Stock Market Dissonance: Why the Stock Market no Longer Reflects Main Street Economics.

The Dow Jones Industrial Average.

One of the biggest bankruptcies in history occurred on June 1st yet you would not know this by looking at the stock market. In fact, the Dow Jones Industrial Average (DJIA) shot up by 220 points. If we look at total assets, this is the fourth largest bankruptcy in history. The Dow is made up of 30 companies that show a supposedly wide cross section of the American economy. The company that filed for bankruptcy was General Motors and was actually one of the 30 components. A company that dates back to 1908 and survived the Great Depression. So how can it be that a company that employs 250,000 filing for bankruptcy is actually good for the stock market and makes the DJIA rally so strongly? The easy answer is the stock market no longer reflects the economic reality on main street.

The U.S. Treasury and Federal Reserve have created an artificial system and the stock market is reacting to these new conditions. These conditions now assume rock bottom low rates and financial institutions being continuously bailed out. Yet this paradigm is not helping the American public that now has 25,000,000 unemployed or underemployed family, friends, or colleagues. Think of the implication of the GM bankruptcy. Right when the announcement was made there were details of laying off thousands of workers and closing numerous dealers. The market rallies and unemployment this Friday will shoot up by another 500,000. This disconnect is so obvious and shows the priorities of those pushing legislation.

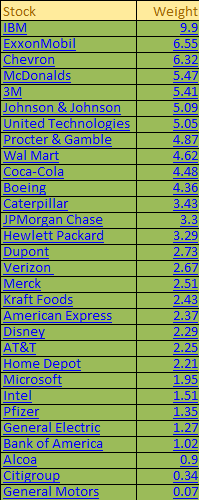

Before we get ahead of ourselves, why would a bankruptcy of GM, a DJIA component lead to a strong rally? First, let us look at the weighting of each of the 30 components:

The above is a reason I take very little stock with the DJIA but it is still widely regarded in the mainstream media as an accurate reflection of the overall stock market performance. A better measure would be the Wilshire 5000 but how many times have you heard that market index in the media? Let us focus on the above list I compiled a little further. You notice that GM and Citigroup are all the way at the bottom? That is why even if GM and Citigroup went straight to zero (GM practically did) it had very little impact on the DJIA. Yet in reality, the bankruptcy impact is gigantic in the real world since it means tens of thousands more Americans out of work and a giant of American manufacturing giant was unable to stand on its own two feet. So what do we hear on June 1st?

http://www.doctorhousingbubble.com/stock-market-dissonance-why-the-stock-market-no-longer-reflects-main-street-economics-the-dow-jones-industrial-average/