General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsXipe Totec

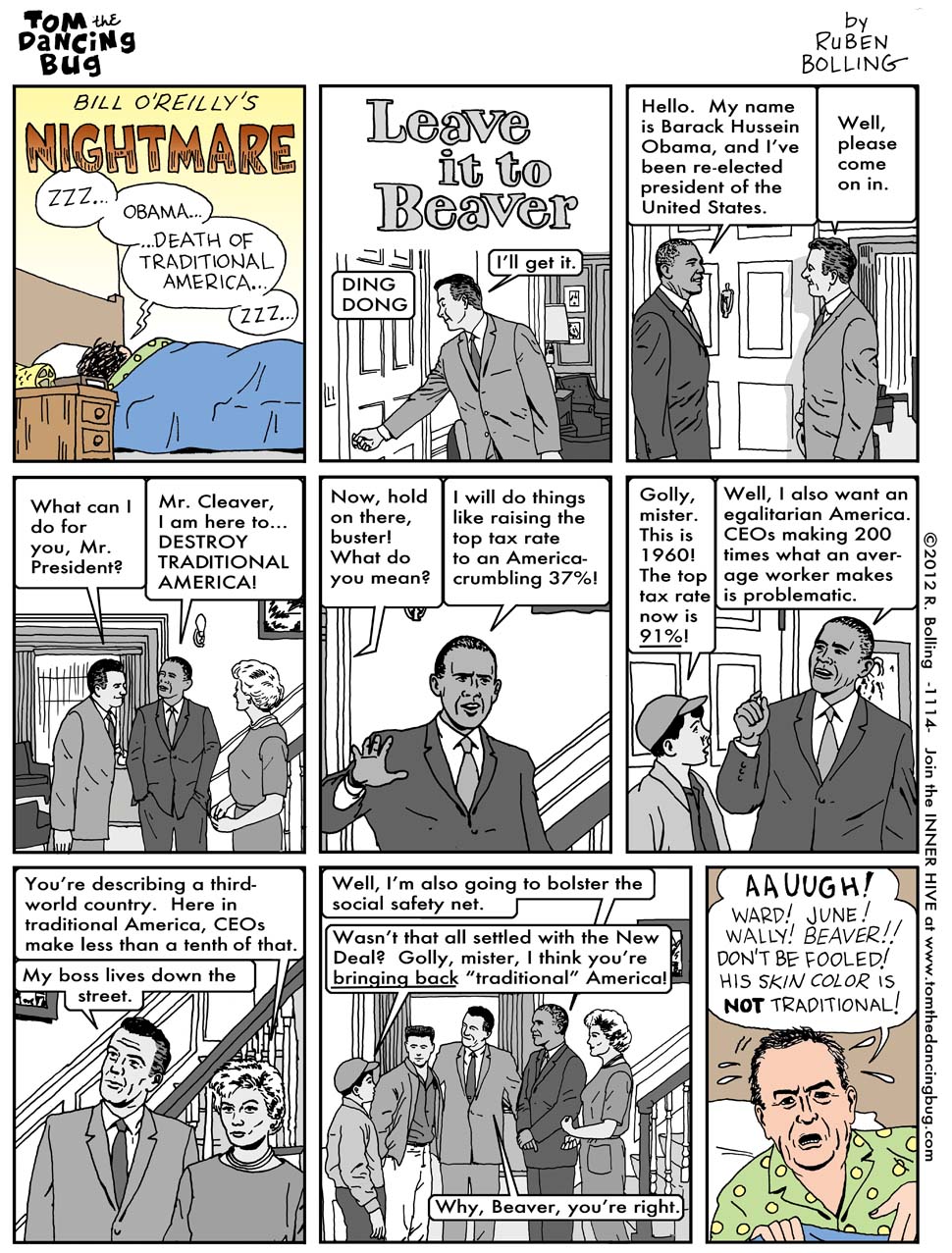

(43,890 posts)Dark n Stormy Knight

(9,771 posts)that, in many ways, the show was more progressive than them.

Ward did not hit his children, though once or twice he threatened to. He talked often, however, of how his father hit him and he didn't want to be that kind of father. He complained now and then about all the "modern" insistence that the parent try to understand rather than bully the children, but his behavior showed that he subscribed to those "modern" ideas.

Beaver had a non-English speaking Hispanic friend over and everyone was cool with that. Everyone was polite to the boy and his non-English speaking parents. Only Eddie Haskell was a dick about it.

Wally was an awesome kid who believed in kindness, fairness, and honestly, though he did give Beaver "the business" sometimes. Beaver, of course, deserved it.

Now June--she was definitely kind of an idiot. But, it's not her fault. She was written that way.

On edit: Meant to respond to the OP. Oh well. Sorry.

maddiemom

(5,106 posts)Funny that the Ward "hitting" discussions are nothing I remember about"Beaver." Maybe "are you gonna hit me dad?" I may be mistaken. Growing up in the fifties and sixties, I was never struck anywhere but my butt. By the time I was an adult, dealing with discipline as a mother and teacher, my Mom swore she'd never hit me in my life. She denied she'd ever struck me, but for sure she once spanked my butt with a hairbrush. I'll never forget it. That was the point of course.

Dark n Stormy Knight

(9,771 posts)his dad did. Fred Rutherford talked about hitting Lumpy. A random kid gets hit by his mom in the bus station. These hitting are not portrayed in a particularly positive light. We are clearly to see it as not cool.

Yes, Beaver, and Wally, did often say that Ward was gonna "clobber" them, but he didn't. When they mention it in front of Ward, he almost always says something like, "You know I would never hit you."

In an early episode, after Ward says he'd never hit him, Beaver brings up a time when Ward did hit him in the past and Ward looks uncomfortable. Another time or two Ward talks about possibly using corporal punishment on Beaver, but he doesn't. And he is presented as more enlightened due to his approach to parenting. I agree with that attitude towards hitting children for punishment. I'd say 99%, if not 100%, of the time there is a better choice.

Also, quickly found this about the Andy Griffith Show:

JHB

(37,161 posts)...which gives me yet another chance to K&R it! Yippee!

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

slogan057

(25 posts)mostlyconfused

(211 posts)Well, two problems.

1 - taxing the top 2% of wage earners with a top marginal rate of 91% would not come anywhere close to covering the deficit. The month simply isn't there to be taxed.

2 - back when that top rate was 91%, almost nobody paid it.

But yes, the ratio of CEO pay to regular worker pay as exploded. Ezra Klein put the ratio at 40 to 1 back in those days, and as much as 200 or 300 to 1 today.

Ikonoklast

(23,973 posts)1 - No one says it will.

2 - No one said they did.

Those are both right-wing memes that ignore how the tax code now rewards the accumulation of capital and punishes wage-earners.

mostlyconfused

(211 posts)On both points 1 and 2. I've heard so many people who are under the impression that we can raise taxes enough to fix the deficit..without some huge spending cuts as well (defense, etc). We have to at least have a fact based conversation about how to fix things.

arely staircase

(12,482 posts)nt

Dark n Stormy Knight

(9,771 posts)you're not going to get that agreement. ![]()

arely staircase

(12,482 posts)eom

Springslips

(533 posts)But a 91-percent top tax forced owners to invest it back into their companies producing economic growth. Not like today where the incentive is to pull money out and then invest it in hedge funds and to buy out other firms, creating the entire "Bane Culture" of the 1980s.

Spitfire of ATJ

(32,723 posts)mostlyconfused

(211 posts)but would not be surprised. Are you talking direct salary, or salary plus other benefits? Oracle corporation just announced that it would pull 3/4 of it dividend payments into 2012 to avoid the higher tax in 2013. I think that netted Larry Ellison close to $200 million.

When the IRS breaks out tax returns by gross income, the top group are those making $10+ million....about 8,100 returns. I wonder how many of those are actors, musicians, and athletes. Their pay is also way out of whack.

Spitfire of ATJ

(32,723 posts)

40,000 sq ft home, 22 car garage and a private golf course built with pizza.

D Gary Grady

(133 posts)Dear Mostly,

With respect, I believe you're repeating something you've heard without bothering to check it out. Please take a few minutes with Google and a calculator and tell me if your results match mine:

The U.S. federal deficit for fiscal year 2012 (which ended September 30) was about $1.1 trillion. As of 2007 (I grabbed the first recent data I could find), the top one (not two) percent of Americans took in a remarkable 24% of all personal income. Annualized and seasonally adjusted nominal personal income is running over $13.4 trillion.

So assuming the top 1% rake in the same share as in 2007, they're pulling down over $3.2 trillion in gross income. Taxing that at an overall rate of 91% would produce over $2.9 trillion, or enough to cover the deficit 2.6 times over. Of course, a marginal rate of 91% would apply only to the part of income over a certain cutoff, and would hence bring in less in taxes. But clearly we could pick a cutoff such that a 91% marginal rate would cover the deficit completely. And that's just the top 1%, not 2%.

Whether we should do that is of course a separate question. My point is that whoever told you it couldn't be done is simply wrong at level of basic arithmetic.

You're of course right that few people paid the 91% marginal rate in 1960, and for that matter even they paid it on only a portion of their income. But this illustrates a problem with today's tax structure. The current top rate applies to the portion of taxable income over $400,000 (actually a bit less), and there are no more steps above that point. A surgeon making $500,000 a year winds up in the same marginal bracket as a hedge fund manager pulling down tens of millions. (And that's overlooking the fact that most of the hedge fund guy's income is taxed at a top marginal rate of 15%.) As even Ben Stein said on Fox & Friends the other day, rates should keep going up with income.

(Incidentally, at one point in history we had a marginal rate that affected only a single taxpayer: John D. Rockefeller.)

D Gary Grady

(133 posts)OK, I omitted to note that the top 1% already pay taxes, and adding a 91% rate to what they already pay would put it over 100%. My bad.

But if the top 1% pull down about $3.3 trillion and the deficit is $1.1 trillion, that taxing an additional 1/3 of their income above what they currently pay (which is obviously less than the top marginal rate of 35%) would cover the deficit. Again, I'm not arguing that we should do that, just noting that it's incorrect to say it's mathematically impossible.

mostlyconfused

(211 posts)I have no idea where you get that $13.4 trillion figure, or what "Annualized and seasonally adjusted nominal personal income" means, but I'm quite certain it's wrong. Rather than making some snarky comments about math skills, can I ask you to point me to your source on that?

My source is the most recent detailed tax figures directly from the IRS. Check this out...

http://www.irs.gov/uac/SOI-Tax-Stats---Individual-Statistical-Tables-by-Size-of-Adjusted-Gross-Income

The top tax bracket is at a 35% marginal rate and kicks in at incomes above $388K annually. Unfortunately the IRS doesn't split out the returns at that income level in its reporting, so the closest thing we can do is look at income tax returns with taxable income above $500K. In 2009 (the most recent detailed info available) there were 723,191 returns filed that fit that criteria and total taxable income from those returns was $903 billion.

I'm assuming you'd not advocate raising the rates on all earnings, but just that top bracket. So let's say we take that 35% bracket and raise it to a 91% rate, and not just on pay but on capital gains as well. So any income above $500K will now be taxed at 91%. Leave the rest of the rates alone.

Walking through the numbers....

> Total taxable income for this group: $903.1 billion

> Income above the $500k level: $541.5 billion (get there by subtracting $500K x 723,191)

> Tax already paid on those dollars: $130.5 billion (this group collectively paid an effective rate of 24.1% in 2009)

> Tax to be paid at a 91% rate: $492.7 billion

> Net increase in taxes at the new rate: $362.2 billion

Against a 2012 annual debt of $1.1 trillion, that's 32.9%. So ironically, it is the opposite of your assertion. Instead of being able to tax at that rate for one year and cover the deficit nearly three times over, you'd need to tax at that rate for three years to cover just one year worth of deficit. But I'm not sure how much of that money would still be there to be taxed in the second year.

What you'd be doing here is effectively capping personal income (from wages + capital gains) at $500K in this country, without coming anywhere near close to addressing the deficit. I stand by my math. Though I would happily be corrected, the IRS data says that the money is just not there.

Yes, increase taxes on the rich. That's one of the reasons we reelected the president, and he needs to keep pushing for it. And if John Boehner stands in the way, then we get our crack at his house majority in two years. But we need to have a fact based conversation and recognize that you cannot tax the rich enough to fix the budget problem, not even if the top marginal rate were 100%.

D Gary Grady

(133 posts)My source for personal income is the Bureau of Economic Analysis in the Department of Commerce, specifically the latest estimate as of October. The published estimate is actually $13,434.4 billion. See this release (PDF).

The assertion that the top 1% were taking in nearly 1/4 of all personal income as of 2007 comes from a series by Timothy Noah in Slate. Other figures I've seen suggest that this fraction had fallen to around 20% in 2011 as a consequence of the Great Recession, but I suspect inequality is rising again since numerous reports say that most of the gains of the recovery are going to the top of the income spectrum.

Re "annualized and seasonally adjusted nominal personal income": "Personal income" means income to individuals, "nominal" means current dollars, "seasonally adjusted" means corrected for the usual seasonal pattern of income fluctuation, and "annualized" basically means that the monthly figure for October has been multiplied by 12. (Since GDP is computed quarterly and personal income and outlays monthly and other numbers on different timeframes, quoting them on an annualized basis makes them easier to compare.)

There were about 112 million U.S. households in 2009, so you're now talking about raising rates on part of the income of the top 2/3 of 1% of U.S. households. What I was responding to was a previous assertion that there isn't enough income among the top 2% of households to cover the deficit, which isn't true.

Again, I am not advocating a drastic tax increase on the top of the income scale, merely noting that it would be mathematically possible to raise marginal rates high enough to cover the deficit.

mostlyconfused

(211 posts)Current GDP is about $15.7 trillion, but if you compare it at constant dollars over the last decade it's very close to $13.4 trillion. I get where the figure came from now, but it has no meaning in the context of a discussion on personal income, income tax rates, and federal income tax receipts.

The total adjusted gross income from every return filed in 2009 was 6.8 trillion. Most of it ($5.7 trillion of it) came from people who reported less than $500k in adjusted gross income.

If we talk taxable income rather than gross income, the total taxable income from all returns filed in 2009 was $4.9 trillion. $3.9 trillion from people making below $500K, and then the $903 billion I previously mentioned from people with taxable income above $500K.

I find it interesting that the vast, vast majority of deductions come from that under $500K group...but the thing is, that makes up the biggest number of returns, so on a per return basis the rich have to be deducting much, much more...will have to do some more figuring on that.

D Gary Grady

(133 posts)Quibble in passing: As already noted I was talking personal income, not GDP.

Be that as it may, 2009 was a very anomalous year, the worse of the Great Recession, and not a good basis for future estimates. For one thing, over the last three years personal income has grown from $11.8 to $13.4 trillion, and by most accounts a large fraction of that increase has gone to those at the top. You raise an interesting point that total adjusted gross income reported on tax returns in 2009 was far a lot lower than total personal income. Even personal consumption expenditures in 2009 were running nearly $9.9 trillion. I have some guesses about why the difference is that great, but it would be an interesting point to investigate further.

Thanks for going to the trouble to dig up the IRS data. I think you and I are fairly close on what we consider sensible policy, my only quibble being that your original assertion was technically incorrect (as for that matter was my original response to it) and sounded like a talking point I've heard repeated ad nauseam without solid backing.

As for what policy I actually advocate: I think we need to raise taxes on upper income groups, including restoring progressively higher taxes on income levels over $400,000, as even Ben Stein favors. We also desperately need to do something about rising medical costs, which are double those in other countries with comparable or better levels of care and account for almost all the so-called "entitlements" problem. We should not rush to balance the budget short-term lest we repeat FDR's mistake in 1937. We should also reduce defense spending. But there's very little good we can do by cutting non-defense discretionary spending because it's actually running at a low rate right now, and cutting it would likely damage the economy and actually increase the deficit, as witness the result of ill-considered austerity in Europe.

D Gary Grady

(133 posts)Sorry for that blank. Apparently trying to link to the source of that number at the BEA.gov website somehow made it invisible. Anyway, if you go to the interactive national income and product account tables you'll see that in the third quarter of 2009 seasonally-adjusted personal consumption spending was running at an annualized rate of nearly $9.9 trillion, even though total reported income on tax returns came to under $7 trillion. I'm not sure why.

mostlyconfused

(211 posts)Thanks for the sources. I'm a little confused as well why they would be do different in terms of a total personal income number. That said, if we're talking about the impact changes in tax rates will have on federal tax receipts I cannot think of a more accurate source than the IRS data. Total personal income, whether it be $7 trillion or $10+ trillion doesn't tell us much as the bulk of it comes from earners that have less than $500K of income.

If we classify "the rich" as people being in the top $388,000+ income category (but relying on $500,000+ because of IRS data)...then we need to look at how much tax could be collected based on a rate change to those people.

I'll grant that 2009 was not a typical year. I don't think 2007 was either as it was the year that last decades fiscal and tax policy led to..before the bubble burst in 2008.

So, I'd looked at 2009 before, but now went back and analyzed the IRS tables from 2008, 2007, 2006, 2005, and 2003. Skipped a year and didn't go back further because I ran out of time and it is late.

Here's what I found...if for each one of those years you were to collect 100% of all taxable income above $500K, the additional tax revenue would cover the following amount of a $1.1 trillion deficit.

2009: 38.53%

2008: 59.48%

2007: 81.93%

2006: 70.37%

2005: 60.32%

2003: 30.36%

Clearly the wealthy were making a lot more money in 2007, but I'm pretty sure we don't want to go back to the policies that allowed that to happen, so with Obama in the white house it may be safe to say that 2007 was as much of an anomaly as 2009. And I stand by my assertion that you cannot tax the people in that $500+ K group at a high enough rate to cover the current deficit...and as you note, I think we agree that we should not try to do so.

One more thought...to support your point about the wealthy having their share of the income peaking in 2007..since I'd pulled multiple years worth of IRS data I looked at that same range of years the percentage of total gross income and percentage of taxes paid by that over $500K group each year.

Year: Gross Inc, Taxes Paid

2009: 13.89%, 29.79%

2008: 17.77%, 33.24%

2007: 21.21%, 37.03%

2006: 20.06%, 35.87%

2005: 18.61%, 34.27%

2003: 12.51%, 25.76%

From 2003 to 2007 the number of people/returns in the above $500K group roughly doubled.

Yes, I get going a bit too much when I get into the numbers, but I find it interesting...and I thought you'd like to know that it validated your point about the share of income in 2007.

Bette Noir

(3,581 posts)toby jo

(1,269 posts)He states, without batting a eye, that the reason O won was because of hurricane Sandy. He said that up until that storm hit, the numbers were trending towards Romney, but that after the storm, O got to be in the public spotlight continually, and Romney was completely out of the news cycle.

Nothing deeper at play. No consensus. No 6 months of O on top of the ratings 99% of the time. It was the storm.

And he segues into his next delusion.

The man is going to discover what a learning curve looks like one day and just shit his pants.

Stainless

(718 posts)"The man is going to discover what a learning curve looks like one day and just shit his pants."

Bill O is already a shitstain on the underwear of society because he is so far behind the curve.

RiverSong

(35 posts)cantbeserious

(13,039 posts)eom

MatthewStLouis

(904 posts)Quixote1818

(28,947 posts)thesquanderer

(11,990 posts)ChairmanAgnostic

(28,017 posts)JanMichael

(24,890 posts)Love it!

krispos42

(49,445 posts)rppper

(2,952 posts)Nt