Point of no return: Interest on T-bills hits zeroAssociated Press

By MADLEN READ and MARTIN CRUTSINGER

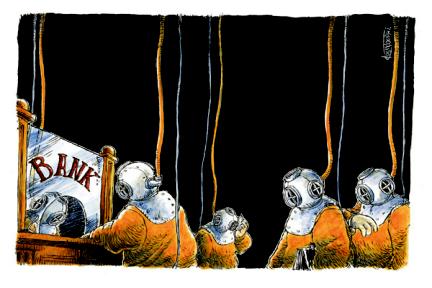

December 9, 2008NEW YORK Investors are so nervous they're willing to accept the same return from government debt

that they'd get from burying money in a coffee can zero. The Treasury Department said Tuesday it had sold $30 billion in four-week bills at an interest rate of zero percent, the first time that's happened since the government began issuing the notes in 2001.

And when investors traded their T-bills with each other, the yield sometimes went negative. That's how extreme the market anxiety is: Some are willing to give up a little of their money just to park it in a relatively safe place. "No one wants to run the risk of any accidents," said Lou Crandall, chief economist at Wrightson ICAP, a research company that specializes in government finance.

At last week's government auction of the four-week bills, the interest rate was a slightly higher but still paltry 0.04 percent. Three-month T-bills auctioned by the government on Monday paid poorly, too 0.005 percent. While everyday people can keep their cash in an interest-earning CD or savings account at the bank, institutional investors with hundreds of millions of dollars on their hands often use government debt as part of their investment strategy.

In the Treasury market, the U.S. government, considered the most creditworthy of borrowers, issues IOUs of varying durations to raise money. The zero percent interest rate is no reason to panic. As recently as Monday, investors were plowing cash into stocks, and averages like the Dow industrials are off their lows.

http://www.google.com/hostednews/ap/article/ALeqM5iRlb3SCsQkRYQ9qVE-7U3OMml5VQD94VG7680">MORE

- At least if you put your money in a coffee can, it'll smell better when you have to spend some of it......

- At least if you put your money in a coffee can, it'll smell better when you have to spend some of it......==============================================================================

DeSwiss

http://www.atheisttoolbox.com/">The Atheist ToolboxQuotes: "Another reason is the degeneracy of the conservative intelligentsia itself, a modern-day version of the 1970s liberals it arose to do battle with: trapped in an ideological cocoon, defined by its outer fringes, ruled by dynasties and incapable of adjusting to a changed world. The movement has little to say about todays pressing problems, such as global warming and the debacle in Iraq, and expends too much of its energy on xenophobia, homophobia and opposing stem-cell research. -- The Economist

http://www.economist.com/world/unitedstates/displaystory.cfm?story_id=12599247">Link

"Prayer is just a way of telling god that his divine plan for

you is flawed -- and shockingly stingy" ~ Betty Bowers