Environment & Energy

Related: About this forumWhy Oil Prices Haven't Gone Crazy

The oil markets remain placid because almost all the oil production lost over the past few years has been replaced by the U.S. shale boom and increased Canadian production. U.S. shale oil production started to rise quickly in early 2011, right as the Arab Spring was kicking off. Since then, daily oil output in the U.S. has climbed by about 3 million barrels, to more than 8 million barrels. Canada has added more than 1 million barrels to its daily oil output since May 2011. “North America’s shale boom has been a huge calming factor,” says Lysle Brinker, an oil analyst at IHS Energy. “Without it, we might be seeing $150 oil right now.”

This calm may not last. Over the next five years, the world could experience an oil glut followed by a shortage. According to the International Energy Agency, which tracks oil markets, oil output by non-OPEC producers will rise by 1.7 million barrels per day in 2014, while total global demand will grow by only 1.4 million barrels. That has a lot of analysts predicting a crash in prices.

Longer term, the problem may be an insufficiency of oil. Crude is becoming much more expensive to produce. Major oil companies have increased spending on exploration and production by 14 percent a year since 2005, only to see their combined production fall. This has many big oil companies lowering their capital spending in 2014: ExxonMobil (XOM) has announced it will cut spending by 6 percent, Chevron (CVX) by 5 percent. Royal Dutch Shell (RDSB:LN) is looking to reduce spending by 20 percent this year. “Oil majors are being eaten alive” on exploration costs, says Steven Kopits, an oil analyst at Princeton Energy Advisors. Charles Maxwell, a veteran energy analyst, says that lack of spending today will eventually lead to higher prices. “That’s going to bite us big time,” he says. “2019 is going to be hell.”

Once the shale boom goes bust, the world is going to see some interesting times. And again the time frame around 2020 pops up.

that formic acid from nitrogen looks quite interesting. Might replace lots of oil.

-

http://www.democraticunderground.com/112770239

FBaggins

(26,729 posts)Let's look at one of the predictions that you were using about seven years ago:

Simple question - which line on that projection appears to be accurate at this point?

GliderGuider

(21,088 posts)I've been wrong about a lot of stuff in my life. So have we all.

FBaggins

(26,729 posts)It's entertaining to read the "it's only because" peakist stories that now talk about oil sands and shales being the reason that their predictions of doom were wrong... since those same authors were so often the ones that were told this years ago and rejected that it was possible.

Yep, I was wrong about the shape and timing of the peak.

Yet you refuse to recognize why you were wrong... and thus have developed no immunity to catching the same bug over and over and over.

GliderGuider

(21,088 posts)Last edited Thu Jun 5, 2014, 02:52 PM - Edit history (4)

I've said nothing about what I learned from the experience.

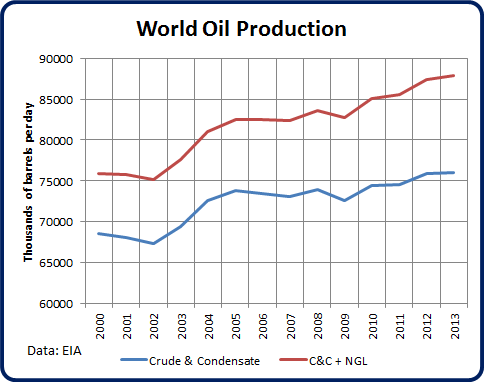

On edit: According to the EIA, world crude plus ngl production in 2013 averaged about 88 mbpd. That puts it between the pink population based estimate and the blue diamonds of the EIA 2006 estimate. In other words, all the lines on your graph were "wrong" to one degree or another.

Note that ~60% of the increase from 2005 to 2013 has been in NGL rather than C&C. The increase from 2012 to 2013 was 69% NGL.

I expect the error occurred because the PO advocates overestimated the influence of geology and underestimated the influence of economics on oil extraction rates.

Benton D Struckcheon

(2,347 posts)Oil reserves are a function of economics: how much can be profitably extracted. The variables that go into that are about as subject to prediction as the actual path of the first hurricane we get this year.

Longer term, the oil market's default condition is glut. Saudi Arabia almost never produces what it actually could, because it wants the price held within a range: too low and they don't make any money, too high and conservation and substitution become so profitable that a bust gets built in. If Saudi Arabia actually produced what it actually is able to, and there were no sanctions on Iran, and so on down the line, you'd see the oil market crash.

Fracking would disappear of course if that happened, which would be nice.

happyslug

(14,779 posts)Last edited Thu Jun 5, 2014, 11:58 PM - Edit history (1)

That is when US Shale Oil production is expected to peak and then decline. We are still in the increase part of that production and will be in that increase part for at least three more years. That would off set any reduction elsewhere in the world for now.

Now Iraqi oil production is expected to increase in the next few years, the Shiites in charge of Iraq has managed to solve most of the problems with exporting its oil and now can export even more oil then it has since the fall of Saddam's government,

http://www.forbes.com/sites/williampentland/2014/01/31/sorry-shale-iraq-is-the-real-oil-revolution/

Here is an article that admits to the problem with Shale, but then tries to say they are using "smart technology" to fix the problem:

http://www.bloomberg.com/news/2014-02-24/wells-that-fizzle-are-a-potential-show-stopper-for-the-shale-boom.html

Another article, after pointing out US conventional oil production will start to decline in 2013 (it has been increasing in recent decades due to the increase in off shore oil production, but that is about peaked out). Goes on to say the whole oil Shale is a bubble and maybe even fraud. :

In early 2012, two US energy consultants, writing in the flagship British energy industry journal Petroleum Review, sounded the alarm. They noted a strong “basis for reasonable doubts about the reliability and durability of US shale gas reserves” which have been “inflated” under new Security and Exchange Commission (SEC) rules introduced in 2009 (3). The new rules allow gas companies to claim reserve sizes without any independent third party audit.

http://mondediplo.com/2013/03/09gaz

I missed that change in the SEC ruling, one of the reason for the debate on Peak oil was that when the US oil companies owned the Middle East Wells they had to submit to SEC regulations as to estimating how much oil they actually had. When the oil fields were taken over by the Arabs themselves, they no longer had that restriction and estimates of recoverable oil increased tremulously. Thus the debate among peak oilers, if you trusted the numbers used by OPEC since the 1980s, we had enough oil to 2030. If you distrusted OPEC but trusted the earlier estimate of the oil companies, it was 2010. If you believed the oil companies lied about the oil, so that that if their fields would be taken over, they would get more then they did when Mexico in 1938 and Iraq in 1954 took over their fields, Peal oil was to be in 2005 (Looking back, 2005 appears to be the date for Conventional oil).

My point was the SEC rules prior to 2009 had the ability to restrict to high a claim for oil reserves. Sometimes the stated reserves were to little, sometimes to much, but over ALL fields both balanced out and we had a somewhat reliable number.

Now, Eagle Ford is heading for peak production sometime in 2014, i.e. the point where the oik production from new wells being drilled is less then the decline in oil production in older wells.

http://srsroccoreport.com/eagle-ford-shale-decline-rate-increases-substantially-in-one-month/eagle-ford-shale-decline-rate-increases-substantially-in-one-month/

Post Carbon report on Energy from Febuary 2013:

http://www.postcarbon.org/reports/DBD-report-FINAL.pdf

Lets not forget even with massive drilling Bakkan and Eagle Ford provides 80% of all oil from Shale Oil, thus if those two fields peak out, production will start to drop in 2014 not 2017.

Now, the Bakkan field is still growing in production at a good clip, it is much more productive then Eagle Ford, but has shown signs of a flattening of production. This could be the result of peak production, but also could be the result of bad weather slowing drilling of new wells. Given the rough winter we have had I suspect a little of both:

http://peakoilbarrel.com/bakken-update-march-production-data/

Bakkan field is still hitting record numbers in production, but drilling of new wells had stop increasing i.e. they are drilling the same number of wells in 2014 as they did in 2013. That is expected to make 2014 their peak production year. This may be a temporary situation do to the need to improve infrastructure or something more fundamental (i.e. that outside of four countries, all heavy drilled already, the rate of successful wells is extremely small, i.e. you do not drill where you do NOT expect to find oil).

http://bismarcktribune.com/bakken/north-dakota-oil-production-returns-to-record-territory/article_90219e38-dac1-11e3-a1ae-001a4bcf887a.html