Trump Accidentally Raised Taxes on the Children of Dead Veterans

Donald Trump always knew that his tax law would include a few unpopular provisions. After all, as a Republican president, he had a fiduciary duty to provide his party’s shareholders a hefty return on their investments. Thus, even as Trump assured the public that “the wealthy and well-connected” would derive no benefit from his tax reform, he rubber-stamped a (deeply unpopular) package of giant tax cuts for the wealthy and corporations.

The president and his party nevertheless assumed that the sugar of middle-class tax relief would make the medicine of creeping plutocracy go down. But their bill’s tax breaks for ordinary Americans proved too meager to make themselves felt amid rising health-insurance premiums, shifting 401k contributions, changes in base pay, and the myriad other forces that alter Americans’ paychecks. Meanwhile, the combination of deduction eliminations — and the IRS’s lax approach to withholding — left many Americans with surprise tax bills this spring, leading some voters to mistakenly believe that their overall tax burden had actually gone up: Although the president’s law did technically reduce taxes on 80 percent of households, less than 20 percent of Americans believe that their taxes went down last year.

To understand how congressional Republicans ended up taking on “Big Gold Star Family,” you need to get familiar with the Kiddie Tax of 1986. That year, as part of Reagan’s storied bipartisan tax-reform law, Congress closed a loophole that enabled wealthy parents to use their children as a kind of tax shelter: Before 1986, you could transfer an appreciated asset to your small child, have her sell it, and pay way less taxes on the capital gain (assuming your 5-year-old has a lower overall income than you do), then use the proceeds to pay her college tuition.

To combat such scheming, Congress required children to pay their parents’ tax rate on all unearned income above $2,200. This rule didn’t solely affect the children of the superrich. Under U.S. law, survivor benefits and non-tuition college scholarships can count as unearned “kiddie” income. Thus, a child from a working-class family might pay a 12 percent rate on a scholarship that covered her room and board at university — while a child from a wealthy family would pay a 37 percent rate on that same scholarship.

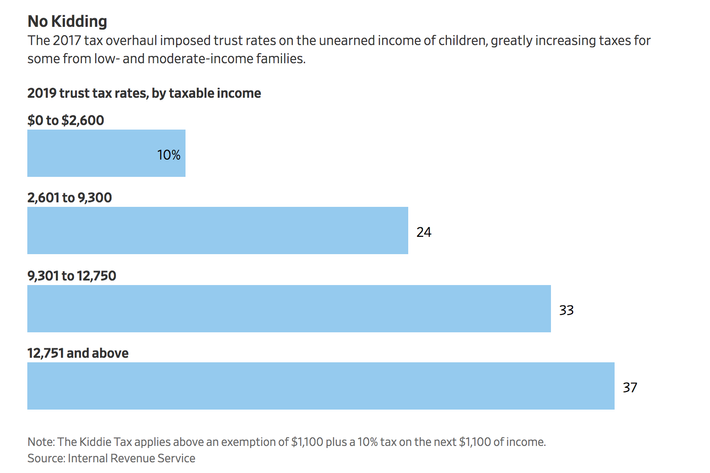

But in 2017, congressional Republicans decided that these rules were needlessly complex. Rather than maintaining the kiddie tax, they decided to merely apply the rate on trusts to all unearned children’s income. In practice, this means that the size of a child’s scholarship or survivor benefit — not her parents’ tax rate — determines how much tax she needs to pay on her unearned income. As the Wall Street Journal illustrates:

http://nymag.com/intelligencer/2019/05/trump-accidentally-raised-taxes-on-the-kids-of-dead-veterans.html?utm_source=tw&utm_medium=s1&utm_campaign=di