General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHEADS-UP! Larry Summers Whitewashed Bankster Bailout

Black's Background on the guy who'd Dole out Dough to Everyone but Detroit from the FED:

No Mr. President, Larry Summers Did Not Resolve the Financial Crisis for a Pittance. He Just Papered Over the Problem.

by William K. Black

Oct. 28, 2010

I passed up the obvious title: "Heckuva Job Larry!" That was the moment of President Obama's appearance on The Daily Show with Jon Stewart that set all Americans cringing. Yes, he really said that Summers "did a heckuva job." The candidate that was gifted the opportunity to run against the legacy of one of the worst presidents in U.S. history has, as president, used Bush as his role model to continue many disastrous policies. It was strangely fitting that he would channel Bush's infamous praise ("Heckuva job Brownie"![]() for the FEMA chief who failed New Orleans so badly in the hurricane.

for the FEMA chief who failed New Orleans so badly in the hurricane.

President Obama understandably wishes to focus attention on the economic disaster he inherited from President Bush. But Jon Stewart's question to him, which led to the president's gaffe, correctly asked about the message that Summers' appointment sent about the administration's commitment to fundamental change.

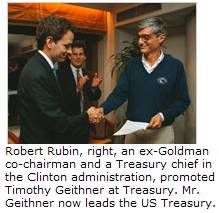

Summers had financial red ink on his hands at the time he was appointed. He was Rubin's chief minion in the successful effort to defeat effective financial regulation and supervision. (Yes, the effort was bipartisan and the Republican leadership shares in the guilt.) [font color="green"]Summers was not simply wrong, but also arrogant and brutal, in blocking effective regulation at the SEC and the Commodity Futures Trading Commission. Summers was made rich by Wall Street in one of those sordid consulting arrangements designed to buy influence and reward past and future favors.[/font color]

President Obama's appointment of Summers as his chief economic advisor made the administration's overall response to the crisis predictable. (Robert Kuttner gives a detailed explanation of the policies that Rubin's protégés championed in his new book, A Presidency in Peril.) The response would follow the disastrous Japanese model that has harmed their economy and damaged their integrity. The dominant characteristics can be summarized quickly: [font color="green"](1) the government would act for the benefit of the largest financial firms and their CEOs, even when they directed massive frauds, by (2) engineering a cover up of the banks' losses and the CEO's misconduct; (3) the administration would use the fictional reports generated to conduct the cover up to declare victory (due to their brilliance); and (4) the same strategy would impair the recovery.[/font color] (For more on the cover up, see here and here.)

CONTINUED w/links...

http://www.huffingtonpost.com/william-k-black/no-mr-president-larry-sum_b_775307.html

William K. Black is a forensic economist who, as a government investigator, helped send many white collar criminals to jail during the S&L crisis.

mick063

(2,424 posts)The only way we fix this bullshit is for all Americans to wake up and collectively point in one direction.

I really don't give a shit who wrote this. Additionally, I give proper due that Republicans were named as complicit enablers.

Only the truth matters, regardless of who tells it.

The Obama defenders can light their hair on fire starting now..........

Elizabeth Warren for President 2016.

Octafish

(55,745 posts)Agree totally, mick063. Professor Black says honest government is the answer to what ails the nation.

It's no wonder the S&L crook Charles Keating said: "Get Black. Kill him dead." The once-billionaire must've been speaking figuratively, of course.

http://www.pbs.org/moyers/journal/04032009/watch.html

To demonstrate how messed up things are, Black says the current crisis is 1,000 times worse than the S&L Crisis, yet the FBI has only 1/5th the number of agents assigned to investigate Wall Street fraud.

Here's the best part: There are a LOT of still honest people in government. We the People can -- and WILL win. The reason is TRUTH is on our side. Plus, Elizabeth Warren, a sizable number of Democrats and Republians.

mick063

(2,424 posts)Last edited Wed Jul 24, 2013, 12:44 AM - Edit history (1)

Some investigations were simply stopped dead in their tracks.

In 2008, the FBI complained that they could not properly investigate the housing collapse because so many assets were tied up with the war on Terrorism.

Since then, the Dept. of Justice has declined to investigate the 2008 collapse, largely leaving it to the New York and California Attorney Generals. After the states had provided enough information to make the endeavor worthwhile to pursue at the federal level, Eric Holder comes out with his "Too big to prosecute" bullshit.

Currently we are building massive surveillance capability to counter terrorism, meanwhile, a man from Goldman Sachs has a seat on the cabinet, and Goldman Sachs has been recently implicated with manipulating copper and aluminum prices. All this, despite the fact that the Joint Chiefs of Staffs have declared that economic instability trumps terrorism as the primary threat to US Security.

But for some reason, we must build that giant fucking server center in Utah.

"Heckuva Job Larry!", says the President.

Octafish

(55,745 posts)A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

sabrina 1

(62,325 posts)if they allowed derivatives to remain legal.

Summers and Greenspan and a few others, drove her out of her job for being too smart and too honorable to play the game they were playing with our futures.

I cannot think of a worse choice for this job than the rogue, Summers.

MannyGoldstein

(34,589 posts)Last edited Tue Jul 23, 2013, 11:29 PM - Edit history (1)

He's publically admitted that he thinks criminal activity is wrong. Take what he says with a dash of salt.

Regards,

Third-Way Manny

Octafish

(55,745 posts)"Silverado" Neil Bush has a history as a real BFEE Desperado. The guy was a Director of Silverado savings and loan, a crooked S&L that sent multi-million dollar loans to friends and family that were never repaid. The bailout cost taxpayers more than $1 billion.

O, BROTHER! WHERE ART THOU?

Like Hugh Rodham, the Bush Bros. Have Capitalized on Family Ties

BY LOUIS DUBOSE

Austin Chronicle, March 16, 2001

Unless you've been reading the Houston Chronicle society page, it's unlikely you've seen any current news about Neil Bush. The third Bush sibling has been almost as invisible as his apolitical brother Marvin, a venture capitalist living in northern Virginia, and his sister Dorothy "Doro" Koch, the youngest of the five Bush siblings, who quietly raises funds for charities in a Maryland suburb near Washington. While Jeb was governor of Florida and George W. was twice elected governor of Texas, Neil was either part of the late Maxine Mesinger's "crème de la crème crowd" at a Houston social event, or a stale S&L footnote: "the director of Silverado Banking, Savings and Loan when it crashed in 1988 at a cost of $1 billion to taxpayers."

In 1990, Bush paid a $50,000 fine and was banned from banking activities for his role in taking down Silverado, which actually cost taxpayers $1.3 billion. A Resolution Trust Corporation Suit against Bush and other officers of Silverado was settled in 1991 for $26.5 million. And the fine wasn't exactly paid by Neil Bush. A Republican fundraiser set up a fund to help defer costs Neil incurred in his S&L dealings. Friends and relatives contributed -- but not then-President and Barbara Bush, which would have been unseemly. Since then, the Bush political combine has done such a remarkable job keeping Neil in the background that what seemed like a 10-year news blackout didn't end until mid-February, when the Austin Business Journal reported that Bush "quietly is heading a local start-up that's raising at least $10 million in second-round funding." According to the business newsweekly, Bush has already raised $7.1 million from 53 investors underwriting Ignite! Inc., an educational software company. After being banned from banking and all but airbrushed out of the family portrait -- or at least the family news profile -- Neil Bush is back.

Bush wasn't just an average S&L exec drawing a big salary and recklessly pushing a federally insured institution beyond its lending limits. As a director of a failing thrift in Denver, Bush voted to approve $100 million in what were ultimately bad loans to two of his business partners. And in voting for the loans, he failed to inform fellow board members at Silverado Savings & Loan that the loan applicants were his business partners. Federal banking regulators later followed the trail of defaulted loans to Neil Bush oil ventures, in particular JNB International, an oil and gas exploration company awarded drilling concessions in Argentina -- despite its complete lack of experience in international oil and gas drilling. It probably helped that the Bush family had cultivated close ties with the fabulously corrupt Carlos Menem, former president of Argentina.

When JNB's rights and obligations were assumed by other investors, Neil tried to persuade another American oil and gas exploration company, Plains Resources, to invest in Argentina. Plains wasn't buying. But it was hiring, and picked up Neil as a consultant for its Argentine market -- because, as Plains executive Carlos Garibaldi told The New York Times' Jeff Gerth in 1992, Neil had "traveled [in Argentina] and played tennis with President Menem." Plains President J. Patrick Collins told Gerth at the time that Neil Bush "bent over backwards not to trade on his name."

CONTINUED...

http://www.austinchronicle.com/news/2001-03-16/o-brother-where-art-thou/

Of course, it's only money. His gentle ex-wife understood enough to keep her wug shut.

MannyGoldstein

(34,589 posts)He was literally laughing at them. It was amazing.

Octafish

(55,745 posts)Remember, 1988 was the year that the S&L industry, which had been plundered throughout the Reagan-Bush administration by a horde of crooks, began to have all its rot exposed. Vice President Bush managed to keep some of it under cover until after the election – particularly the role of his son Neil, who had been on the board of the infamous Silverado Banking, Savings and Loan of Denver. (The bank’s chairman took out insurance, so to speak, by helping to raise $300,000 for Bush’s presidential race.) Silverado – or “Desperado,” as buffs of the S&L crime wave called it – ultimately went bottom up (costing taxpayers an estimated $1 billion, not counting interest) because of bad debts, among which were the $132 million that Neil’s two partners in an oil company defaulted on. One of Neil’s partners sold some office buildings to Silverado for several times their economic worth; Neil, as a board member, voted to approve the purchases. For his conflict of interest, Neil would later pay a $50,000 fine and become known, in some circles, as the “poster boy of bunko banking.”

There was so much smoke rising from the Silverado ledgers that bank examiners had wanted to close down the establishment in the summer of 1988, but that would have inevitably spotlighted the Republican candidate’s son. According to Time magazine, a phone call from the White House – the identity of the person on that end of the line is still unknown – persuaded the examiners to hold off until December 9 before putting a lock on Silverado’s door. The Bush boys have been amazingly adept at using the elder George’s political rank to swing business deals (some of them a bit sticky), raise gobs of money, and cover up business blunders. And they do it without much attention or criticism from the mainstream press.

SOURCE: http://www.texasobserver.org/1179-what-fertilized-the-bushes/

Enthusiast

(50,983 posts)rhett o rick

(55,981 posts)apply to the sociopathic 1%.

leftstreet

(36,111 posts)Another economic aristocrat

![]()

DURec

Octafish

(55,745 posts)Eight reasons not to hire Larry Summers for Fed chief

By Jerry Mazza

Posted on June 3, 2013 by Jerry Mazza

Last Wednesday, I heard Perianne Boring, a new reporter on RT.com, report that Ben Bernanke was planning to resign as head of the Federal Reserve and that Larry Summers name had been mentioned as a replacement. I flashed back to four years ago and an article I wrote called “Bankrupting the world,” which said that Tim Geithner was just the face, the voice, behind the PPPIP (Public Private Partnership Investment Program) giveaway to America’s top commercial banks to restore what amounts to $200 trillion in their cumulative derivative debt.

I can say today that it’s even more apparent that Larry Summers was the corrupt brain behind the give-away and should go. Today, I can give you the same eight reasons why he shouldn’t be the Head of the notorious Federal Reserve Bank.

First: Summers and his backers persuaded Obama they had the best way to solve the worst financial crisis in history, that is, hand the keys to the banking system to a gang of hedge fund thieves.

Nevertheless, a number of “real” economists, like professor and noted author James Galbraith (son of FDR’s economic adviser John Galbraith), and Nobel Laureate Paul Krugman, warned that the bailout schemes would make things go from bad to worse.

They argued that to save the US banking system, it needed reorganization under bankruptcy protection. Additionally, Former Federal Reserve Chairman Paul Volker, who headed the President’s Economic Recovery Advisory Board, reiterated even more resolutely in a speech in New York City that the current system had to be reorganized in a Glass-Steagall framework, no ifs, ands, or buts.

Apparently, Summer’s notorious ego blew and his penchant for job-losing got the better of him. He actually had the chutzpah to tell President Obama he wasn’t going to continue working in the same arena with Volcker. In the army, you get shot for that or spend a long time looking at brick walls. Yet the novice president, perhaps intimidated or brainwashed, feeling he really needed Summers and Geithner to make things happen, quietly charged Volcker instead to head a tax-code review to close corporate loopholes, and streamline tax laws to generate revenue.

This was announced by OMB Director Peter Orszag, who said the review had a December 4 deadline, and the code, some 96 years old, needed simplifying to reduce tax evasion and what he termed “corporate welfare.” This is like being two touchdowns behind in the fourth quarter and you put your second-string quarterback in because the first one isn’t hacking it and is having a fit on the sidelines. Not good.

It didn’t take a rocket scientist to figure out that as soon as Volcker butted heads with Summers: first over timing of regulatory reform, second, over the larger question of bringing back the Glass-Steagall Act, there would be major conflict. After all, Summers spent all of 1999 wrecking the act as Bill Clinton’s Treasury secretary, replacing it with his fellow free-marketer friends’ Gramm-Leach-Bliley Act. The latter killed the parts of The Glass-Steagall Act that prohibited commercial banks from getting into the mortgage-backed securities and collateralized debt obligations game.

The Gramm-Leach-Bliley Act also split supervision of banking conglomerates among a host of different government agencies, creating an oversight disaster. The Glass-Steagall Act would have allowed Congress to simply break down the US’s five largest banking conglomerates into their smaller components, and to determine which were solvent enough to continue, and which were too broke to live. So a lot was on the table. Yet, Obama, like a Manchurian Candidate gave the nod to Summers and not to Volcker to proceed with “Summers plan.”

SNIP...

Third: back in 1998 Summers testified in Congress against regulating the derivatives market. He actually said we could trust Wall Street.

“The parties to these kinds of contracts,” Summers pronounced, “Are largely sophisticated financial institutions that would appear to be eminently capable of protecting themselves from fraud and counterparty insolvencies and most of which are already subject to basic safety and soundness regulation under existing banking and securities laws.” Is this our Wall Streeters he’s talking about? Bernie Madoff? Goldman’s Lloyd Blankfein? AIG FC’s, Joseph Cassano? You’re kidding?

Summers ladled even more praise on over-the-counter derivatives, blocking all moves to regulate them right up through 2000. He waxed patriotic, calling them “an important component of the American capital markets and a powerful symbol of the kind of innovation and technology that has made the American financial system as strong as it is today.” As strong as it is today, as I wrote then, it happened to be April Fool’s Day, 2009. Of course, after Summers retired from the Treasury, he took a high level management position at D.E. Shaw, a hedge fund famous for its omertầ (Mafia’s conspiracy of silence).

CONTINUED...

http://www.intrepidreport.com/archives/9793

rhett o rick

(55,981 posts)forestpath

(3,102 posts)And it's not ours.

rhett o rick

(55,981 posts)GiaGiovanni

(1,247 posts)and ignoring her warning.

sabrina 1

(62,325 posts)sexist, greedy, Wall St. elitist.

GiaGiovanni

(1,247 posts).

rhett o rick

(55,981 posts)is he being forced into appointing Summers?

Rex

(65,616 posts)Doesn't seem to be a problem anymore for some of the PTB. They now just view it as a perk, like having your own personal lobbying firm or special interest group. Like pouring countless dollars into campaign funds. Like MONEY.

$$$

Octafish

(55,745 posts)

Conspiratorial Wink (detail) by Michael Samuels

The Truth in Plain English:

Picking Our Pockets and Lining Theirs

Banksters Take Us to the Brink

by BILL MOYERS and MICHAEL WINSHIP

CounterPunch

Weekend Edition July 13-15, 2012

EXCERPT...

And what a business! You’ve most likely been hearing about the newest scandal in banking, centering on Barclays Bank in Great Britain and something called Libor. That stands for London Interbank Offered Rate and involves a group of bankers who set a daily interest rate affecting trillions of dollars of transactions around the world. Your home mortgage, your college debt, your credit card fees; all of these could have been affected by Libor.

Now you would think the rates would be set by market forces, right? Aren’t they what makes the world go ‘round? But it turns out some of those insiders were manipulating the index for their own gain, to make their banks look better off during the financial crisis, lower their borrowing costs, and raise their profits – by cheating. Picking our pockets and lining theirs.

SNIP...

“In testimony last week before the British Parliament, former Barclays chief executive Robert E. Diamond said the bank had repeatedly brought to the attention of U.S. regulators — as well as U.K. regulators — the problems that the bank was experiencing in the Libor market.

“He said the bank’s warnings to regulators that Libor was artificially low did not lead to action. Barclays’ regulator in the United States is the Federal Reserve Bank of New York, which was run at the time by current Treasury Secretary Timothy F. Geithner.”

CONTINUED...

http://www.counterpunch.org/2012/07/13/banksters-take-us-to-the-brink/

Gosh, Rex. I'm so old that I can remember when America had more than a few leaders who put the People ahead of profits. Oh well. Thanks to DU, we can be very heartened to know there are so many who remember there are more important things in life than money.

Rex

(65,616 posts)I can remember a time when we had real leaders and not just wall street, business suits disguised as leaders.

jtuck004

(15,882 posts)statement, and leave that one up top here with a real person that brought tragedy to millions of people, perhaps led to the early death of thousands, and helped wreck our economy for decades. With Obama's hearty handshake and smile.

No accounting for taste, I guess.

DeSwiss

(27,137 posts) - He did what he was hired to do. He and his buddies worked to protect his master's backsides from the likes of us. And no matter how you cut it up, no matter which direction you point your finger, in the end we let them.

- He did what he was hired to do. He and his buddies worked to protect his master's backsides from the likes of us. And no matter how you cut it up, no matter which direction you point your finger, in the end we let them.

Because they've learned how to exploit our weaknesses, in order to diffuse our strengths.....

K&R

[center]

[/center]

[/center]mick063

(2,424 posts)That's why I'm checking out. No more work, no more money. I will be as much of a pain in the ass as I legally can.

To the folks that think this is a team sport, I promise to leave the top of the ballot blank for Hillary, and I'll try to talk as many others into doing the same, as I can.

Then......I can't be accused of "letting it happen."

Fire Walk With Me

(38,893 posts)Fawke Em

(11,366 posts)He seems like a decent guy, that Obama, but he surrounds himself with assholes.

MannyGoldstein

(34,589 posts)Hmmm...

rhett o rick

(55,981 posts)Fawke Em

(11,366 posts)rhett o rick

(55,981 posts)Ms. Clinton or Gov Christie become president, all the same "players" like Clapper, Mueller, Comey, Alexander, Bernanke, Summers, etc, etc, will still be in control.

chimpymustgo

(12,774 posts)...still be in control."

Terrifying, but true.

rhett o rick

(55,981 posts)GiaGiovanni

(1,247 posts)and if the American people could pull themselves away from the Kardashians, they could learn something from the man.

Octafish

(55,745 posts)As a white-collar criminologist and former financial regulator much of my research studies what causes financial markets to become profoundly dysfunctional. The FBI has been warning of an "epidemic" of mortgage fraud since September 2004. It also reports that lenders initiated 80% of these frauds.1 When the person that controls a seemingly legitimate business or government agency uses it as a "weapon" to defraud we categorize it as a "control fraud" ("The Organization as 'Weapon' in White Collar Crime." Wheeler & Rothman 1982; The Best Way to Rob a Bank is to Own One. Black 2005). Financial control frauds' "weapon of choice" is accounting. Control frauds cause greater financial losses than all other forms of property crime -- combined. Control fraud epidemics can arise when financial deregulation and desupervision and perverse compensation systems create a "criminogenic environment" (Big Money Crime. Calavita, Pontell & Tillman 1997.)

CONTINUED...

http://www.huffingtonpost.com/william-k-black/the-two-documents-everyon_b_169813.html

Control Fraud

GiaGiovanni

(1,247 posts)I'll have to read the entire article. Thanks!

AzDar

(14,023 posts)Octafish

(55,745 posts)When the people who set-up the Bank Bailout get jobs and the people who tried to stop it get the shaft. And this is repeated, ad nauseum, to form a pattern that is repeatedly IGNORED. Then, we have a problem. A really big problem.

It explains Just-Us, the Secret Government: When a select few get to run things, things will benefit the select few.

It goes back to this:

Know your BFEE: Spawn of Wall Street and the Third Reich

Adm. Gene Laroque warned us about the Secret Government.

Secret Government is un-American. Otherwise, the People would prosecute the crew who ripped off the banks. And they would pay in restitution of every penny they stole. May it come sooner, rather than later, AzDar. The survival of the nation is depending on it.

MinM

(2,650 posts) @NotLarrySummers: I kid, I kid – of course women can handle mundane duties like balancing domestic checkbooks. Did you think I was a sexist? I’m a scholar!

@NotLarrySummers: I kid, I kid – of course women can handle mundane duties like balancing domestic checkbooks. Did you think I was a sexist? I’m a scholar!KharmaTrain

(31,706 posts)...first, add the usual rushpublican obstructionism and maybe even a filibuster for old times sake. Then I would suspect there are several Democrats (Warren, Franken) and Bernie Sanders who would have a bunch of questions for Mr. Summers that could be quite embarassing. Add to that the corporate media would smell the chum in the water and dig into his history at Harvard...not a pretty picture. I sure hope the administration thinks real hard before they try to pull this one off...