1. Can you substantiate your total? 2. Can you separate expenditures from loans?

You have posted this sort of thing several times, but you've never seemed to indicate that you understand the difference between an investment/loan and an expenditure.

Was the federal government paid back for any tank or plane built during WWII?

What portion of the bailout is attributable to the actions of the Fed? And of those how much has been paid back into the revolving facility?

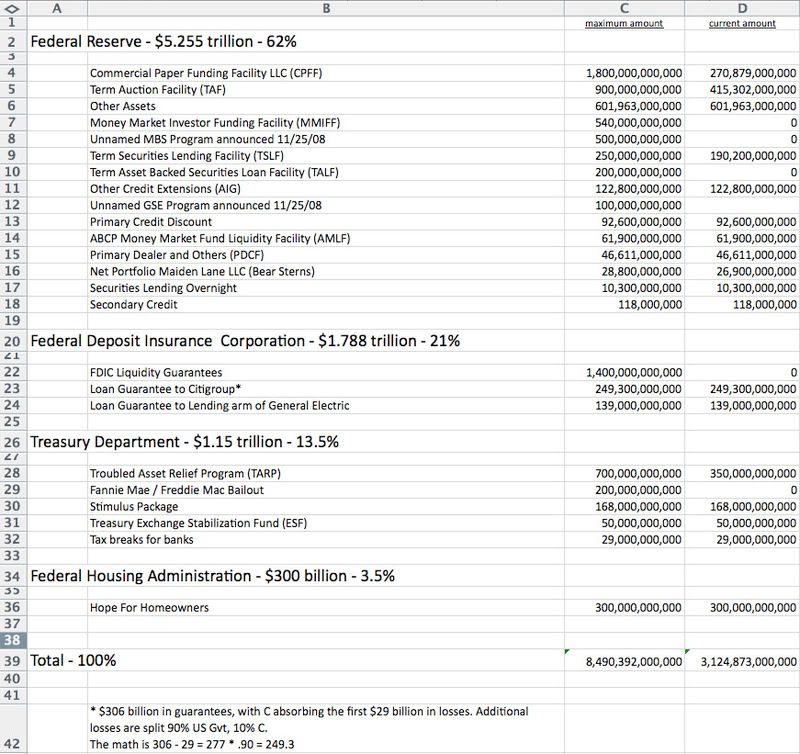

Fortunately, I've tracked down the spread sheet that seems to be the source of all the $8+ trillion hysteria. Here is a jpg of the spread sheet:

You can also see a good explanation of the bailout totals here:

http://money.cnn.com/news/specials/storysupplement/bailout_scorecard/According to these spread sheets,

the total cost of the bailout so far in terms of actual expenditures is $317 billion.

The bulk of that is:

$168 billion -- tax relief for families

$8 billion -- unemployment benefits

$125 billion -- AIG expenditures -- but it's hard to tell if these are costs or investments. The Fed says they are just credit extensions, and if so should not be in this total

$16.7 billion -- FDIC payouts in 2008 to depositors of failed banks

.470 billion -- FDIC payouts in 2009

Notice how many line items that go into the $8 trillion number are extensions of credit, lending facilities by the Fed that involve collateral or loan guarantees that haven't been called (hence designed mainly for psychological effect on the market). In essence, the Fed is trading dollars for securities, which means that the Fed has not made an expenditure, but traded one asset (cash) for another asset (eg commercial paper or foreign currency). Even the incredibly badly managed TARP program is an investment in securities, preferred stock -- which, btw, unlike common stock have a face value, interest rate and requirement that the banks buy them back at face value. Note especially how many of them have a draw down of zero -- ie they haven't even been used yet.