http://www.mybudget360.com/financial-disaster-bailout-commercial-real-estate-through-the-shadows-of-federal-reserve/?utm_campaign=Feed%3A+mybudget360%2FQePx+%28My+Budget+360%29&utm_content=Bloglines&utm_medium=feed&utm_source=feedburnerThe media has done a fantastic job painting over the enormous sinkhole of a problem that is commercial real estate (CRE). U.S. banks hold over $3 trillion in commercial real estate loans on properties that were once valued at over $6 trillion. Today those values are down to roughly $3 to $3.5 trillion depending on what metric you believe. How is it possible for a market that has lost $2.5 to $3 trillion to become largely hidden in the dark from the mainstream media? We constantly hear about $3 billion deficits or other issues but is the trillion dollar figure just so enormous that they don�t even bother investigating? It is probably more likely that the Federal Reserve has concealed massive failures in CRE by allowing banks to play a game of extend and pretend that continues today. The shadowy problems of empty shopping centers, vacant car dealership lots, and misplaced strip malls is largely a taxpayer problem now. Banks made these irresponsible loans but had the Fed hand over taxpayer loot in exchange for worthless real estate.

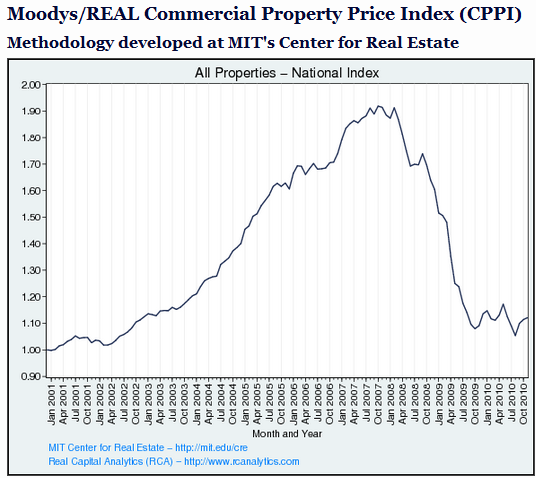

CRE values are still hovering near their trough and are likely to move lower. The only reason these prices haven�t moved lower is because banks are more generous with the borrowers of CRE debt since these holders are grappling with multi-million dollar cuts in each deal. Banks would rather pretend a mall is valued at $100 million instead of marking it to a real value of $40 million or less. The fact that the Federal Reserve allows this to happen is financial chicanery. Can you pretend to the government that you really don�t make $100,000 a year so instead you will act as if you make $30,000 a year and act accordingly? This is what is happening here. Banks are essentially allowing these toxic loans to be laundered through the system in exchange for taxpayer dollars. The Fed is betting that the public doesn�t wake up to this scam.

CRE is a giant and pernicious problem. With residential real estate it hits directly home and many American families are considered home owners. This bubble has garnered most media attention as it should. Yet CRE debt is enormous, larger than every state budget deficit combined by many times! In fact, the losses on CRE loans is larger than the state budget issues. Of course the Fed wants the public to look away from the real culprit behind the decline of the American middle class. The scheme was to build junk and pawn off the loans to average Americans whether they wanted to accept the debt or not.

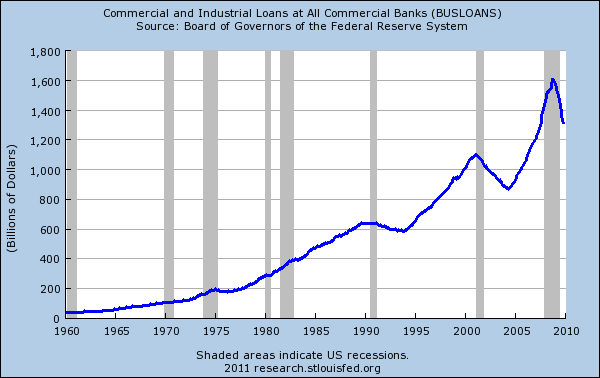

Banks have no faith in this recovery. Look at the above regarding commercial loans. Banks continue to claim that the reason for the taxpayer bailouts was to help the American public weather the economic storm and for banks to continue lending to average Americans. Instead, as you can see above, commercial loan lending has collapsed and banks have hoarded money and speculated on the stock market casino on the taxpayer dime. This money was used to shore up bad balance sheet problems and for gambling on the stock market to boost profits. In short it was one giant swindle perpetrated on the public.

More at the link --