http://www.mybudget360.com/financial-dismantling-of-the-american-middle-class-in-8-charts-peak-debt-credit-card-cash-banking-finance-wealth/Financial dismantling of the American middle class in 8 charts � Peak debt, credit card addiction withdrawal, banks hoarding cash, financial sector dominance in pay, Federal debt will never be paid off, and struggles of the middle class.

The American economy runs on high octane debt. Debt has been welcomed by many with open arms and things seemed to be going well until people realized they actually had to pay the debt back. Average Americans trying to keep up with the picket white fence image of Leave it to Beaver were largely relying on debt to keep up with this lifestyle that was unsustainable with current incomes. Paradigm shifts in economies the size of the United States happen gradually over time. They occur slowly and systematically with the patience of a person watching grass grow. The Federal Reserve has made a conscious effort to bailout the banks and use the crisis as an excuse to lower the standard of living of most Americans to pay for the bailouts. Federal debt is so large that only someone with blind optimism would have any hope that it would ever be paid off. When an average person cannot pay their mortgage they lose their home in foreclosure. If someone can�t pay their car they get it repossessed. When banks need bailouts they simply print away and devalue the currency of the domestic country shifting the burden to society. Have we in the United States reached a peak debt scenario? Is the Fed willing to sacrifice the middle class to keep the banking system intact? Let us look at 8 charts showing shifts in our economy that put the middle class at risk.

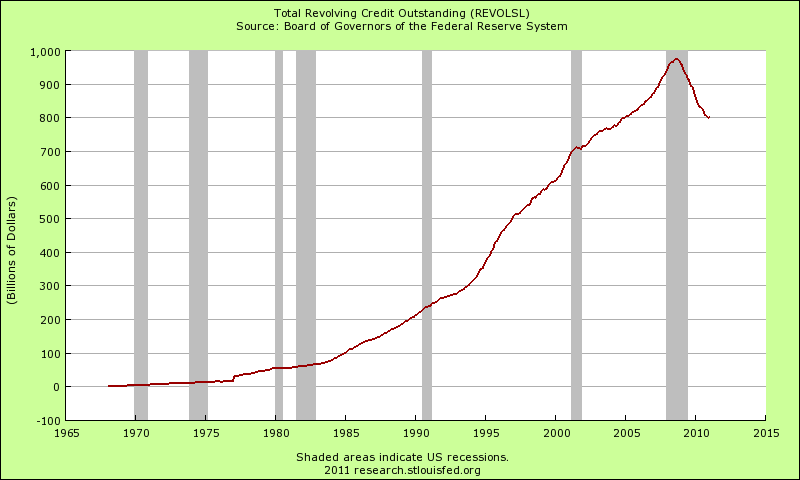

Americans love credit cards right along with apple pie. Since the 1970s the amount of credit card debt in the United States moved unrelentingly higher and higher. By 2007 close to $1 trillion in credit card debt was outstanding. During the crazy debt era of securitization we were hearing stories of cats being issued credit cards with $5,000 limits. It was a massive debt bubble. Many average American families have relied on credit cards to give them the impression that they were keeping up with a middle class lifestyle but instead were simply borrowing time on expensive shiny plastic. With stagnant incomes over a decade the piper is now calling. The above chart clearly shows the contraction in outstanding credit card debt in the U.S. Much of this debt is being discharged in bankruptcy if you are wondering how the chart is moving lower so quickly.

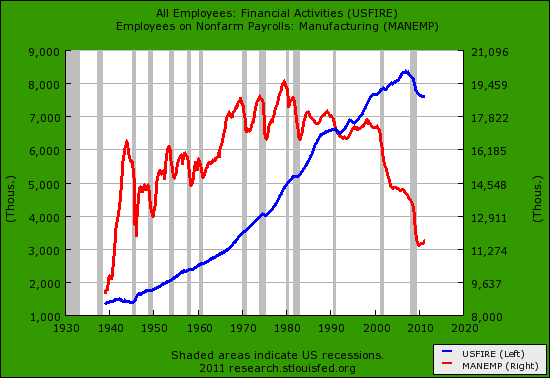

The above chart shows the financialization of the American economy. Since 1970s the U.S. manufacturing sector has contracted. Over 19 million workers were employed in manufacturing during the 1970s. Today we have slightly above 11 million workers with many more living in the country. Over 40 years later and our manufacturing workforce has been cut nearly in half. But look at the financial sector. This part of the economy has been adding jobs almost nonstop. It seems that the U.S. economy was largely built on debt production and collection; credit cards, mortgages, student loans, and auto debt. Someone needs to collect the interest right? Yet how useful is it to have giant parts of your economy developed to make nothing and suck away actual real wealth from the productive side of the market? That is what Wall Street investment banks have done for many decades and it coalesced with our current Great Recession.

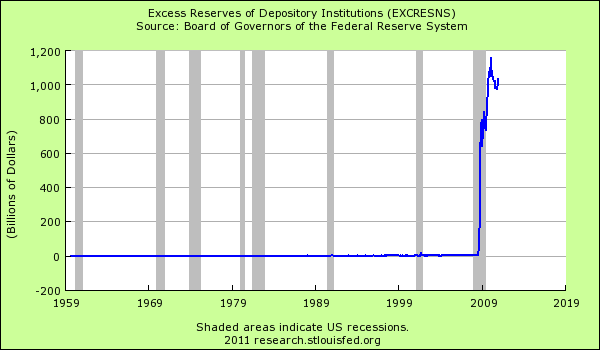

Where is all that easy money going from the Federal Reserve? Clearly it isn�t going to average Americans in credit cards. Much of the taxpayer bailouts are being held as excess reserves and banks currently have over $1 trillion that they can easily deploy into the economy helping the middle class. Why don�t they? They don�t trust the economy because they only need to look at their internal shady practices. They are holding onto this money for the coming problems that will hit with more defaults across all levels of loans. The bailouts were simply a way to save the banks. Make no mistake, banks do not trust the middle class that is largely responsible for bailing them out.

More at the link --