1.8 Million California Mortgages Underwater. In 2008 100,000 Renters were added. 2010 California Housing Market Trends. How Banks Hoodwinked the Public into Believing the Bailouts were to help the Housing Market.

As we wind the year down the California housing market is entering a new chapter in its bubble saga. 2009 brought many new factors to consider in how the housing correction will play out. One major trend was the growing number of moratoriums. These programs largely failed at preventing foreclosure and only pushed the inevitable down the road creating a cryogenic toxic mortgage. The growing number of shadow inventory has been mounting as well. A few articles appeared in the L.A. Times and O.C. Register discussing this topic. Hopefully well see some opinion pieces discussing how shady bank practices are when banks claim housing numbers look good when they know that the numbers on the books state otherwise. As of today, on the eve of a new year, roughly 1,800,000 mortgages in California sit underwater. That is, the home backing the mortgage is not even worth the current balance.

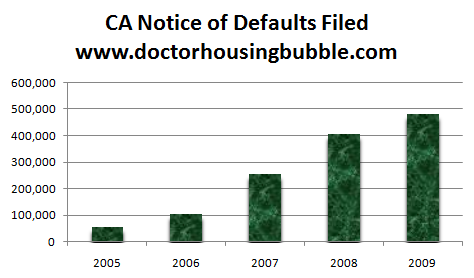

This is hard for people to imagine. Recent annual data from 2008 showed that California added 100,000+ new renters in 2008. When the 2009 data is released late in 2010 we should expect a similar trend. 2009 saw a record number of notice of defaults filed:

So 2009 was the worst year for California housing if we consider people not paying their mortgage as a significant criteria. And the above chart is largely responsible for the growing number of shadow inventory. In a typical foreclosure process, after a notice of default is filed a home will be taken back in 3 to 6 months. Take for example the 135,000 notice of defaults filed in Q1 of 2009. With a cure rate of 3 to 5 percent according to recent reports we would expect 128,000+ of these homes to be taken back in Q3 of 2009 by the bank. How many foreclosures occurred? 50,000. Now this isnt a new trend or something that is shocking. In fact, with the HAMP initiative it has become a formalized process. Yet HAMP has only converted some 4 percent of trial modifications to permanent status (they have extended the deadline to the end of January as if this was going to miraculously boost the numbers). Plus, we have yet to see drilled down statewide data. California also has toxic mortgages like option ARMs and Alt-A products that largely do not qualify for HAMP. Many of the option ARMs recast in 2010.

http://www.doctorhousingbubble.com/1-8-million-california-mortgages-underwater-in-2008-100000-renters-were-added-2010-california-housing-market-trends-how-banks-hoodwinked-the-public-into-believing-the-bailouts-were-to-help-the/