General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThere is something very wrong about these numbers.

I saw this on Drudge:

RECORD 47,791,996 ON FOOD STAMPS...

STOCKS HIT NEW HIGHS...

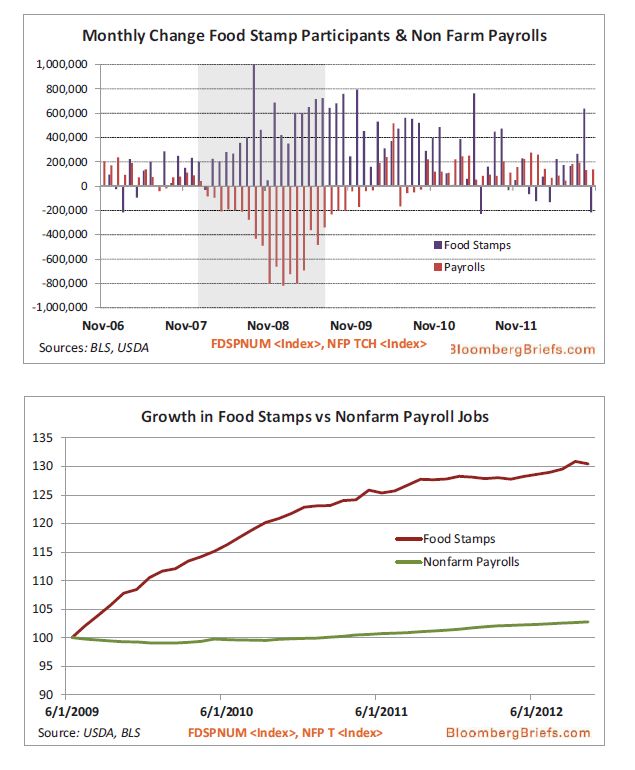

I realized that Drudge is trying to make some kind of RW point, but I see that as sickening. Record numbers on food stamps and the 1%ers are richer than ever before! Where are all the jobs that new wealth is supposed to create? Oh, wait...they are in China. ![]()

thelordofhell

(4,569 posts)GreenStormCloud

(12,072 posts)...which is supposed to create jobs. Where are the jobs? We have been seeing record high stocks for a long time now.

lunasun

(21,646 posts)for food stamps and should be in the news if it keeps going up imo

it has gone way up (at least in some states) quite a lot post Bush destruction of the country

Ok I googled one ........ the 2nd chart shows stamps vs all the nonfarm jobs

2naSalit

(86,769 posts)DesMoinesDem

(1,569 posts)Dow Jones Industrial Average: Then 14164.5; Now 14164.5

Regular Gas Price: Then $2.75; Now $3.73

GDP Growth: Then +2.5%; Now +1.6%

Americans Unemployed (in Labor Force): Then 6.7 million; Now 13.2 million

Americans On Food Stamps: Then 26.9 million; Now 47.69 million

Size of Fed's Balance Sheet: Then $0.89 trillion; Now $3.01 trillion

US Debt as a Percentage of GDP: Then ~38%; Now 74.2%

US Deficit (LTM): Then $97 billion; Now $975.6 billion

Total US Debt Oustanding: Then $9.008 trillion; Now $16.43 trillion

US Household Debt: Then $13.5 trillion; Now 12.87 trillion

Labor Force Particpation Rate: Then 65.8%; Now 63.6%

Consumer Confidence: Then 99.5; Now 69.6

S&P Rating of the US: Then AAA; Now AA+

VIX: Then 17.5%; Now 14%

10 Year Treasury Yield: Then 4.64%; Now 1.89%

USDJPY: Then 117; Now 93

EURUSD: Then 1.4145; Now 1.3050

Gold: Then $748; Now $1583

NYSE Average LTM Volume (per day): Then 1.3 billion shares; Now 545 million shares

GreenStormCloud

(12,072 posts)If we go into hyperinflation we will be well and truly screwed. The preppers will have been right.

Egalitarian Thug

(12,448 posts)thing that can change that is if we institute economy-killing austerity programs. Even this corporate inspired, anemic recovery is hacking into the debt with sufficient speed, and the fact that we are able to raise money essentially for free means that, of all the real problems we facing, our national debt is waaaaay down the list.

Try thinking of it this way, what is your annual income? How much do you owe on your house? This is not a perfect analogy by any means, but it should give you some sense of proportion regarding our debt. And learn what hyper-inflation is.

GreenStormCloud

(12,072 posts)Don't be condescending. You can disagree without being insulting. There have been some extreme examples of it. Germany in 1921 to 1924.

Argentina in 1989, inflation rate of 12,000%, annually.

Basically the government attempts monetize its debt.

dawg

(10,624 posts)All our debt is dollar denominated, which makes a huge difference.

Egalitarian Thug

(12,448 posts)There is no correlation between the United States and post WWI Germany or the World Bank/IMF corporate looting of Argentina, or to present day Greece, or any other RW corporate propaganda currently being churned out by our media, zero, zilch, nada, none whatsoever.

Hyper-inflation had only the most tenuous connection to national debt and even there when the debt becomes many, many times greater than GDP of said nation. It is caused by the widespread collapse of confidence in a national currency.

The U.S. has the most stable, and therefore sought after, currency in the world. If China, the Reich's favorite economic bogey-man, decided tomorrow to never buy another U.S. bond, there is a line around the globe of other governments and gigantic financial entities waiting to take their place. Worst case scenario today, we might have to pay some tiny bit of interest on our bonds to attract as much money as we could possibly want. The only people worried about our debt are those with a social/political agenda and people that don't understand the most basic principles of macroeconomics.