This is a very exciting piece of synthesis by Stoneleigh, one of the people behind the financial blog The Automatic Earth. Fractals, adaptive cycles, panarchies, Elliot Waves, the human herding instinct and marginal return on complexity -- all drawn together into a single view.

Fractal Adaptive Cycles in Natural and Human SystemsAdaptive cycles are the foundation of both natural ecological and human socio-economic systems, and have been investigated independently from very different perspectives by ecologists and financial analysts who have almost certainly never heard of each others' work. It is interesting then to look at the strong correspondence of the self-similar hierarchical patterns, best described as fractals, which emerge from both fields. This form of organization seems to be a fundamental dynamic in many areas.

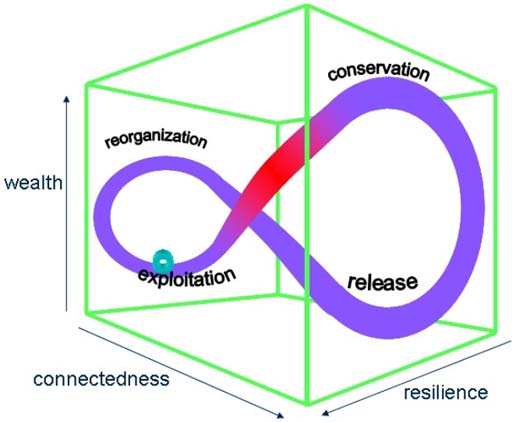

Arguably the most significant thinker in the field of ecological cycles has been Buzz Holling, who refers to the conceptual model he derived from the study of forest ecosystems as Panarchy. Holling observed that ecosystems developed in adaptive cycles of exploitation, conservation, release and reorganization which could be described in three dimensions - ecological 'wealth', connectedness and resilience. These cycles provide a framework for the opposing forces of growth and stability versus change and variety.

Where higher and lower order cycles are very tightly coupled, they may synchronize, becoming trapped in a extended growth phase at many scales at once, thereby risking synchronous collapse. This need not be triggered at a large-scale level, but can begin anywhere in a set of nested adaptive cycles and proceed both upwards and downwards.

Resilience arises from a redundancy that has the appearance of inefficiency and a lack of critical structural dependency on specialized hierarchy, neither of which conditions are likely to be met at the peak of the growth phase of an adaptive cycle. For these to be achieved from this point at least a partial, or localized, collapse to a simpler level of organization would have to occur. There can potentially be a fine line between a retreat from rigidity to this level of resilience and a 'poverty trap', where a collapse has proceeded so far and so fast that the system has been stripped of the wealth (biological or otherwise) that it would need to rebuild. Where adaptive cycles have become synchronized, so that the likelihood of deep collapse is increased, striking a balance of resilience would be far more difficult.

Like Holling's panarchy, Prechter's nested socionomic cycles either reinforce or counter each other depending on the direction of cycles larger and smaller than the one under consideration. Where cycles at several degrees of trend are moving in the same direction, the move will be extreme - either a mania to the upside or a crash to the downside. The largest mania ever known topped in the year 2000, and we have been in bear market territory since then (more obviously in real terms). We are now approaching a synchronized move in the opposite direction as the rally of recent months peters out in the face of the larger downtrend. The consequences of this will be considerable, but we are still quite near the beginning of the large-scale and complex downward pattern the model predicts will unfold over the next several decades. We can expect many deleveraging cascades and many intervening rallies, some larger than we have seen so far.

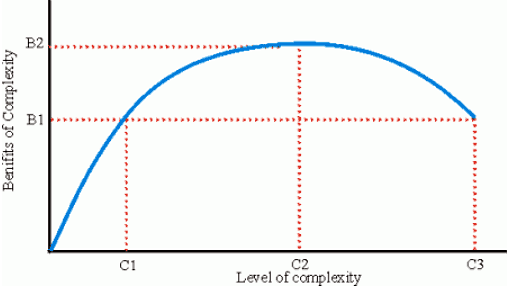

Joseph Tainter's work complements that of Holling and Prechter, providing a framework of diminishing marginal returns to complexity which encompasses ecosystems, individual societies and competitive peer polities. As complexity increases, it eventually becomes a liability, as we can see with Holling's description of rigidity reducing the resilience of ecosystems and Prechter's many writings on the debt complexity of manias and the systemic risk it engenders.

As with diminishing marginal productivity of debt, past a certain point further investments in complex solutions to increasingly complex problems has a negative return. Tainter explains, however, that where there is not a single political structure, but instead competitive peer polities, these entities become trapped in a competitive spiral where investment in organizational complexity must be maintained regardless of cost, as the alternative is domination by another member of the cluster at the same level of complexity, rather than collapse to a simpler system. The counter-productive actions of states are legitimized to the citizenry by the fact that each member of the cluster is engaging in the same behaviour. Collapse, which requires a power vacuum, is not possible unless the whole cluster collapses at once at the point of economic exhaustion.

More at the link.