Post-Recession Job Recovery Hampered by Offshoring

- Media Whitewashing Offshoring Reality, Evidence Shows Otherwise

By Dan, Seattle, 11/25/2010 (Edited 11/28)

In the 2001-2007 period, there was plenty of discussion about offshoring among the public and in Congress, with a number of studies published--funded mostly by special interests. These studies amount to little more than speculative projections about the future of US employment, while underplaying the downsides, such as the fact that displaced workers have poor prospects towards new careers, once lost to offshoring.

In addition, these studies neglect to account for additional US job loss related to offshore subcontracting (see note 1) and offshore partnerships/joint ventures, and the negative effects on the local US economy due to lost workers. Somewhere around 2007, the offshoring discussion largely fizzled out, as the popping of the housing bubble and associated financial crisis dominated the news. Incredibly, no Congressional action was taken to tackle the core issues surrounding offshoring. Interestingly, in the early 2000s and likely before, the inflation of the housing bubble may have somewhat masked the underlying erosion of employment due to offshoring.

In fact, to this day, there are a number of incentives in place to encourage shipping jobs overseas, including:

(1) US Tax write-downs which allow companies to move operations overseas, while gaining tax benefit from shuttered US operations. That's right, everyone gets to pay for that factory shipped to China.

(2) US Tax loopholes which allow corporations to shuffle profits gained overseas to tax havens, which leads to reduced tax bills.

(3) US Tax loopholes which allow corporations to permanently postpone repatriation of profits gained overseas, that leads them to both avoid paying US corporate income taxes, and to re-invest in overseas operations instead of in the US (which means no new US jobs.)(4) Foreign worker visa programs which allow offshore companies to reap competitive advantage over US companies.

and finally:

(5) The powerful US Chamber of Commerce has staunchly and steadfastly furthered a pro-offshoring agenda. This group recently got a big financial boost as a result of the Citizens United Supreme Court decision--which eighty percent of the public is opposed to.

Now, the question arises as to how much offshoring has gone on during the last decade or so, and even before--not only which has led directly to a "slow and bleeding" job loss, but how much offshoring has led to weak job recovery following the current recession (which is supposedly over.) According to mainstream press explanations, per a recent Bloomberg report, "rising productivity is helping boost profit margins...business (is) asking workers to help save cash by working smarter and with existing technology...A potential cost: efficiency gains reduce the chances recession-casualty jobs will come back."

"Bernake Goal of Optimal Employment Elusive with Profits Bringing No Jobs"

http://www.bloomberg.com/news/2010-11-24/bernanke-goal-of-optimal-employment-elusive-with-profits-bringing-no-jobs.htmlIt's true that some efficiency gains are due to factors such as mechanization and "working smarter." What the above article doesn't mention is that business is offshoring to achieve productivity gains, and perhaps has even accelerated doing this in response to the recession--yet, the word "offshoring" is nowhere to be found in the whole article.

In other words, instead of hiring in the US, companies have simply been diverting resources into offshoring (building and hiring at non-US affiliates, partnerships/joint ventures, etc.) at a quicker pace--and in fact have built up substantial offshore investment since 1990; it so happens that US manufacturing employment also began to tumble sharply around 1990:

http://www.economagic.com/em-cgi/charter.exe/blsce/ces3000000001+1985+2010+0+0+0+290+545++0 This offshoring trend is reinforced by the tax loophole (3) listed above, which allows companies to re-invest in overseas operations. The result?

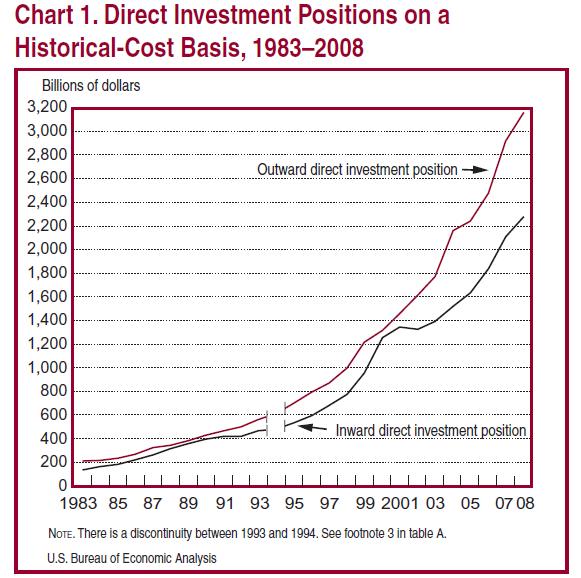

A slow and expensive US job recovery!Chart 1 Illustrates Decline in Manufacturing, Slow Post 2001 Recovery , and Slow Current Recovery Due to OffshoringYou might think this is all speculation. However, I have found a chart which clearly illustrates the growth in offshoring since 1990. The chart accounts not only for slow job recovery related to the current (ahem, "past") recession, but the drop in manufacturing employment since 1990, and the slow job recovery after the 2001 recession as well!

The trend of this chart roughly represents the amount being invested by companies in offshoring. The top RED line is OUTGOING US direct investment. The lower BLACK line is INCOMING foreign direct investment. Notice the GAP has been growing since the early 1990s. This gap is proportional to the growth of offshoring. The gap from 1990 to 2008 has grown from roughly 0 to roughly 1 trillion dollars, and as you can see, the gap is widening at a greater rate as time goes on. Although the 1 trillion dollar number doesn't necessarily represent actual holdings in foreign affiliates of multinationals, about 1/3 of all outgoing US direct investment is passed through holding companies, often via the EU or other "tax haven" countries, for tax reduction purposes--ultimately headed for offshoring investment destinations in China, India, Brazil, or elsewhere.

The KEY thing to notice is the growth in the gap between the lines, and the increasing slope of the red line. This represents the acceleration of the offshoring trend--the shift from US investment in plants and people to overseas destinations. You can see that while the gap has been around since about 1990, it started to grow as manufacturing jobs fell, and it widened sharply right after the last recession in 2001--implying that US companies began using offshoring as a prime alternative means to "re-hire" (by hiring non-US citizens abroad.) Hence, the post-2001 recovery was relatively jobless as compared to previous recessions. Likewise with this recession--it has shown record, extended joblessness. Why more economists don't look at the broad measure illustrated by such charts to gauge offshoring is a mystery. Or--perhaps not--many economists are bought-out by industry groups, and look the other way.

It's really bad at this point--IBM Corporation has around 75,000 employees in India alone, but is so embarrassed about the massive job offshoring going on, it has ceased to make personnel announcements. Clearly, given that there is evidence offshoring has impeded recovery for two recessions in a row, it's time for Congress to take action (to wit, on items (1) through (5) above.) As shown by the chart, offshoring is accelerating--and it can only impede the current economic recovery. And don't buy into media stories which hide offshoring, by whitewashing it as "productivity gains"--this mindset ignores all the side effects. As to what the full side effects of offshoring really are--corporations and Congress would prefer you ignorant to these.

"Economic theory assumes that capitalists pursuing their individual interests are led to benefit the general welfare of their society by an indivisible hand. But offshoring, or the pursuit of absolute advantage, breaks the connection between the profit motive and the general welfare. The beneficiaries of offshoring are the corporations' shareholders and top executives and the foreign country, the GDP of which rises when its labor is substituted for the corporations' home labor. Every time a corporation offshores its production, it converts domestic GDP into imports. The home economy loses GDP to the foreign country that gains it."

- Paul Craig Roberts, Economist, former Assistant Secretary of the Treasury, former editor and columnist Wall Street Journal, Businessweek

http://www.creators.com/opinion/paul-craig-roberts/cato-s-trade-report-blinded-by-ideology.htmlNotes:

(1) Foxconn, one of many Chinese subcontractors, has 500,000 employees, which work on "American-made" products. Subcontractors abound in other offshored countries.