2016 Postmortem

Related: About this forumSanders’ Tax Wall Street Plan Would Raise $300 Billion And Create Millions of New Jobs

"Simply put," writes DeMoro, "a socially productive economy, from education to healthcare to renewable energy is also a job creation engine." (Photo: Courtesy of National Nurses United)

Major Research Findings:

Sanders’ Tax Wall Street Plan Would Raise $300 Billion And Create Millions of New Jobs

by RoseAnn DeMoro

Common Dreams, March 22, 2016

New research findings from a team of progressive economists provides documentary evidence that the financial footing for Sen. Bernie Sanders visionary social change agenda is not only plausible, but would create far more socially productive jobs, as well as moving us down the road to the more humane society that is at the heart of the Sanders campaign.

In their push to vilify Sanders, Democratic Party acolytes from the media to academia have fallen in line attacking the economic foundations of his campaign for free public college tuition, Medicare for all, job creation through infrastructure repair, and other critical needs.

But a new report from the University of Massachusetts Amherst Political Economy Research Institute documents how a key Sanders proposal — a tax on Wall Street speculation -would bring at least $300 billion a year in new revenues from those who can most afford to pay it for the critical reforms the country so desperately needs.

Further, the report by Robert Pollin, lead author, and his colleagues James Heintz and Thomas Herndon, breaks new ground in documenting that the tax would be a huge boon to the economy in creating millions of new jobs in education beyond what the same spending creates on Wall Street.

And contrary to the critics would not dampen productive investment, which has fallen sharply under the reckless Wall Street behavior of recent decades.

Taxing Wall Street speculation to finance free public college tuition, as Sanders talks about on the campaign trail, and has introduced in legislation, S 1373, the College for All Act, could create a net expansion of 4.2 million jobs. Not to mention securing equal educational opportunity for everyone, regardless of background or ability to pay.

Investing in education produces more than 8 times the number of jobs created by the same spending in financial services, the authors explain.

This finding parallels a 2009 National Nurses United study that found conversion to a Medicare for all health care system, as Sanders also proposes, would create millions of new, good paying jobs, as would a green economy as Pollin documented in his 2012 book “Back to Full Employment.”

Simply put, a socially productive economy, from education to healthcare to renewable energy is also a job creation engine.

The report’s second ground breaking finding is that taxing Wall Street speculation would not harm productive investment in the economy, as the Wall Street shills constantly allege.

Since the 1970s, with the escalation of a neoliberal program of decimation of our manufacturing sector with outsourcing, globalization, and the domination of the financial sector of the economy, there has been an 18-fold increase in Wall Street trading over productive investment in the economy, Pollin, Heintz and Herndon reveal.

As the authors note Wall Street speculation “has not delivered” in “investments in physical plants and machinery that can deliver technical innovations (that) raise overall productivity.”

In other words, the idea that the speculation tax would harm productive investments in a corporate dominated economy through outsourcing, unfair trade pacts from NAFTA to the Trans Pacific Partnership proposal, and domination by Wall Street, that has long abandoned manufacturing jobs at home and harmed millions of working class families is nonsense.

For those new to the idea of a speculation tax, or as nurses call it, the Robin Hood tax, is explained by Pollin, Heintz and Herndon.

A simple tax of $5 in every $1,000 of stock trades, $1 on the trading of a $1,000 bond, and a mere 5 cents on the trades of derivatives, “such as a stock option, in which the value of the underlying asset, i.e. the stock itself, is worth $1,000.”

Compare that to the average sales tax in the U.S. of 8.4 percent, or $84 on every $1,000 most Americans pay on nearly every consumer item, from shoes to tooth paste.

Further, the cost falls almost entirely on trading done by the biggest Wall Street high rollers - think Lehman Brothers or Goldman Sachs - the very people who tanked our economy by reckless gambling with people’s mortgages and pensions.

And it would pump at least $300 billion a year into the economy, not from regular Americans who make occasional stock trades, but from the Wolves of Wall Street who make thousands or millions of trades a day, often through computerized algorithms.

Individuals with annual incomes under $50,000 and families under $75,000 a year are exempted through the two bills Sanders has introduced, S 1371, the Inclusive Prosperity Act, which parallels a companion House measure, HR 1464, introduced by Rep. Keith Ellison.

No surprise, Wall Street moguls, and their surrogates in the media and Washington, hate it. They don’t want any restraints on their profiteering and stranglehold on the economy. But, shamefully, many in the liberal and Democratic Party elite, from Hillary Clinton to her surrogates in the Democratic National Committee and Congress have also attacked Sanders social change agenda as “pie in the sky.”

Even though a similar tax is in place in most of the world’s major financial markets, is in the process of implementation in the European Union, and actually existed in the U.S. for the first half of the last century.

Far from the fear mongering here, a Wall Street tax is achievable, it would have an enormous salutary effect on our economy, and help lead the way to a program of such critical needs as education and health care for all, good paying jobs, and forceful action on the climate crisis — just as Bernie Sanders proposes.

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License

RoseAnn DeMoro is executive director of the 185,000-member National Nurses United, the nation’s largest union and professional association of nurses, and a national vice president of the AFL-CIO. Follow Rose Ann DeMoro on Twitter: www.twitter.com/NationalNurses

SOURCE: http://www.commondreams.org/views/2016/03/22/major-research-findings-sanders-tax-wall-street-plan-would-raise-300-billion-and

Hope the idea catches on.

Human101948

(3,457 posts)It would be unfair to tax the job creators of Goldman Sachs. And they might not be able to afford her speaking fees if you do!

Octafish

(55,745 posts)"Hillary, the Banksters Committed ‘Fraud,’ Not ‘Shenanigans’." -- William K. Black

http://m.huffpost.com/us/entry/hillary-the-banksters-com_b_9164930.html

rhett o rick

(55,981 posts)pay their fair share. We pay for the roads they drive on and their trucks drive on. We pay for fire dept and police to protect their properties. We pay to educate their workforce. We pay for a Defense Dept to protect their interests around the world.

Clinton hasn't even tried make us think she would work to reverse the ever growing wealth gap that she enjoys herself.

Octafish

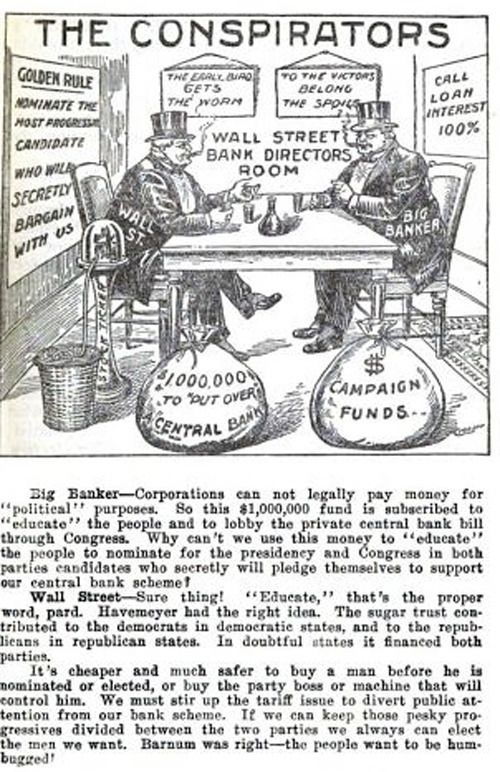

(55,745 posts)Democrats put We the People ahead of the almighty dollar.

Repuglians are the party of Wall Street.

At least it used to be that way before the rich bought Washington.

http://www.counterpunch.org/2010/12/10/the-rise-of-the-wall-street-ruling-class/

rhett o rick

(55,981 posts)pushed the Republcon parth off the cliff and then turn to pay to control the Democratic party. They own the Party elite.

The true Democrats, the Left, have to kick the conservative Democrats back to the Conservative Party where they belong.

Octafish

(55,745 posts)

rhett o rick

(55,981 posts)some rewards? Do they worship wealth or the wealthy? Are they cowards that like to give their lives to those that are tough like Clinton who will make their decisions for them.

Octafish

(55,745 posts)The late Jackson Stephens, a wise man and investor, backed both Poppy Bush and Bill Clinton in '92. Perhaps he could count on either one helping him in doing his work on behalf of the Almighty Dollar later.

Where are you Al?

Our "Earth in the Balance" Vice President is unable--or unwilling--to stop even as dangerous a project as the Ohio incinerator

by L.J. Davis, MotherJones, Nov/Dec. 1993

EXCERPT...

There has always been something incongruous about Stephens Inc. Despite the Little rock firm's attempts to portray itself as a small- city operation that closes for the duck season and got fabulously lucky on a couple of down-home deals like Wal-Mart, it was, at the incinerator's inception, the ninth-largest investment bank in the country. Since it is not headquartered in New York, its dealings are local news, little noticed by the national press, even when they have national implications. And, as a source close to the company once remarked, "The farther you get from Arkansas, the better it looks."

Stephens Inc. was founded by Witt Stephens, a state legislator's son who parlayed a Depression-era belt-buckle, Bible, and municipal-bond business into an immense personal fortune. After his retirement in 1973, the company was run by his shy younger brother, Jackson (a classmate of Jimmy Carter's at the Naval Academy). Witt Stephens and Stephens Inc. did much to create the economic paradox that is modern Arkansas: a desperately poor state with a scant 2.3 million inhabitants that is nonetheless home to a number of wealthy companies. Without the financial assistance of the Stephens brothers, Sam Walton might have ended his days as the most innovative merchant in Bentonville. Stephens money was also important to the fortunes of enterprises as various as Tyson Foods and Linda Bloodworth-Thomason, the television producer and reigning First Friend. Stephens Inc. is an important client of the Rose law firm, whose chairman, C. Joseph Giroir, made Hillary Rodham Clinton a partner. And back in 1977, Stephens assisted BCCI's infiltration of the American banking system by brokering the latter's purchase of National Bank of Georgia stock held by Bert Lance, former President Jimmy Carter's friend and disgraced budget director.

Jackson Stephens (who turned over the reins to his son, Warren, in the late eighties) and his firm were both substantial contributors to the campaigns of Presidents Reagan and Bush (to the tune of at least $100,000 in 1980 and 1989), but they have been closer still to Bill Clinton (whom Witt Stephens had been known to call "that boy"

On two occasions, once when Clinton was running for reelection in Arkansas in 1990 and again in March 1992, when his battered presidential campaign was broke, the Stephens family saved Clinton's bacon with an infusion of money. Indeed, it may not be too much to say that their Worthen Bank's emergency $3.5 million line of credit saved the presidential campaign from extinction. --L.J.D.

CONTINUED...

http://www.motherjones.com/news/feature/1993/11/davis.html

Why is a special prosecutor never around when you need one?

rhett o rick

(55,981 posts)Gregorian

(23,867 posts)Thanks. I'm bookmarking to read when there's no Bernie rally going on. I'm barely getting any life done during these primaries.

Octafish

(55,745 posts)

By Jason Easley on Thu, Jan 14th, 2016 at 2:23 pm

170 of the nation’s top economists have released a letter endorsing Democratic presidential candidate Bernie Sanders’s plan to reform Wall Street.

A letter signed by 170 economists including former Labor Secretary Robert Reich, University of Texas Professor James K. Galbraith, Dean Baker, co-director of the Center for Economic and Policy Research in Washington, DC., Brad Miller, former U.S. Congressman from North Carolina, and William K. Black, University of Missouri-Kansas City endorsed the Sanders plan to reform Wall Street.

The economists wrote:

In our view, Sanders’ plan for comprehensive financial reform is critical for avoiding another ‘too-big-to-fail’ financial crisis. The Senator is correct that the biggest banks must be broken up and that a new 21st Century Glass-Steagall Act, separating investment from commercial banking, must be enacted.

Wall Street’s largest banks are now far bigger than they were before the crisis, and they still have every incentive to take excessive risks. No major Wall Street executive has been indicted for the fraudulent behavior that led up to the 2008 crash, and fines imposed on the banks have been only a fraction of the banks’ potential gains. In addition, the banks and their lobbyists have succeeded in watering down the Dodd-Frank reform legislation, and the financial institutions that pose the greatest risk to our economy have still not devised sufficient “living wills” for winding down their operations in the event of another crisis.

Secretary Hillary Clinton’s more modest proposals do not go far enough. They call for a bit more oversight and a few new charges on shadow banking activity, but they leave intact the titanic financial conglomerates that practice most shadow banking. As a result, her plan does not adequately reduce the serious risks our financial system poses to the American economy and to individual Americans. Given the size and political power of Wall Street, her proposals would only invite more dilution and finagle.

The only way to contain Wall Street’s excesses is with reforms sufficiently bold and public they can’t be watered down. That’s why we support Senator Sanders’s plans for busting up the biggest banks and resurrecting a modernized version of Glass-Steagall.

Both campaigns are rolling out endorsements on a daily basis, but the anger over Wall Street crashing the US economy and walking away with a slap on the wrist is one of the main drivers behind the popularity of Sen. Sanders.

CONTINUED...

http://www.politicususa.com/2016/01/14/170-economists-bernie-sanders-plan-reform-wall-st-rein-greed.html

For those new to the subject of forensic economics: Those 170 economists are a Who's Who of Integrity.

PS: You are most welcome, Gregorian. All old news to you. Missed by the Corporate McPravda radar for some reason.

TheFarS1de

(1,017 posts)The benefits are more than just the initial "Wolves Tax Education Contribution" , the onflow to spending and savings amongst the working and middle class will inject much needed economic stimulus .

Ghost Dog

(16,881 posts)BlueStateLib

(937 posts)The economy could suffer. When the European Commission looked at the issue, it found that a tax of 0.1% would reduce gross domestic product by 1.76% in the long run. That's mainly because the tax raises the cost of capital, resulting in less investment and diminished economic output.

DanTex

(20,709 posts)rhett o rick

(55,981 posts)to support the wealthy class. Shame on you.

Jitter65

(3,089 posts)of Sanders or Hillary or anyone else. It will be because the money that is being hoarded now by the real power masters will be released. It's a part of the same plan that McConnell called for when Obama was first sworn in. The money will begin to flow and the GOP and the Dem Obama detractors will be able to claim that Obama was a "failed" Presidency. They couldn't exactly ruin him while in office so they are left to destroy his legacy as the President who bought us through the biggest recession since the great depression. Notice that every economic indicator has been on the increase except for unemployment which is good. Yet the media and the opposition have decried every report of improvement as "too little" not enough...just to plant in people's minds that Obama is not doing a good job. Once he is out of office and a new President is sworn in...Dem or GOP the flood gates will open and the pent up recovery will begin. Or so they think. But I see other forces also waiting for Obama to leave office. And it won't be a pretty picture..especially if the GOP wins. Hold on....![]()

MrMickeysMom

(20,453 posts)A simple tax of $5 in every $1,000 of stock trades, $1 on the trading of a $1,000 bond, and a mere 5 cents on the trades of derivatives, “such as a stock option, in which the value of the underlying asset, i.e. the stock itself, is worth $1,000.”

Reality? You better fucking believe it's reality... Apologies to all the little robots who would be confused over this.

rhett o rick

(55,981 posts)accounts. If working people have their money invested in derivative swaps, they will get what they deserve. Sen Sanders' tax will only significantly effect those they make thousands of trades a day.

The nitwits arguing that a tax on Wall Street would hurt the People have their heads up their Wall Street.

snowy owl

(2,145 posts)too many people swallow the propaganda of the special interests which includes the Clintons. I guess Americans not only want to stay poor but get poorer. Well, you can always send your kids to war. I'm sure Hillary will give them lots of opportunities for that.

snowy owl

(2,145 posts)It's very possible. The media has created Trump. None of us really knows him. I'm sure glad he's beating Cruz.

Gregorian

(23,867 posts)Like Bernie, it's people-centric- "Simply put, a socially productive economy, from education to healthcare to renewable energy is also a job creation engine. "

We've made a ton of progress wading through the Reagan/Rove/Name that moron over the many years. Now we're having to fight an uphill battle. But we're talking about, and running candidates who care about humane issues. Not bad.

Response to Octafish (Original post)

Corruption Inc This message was self-deleted by its author.