-short-trailer/

Demeter

(85,373 posts)Recently I worked in another Maine city and was astonished at the number of patients I encountered who were using heroin. I had never seen anything like it, during a lifetime practicing medicine. In New Hampshire, it was said, deaths from heroin now exceed deaths from car accidents. Nationwide, CDC noted, "Between 2002 and 2013, the rate of heroin-related overdose deaths nearly quadrupled, and more than 8,200 people died in 2013." Massachusetts (population under 7 million) had 1,000 deaths related to (all) opioids in 2014, "the highest ever recorded." According to CDC, in the two years between 2010 and 2012, heroin overdose rates in the Northeast (where I live) tripled...I've heard stories on NPR about insufficient state funding of heroin treatment facilities. I've heard about plans to make Narcan injections available to iv drug users, for overdoses. Another popular angle I've seen repeated over and over (and one currently pushed by the US Drug Enforcement Agency and the White House Office on National Drug Control Policy) claims legal prescriptions for narcotics increased, then became harder to get, so users switched to heroin, which was cheaper. Marijuana used to be claimed the "entry" drug to heroin, but now prescription narcotics have assumed that role. How times change. The narrative we have been given is that a massive increase in heroin use has nothing to do with increased supply. (This violates the laws of arithmetic and economics, not to mention common sense.)

If increased prescriptions for controlled substances was the primary cause of the heroin epidemic, then Americans would also be using more cocaine. The massive increase in ADHD drug prescriptions (presumed "entry" drugs for cocaine) should have caused a cocaine explosion. While prescriptions for narcotics (hydrocodone and oxycodone) increased 4.5-fold between 1991 and 2007 in the US, prescriptions for ADHD stimulants rose even more, by 7-fold, according to National Institute on Drug Abuse testimony to Congress in 2008:

But in fact, the DOJ-DEA 2014 National Drug Threat Assessment Summary notes that cocaine availability "remains stable at historically low levels throughout most domestic markets along the East Coast." So prescription drug users are switching to heroin, but not switching to cocaine. Hmmm. Might this be because we have no large military-CIA presence currently in cocaine-trafficking areas, as we did during the 1980s Contra war in Nicaragua, when cocaine use was at high levels? (Coca plants are only grown in South America's Andes.) According to a 2010 UN document, "Based on seizure figures, it appears that cocaine markets grew most dramatically during the 1980s, when the amounts seized increased by more than 40% per year". (See this 1987 Senate hearing and this for evidence of CIA and State Dept. connivance with cocaine trafficking by the Contras.)

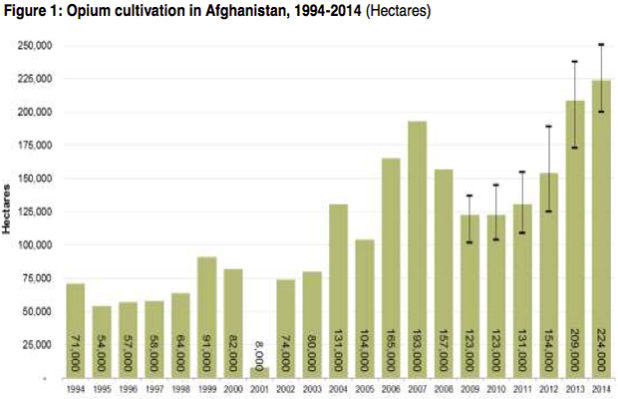

You can frame stories about the current heroin problem in many ways. But the real heroin story isn't being discussed--which is that since the US military entered Afghanistan in 2001, its opium production doubled, per the UN Afghanistan Opium Survey 2014, page 34. The area under opium cultivation in Afghanistan tripled. And the resulting heroin appears to more easily make its way deep into our rural, as well as urban communities. The graph below is from the 2014 UN Opium Survey:

The world supply of opium increased 5-fold between 1980 and 2010, according to the UN. Afghanistan accounts for around 90% of global illicit opium production in recent years. By itself, Afghanistan provides 85% of the estimated global heroin and morphine supply, a near monopoly."

Despite the (now) US $8.4 billion spent to defeat this trade, it just keeps growing. The costs of US reconstruction efforts in Afghanistan total "$110 billion, after adjusting for inflation, which]exceeds the value of the entire Marshall Plan effort to rebuild Western Europe after World War II" according to the Special Inspector General for Afghanistan Reconstruction, speaking in May 2015. The Special Inspector General noted elsewhere that, "US reconstruction projects, particularly those devoted to “improved irrigation, roads, and agricultural assistance” were probably leading to the explosion in opium cultivation." Only 1.2% of the acreage used for Afghan opium production (est. 224,000 hectares) was eradicated in 2014, according to the UN. Also according to the UN, Burma is the world's second largest producer of opium, currently growing only about 10% as much as Afghanistan. But Mexico has been increasing production.

According to the UN World Drug Report, in the 1990's Afghanistan supplied opium that was converted into half the world's heroin production. According to University of Wisconsin Professor Alfred McCoy, the rapid 1980s rise in Afghani opium production came about through CIA efforts to create, arm and fund the mujahedeen using opium sales. (After defeating the Soviets in Afghanistan the mujahedeen morphed into Al Qaeda). By 2010, Afghanistan supplied 90% of the world's total heroin. But the DEA, White House and other official US sources claim that US heroin derives almost entirely (96%) from Latin American opium (based on seizures of shipments); the DEA in 2014 claimed that Latin America was the source for the vast majority of US heroin, with southwest Asia (i.e., Afghanistan) accounting for only 4% of US heroin in 2012.

This is highly unlikely. In 2008, the UN estimated that the US and Canada accounted for 13% of global heroin use. Ninety-five percent of global heroin derives from Afghanistan, Burma, Thailand and Laos. Latin America (mainly Mexico, with a small amount from Colombia) does not produce enough to supply the majority of US heroin, let alone 96%. In fact, the White House Office of National Drug Control Policy undercut this claim when it noted Mexico had 10,500 hectares under poppy cultivation in 2012, while Afghanistan alone had 154,000 hectares in 2012 and 224,000 hectares in 2014 (and produced a higher quality product) per UN estimates. This DEA claim, based on heroin interdiction, suggests something entirely different: that heroin shipments from Afghanistan are at lower risk of being seized than heroin coming from Latin America. Might some be entering through official government channels, when so much materiel and so many people (soldiers, aid workers, diplomats and contractors) fly directly between the US and Afghanistan?

Putting aside the issue of the provenance of the US heroin supply for the moment, surely we can look at heroin as we would any other global commodity. Congruent with the 1980s mujahedeen fight against the Soviets, and then -- in a repeat performance -- congruent with the US presence in Afghanistan since 2001, Afghanistan rapidly expanded opium production, and the global supply of heroin increased concomitantly. The price dropped as a result. New buyers entered the market. And the US now has several hundred thousand new addicts. Russia and the rest of Europe (with overland access to Afghanistan) have even more. The resulting social problems are hugely tragic and hugely costly for millions of families, and for our societies as a whole. If we start being honest about why there is a major heroin epidemic, maybe we can get serious about solving the problem with meaningful eradication and interdiction. Aerial spraying of crops with herbicides or similar methods has been prohibited in Afghanistan, but it works. In 2014, Britain's former Ambassador to Afghanistan (2010-2012) called for legalization and regulation of illicit drugs as one means of attacking the problem. Looking beyond the Mexican border for heroin, and inspecting all flights from southwest Asia, including military and CIA flights, could have a large impact on supply as well.

Demeter

(85,373 posts)Noting that it was the sensible thing to do at this point in his life, 27-year-old web designer Jonathan Elridge confirmed Thursday that he puts aside a small percentage of each paycheck for his bank to gamble with.

“It’s really important to save money for the future, even if it’s just a little bit each month,” said Elridge, explaining that roughly $80 per pay period is automatically directed into a separate pool of funds that Bank of America proprietary traders use to continuously wage bets on complicated asset-backed securities and opaque financial derivatives with varying levels of risk.

“I just want to make sure that over time, I slowly accumulate a significant amount of money

(that some extremely well-compensated Wall Street speculators can indiscriminately throw around in what essentially amounts to a massive game of chance, for which they have zero accountability in any way, shape, or form). Honestly, it’s just common sense.”

While spending several minutes filing the paperwork necessary to increase his regular contributions to the fund, Elridge was reportedly unaware that his retirement savings had increased and decreased in value roughly 12,000 times.

Demeter

(85,373 posts)and out of material...I'm calling it a wrap on this thread, for myself.

If you got it, post!

Everybody have a good week, and stay healthy! Next week we are rid of the dread Daylight Saving Time, so expect some changes.

hamerfan

(1,404 posts)Living In The Future by John Prine:

I likes me some John Prine!