General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Fed Finally Does Something About Unemployment. And Itís Big.

http://swampland.time.com/2012/12/12/the-fed-finally-does-something-about-unemployment-and-its-big/?iid=sl-main-leadThe Fed Finally Does Something About Unemployment. And It’s Big.

By Michael Grunwald

Dec. 12, 2012

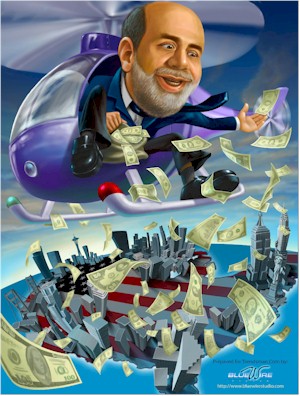

Wow. I’ve been a broken record about America’s stay-the-course monetary policy, about the Fed failing to fulfill its mandate to maximize employment at a time of rampant joblessness, about Ben Bernanke channeling Jerry Seinfeld and basically doing nothing while Congress was doing less than nothing. Well, Bernanke and the Fed did something Wednesday. They did something big.

The technical details are pretty dull. The Fed announced that it intends to keep its key interest rate at zero until unemployment drops to 6.5%, the first time it’s ever set a target for employment. It also signaled that it will tolerate inflation as high as 2.5%, above its stated goal of 2%. And it extended its “QE3” bond-buying program to hold down long-term interest rates. What it means is that Bernanke and his fellow inflation doves have won their argument with the hawks, and the Fed is stepping on the accelerator instead of riding the brakes. After three years of doing a wonderful job of maintaining stable prices while doing a terrible job of maximizing employment, the Fed finally seems determined to take its dual mandate seriously. As Bernanke admitted in his press conference, the Fed has consistently overestimated the pace of growth since the recovery began in 2009.

snip//

It would have been nice if Bernanke had picked up the slack sooner. Maybe he feared the political consequences of juicing the economy before the election; Governor Rick Perry had warned that “we would treat him pretty ugly down in Texas” if he tried another round of monetary stimulus. Maybe some of his hawkish colleagues who had been fighting for tighter policies came around to his side after their predictions stubbornly failed to come true; to his credit, Narayana Kocherlakota of the Minneapolis Fed changed his views after seeing more data. Maybe Bernanke just figured that enough was enough, that it shouldn’t require a global economic meltdown to get the Fed to do creative things, that it was time to re-adopt the whatever-it-takes attitude that made him Person of the Year in 2009.

There will be more to say about what these new targets mean for the Fed. But for now, they should help the economy—or at least prevent cliff-diving politicians from harming the economy as much as they might like.

hedgehog

(36,286 posts)AndyTiedye

(23,500 posts)

Tarheel_Dem

(31,235 posts)WillyT

(72,631 posts)jody

(26,624 posts)with joy over “key interest rate at zero” & “inflation as high as 2.5%”

mostlyconfused

(211 posts)What happens the the budget, the deficit, and to interest payments on the debt when interest rates climb again? At least that's a question we can now kick down the road for a little while longer.

HiPointDem

(20,729 posts)jody

(26,624 posts)BlueStreak

(8,377 posts)This just means that we'll have near zero percent for long-term (i.e. mortgage term) loans. That will help housing a little, but not much. Anybody who was well qualified and really wanted to buy a home would already have done so. This is not going to bring in millions of buyers. What it will do is start to form the next bubble.

And here is how the market reacted to it:

Please note that the past 6 trading days were all positive -- a nice run up. The Market hit a brick wall when they saw this from the Fed. It is absolutely toothless, and just points out the fact that the Fed has already used up all its ammo.

We need to stop with the financial trickery and do what we know works: infrastructure projects and other projects that will hire people and get their paychecks circulating in the economy.

HiPointDem

(20,729 posts)thinks is good is generally not good for most of the population. "the market" loves unemployment, for example.

Myrina

(12,296 posts)Uncle Joe

(58,372 posts)The technical details are pretty dull. The Fed announced that it intends to keep its key interest rate at zero until unemployment drops to 6.5%, the first time it’s ever set a target for employment. It also signaled that it will tolerate inflation as high as 2.5%, above its stated goal of 2%. And it extended its “QE3” bond-buying program to hold down long-term interest rates. What it means is that Bernanke and his fellow inflation doves have won their argument with the hawks, and the Fed is stepping on the accelerator instead of riding the brakes. After three years of doing a wonderful job of maintaining stable prices while doing a terrible job of maximizing employment, the Fed finally seems determined to take its dual mandate seriously. As Bernanke admitted in his press conference, the Fed has consistently overestimated the pace of growth since the recovery began in 2009.

Perhaps the Fed is making monetary room for those infrastructure needs to be met by the Congress and the President?

Egalitarian Thug

(12,448 posts)Yeah, continuing to prop up the bond market at taxpayer expense while maintaining the fiction of solvency is really going to turn things around for Main Street.

![]()

BlueStreak

(8,377 posts)You would think that a person working in the financial press would have enough knowledge to figure this out, but they all just seem to repeat talking points. It seems that hardly anybody in the media is able to think for themselves.

I'm not a big fan of Mad Money, but I'll at least give that guy some credit for reasoning through some of the news.

Egalitarian Thug

(12,448 posts)from workers, otherwise known as the financial industry and all its tangential support occupations, has at least an idea that they sure as hell don't want to ever have to live in the hell they've created for us.

banned from Kos

(4,017 posts)the intent of the Fed is to buy fully guaranteed US bonds that don't need "propping up" so that other money is chased into private productive endeavors.

Egalitarian Thug

(12,448 posts)from collapse, although he and his cronies like to use different terminology. But then, you have exposed your agenda here from day one, so your non-sequiturs are of no surprise whatsoever.

We could also accurately describe this ongoing theft as monetizing the banks losses (more taxpayer's money bailing out billionaires while they take ever more), exactly as was predicted 4 years ago.

banned from Kos

(4,017 posts)None of this money goes to banks. It is used to buy Fannie Mae and Freddie Mac bonds (100% backed by the Treasury) and actual US Treasuries (same backing).

There was a 2008 program called Maiden Lane that bought bank debt but it has been cashed in at a profit to taxpayers.

Egalitarian Thug

(12,448 posts)The illusion of solvency is a completely different part of the Great Con Job. Keep on spinning and trying to convince someone that you have a clue...

(here's a hint; Cutting and pasting what you find on sites which appear to agree with your take is not equivalent to knowledge)

![]()

banned from Kos

(4,017 posts)Yet you pout about "solvency" like the teabagging idiots on Zero Head.

The market punishes the insolvent quickly so put up or shut up.

Egalitarian Thug

(12,448 posts)You're a parody of the guy you're trying to project/pretend that you are. And how is it that you know so much about what "teabagging idiots" are saying on what I can only assume is some Reich-wing, gold-bug website?

![]() or

or ![]() take your pick.

take your pick.

BlueStreak

(8,377 posts)TheAmbivalante

(114 posts)Babylonsis, this wouldn't have even made it on my radar without you. Danke!

RC

(25,592 posts)Or just keep on fucking around with the symptoms in a way that benefits the already rich and no one else?

Stop tearing up the Safety Nets for people that depend on them to survive.

Change the tax laws so that off shoring our jobs raises the corporations taxes. Creating new Living-Wage-Jobs lowers their taxes.

Put in place a realistic income tax in this country. Tax all income above 20% (or so) of the poverty level. 93% as the top income tax bracket worked just fine and the economy took off. Do not tax real income below the poverty level.

Do not tax the recipients for Social Security, Unemployment, and other Safety Net programs. This means Federal. State and Local levels! Social Security needs to keep pace with the REAL inflation rate.

Put in place tough laws against raiding worker retirement funds for the benefit of CEO's and top management.

Single Payer, Universal Health Care. Health insurance companies are nothing more than parasitic middle men, profiting from the misfortune of others (the real Death Panels). The rest of the world gets it, why don't we?

banned from Kos

(4,017 posts)Your suggestions are suited for Congress.

RC

(25,592 posts)How does that help most of us? To actually help, money needs to start circulating on main street. Zero is still zero. Why? Because nothing is still being done about the root cause of the low interest rates and our financial problems to help the Middle Class and below. The FED may be able to keep things down, but it is past the point of them doing much of anything else, other than continue the status quo.