General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsCan someone explain the stock market rise to me

Can someone explain the stock market rise to me and how long Main Street and Wall Street can diverge? How can there be a V shaped recovery when it will take a long time if forever for America and the world to look the way it was before COVID-19.

Until there is a vaccine or herd immunity the elderly will stay home as much as possible, only venturing out for necessities, and working folks will only venture out to go to work and for necessities. I don't see many folks going to restaurants, going to malls, going to bars, going on vacations; all the things that contribute to consumer spending which is seventy percent of the economy.

What am I missing?

Newest Reality

(12,712 posts)Claustrum

(4,846 posts)It will have it's ups and downs. After the 10k point drop, it's due for a bounce back. But I have been really puzzled by the daily bad economic reports from around the world (not just the US, UK, China, etc also had bad economic reports this week) and somehow it is still up this few days.

uponit7771

(90,364 posts)There was a drug that pumped and dumped for Ebola that someone leaked comments about

Also red Don intimated May 1 for opening

efhmc

(14,732 posts)a vaccine is on its way. Full steam ahead.

mtngirl47

(991 posts)Also from a small test of a drug called remdisivir which has had good results in Chicago to mitigate corona virus symptoms.

DemocratSinceBirth

(99,711 posts)Would you go to a crowded restaurant or retail store?

kentuck

(111,110 posts)To anyone that wishes to play the game.

The Velveteen Ocelot

(115,836 posts)Every time someone announces a possible treatment, cure or vaccine it will go up. If some big corporation announces poor earnings or goes out of business it will go down. Don't expect any stability for a long time.

Zoonart

(11,878 posts)More Encouraging Signs for Remdesivir as COVID-19 Treatment

https://time.com/5823384/remdesivier-coronavirus-study-results/

Celerity

(43,499 posts)

Bernardo de La Paz

(49,036 posts)Bernardo de La Paz

(49,036 posts)NRaleighLiberal

(60,019 posts)pwb

(11,287 posts)Fewer workers = more profit. Corporations don't have to save anymore, pukes always put them first at every turn.

smirkymonkey

(63,221 posts)will translate into less revenue for them? Even people who still have jobs are going to be tightening the belt - I certainly am - due to future uncertainty.

The "powers that be" can be so stupid and short sighted. Sooner or later, without enough demand for their products and services, they will not be able to survive. The very rich can only consume so much. Without a robust middle class of consumers to keep them going, they can't sustain growth.

DemocratSinceBirth

(99,711 posts)And if nobody buys their stuff how can they stay in business?

gibraltar72

(7,511 posts)Also any sign of good news sends them running in.

Celerity

(43,499 posts)Investors and economists are flying blind regarding the return of aggregate demand

https://www.marketwatch.com/story/the-stock-market-is-rebounding-because-investors-are-asking-the-wrong-question-analyst-says-2020-04-14

The rebound by the U.S. stock market off its March 23 coronavirus low is impressive, but it might be predicated on the wrong question, according to one analyst. “Most of the analysts are asking — ‘When will the economies return back to work?’ — which we believe is the wrong question,” said Boris Schlossberg, managing director of BK Asset Management, in a Tuesday note. “The much more relevant question is — ‘When will aggregate demand recover to pre-virus levels?’ That is a much more difficult dilemma to assess given the massive damage done to consumer balance sheets.”

Signs the COVID-19 pandemic is peaking in Europe and the U.S. have fanned buying interest for equities and lifted investor appetite for risky assets. Some European countries have started to lift restrictions on movement and activity, while U.S. politicians are scrapping over the timing of a reopening and who has authority to decide.

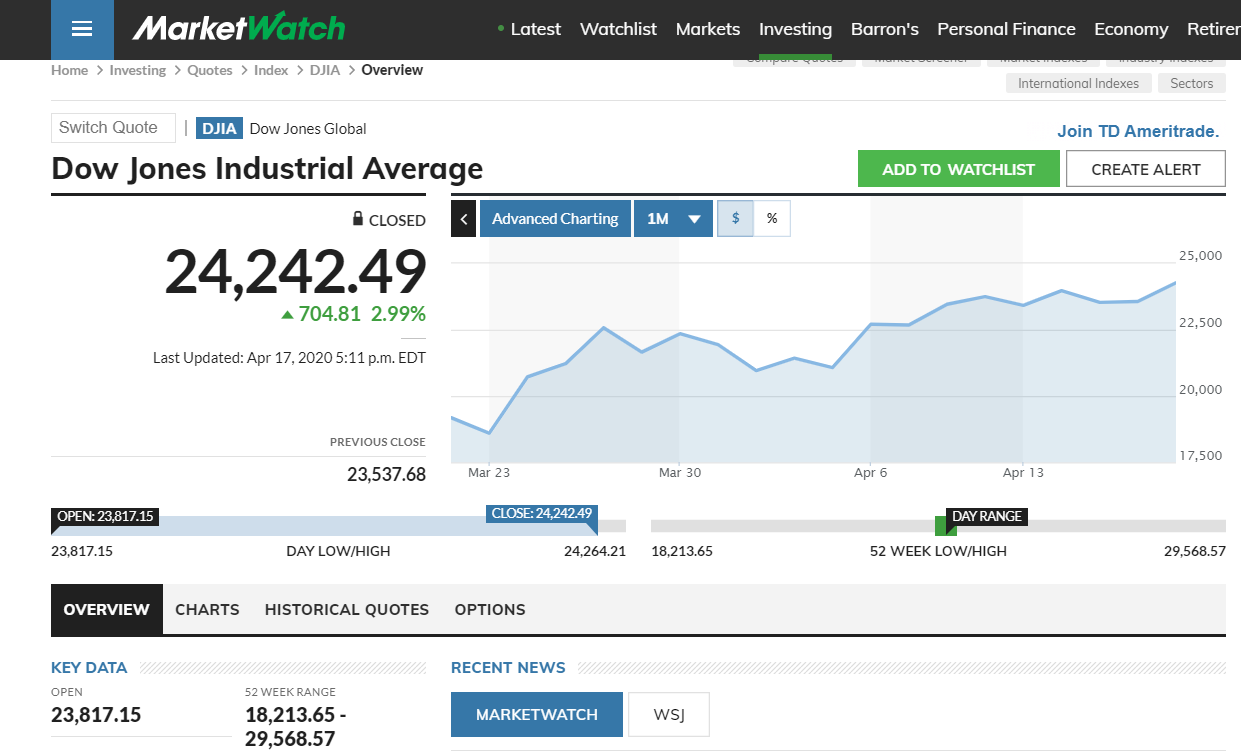

Stocks rallied Tuesday, with the Dow Jones Industrial Average DJIA, +2.99% gaining 558.99 points, or 2.4%, while the S&P 500 index SPX, +2.67% advanced 3.1%. The Dow has risen 28.8% from its March 23 low, while the S&P 500 was up 27.2%. That leaves the Dow 19% below its all-time closing high set on Feb. 12, while the S&P 500 was 16% below its Feb. 19 record close.

Analysts at Goldman Sachs this week threw in the towel on their near-term bearish forecast, which had called for the S&P 500 to test 2,000, arguing that the March 23 low would mark the bottom. Like other bulls, they argued that the flattening of the so-called viral curve combined with unprecedented rounds of monetary and fiscal stimulus by the Federal Reserve and U.S. government made it unlikely the market would carve out new lows, barring a second wave of infections down the road. Others have argued that the rally will give way to renewed selling pressure as the damage to the economy from lockdowns becomes apparent and uncertainty about the shape of the economic recovery remains.

snip

uponit7771

(90,364 posts)IMHE's projections out till end of June.

These guys think this is going to be over next month because that's what Red Don keeps hyping, just take a look at CNBC analyst which are usually the least biased.

They all think next month the planes are going to be back flying ... they're all nuts

lunatica

(53,410 posts)For example, the need for a vaccine will make labs and Pharma stock worth buying so you can make money off the pandemic. When we go to war the stocks for weapon making businesses are good ones to buy. If there is a terrible earthquake then anything that will be used to help the people is good stock, like food production, pharma, rebuilding equipment, etc.

For every calamity there are all kinds of gains in betting on the materials needed to deal with that calamity.

Windy City Charlie

(1,178 posts)Also, it could be bit of bait to see if they can reel people in to play the game and then leave them hanging.

James48

(4,440 posts)Pumped 2.7 TRILLION dollars into the economy last week - and that had to end up somewhere. It ended up in the stock market, a bunch of smart guys stirred rumors that all was going to be well after Donny threw a little snake oil Hydroxychloroquin in on the mix, and poof!

We get a 800 point run.

Don’t worry- in a week they will all realize a good number of companies aren’t going to survive much longer, and it will all come tumbling down in May and June.

OhioChick

(23,218 posts)former9thward

(32,077 posts)They never have. Most people will go back to some sort of normal behavior. People will not remain on house arrest for long. They will not just "go to work" and that is all of their life.

Also, and more important, the stock market is made up of large companies. Small businesses which will be hurt the most are not listed on the stock market. Large companies will do just fine in the long run and that is what the market reflects.

ck4829

(35,091 posts)honest.abe

(8,685 posts)Many investors were fearing worst case scenario of an out of control world-wide pandemic which would cause a global economic disaster. That appears is not going to happen as many countries including the US are seeing a leveling off of cases and some reporting decline. So many investors started buying back looking to get "bargains". However, I see another downturn once the effects of huge unemployment hit our economy.

Maeve

(42,288 posts)With very few places for it to go. The idea of investing in (dare I mention) infrastructure and personnel is so terribly 20th century and, well, democratic.

There has also been a foreshortening of vision--winning the next news cycle is as far as many are looking. Ooo, shiny vaccine promise, treatment seems to maybe be working in some extreme cases...oooo, everything back to normal by summer....and hey, what's the loss of 2-3% as long as I'm rich? and as long as it isn't me...

ProfessorGAC

(65,168 posts)As 9thWard mentioned, the large publicly traded companies are affected less because many are operating normally with a squeeze on revenues for a while. And some, barely. Think about a company like P&G. People are still buying their cleaning products, their food products, & skin care. That section of their portfolio is barely hit. And the suppliers to them are keeping up with P&G's demand.

Second when Obama left office, the Dow was around 19k. 3.25 years later, at 24.5k, shows 28%, or about 8.5%/yr.

The overall economy was good enough to sustain 8.5% value growth. It averaged 12%/yr. through Obama's last 6 years.

The growth to nearly 30k was not economically justified, so a correction was imminent. The virus triggered the correction, and in typical market fashion, overreacted to 18k.

The right number is probably somewhere between 23 & 25k.

DemocratSinceBirth

(99,711 posts)Even if I was a bit dramatic do you think people will resume their normal behavior anytime soon?

ProfessorGAC

(65,168 posts)But, 30-50% won't.

And either way, the markets for true consumable goods will be fine. Even you & I need food, clothes, paper products, & the like.

Much of the service sector, however, is a different matter.

I see many avoiding crowded restaurants and the like. Not every restaurant fits with a carryout only model.

Then, some people will just run out of $. Desperation is a powerful motivator.

They'll try to get back to normal, even with fear, because their options are fast dwindling.

DemocratSinceBirth

(99,711 posts)You would agree that's a lot of people who won't fully participate in the economy who fully participated before and that's bound to have a dramatic effect on economic growth?

ProfessorGAC

(65,168 posts)I've been saying, countering the Drew & Phil types, that it's ridiculous to think a few extra million people dying won't cause huge economic damage.

So the damage they think they're avoiding by opening, is being compared to nothing. It's stupid.

Also, keep in mind that I ended with the desperation concern.

That only applies to the 30-50%. Those that don't care now aren't going to care upon reopening.

Not everybody in that 30-50% can afford to "ride it out" indefinitely. In fact, the preponderance of that fraction cannot.

The economy & social life is going to come back at some point no matter what.

The goal can't be doing this until a vaccine. People, by & large, just can't. Either mentally or financially. Probably both.

We need a specific reopen plan with contingencies set in stone, if things go sideways.

DemocratSinceBirth

(99,711 posts)That is what I don't get.

ProfessorGAC

(65,168 posts)I don't think the market is pricing at boom values.

It's bouncing around within a range consistent with the increases in P & Q, and substantive profit improvement.

What was boom pricing was the 29,000+ before all this started.

Things like the increases I mentioned, plus rising D/E ratios & cash positions at at lower fraction of liabilities should have had the big markets roughly in the current range. So the virus forced a correction that was due. It was just more dramatic & volatile than typical corrections.

Now, if you're wondering why it's not continuing to plunge, that's a different question.

Assume my hypothesis makes total sense (they're just educated projections, not fact). The market is now valued at an "about right" level, but future profit margins shrink even with gradual return to normal.

If we're starting at around 90% of normal daily GDP, with the UE and stimulus $ the overall economy won't shrink by a whole lot more.

So, it's the investors letting it ride at equilibrium, or at least they hope. We saw a massive drop, a dead cat bounce, another huge drop, the a rise back up to now, which included up & down days.

Market seems to be seeking it's own level, not booming.

ooky

(8,929 posts)Over the long term there should be a convergence of a stock's value and price, in the short term it's going to react to other non-direct influences of that company's stock prices, particularly those that trigger general market buying and selling; and therefore, on any days that there are more buyers than sellers that it will indeed rise. Right now we are watching a string of days with more buyers than sellers.

Short term doesn't mean much unless you are a day trader. Long term, I suggest you trust your instincts. Like yourself, I don't see stock values, and therefore their prices, rising long term given the economic outlook we are currently facing.