General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWill the Illinois Legislature Steal Public Workers’ Retirement Security?

http://nhlabornews.com/2013/12/will-the-illinois-legislature-steal-public-workers-retirement-security/

By Liz Iacobucci | December 2, 2013

And so the campaign to eliminate our retirement security continues.

As everyone was leaving for Thanksgiving weekend, Illinois legislators announced a “bipartisan” plan to “bail out” the state’s public pension funds.

That was Wednesday. (LATE Wednesday.)

Details of the plan weren’t released until Friday. (Increased retirement age. Limits on COLAs. Prohibits collective bargaining regarding pensions. Prohibits use of pension funds for retiree health care. Etc.)

The actual bill was released today. (All 325 pages of it.)

FULL story at link.

Read “Going behind the rhetoric on public employee pensions” here.

Read “Detroit’s pension systems: not ‘unaffordable’, just battered by Wall Street” here.

If you liked this post consider subscribing to the NH Labor News via email. There are more great articles to come.

About Liz Iacobucci

Liz Iacobucci is the former Public Information Officer for the State Employees’ Association of New Hampshire, SEIU Local 1984. Over the past three decades, she has served in government at the federal, state and municipal levels; and she has worked for both Democratic and Republican politicians.

beachbum bob

(10,437 posts)and something needs to be done. Giving out 3% COLA on retirees's pensions...when inflation is less than that cost the taxpayers of Illinois. Why should public sector retirees have it better than the average Illinois private sector worker when it comes to retirement? I like to see rules in place that disallow double dipping, disallow collecting a pension benefit if working another job....Illinois taxpayers are stretched as federal govt and state govt has pushed so much cost onto the locals.

Omaha Steve

(99,653 posts)Many public workers make LESS than private workers their entire career. Or maybe because we are required to educate at our expense for licensees required to do our job. And paying for required continuing education. That means class, travel, seminars, etc.

I went to school at my expense for the glorious job of cleaning water that came from your toilet. People that want to apply were required to visit the dirty parts of the plants. Over 500 to 1 decided against playing in doo doo water. Same with storm and sanitary sewer workers.

CDL's for the guys that drive the snow plow. Because of the driver shortage nationwide, most would earn more take home IF they left the government job. Do you want your street plowed by a qualified safe driver or not when it snows?

NCIC etc. to work in the police dept as a back up civilian like I do now. I got hurt at the treatment plant and was demoted to an IST police position. We also have to have background clearance that a large portion of the public won't pass.

Job after job requires time, experience, dedication, and an investment of workers time and $.

And just why don't YOU apply for a job in public service IF it is so great? Don't like playing in doo doo water perhaps?

Omaha Steve

beachbum bob

(10,437 posts)Illinois public workers are neither underpaid or overworked.....many state workers work a 37 hr work week and get paid for 40hrs. They get overtime pay at 1.5x or equivalent comp time. How many salaried illinois private sector workers get paid anything for overtime?

Illinois public workers (at the State level) have a pension system AND a 401k system available (no state contribution to it).

The teacher's retirement system is even more skewed. Local school districts (except for the Chicago School District) pay nothing into the teacher retirement system except the teacher's portion from their paycheck...the taxpayers of Illinois picks up that tab. So local districts can negotiate the teacher's contracts and NOT have to pay into the teachers retirement system for what they sign on to. Factor in the universities, where tenured professors can get paid sabbaticals for year every few years and its easy to see how the taxpayer in Illinois is getting it in the rear.

Illinois politicians have been out of control for 40 years and we have run away cost today because of it. I don't want to hear whining about how bad off public sector employees have it.....so many can draw a pension (if you come from corrections or state police) after just working 20 years, take another job...and get another pension while drawing a check from the first one...

Omaha Steve

(99,653 posts)Your comparison seems to be against non-unionized workers. Again it seems you should join a union for your workplace. Why don't you have a contract at your job?

My wife is salaried. Her employer paid for most of her MASTERS. She isn't unionized. She has better time off than "11 paid holidays, the 10 sick days and 3 weeks vacation". She has 3 weeks to burn before Jan. one or she will lose them.

Are you upset many workers draw a military pension and go to public work in Illinois because of their learned military skills?

I agree with you on several points. My union is fighting double dippers too. Even the elected pension board members and the accountants are against it it. Yet the city continues to do it.

Stay tuned.

Omaha Steve

beachbum bob

(10,437 posts)Kick out an underperforming worker yet....they do go out of they way to protect them....as for public sector jobs...they are hard to get.

Omaha Steve

(99,653 posts)Or just jealous?

I worked for 9 years as a part time or seasonal worker before I got a FULL time job with benefits.

beachbum bob

(10,437 posts)electrical apprenticeship.....you had to have inside help to make the cut which I didn't have. As for public sector jobs, none were of interest to me but I have friends and relatives who did work them and believe me, they weren't underpaid or overworked.

But thats not the real issue is it...the issue is the FACT Illinois has a huge problem and a way has to be worked out. I don't like the bill that was passed as it avoided one of the biggest contributors to the pension hole.....

the fact that local districts DO NOT FUND THEIR TEACHERS PENSIONS and Illinois legislatures that are cowards to change the law because of the fallout. Take the teachers out of the mix...the pension shortfall for state workers nearly disappears.

Real reform has to cover the teachers pensions, has to cover the Illinois university system pensions and reign in the cost.

Omaha Steve

(99,653 posts)Sorry you didn't get the job.

OS

former9thward

(32,013 posts)But not in Illinois and especially Chicago. I worked for the state for 14 years. No employee pays for licenses, travel, education or anything else. At the entry level you get your job through patronage. Not merit or any other factor. A ward committeeman or similar knows where the openings are and gives you a recommendation. That recommendation is based on how many votes you get for him/her. It has been like that forever and continues.

There is a great resentment in Illinois towards government workers (I am not talking about teachers -- that is a different system and issue) because of this.

Omaha Steve

(99,653 posts)What are you bitching about?

OS

former9thward

(32,013 posts)They offered me a pension buy out in 2004. I took it and within two years I was able to increase it by ten times in the stock market. Because of that I 'retired' very early and have plenty of money to live on. BTW I was not bitching about anything. Just explaining how things work in IL.

Omaha Steve

(99,653 posts)In the end, you benefited greatly from a union contract?

former9thward

(32,013 posts)Had I stayed there I would still be working there because of their poor returns on the pension program. That is not the union's fault, it is the fault of poor investments by the state.

The main union contract I benefited from was from the Steelworkers Union. I worked at a steel mill in Chicago for 15 years and made a fine living. In that experience I was elected by the membership to chair the committee negotiating the local contract. (The national contract was negotiated by the International Union in Pittsburgh.) Negotiating the local contract taught me a lot about the process and labor relations in general.

Omaha Steve

(99,653 posts)Thanks.

OS

Gidney N Cloyd

(19,838 posts)Not too long ago we looked like a bunch of saps. This is "Ant and the Grasshopper" stuff. Public sector workers settled for less, NEGOTIATED for less, upfront than their private sector compatriots with the understanding that they'd have decent reliable benefits waiting for them on the back end. I'm not sure what happened with the private sector but it seems that where ever their once cgreater pensions weren't ripped off by vulture capitalists like Baine Cap/Romney they were enticed into switching to magical 401ks that eventually got sucked up by Wall Street.

As for COLAs, yeah maybe they should be tied to actual inflation rather than that 3% ongoing guestimate but there has to be an inflationary adjustment.Those of us who lived through periods of high inflation in the 70's and 80's know that low inflation like we have now won't last and we could go from a comfortable retirement like we'd contracted for to just scraping by in the blink of an eye, even as property and sales taxes rise.

As for double dipping and other funny business, yeah we can work on that. I'll even throw in salary bumps. But don't hold that stuff against the vast majority of public workers who won't profit a nickle from that crap.

beachbum bob

(10,437 posts)Vastly underpaid from their private sector counterparts? The ones I know certainly aren't ....that old line is well worn out. Work 37hrs a week...get 11 holidays...12 sick days...3 week vacation...overtime pay. I know plenty of architects and engineers wish they had package.

gollygee

(22,336 posts)If all companies had pensions - and funded them as they did before the 70s - then everyone would have an easier time in retirement. But we're all about privatization and cutting costs to corporations at the expense of workers.

State workers have pensions built into their contracts. They negotiated for contracts that paid less because of the pension plan. It isn't right to accept contracts with lower salaries for decades that include this pension plan and then cut pensions anyway. It would be like you paying into your 401k and then the company your 401k is through deciding that they're only going to pay you a portion of that because they didn't put as much money in as they should have, and you could probably do OK without it anyway.

beachbum bob

(10,437 posts)What makes public employees better than the taxpayers? The fact is reform must happen and employees will have accept less.

gollygee

(22,336 posts)Your post was worded oddly.

Are you a fan of races to the bottom? Public employes have had pensions rather than 401k plans. Their pensions are what they have. I think private companies should have kept (and funded) pensions too, but the fact that they didn't isn't the fault of public employes. Maybe they should unionize.

beachbum bob

(10,437 posts)the state taxpayer who many don't have pensions... don't have 11 or 12 paid holidays or 12 paid sick days or 3 weeks of vacation... Or a 37hr work week and 1.5 over time...

gollygee

(22,336 posts)Those are the kinds of things you get with unions.

alarimer

(16,245 posts)The glorified "private sector" should not get to exploit their workers in that. They should be REQUIRED to give their employers a pension, not this 401k shit. And insurance and at least the same amount of paid time off, none of this cafeteria-style bullshit, where one long bout of flu costs you your entire vacation.

Why is nobody questioning how the private sector gets away with treating their employees (the people who make them money) so badly?

Instead you and others seem focused on deriding and degrading public workers for having benefits you SHOULD have.

tritsofme

(17,379 posts)Several GOP gubernatorial candidates are already lobbying against the deal promising to enact something worse.

The status quo isn't an option here, I think the deal is in the best long term interests of the state.

Gidney N Cloyd

(19,838 posts)...and cutting waste. Not in reneging on deals with the public workers.

beachbum bob

(10,437 posts)I haven't seen ASFME offer anything in a deal...as bad as dealing with the NRA concerning gun laws.

I firmly believe that the average pay and benefit which would include pensions of public sector employees should never be more than the average pay and benefit (and pensions) for the private sector employee in our state.

The local school districts have to pay their portion of THEIR teachers retirement, no ifs, buts or maybes......

Any public sector pension should NEVER pay out after 20yrs service and the worker being younger than 55 or 60. And pension payout to should be means tested to help cut down on double dipping.

I feel this way for all public sector employees including federal govt with the only exception being the military but changes need to be made their as well. Peace time duty and 20yr retirement gotta go.

btw, my wife is a state of illinois worker so I have seen all this from the inside for years

Gidney N Cloyd

(19,838 posts)...their 1% slavemasters. Stick a shiv in the back of the public sector and then see how much lower the private sector can get. The 1% folks would love nothing more. Or you can draw a line, support the public sector and start rebuilding the private sector.

beachbum bob

(10,437 posts)Private sector income.. Benefits... Pensions been downward for 20 years....offshoring and outsourcing. Public sector jobs have been hard fought for because of the pay.. The benefits and pensions as long as I remember and I'm near ss age.

AngryAmish

(25,704 posts)As it stands about 25% of state tax revenue goes to pensioners. This is going to increase over the years. Illinois has chosen this. Social services have been cut, medicaid does not pay it's bills and the roads suck but this is the choice we made.

badtoworse

(5,957 posts)Decades of underfunding have come home to roost and the state doesn't have the money to make good on all its promises. I don't see any alternative to the retirees and prospective retirees getting a haircut.

beachbum bob

(10,437 posts)Continue to get worse at local levels. Right now our cities budget has 40% going out in pensions and benefits for their retirees....and growing worse each year.

badtoworse

(5,957 posts)It will be interesting to see how this plays out. I expect that the Illinois pension system may ultimately wind up in the same place.

Joel thakkar

(363 posts)1) High level govt officers do get high pension...thus, they have already made millions and will keep on getting hundreds of thousands every year in form of pension.

2) Illinois is not a retirement state. People usually go to Florida for retirement..Thus, the money spend goes to Florida and other states. Again loss of revenue in terms of sales tax, property tax etc..etc..

Egalitarian Thug

(12,448 posts)been taking money out the back door as fast as it comes in the front door. It's been this way for generations there, if the people didn't like it, they could have changed it at any time. I met an honest politician once in Illinois, needless to say, since she chose to remain honest, she is not a politician any more.

Omaha Steve

(99,653 posts)That is high on the just above poverty line for for years of public service.

beachbum bob

(10,437 posts)Ss too?....how many private sector employees get 18,000 a year pension?

Omaha Steve

(99,653 posts)beachbum bob

(10,437 posts)Retired general city workers, such as librarians or sanitation workers, received average payments of $18,275 a year in 2011, according to the Detroit General Retirement System. But those who put in the most time (or earn higher salaries) can see far healthier payments. A general city employee who retired in 2011 with an average ending salary of $60,000 and 40 years of service could receive around $45,000 a year.

Such benefits are more or less on par with the Detroit-area union auto workers. Retirees of the three big automakers receive average annual benefits of about $18,000 per year, in addition to another roughly $15,000 to $18,000 in Social Security payments, according to the United Automobile Workers, or UAW.

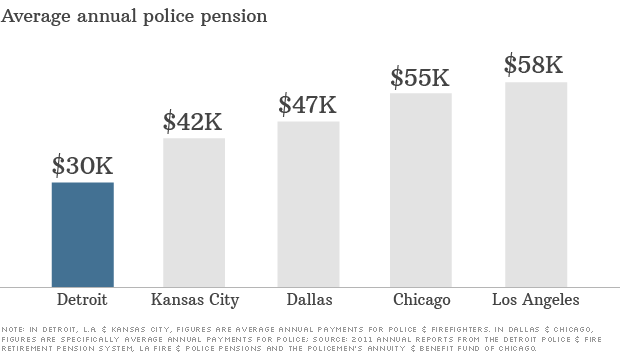

That's a big distinction: While retired Detroit firefighters and police officers receive more generous pension checks than auto workers -- checks averaged almost $30,000 a year in 2011 -- they often don't receive the added bonus of Social Security payments.

A 30-year veteran of the fire department who retired last year with an average ending salary of $60,000 would have qualified to receive around $44,000 a year, according to calculations using the plan's pension formula.

Omaha Steve

(99,653 posts)How Wall Street — not pensioners — wrecked Detroit : http://www.salon.com/2013/11/20/how_wall_street_not_pensioners_wrecked_detroit/

While clueless elites continue to blame "reckless public pensions," a new report tells a very different story

OR http://bigstory.ap.org/article/detroit-retirees-worry-about-possible-pension-cuts

The average annual pension payment for Detroit municipal retirees is about $19,000. Retired police officers and firefighters receive an average of $30,500. Top executives and chiefs can receive $100,000. Police and firefighters don't pay into the Social Security system so they don't receive Social Security benefits upon retiring.

http://money.cnn.com/2013/07/23/retirement/detroit-pensions/

beachbum bob

(10,437 posts)Omaha Steve

(99,653 posts)There are more clerks, cashiers, etc than you seem to think.

http://womensenews.org/story/economyeconomic-policy/130917/pensioners-face-betrayal-in-detroits-bankruptcy-push#.Up5t3ycliRM

The average pension benefit in Detroit is $19,000, compared to a national average of $30,000, reports the Center for Retirement Research at Boston College.

So for every $30,000 you are pissed about, several retirees make LESS than $19,000. That is what average means.

http://www.mathsisfun.com/definitions/average.html

To calculate: add up all the numbers, then divide by how many numbers there are.

Example: what is the average of 2, 7 and 9?

Add the numbers: 2 + 7 + 9 = 18

Divide by how many numbers (i.e. we added 3 numbers): 18 ÷ 3 = 6

So the average is 6

Anyway now these retirees can draw on food stamps etc. since they don't get SS. That saved taxpayers 6.2 of the workers gross that went towards pensions.

http://ssa-custhelp.ssa.gov/app/answers/detail/a_id/240

You really need to brush up your math skills. Then maybe you can ghet a public high paying job. I never did hear why YOU don't have a union at work?

rdking647

(5,113 posts)if they dont reform pensions then thats where they are headed. and i say this even though my wife gets an illinois pension

beachbum bob

(10,437 posts)Something has to done. And public sector employee unions have to relent or all will be lost for them

Egalitarian Thug

(12,448 posts)beachbum bob

(10,437 posts)Omaha Steve

(99,653 posts)It isn't every day a tax payer breaks his or her ages old promise to the workers.

So now Illinois has a new group of takers below the poverty level in the near future. No SS safety net.