Bernie Madoff’s colossal investment fraud is almost everywhere described as a “Ponzi scheme”. That echoes the very words Madoff, himself, used to describe it to the FBI agents who arrested him on December 11.

I’ve been running “basically, a giant Ponzi scheme,” he told investigators. But, that was quite misleading.

Madoff gives the impression that his scam was a classic, self-contained Ponzi, wherein the first investors see the payouts and later investors are the ones whose capital provides the payouts. In that scheme, Ponzi pockets the proceeds.

But, it didn’t really work that way. Madoff Securities was not designed to rip-off its own customers. Instead, it sustained itself over four decades by an infusion of money from “feeder fund” franchizes, the proceeds of which were methodically diverted into hidden accounts. It was part multi-level marketing, part money-laundering scheme, and part bleed-out fraud designed to provide a cover for conversion of funds that would be used by banks a continent or two away from Madoff’s Manhattan headquarters.

And, it really wasn’t an ethnocentric raid designed to impoverish any particular national or religious group – that would be killing the Golden Goose, but it may have had that effect. Madoff’s biggest clients were powerful banks and politically well-connected, philanthropic men who owned them. Their customers will get some of their money back through deposit guarantee insurance, law suits and other institutional safeguards. Madoff’s own customers get first crack at funds eventually recovered – there is no way that Madoff spent $65 billion on caviar and vintage wine.

An accounting of Madoff’s real estate and personal property, including that placed in the name of his wife, Ruth, amounted to no more than $67 million – not a lot by Wall Street standards. Bernie was smart, emotionally controlled, and personally frugal. His refusal to take the deal reportedly offered by the feds -- trade what he knows for allowing Ruth to keep most of their joint assets -- is telling. No, Bernie didn’t squander it all away. Most of the money his fund piled up over the years is still out there.

The answer to where that money is goes back to where it came from.

The Feeder Funds – Swiss Bankers, Aristocrats and Vultures Wrapped up in TARPAs for the feeder funds, seventeen of the 20 largest investors in Madoff Securities were banks or insurance companies. The others were huge “funds of funds”, unregulated hedge funds and private equity funds. It was the comparative small-fry who got scalded. The bankruptcy courts will have to come to the rescue of many of the 4500 individual investors and those who were attracted through smaller feeder funds.

Most of the biggest losses were sustained by large Swiss, Euro and Asian banks – but, they will survive, and their customers will eventually receive some sort of substantial recovery or part of a government bail-out. Like so many scandals of the era, this too will pass, and public attention will wane.

But, take a good look, anyway.

The third largest institutional investor in Madoff’s scheme — Tremont Group Holdings Inc., a fund of funds owned by Massachusetts Mutual Life Insurance Co. Tremont is attached to an institution so big that its customers are also likely to regain the $3.3 billion in reported losses as the result of investor law suits. A 2007 Hoover’s profile characterized the firm as follows: “Tremont Group Holdings wants to make you a tremendous amount of money -- and to make a tremendous amount for itself, as well....”

http://www.hoovers.com/tremont/--ID__101157--/free-co-factsheet.xhtml

Prior to his well-timed resignation as Chairman in July 2008 after the Mass Mutual takeover, Tremont had been run by its founder

Robert Schulman. Tremont was one of Madoff’s “early customers.” Schulman now runs a charity with his wife, and invests in real estate. He is named as a co-defendant in an investors’ suit along with Tremont, Mass Mutual and the company’s auditing firm, KPMG, which recently announced its bankruptcy. Déjà vu?

http://www.bloomberg.com/apps/news?pid=20601087&sid=aCT_aoIRYqRg&refer=home ;

http://newsblaze.com/story/2009020415373300001.pz/topstory.html There were only three independent funds among the top feeders: Fairfield Greenwich Group, Walter Noel’s hedge-fund, ($7.5 billion in losses); Ascot Partners, headed by former GMAC Chairman Ezra Merkin ($1.8 billion); and Access International Advisors ($1.2 billion), a European investment fund

In 2007, AIA took over management of the Rothschilds family bank portfolio previously managed by UBS. AIA founder,

Rene-Thierry Magon de la Villehuchet, committed suicide in his Manhattan office days after the Madoff scandal became public.

Villehuchet had carved a lucrative franchize for himself peddling access to the exclusive Madoff connection among Europe’s richest glitterati, including Bettencourt family heirs to the L’Oreal cosmetics family.

Most of these private hedge funds were not only rich, they had close ties to government officials and political figures, access to public money, and knew how to benefit from bailouts. Ezra Merkin was chair of two large American industrial corporations, GM and Chrysler, which have already received more than ten billion dollars in TARP bail-outs, and are currently seeking more.

J. Ezra Merkin

J. Ezra Merkin is also owner of a large stake in Bank Leumi, the privatized national bank of Israel, which he acquired with partner Stephen Feinberg, founder of Cerberus Capital Management, which (like so many of the others) grew during the Sharon - Olmert era from a bank holding company into a large global hedge fund.

Accusations abound that Noel and Merkin failed to perform due diligence, and in some cases, allegedly deceived their own customers that they were placing client funds with Madoff. For well over a decade, Madoff had a reputation on The Street not only for phenomenally steady returns but also the whiff of illegitimate methods. The only thing that nobody could quite figure out was how he did it. Suspicions were quietly voiced that he was using insider knowledge gained from his proprietary trading platform that was adopted by NASDAQ brokers that Madoff headed.

But, if the preliminary findings are indeed correct, Madoff hasn’t been trading listed stocks in customer accounts for at least 13 years. But, Bernie nonetheless managed to consistently pay out tens of billions in dividends during that period. At the eight to 17 percent annual returns his investors were reportedly receiving, that would have depleted the fund’s capital in half that time. It is arithmetically not possible that Madoff was simply paying his older investors out of the funds gained from newer, and only from those funds. As one long-term investor who got out a couple years ago remarked, Bernie “never missed a quarter.” If he wasn’t trading, Bernie had to have another source of funds, someone who was. A feeder relationship can operate in both directions, if regulators aren’t looking very closely at both ends. And, in fact, as we are learning, regulatory authorities in several countries in the last decade have been legally blind.

Among the Madoff feeder-funds, closest attention has focused on Ascot Partners. But, J. Ezra Merkin also operates a hedge firm, Gabriel Capital, which partnered with Cerberus in the takeover of the distressed U.S. auto industry and made a big move into the defense sector during the Bush years. The partnership left companies in both sectors worse off for their attentions, but made these hedge funds owners hundreds of millions richer. Money lost in operating failing companies have been made up by lucrative government contracts and bailouts, a not entirely unexpected bonus. The new TARP loans now being sought are in addition to the $13.4 billion the US Treasury lent earlier to Merkin's GM, and Fineberg's Chrysler. In 2006, GM sold 51 percent of Merkin's GMAC to Feinberg's private equity firm Cerberus Capital Management LP (which also owns Chrysler). In May 2004, Feinberg's private equity group, Cerberus Capital Management, LP (Cerebrus is the three-headed dog that guards Hades), became majority owner of IAP Worldwide Services, Inc, one of the US Army’s largest contractors in Iraq. IAP was at the center of the Walter Reed Army medical center privatization scandal. For the sordid details of this fetid corner of pirate capitalism, see,

http://www.dailykos.com/story/2007/3/10/21556/5045 Other key parts of the business model pursued by Madoff’s private feeder funds has been political influence-peddling and its financial partner, money-laundering, facilitated by bank secrecy. Merkin and Feinberg are major campaign contributors to GOP candidates and backers of the Likud Party and other right-leaning parties in Israel. Merkin is involved in the same fundraising network for Israeli charities as Morris Talansky, a secretive financier and philanthropist. Talansky’s illegal campaign contributions to Israeli PM Ehud Olmert led to the Israeli Prime Minister’s resignation. Haaretz reports, “Olmert's close associates called Talansky ‘the banker’ or ‘the launderer.’”

http://www.haaretz.com/hasen/spages/981755.html Cerberus-Gabriel has earned a global reputation as a politically-connected “vulture capital” firm. As a hedge fund, it plays the downside, and swoops in on distressed firms considered essential to the national interest. Characteristically, it breaks companies up and sells off their assets when it cannot successfully green-mail governments, extracting huge concessions and cash incentives in several countries. “Crash and burn,” in the parlance.

Walter Noel

Walter Noel, like Merkin, is well connected, both financially and politically. According to the WSJ, his fund was part of the fund of funds of the Swiss private bank Union Bancaire Privée (UBP), “one of the world's largest managers of funds of funds. As of June, it managed some $124.5 billion.”

http://online.wsj.com/article/SB123058674048040525.html UBP pioneered the use of hedge funds in private equity, and is currently the world’s second largest hedge fund manager. Because of Swiss resistance to international efforts to stem money-laundering, the Madoff scandal has offered the first opportunity to peek inside some of the inner workings of this most secretive of major global financial operators. Noel was also an active contributor to conservative political parties in the United States and Israel. Noel and his wife have contributed to the presidential campaign funds of John McCain, George W. Bush, Dan Quayle and George H.W. Bush.

***

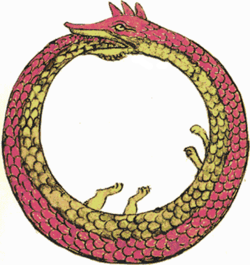

Look Closely, and You'll See a Snake Swallowing Its Own TailRecall that Madoff’s Securities was actually a network of banks connected to hedge funds connected by “funds of funds”, drawing from a half-dozen major large feeder funds and about 30 smaller brokers. Many of them escaped official scrutiny, and were virtually self-regulating. The scam went on for at least 14 years, yet no one blew the whistle, and they all kept depositing funds in Bernie's accounts. See TABLE below.

These funds accounts were deposited at a number of U.S. and foreign banks. At that point, a curtain has been drawn down on what happened to the $64.8 billion principal and reported earnings in the fund. The strange secrecy about Madoff's foreign bank accounts has been imposed by the court - in itself, this is a red-flag that this was no conventional Ponzi scheme.

Table 1: “Madoff’s Victims: A List of Reported Victims and Their Exposure” , in Wall Street Journal, December 17, 2008. p. A14.

(Victims For Whom No Exposure Amount Is Available Are Not Shown.)

Fairfield Greenwich Advisors (investment management firm): $7500 million.

Tremont Capital Management (fund of funds run by Tremont Group Holdings): $3300 million.

Banco Santander SA (Spanish bank): $2870 million.

Ascot Partners (hedge fund founded by GMAC chief J. Ezra Merkin): $1800 million.

Access International Advisors (New York investment firm): $1400 million.

Fortis Bank Nederland NV (Dutch bank): $1350 million.

Union Bancaire Privee (Swiss bank): $1000 million.

HSBC Holdings PLC (British-Chinese bank): $1000 million.

Natixis SA (French investment bank): $560 million.

Carl Shapiro (former chairman Kay Windsor Inc.): $550 million.

Royal Bank of Scotland (British Bank): $492.76 million.

BNP Paribas (French Bank): $431.17 million.

BBVA (Spanish bank): $369.57 million.

Man Group PLC (British hedge fund): $360 million.

Reichmuth & Co. (Swiss private bank): $327 million.

Nomura Holdings Ltd. (Japanese brokerage house): $303 million.

Maxam Capital Management Inc. (fund of funds based in Dairen, Conn.): $280 million.

EIM SA (European investment manager with $11 billion in assets): $230 million.

Aozora Bank Ltd. (Japan bank in which Cerebus Capital owns majority stake): $137 million.

AXA (French insurer): $123 million.

UniCredit SA (Italian bank): $92.39 million.

Nordea Bank AB (Swedish bank): $59.13 million.

Hyposwiss (Swiss private bank owned by St. Galler Kantonalbank): $50 million.

Banque Bendict Hoetsch & Cie SA (Swiss private bank): $48.8 million.

City of Fairfield-Connecticut (town pension fund): $42 million.

Bramdean Alternatives (asset manager): $31.2 million.

Haredi Insurance Investments & Financial Services Ltd. (Israeli insurer): $14.2 million.

Societe Generale (French bank): $12.32 million.

Groupama SA (French insurer): $12.32 million.

Credit Agricola SA (French bank): $12.32 million.

Richard Spring (individual investor): $11 million.

RAB Capital (hedge fund): $10 million.

Banco Populare (Italian bank): $9.86 million.

Korea Teachers Pension (Korean pension fund): $9.1 million.

Jewish Community Foundation of Los Angeles: $6.4 million.

Neue Privat Bank (Swiss bank): $5 million.

Clal Insurance Enterprise Holdings Ltd. (Israeli financial services): $3.1 million.

Mediobanca SpA (via its unit Compagnie Monegasque de Banque): $671000.

Now, squint, and it becomes a snake swallowing its own tail.