General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Republican tax bill got worse: now the top 1% gets 83% of the gains

The Republican tax bill got worse: now the top 1% gets 83% of the gains

In its last year, the bill raises taxes on more than 53 percent of Americans.

By Dylan Matthews@dylanmattdylan@vox.com Dec 18, 2017, 4:01pm EST

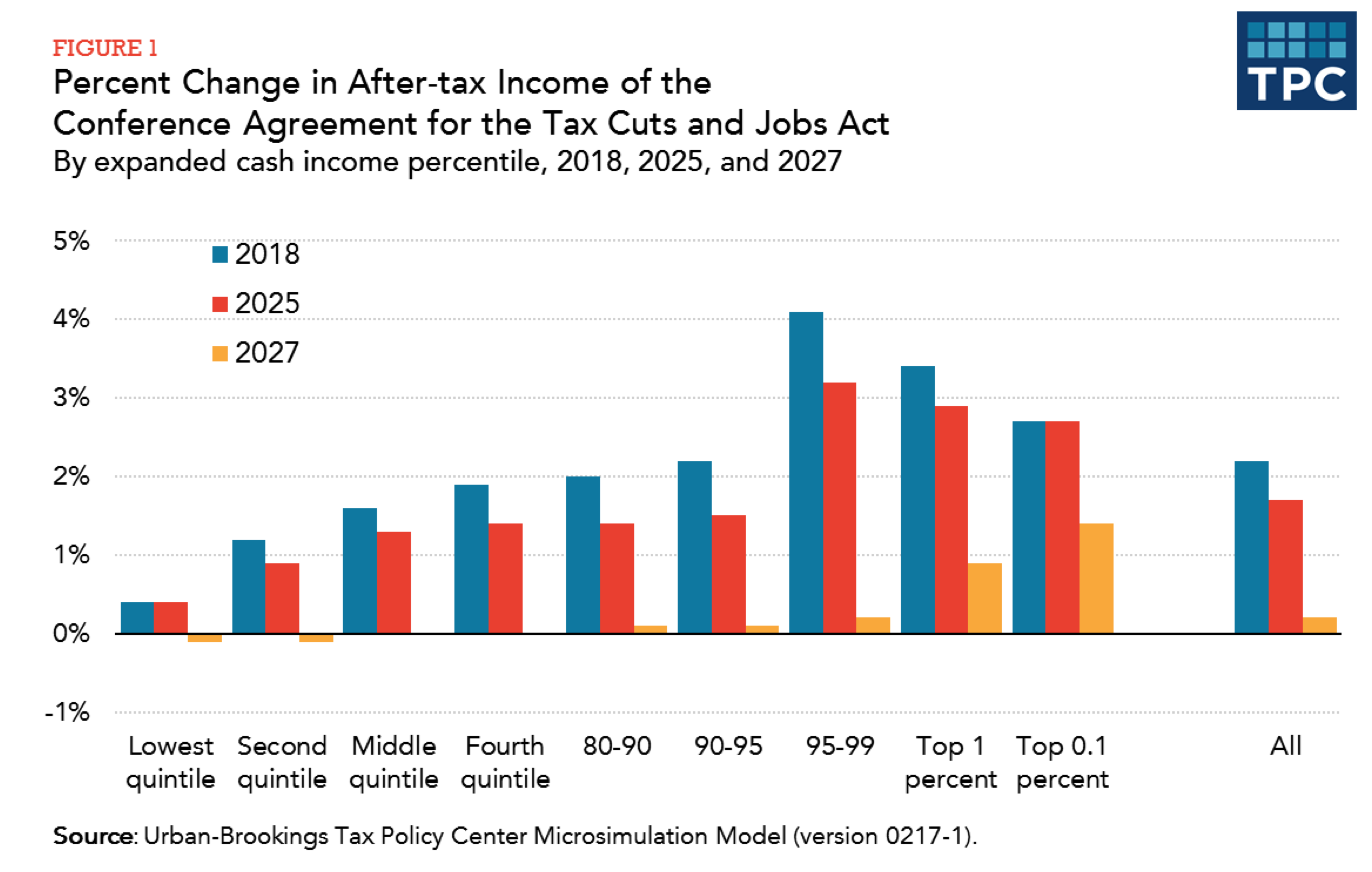

By 2027, more than half of all Americans — 53 percent — would pay more in taxes under the tax bill agreed to by House and Senate Republicans, a new analysis by the Tax Policy Center finds. That year, 82.8 percent of the bill’s benefit would go to the top 1 percent, up from 62.1 under the Senate bill.

And even in the first years of the bill's implementation, when it’s an across-the-board tax cut, the benefits of the law would be heavily concentrated among the upper-middle and upper-class Americans, with nearly two-thirds of the benefit going to the richest fifth of Americans in 2018.

Chart showing distribution of tax bill in 2018, 2025, and 2027 Tax Policy Center

***chart here-don't know how to upload***

The paper is the first rigorous analysis of who wins and loses under the bill as agreed to in conference committee. House and Senate negotiators agreed to a number of changes in the bill, most notably lowering the top income tax rate for individuals to 37 percent from its current level of 39.6 percent. The analysis does not include an additional cost of the legislation: its repeal of the individual mandate, which the Congressional Budget Office estimates could cause as many as 13 million fewer people to have health insurance, reducing federal spending for poor and middle-class Americans’ health insurance by $338 billion over 10 years. That worsens the bill’s distribution for the poor and middle class.

more...

https://www.vox.com/policy-and-politics/2017/12/18/16791174/republican-tax-bill-congress-conference-tax-policy-center

doodsaq

(120 posts)I wonder if any 99%er rightwingers have woken up from their drunken stupor to realize they are gonna get bent over on this bill?

democratisphere

(17,235 posts)I'm damn ashamed to be a part of it!

CurtEastPoint

(18,650 posts)

rgbecker

(4,832 posts).2 percent increase in after tax income for low income people, 4.1 percent increase in after tax income for those in the top 10% of income distribution.

Thanks for posting.

MiniMe

(21,717 posts)"On average", everybody gets a tax break. Of course, most of it goes to the top 5 percent. And by 2027, the bottom 40% are paying more