Real Homes of Genius: Pasadena Home Back to 1996 Price Levels? The Pasadena Housing Market Food Chain 4 Homes from Low Price to High Price all in Distress. Foreclosures and Short Sales in Prime City. Almost 4 out of 10 Homes in California Underwater.

There was an interesting study out of Arizona showing that many underwater homeowners dont walk away from their mortgage because of moral reasons. Well they have yet to get a taste of the Alt-A and option ARM problems that will hit California in the next few years. Another study showed that many in California and Florida had no qualms walking away from their obligations. We now know that being underwater is the biggest risk factor in predicting a foreclosure. This should go without saying because if you had some equity you would merely sell the home and exit the game. I can understand the moral argument if say someone had a $120,000 mortgage and the home is now worth $100,000. In that case, walking away isnt a big deal. But in California with a $500,000 option ARM on a home that is worth $250,000 walking away is the right economic move.

The big question will be whether homeowners in California respond to the Wells Fargo and Chase interest only home owner renter program for example. You havent heard? The plan is to basically convert option ARMs into interest only payments for six to 10 years. In other words, you will be betting home prices speed up in this time to recoup your massive losses. The bank of course is the big winner here. If you can find a cheaper rental chances are you would be better off letting the place go unless you are happy keeping an albatross around your neck just so the banks can claim inflated values so they can please each other on crony Wall Street.

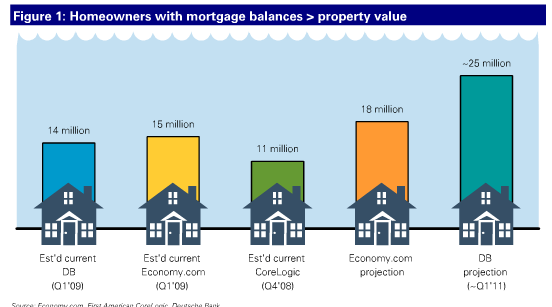

How underwater is California? Roughly 7 million mortgages with 2.4 million underwater. Throw in another 300,000 of near negative equity and you have yourself approximately 40% of all mortgages with negative equity. Forced renters for the moment, but more like real estate speculators. This isnt only a California problem. Let us pull a report from Deutsch Bank that was released in July:

http://www.doctorhousingbubble.com/real-homes-of-genius-pasadena-4-homes-short-sales-and-foreclosures/

http://www.doctorhousingbubble.com/real-homes-of-genius-pasadena-4-homes-short-sales-and-foreclosures/