General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums76% of Americans support Elizabeth Warren's

And AOC's taxes on the super rich.

This is great news.

lark

(23,105 posts)It lept her over most of the others who have thrown their hats in the ring so far, IMO. It's early days and all the players aren't announced yet so I'm not on any bandwagon at this time, but look forward to the primaries and debates to learn more about those who are running. Warren is one of the front-runners by virtue of this policy, IMO.

onit2day

(1,201 posts)He made awareness of income inequality a major campaign issue. Now we need to push it further by increasing the tax rates on the very wealthy. We need to end the Reagan tax cuts and watch income rates increase for the middle class as owners will put their profits back into their companies

lark

(23,105 posts)I think a wealth tax is a gigantic step in the right direction and highlights her common sense and creativity. This is her policy, not a retread Sanders one.

I do agree that the rates need to rise as well.

FakeNoose

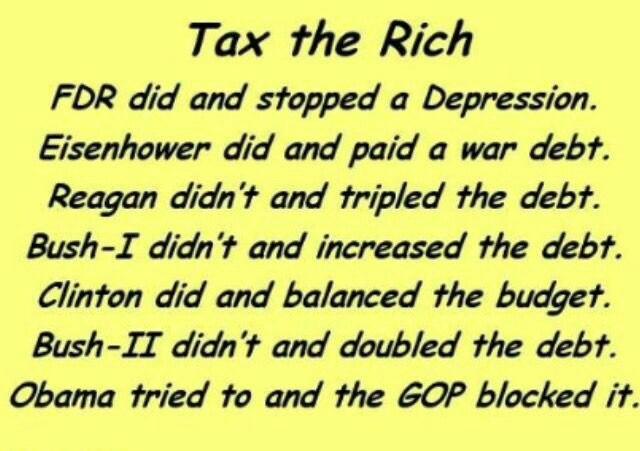

(32,645 posts)... but I like to post this gentle reminder from time to time:

![]()

![]()

malaise

(269,054 posts)Wish I could rec it ![]()

hughee99

(16,113 posts)House and senate?

subterranean

(3,427 posts)We were just beginning to pull out of the Great Recession, and the Bush tax cut extension was passed as part of a broader stimulus package as a compromise with Republicans (we did not have a filibuster-proof Senate majority at the time). Then in 2012, the cuts were made permanent for all but the top tax bracket.

calimary

(81,320 posts)Remember: NOWHERE in the New Testament does it promote comforting the already comfortable. NOWHERE does it quote Jesus as praising the rich or promising them the keys to Heaven. Quite the opposite, actually.

FakeNoose

(32,645 posts)The system is already fixed to help the ones who don't need any help - the one percenters.

![]()

![]()

not fooled

(5,801 posts)when there were more equitable tax policies.

Geez, this country has been effectively propagandized and a large swath of the electorate brainwashed into believing that it's A-OK for the rich to loot the nation while the rest of us fight for crumbs.

Good to see that more and more people are waking up.

![]()

PeeJ52

(1,588 posts)Do the other 23% think they are part of the rich too?

NewJeffCT

(56,828 posts)there was a survey that found over 18% of Americans thought they were in the top 1% of income earners. That's part of the reason, I would assume.

pangaia

(24,324 posts)a lot of people say things like, "they earned the money, so they should have a right to keep it."

Also-- "not only are there federal income taxes, but also state tax, local tax, school tax, sales tax, gas tax," and on and on...

Those poor rich people having to pay taxes...

maddiemom

(5,106 posts)have thought that the tax percentage meant on EVERYTHING the wealthy earn, and not on OVER a certain amount that many of them will never earn in a lifetime. Also, what about comparably equal taxes on their assets to what the average person pays? It does seem that the generation coming into government now has a better grasp of this.

Amishman

(5,557 posts)People see their pay checks stagnating in the face of record profits. We have a very competitive labor market but wages aren't rising. People are waking up to how they are getting screwed and want to turn the tables on big business and the elites.

The funniest part is that if businesses bumped raises by a couple percent, we wouldn't see near as much of a socialist awakening right now.

And tomorrow night the vile MAGAcretin will stand up and tell America about his great economy while regular folks are just discovering that his entire tax break exercise was one of the biggest cons in history.

If you think last year was a blue wave, just wait for next year.

aggiesal

(8,918 posts)He told me this weekend, that the taxes he's done so far, people are

super mad, because their usual $1,500 tax rebate is now $3,000 tax bill.

c-rational

(2,594 posts)money. Enough of the BS about taking more from the poor.

are against it only to own the libs in their quaint brain dead way.

Recursion

(56,582 posts)The problem is, they don't. They vote based on identification.