General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsRemember When People Had Pensions?

Remember When People Had Pensions?

SEPTEMBER 7, 2013

America’s corporate chiefs deserve all their hefty rewards, we’re told, because they take hefty risks. And what exactly are these richly rewarded corporate chiefs putting at risk? Our retirement security.

By Sam Pizzigati

How’s your 401(k) doing?

Working Americans ask themselves this question — and angst about the answer — an awfully lot these days. Any why not? For most Americans, retirement reality has turned chillingly stark: Either you have a robust set of investments in your 401(k) or you’re facing a rocky retirement.

A generation ago, working Americans didn’t have to obsess about retirement savings accounts. Americans had pensions, not 401(k)s. These pensions represented a commitment from employers to workers: You work here a set number of years, you can count on a monthly pension at a set amount.

In these traditional pension plans, the risk rested with employers. They shouldered the responsibility for funding a pension plan’s “defined benefits.” ....................(more)

The complete piece is at: http://toomuchonline.org/remember-when-people-had-pensions/#sthash.TX6vKCkv.dpuf

vi5

(13,305 posts)Of the rich and powerful being able to convince the poor and middle class that they "had a shot".

"C'mon.....invest like we do and you can retire in luxury. Give up that set amount guaranteed and put aside for you and gamble with us in the stock market!!!!".

FreakinDJ

(17,644 posts)Rigged Markets, Insider Trading, hefty Fees, one way or the other the Wealthy 1% syphon off money from the hard fought gains of the Working Class

PotatoChip

(3,186 posts)program about 401K's not too long ago.

I think I've always known on some level that my 401k plan was a bit of a rip-off. But there were some really appalling revelations in that story that shocked the heck out of me.

401k's are worse than a rip-off. They are a con-job IMHO.

Art_from_Ark

(27,247 posts)PotatoChip

(3,186 posts)Thanks for providing the link. ![]()

I hope that everyone interested in this subject will check it out. Well worth the while.

joeglow3

(6,228 posts)Basically, start saving as much as you can when you are in your 20's. Not an answer for every American, but there are certainly millions who fail to follow this.

Fawke Em

(11,366 posts)In my 20s, I made poverty wages. In my 30s, I was a single Mom who had to live off credit. Now, in my 40s and remarried, I'm having to pay back the credit.

I haven't saved much over $5,000 in my former 401(K)-turned-IRA and can't.

P.S. And I have a college degree! It's not like I didn't do what I was asked.

joeglow3

(6,228 posts)I made okay money out of college. The first thing I did was set my 401(k) to 15% and my wife set her's to 20%. The people who were in the same starting class as me chose to get nice cars or new a house. Now, 15 years later, they are bitching about having next to nothing saved (while still driving nice cars and living in kick ass houses).

I have said before, I have no problem helping out those that need. What pisses me off are these middle class people who COULD save for the future, but are more interested in pissing it away on toys.

AnneD

(15,774 posts)my story is the same. At your peak earning years, instead of saving for your retirement, you will be helping your child (ren) pay off their student loans because they can't find a job that pays enough for them to swing it on their own, oh and they will be living with you.

The thing that comes between me and cat food is that I worked for the State of Texas and have a pension from TRS. I followed the rules, went to college, saved money at an early age (24) but my first 401k etc was wiped out by prolonged unemployment and re-education/retooling, the second 401k by the dot com bust. But I learned and have been able to side step a lot (not put so much in 401k's) but it is my pension and working for the state that has been the blessing.

Fawke Em

(11,366 posts)(and a daughter who's only 6, but is blossoming in her education) and he may be a candidate for MIT or Duke or Vandy, depending upon his final decision of a career.

And, I work in a setting that is willing to at least give him some hands-on training to help him round out his resume for such grand goals (Vandy and Duke started recruiting him in middle school - kid you not).

Hopefully, he'll walk out of college making six figures and won't need to move back home. My daughter is still, as I said, blossoming, but she loves school. So, we're off and running.

BTW, hubby's family is in Boston. If he goes there, he'll have some support. And we're visiting in October.

AnneD

(15,774 posts)is very intelligent and financially responsible too, but finding a first career job has been problematic. You can count on helping them at some point...just giving you a heads up.

closeupready

(29,503 posts)life long demo

(1,113 posts)Eventually it was sold. But, the company withdrew every penny they had contributed from every employee's 401K plan. Plan was put into a federal holding something or other and the fees were paid for by our 401K money. We lost health care, vacation, & sick days. We had to get our own health care policy. That was back in 2004. The country was heading down the tubes then. We the employees put our money together and hired a bankruptcy lawyer from Phila to handle our claims. Company was purchased by a co. in NC, manufacturing was moved to Mexico. I was out of a job for 10 months, I was 61 at the time. Scared shitless. I did eventually get a few hundred dollars from the bankruptcy. I hate corporations. The head of our parent co. who manipulated all this ended up with millions of dollars in bonuses. I really hate corporations and the 1%ers.

Lurker Deluxe

(1,039 posts)My company has no control over my money, there is nothing they could do to get to it. Perhaps you were speaking of an amount that was not vested.

401K is your money, the company can not withdraw it from your account.

Adrahil

(13,340 posts)... there is risk involved, but there are risks with defined benefit plans too.

If your company matches contributions, you had an instant return on your own investment.

But it does require some discipline.

I dunno... I think there are trade-offs.

leftyohiolib

(5,917 posts)Adrahil

(13,340 posts)One of which is that companies tend to depend upon the employee's desire to qualify for the pension, and therefore shortchange them on other benefits, or otherwise degrade working conditions. At least once you're vested in the 401K, if the company goes stupid, you can leave, and take your matching contributions with you.

SharonAnn

(13,780 posts)that's pretty unlikely.

Portable pensions would be better. No longer tied to length of time with a specific employer.

Adrahil

(13,340 posts)I'd personally favor an expanded the SSI program to offer meanigful pensions,as opposed to the fairly weak "safety net" pension it offers now.

Kingofalldems

(38,496 posts)Adrahil

(13,340 posts)OTOH, I've been able to get a better return than SS would provide me, but If a crash happens again (and it will), we'll have tons of people who lose everything. I'd prefer a simple defined benefit SSI, I think, though we should still incentivize private retirement savings.

Major Nikon

(36,827 posts)Once you worked long enough to become vested, you would eventually receive your pension even if you didn't work for the company long enough to reach their normal retirement age.

Adrahil

(13,340 posts).... it is frozen at the benefit level of my salary at the time of separation. TBH, by the time I retire, it'll be gas money.

Kingofalldems

(38,496 posts)As if working conditions are now better with the 401k scam.

Adrahil

(13,340 posts)... my company matches my contributions up to 6%. That's not bad. Now I know many companies aren't that good, but I'd hardly call that a scam.

And even if I leave (after 5 years anyway), that money comes with me. What are you looking for?

The problem isn't with 401K's in general. It's with companies that offer crap funds and no matching.

vi5

(13,305 posts)And the risks are largely with the employer rather than the employee.

And I do understand about matching contributions, but if you and the employee both put in a dollar, and the funds lose $1.50 due to market losses, then you're still out of money.

Adrahil

(13,340 posts)Not saying it can't happen, but even in 2008, I didn't see any of my investments take that kind of hit.

AS fro the risk being with the employer.... only rue if the employer is actually around to pay the pension.

I've read the horror stories of people getting screwed by court decision radically cutting their pension benefits during bankruptcy hearings.

Frankly, I don't trust companies to look out after my retirement.... they don't care, and if it's us or them, they'll choose them every time.

Major Nikon

(36,827 posts)With a 401K you can invest in government securities, money markets, bonds, or stocks depending on what options are available which allow one an infinite number of risk vs return scenarios. Through proper diversification, the bankruptcy of dozens of companies won't affect you that much. With a defined pension plan, it only takes one bankruptcy to ruin your retirement plans.

PotatoChip

(3,186 posts)that could net you, the 'investor' w/less then 32K on a 100K (on paper) statement?

Adrahil

(13,340 posts)... I understand some company's options aren't as good as mine, but a company that would screw you on 401K options isn't likely to look after your interests with a pension fund either.

PotatoChip

(3,186 posts)The 'screwing' does not come from the company end. At least not the screwing (fees) I am referring to. This is a Wall Street phenomena hidden deep within everyone's 401K plan.

Check out the Frontline program in the link from post #14. It delves into this issue in great detail.

Adrahil

(13,340 posts)My company is pretty cool and let's me pick from any plan that their management firm offers (Fidelity in our case). Companies, particularly small ones,sometimes pay a fee for a firm to manage their 401K. Some of those companies avoid those fees by agreeing to only offer funds with a high fee structure.

joeglow3

(6,228 posts)If your company is not going to choose a mutual fund family that doesn't screw you on fees (i.e. a low cost family like Vanguard), they would likely not give shit about a pension either.

The point is that there will ALWAYS be people looking to screw you over. You have some responsibilty to not let yourself get screwed over.

PotatoChip

(3,186 posts)I don't have a 401K issue now. You know what they say about a**umptions. ![]()

Furthermore, his/her point only stands for the moment. I just haven't had time to get back to him/her (and won't for another couple of hours at least).

duffyduff

(3,251 posts)in the 401(k) scams, and they ARE scams.

That was one of the reasons companies ditched pensions--they wanted to shift the risk to workers.

People were absolute IDIOTS to have EVER bought into the 401(k) lie.

Major Nikon

(36,827 posts)The company has no risk either way.

Just sayin'

Arugula Latte

(50,566 posts)I saw it on several commercials, so it must be true.

ctsnowman

(1,903 posts)el_bryanto

(11,804 posts)In industries with weak or non-existent unions they often don't.

Weird, isn't it?

Bryant

Smarmie Doofus

(14,498 posts)trade unions and substantive differences between the two parties.

How many elected DEMs do we hear talking about this?

BlueMTexpat

(15,374 posts)duffyduff

(3,251 posts)"investing" in these sham deals that were NEVER designed to replace pensions.

Companies ditched pensions wholesale because it was much, much, much cheaper to have the 401(k)s and shift ALL of the risk onto workers.

People were scammed.

I warned people about this 30 years ago, and that they were better off stuffing the money into a mattress.

Bluenorthwest

(45,319 posts)I'm a fully vested member of my Union and the pension plan.

Adrahil

(13,340 posts)....I've never been a member of a union. Does the union manage your pension, or your company? I'd trust the union to do it, but the company? Not so much.

Bluenorthwest

(45,319 posts)employer side. This is a multi employer situation, with many companies contributing to the plan. Neither Union leadership nor employers have access to or control of these funds. Of course that does not exclude the possibility of a breach of trust, but it does limit it greatly.

Adrahil

(13,340 posts)duffyduff

(3,251 posts)it is a far better deal than any 401(k) scam account.

People have NO idea HOW much money they would need to save to even get a small monthly payout like I am getting.

SoCalDem

(103,856 posts)but I figure that's 366.05 a month that will go a ways to covering medicare part B & D and a supplemental...and will make up what SS will deduct from our checks..![]()

Adrahil

(13,340 posts)By no longer depending on a defined benefit approach, an employee is less beholden to a specific company. I can tell you that it was nice a couple of years when my old company when full-on stupid and I could just LEAVE and take my 401K with me. I didn;t have to consider the fact that I was throwing away progress towards a pension.

zipplewrath

(16,646 posts)Truth was, by the time they were phasing them out, most pensions didn't require a lifetime of employment. One was vested after about 5 years, some even shorter. There are incentives for longevity, but one could move around and ultimately collect from each employer upon retirement.

The fiscal advantage of defined benefit pensions was in their collective nature. One could get a better deal in a group than individually because no one knew who was going to live longest. So they were priced to fund everyone knowing that they wouldn't all live forever. Saving for a 401K means effectively "going it alone".

Adrahil

(13,340 posts)..they offered both a pension plan (with required 15 years service for any meaningful pension), and a 401K, for which matching funds vested after 5 years. I took the 401K and I'm glad I did. I would have had to live to be 110 to get the same amount of money out of my company. YMMV.

duffyduff

(3,251 posts)duffyduff

(3,251 posts)onehandle

(51,122 posts)Just wait...

dogknob

(2,431 posts)...until a leader is identified in a group of armed people and their head explodes because some dude just put a 50-caliber round through it from 5 miles away...

...Nah, too messy -- all that really needs to be done is to charge the leader with Child-Heresy (or just substitute "heresy" with something else. It doesn't matter; once you are accused of Child-This or Child-That, you are guilty even if you didn't do it).

onehandle

(51,122 posts)It's going to be more and more occurrences of individual men, blowing away bosses, politicians, bankers, random wealthier people.

dogknob

(2,431 posts)...these "individual men" will always be "nuts."

God Bless America was a fun little film....

PearliePoo2

(7,768 posts)I'm in a union, a State employee and have PERS2. I'm thankful for that, believe me!

More from the article:

Participants in 401(k)-type plans have to contribute to participate. In an era of shrinking real paychecks, many employees simply can’t afford to set aside much if any money in the 401(k) plans that might be available to them.

We have moved, in short, from a traditional pension system where “many retirees could count on predictable, constant streams of income,” as the new EPI study notes, to a system where most Americans can’t afford to retire. “For a large swath of America,” Marketwatch analyst Matthew Heimer added last week, Social Security has become “the only remaining financial crutch for retirement.”

Robb

(39,665 posts)grilled onions

(1,957 posts)When the main bread winner of the family had a job for life(providing he showed up for work every day,didn't drink on the job or had other infractions in the workplace.) He literally had that job for life and no one had to worry about a paycheck,benefits,insurance,pension. The family never felt threatened or had to move on a constant eviction notice. It made for a content family unit. Today kids as young as 3 notice when the larder is empty. School age kids learn the drill about having to move again and again and hopefully it won't be into a shelter. Both parents keep on looking for jobs. There are more family squabbles as unhappiness breeds fear and the kids become reclusive or get attitude. Meanwhile the CEO's still have a tight a family unit as they want(or that money can buy). Their kids may still act out but money buys a lot of favors and the kids see few repercussions and never understand their peers who are dealing with so much.

Proud Public Servant

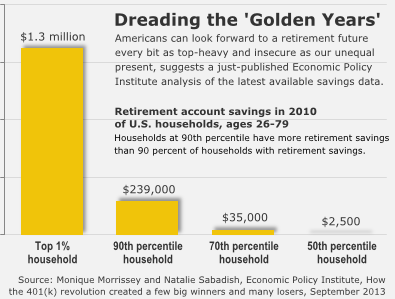

(2,097 posts)I would need about $1 million in my 401(k) to provide me with the same level of support my pension will give me. You've got to wonder how many people would take that deal when cast that way: "We'd like you to give up your pension, but everything will be ok -- provided you can save $1 million on your own..."

Major Nikon

(36,827 posts)Comparing apples to apples, $1 million will buy a $66K per year annuity.

Assuming 4% interest or better, $1 million will pay you $40K per year forever and when you die it will continue to pay your heirs $40K per year forever without ever touching the principal.

duffyduff

(3,251 posts)to even begin to match what a defined benefit pension pays out (Social Security is also patterned on this although it is not deferred compensation unlike a public pension).

People would have to save well over 100k--a near impossibility in this day and age--to even get the pension I get every month and get it over a period of 30 years and not including increases, which make the pension snowball in value.

Major Nikon

(36,827 posts)The average 401k plan has $56K in it, so I'm not sure why you think it's impossible. Most are already halfway there and many are well above it.

90% of defined pension plans have no COLA and will never "snowball".

SheilaT

(23,156 posts)it was in reality a relatively small number of people who ever qualified. You needed to work for a fairly long time, generally twenty years or more, at the same job. Pensions were never portable to another job, unlike a 401k which only depends on your contribution, and doesn't magically go away if you go to work for another company.

I recall reading horror stories back in the 60's and 70's about union workers, whose pension depended on working for the same local for twenty years, and being shifted to another local after nineteen years and nine months on the job.

Often the company pensions depended on your retiring from that company when your age and years of service reached some magic number, like 75 or so. And even then, you usually couldn't start collecting the pension until you turned 65.

When I was twenty years old I went to work for a company that had a pension plan, but you needed to be at least 25 and have worked for the company for two or three years (I no longer recall that part, the length of service), and I didn't expect to work there for forty years or more. A year or so later they changed the pension plan so that now everyone was automatically enrolled from day one, the company contributed the full amount, but you wouldn't be vested until you'd worked there ten years. The vesting time is important, because that meant anyone and everyone who left after being vested, left money behind in the pension plan. Well, I actually did wind up staying ten years in that job. Now, more than thirty years later, I got my first pension check deposit. $172.31. It's better than nothing, but my social security payout, when I start collecting it next year will be significantly more than that.

Not that I'm complaining about that small pension, because every little bit certainly helps. It is after all, just over $2,000 a year, and that is enough to make a difference.

But while I also mourn the loss of defined benefit pensions, they weren't as universal as we'd like to think. The lack of portability was probably the biggest problem. While the 401k's also have a vesting period, usually five years, that money remains with you. I currently work at a hospital where I have a 403b, essentially the same thing, different number because the hospital is a non-profit. The hospital automatically enrolls everyone on day one, but it's up to the employee to decide how much to contribute individually, which I do at the maximum amount I possibly can.

Major Nikon

(36,827 posts)Just because you change jobs, doesn't mean your pension evaporated. So long as you worked for the company long enough to be vested, you will eventually receive a pension. If you go to work somewhere else, you could potentially receive 2-3 different pensions from different sources. If you didn't work long enough to become vested, you received a cash payout instead. Many people did this, even back in the heyday of pensions. It's not that much different with a 401k. You still have to work long enough for the company to become vested if you want to retain any matching funds.

I think the biggest problem with pensions is the likelihood that your employer isn't going to file bankruptcy before you die. I think the 2nd biggest problem with pensions is they typically paid you an annuity, which means dying young benefited your former employer instead of your heirs.

SheilaT

(23,156 posts)There was a time when it was as long as 20 years. Many times you did NOT receive a cash payout, or if you did it was simply the amount you'd put in, no interest at all.

If the employer files bankruptcy the Pension Benefit Guarantee Corporation takes over, but with certain upper limits, so if you were going to get a pretty generous pension, you'd now get a lot less.

My former company filed bankruptcy and shed all its pension obligations, so my check comes from the PBGC. In my case, the payout is what it would have been anyway.

Major Nikon

(36,827 posts)Whether you have a defined pension plan or a 401K, you will probably only get whatever money is vested in an employer bankruptcy and both are subject to employer requirements for vesting. It behooves all employees to know what those vesting rules are regardless of which plan you have.

Half-Century Man

(5,279 posts)...if 401K's are good for 1 class of people, then they are good for everybody.

So every pension is now illegal, every federal and private pension in any form is recycled back into the economy (that being done the same way so many pensions have been recycled, it just stops existing, POOF. the potential retiree gets nothing). All other forms of long term investment become illegal.

If 401K's are as good we have been told...PROVE IT.

raouldukelives

(5,178 posts)The only sure thing that Wall St brings investors is more of the same, and worse. The only thing more effective than voting republican is investing republican, which every dollar in the markets is. A direct cash infusion into the worst enemies of freedom, wildlife, nature and humanity the world has ever known.

"Hey! I have a slightly more comfortable retirement! Sorry you don't have an ecosystem anymore critters of the world. My existence is vastly more important than you."

Major Nikon

(36,827 posts)When blue chip companies are filing bankruptcy as a business strategy to screw workers out of their pensions, I'll take the 401k every day of the week and twice on Sunday.

duffyduff

(3,251 posts)Get educated about pensions, please.

Lurker Deluxe

(1,039 posts)You're pretty much burning down ANY positive thing about a 401K in this thread, so ... I'll bite.

Tell us the story about how a 401K ruined your life.

Mine's doing fine ... but I'm an idiot.

Major Nikon

(36,827 posts)You might want to get your own education on exactly what PBGC covers before you start calling someone a fool. Go talk to an American Airlines employee or just about anyone else with a pension working for a company in bankruptcy or near bankruptcy and ask them how great PBGC is. If you are age 50 when your pension plan goes belly up, PBGC pays you a maximum of $1,500 per month at your normal retirement age and most people aren't going to receive the maximum. The younger you are, the less you receive. The reason why PBGC exists in the first place is because companies tend to invest pension funds in themselves to the maximum extent possible. Put your eggs in different baskets and PBGC becomes irrelevant. All PBGC does is provide an insurance plan which invests in private companies to diversify pensions. It's also currently underfunded by $23 billion and subject to political modification. The chances of PBGC benefits decreasing rather than increasing are virtually guaranteed in this political climate and it just isn't all that great to begin with, but if it makes you sleep better at night, I suppose there's that. Perhaps you shouldn't educate yourself on the subject after all.

Just sayin'

Recursion

(56,582 posts)OK, that was funny. But, seriously, defined benefit pensions are a horrible idea, and offer the workers less real protections even than a 401K. Which are also horrible ideas, but for different reasons.

toby jo

(1,269 posts)Farming I know, & land value ( not so much houses) has continued to go up.

I grew up on Dad's pension security of the United Autoworkers - it absolutely makes for a component of a healthy family life.

Bonx

(2,078 posts)hughee99

(16,113 posts)xchrom

(108,903 posts)HughBeaumont

(24,461 posts)An excellent synopsis of the time period from 1900-1970, where labor fought and made great strides against the Plutocrats and politicians from both parties feared the backlash of unions and the people.

Then came the mid-1970s conservative think tanks, which led to the glacial but highly effective arch-conservative purchase of U.S.A., Inc., starting with their inside puppet St. Ronnie. The End.

littlewolf

(3,813 posts)Military - 20 yrs 14 days. 1/2 pay for life, sometimes we get a COLA, sometimes we don't.

worked for the state of NC for 10 years, vested in the retirement,

will get 300 bucks at age 62. every little bit helps.

third company has a pension and a 401k, the year I got hired was the

last year of the pension, I got in just under the wire.

they also contribute to the 401k.

with the pension you are guaranteed 5 years, after that, it depends.

most ppl take the lump sum payout.

hunter

(38,337 posts)I've no hope left of that future.

Manifestor_of_Light

(21,046 posts)Member of O.C.A.W. (Oil, Chemical and Atomic Workers) and the Pipefitters union.

Worked for Harry Sinclair (and cussed him all the time) from 1936 to 1966, except for when he enlisted in the Army Air Corps during The Big One to help his buddies bomb Germany and Italy.

So he took early retirement at 55.

His pension was a whopping TWENTY-TWO DOLLARS A MONTH.

He had comprehensive health care but that was all. He lived another 34 years.

This was before the looting and pillaging of the Reagan years. Apparently the other refineries, like Shell in Deer Park and Exxon in Baytown, were a lot more generous. Sinclair was just cheap and had the stupidest workers, from the stories I heard. Dad ranted about "stupid Sinclair hands. Too dumb to stay alive if there's a fire."

My parents' generation did not cuss, so we didn't hear words like

"shithead" or "dumbfuck". ![]()

harun

(11,348 posts)It does this for them:

* Makes everyone think they will someday be rich.

* Makes it in peoples interest to have big corporations succeed at all costs.

* Gets them to support anti-union policy.

* Fools people in to thinking their future well-being is based on the success and growth of big corporations.

I am sure others could add to this list.

One_Life_To_Give

(6,036 posts)The real difference is in defined benefit plans you frequently didn't have a choice to not invest. Either system could be setup good or bad depending upon the company setting it up. The real difference is that you had an option to underfund your retirement with one that usually wasn't available with the other.

Major Nikon

(36,827 posts)The real difference is one is managed by your employer and the other is managed by yourself. Either one is subject to being managed poorly and both are subject to their own set of risks.

JEFF9K

(1,935 posts)All the more reason to fight cuts in Social Security benefits.

MisterP

(23,730 posts)but polls for the reasons for outsourcing show "environmental regulation" and "pensions" as under 25% of the reasons why: the rest--higher profits because we could

gopiscrap

(23,765 posts)Hoyt

(54,770 posts)Young folks who left with less than 10 years under defined benefit plans, pretty much left with little or nothing.

I remember I was working in a place with a defined benefit plan in the 1980s. Like many, it was designed by the older workers to favor them. When there was mention of doing away with the defined benefit plan, for a defined contribution plan (a 401K), the young folks jumped at it.

Today, companies come and go. Small companies really can't fund a "pension" plan as such.

It makes me sad too, but I'm not sure it is some grand conspiracy. Times just change, and yeah some business people walk away with more profit in their hands under the guise of "just doing business."

LibertyLover

(4,788 posts)in that where I work there is a pension plan. Moreover, I am very lucky to be covered under what we call "the old plan", which means my retirement benefits are calculated on the basis of my gross salary, not my net salary. I am vested and unless the Board of Directors changes things soon, will have to retire in 2 years at age 62. Actually, I don't want to retire then, but currently it's mandatory unless you get a waiver and I'm not important enough to get one of those.

Recursion

(56,582 posts)The big retirement boom hasn't even started yet and the defined-benefit pension is already a thing of the past. They were never real.