General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHow Democrats can win big in 2014.

If Democrats raise the minimum wage and put forward a plan to create 2 million jobs, they will win back the House and make gains in the Senate.

brooklynite

(94,585 posts)The Senate seats we need to hold are in Red States; the House seats we need to pick up are in the reddest of red gerrymandered districts.

hfojvt

(37,573 posts)We only need to win 18 (net) to take back the House.

One trouble, which I alluded to, is that we need to HOLD some House seats in fairly red districts too, although I haven't enumerated them.

brooklynite

(94,585 posts)...and they're not the type of districts that will respond to working class progressive positions. Trust me....I get briefings from Steve Israel at DCCC and I research the races thoroughly to decide where to put my money.

hfojvt

(37,573 posts)or, for some, came close to voting for Obama. So they are already responding to something.

And sorry, but I am not taking anything from the DCCC on faith. The establishment always likes establishment candidates and establishment positions.

Which those professionals assure us will "win".

Just like they did in 2010.

FBaggins

(26,743 posts) those districts already voted for Obama in 2012

They also voted for the republican incumbent.

Thus... as the OP suggests... we need an issue with traction to overcome the inherent off-year challenges combined with an environment that is currently less attractive.

brooklynite

(94,585 posts)(or so a number of people here say)

Art_from_Ark

(27,247 posts)In fact, it's unprecendeted in at least the last 104 years for the party in the White House to win that many Congressional seats in a mid-term election, let alone take back the House of Representatives.

spanone

(135,841 posts)Scuba

(53,475 posts)... are obstructing that, then possibly.

If they get the grossly insufficient $10.10 raise through by end of summer, it will be forgotten by November.

We will be very, very fortunate to hold the Senate this fall.

"If they get the grossly insufficient $10.10 raise through by end of summer, it will be forgotten by November."

...that is the proposal being pushed by Senator's Harkin, Sanders and Warren.

A loser?

Scuba

(53,475 posts)safeinOhio

(32,686 posts)We need the votes to put it on the state ballots to get out the vote

msongs

(67,413 posts)submit a new jobs bill every month if it's voted down by repubs

submit a minimum wage hike repeatedly as needed

student loan relief

immigration reform

secure social security w/out hedging

even fix obamacare

RobertEarl

(13,685 posts)Remember how so many people came out and voted for Obama's change?

Do it again, only this time advertise it as the "Last Chance for Change".

Obama needs to do everything you say Pro Sense.

Ya think he hears you? You think he'd listen to you?

JaneyVee

(19,877 posts)ProSense

(116,464 posts)this news (http://www.democraticunderground.com/10024511737), it's definitely a winner, one with transformational potential.

B Calm

(28,762 posts)hfojvt

(37,573 posts)then why haven't we used it already?

Too attached to trickle-down maybe?

A blast from the past, that you are sure to love

http://journals.democraticunderground.com/hfojvt/164

ProSense

(116,464 posts)"if we actually had a plan that would create two million jobs then why haven't we used it already?"

There was one.

Macroeconomic Advisers on the American Jobs Act, proposed a year ago:

We estimate that the American Jobs Act (AJA), if enacted, would give a significant boost to GDP and employment over the near-term.

-The various tax cuts aimed at raising workers’ after-tax income and encouraging hiring and investing, combined with the spending increases aimed at maintaining state & local employment and funding infrastructure modernization, would:

-Boost the level of GDP by 1.3% by the end of 2012, and by 0.2% by the end of 2013.

-Raise nonfarm establishment employment by 1.3 million by the end of 2012 and 0.8 million by the end of 2013, relative to the baseline

Of course, it that had happened, Obama would be more or less a lock for reelection. Instead, having blocked the president’s economic plans, Republicans can point to weak job growth and claim that the president’s policies have failed.

http://krugman.blogs.nytimes.com/2012/09/08/the-jobs-program-that-wasnt/

Heck, throw in a climate plan and add another 4 million jobs.

hfojvt

(37,573 posts)you know those -"The various tax cuts aimed at raising workers’ after-tax income"

The trickle down economics part of it DID pass. The accursed payroll tax cut was extended (but fortunately NOT expanded as Obama proposed).

ProSense

(116,464 posts)"Except" nothing. The OP is about creating 2 million jobs. That was the purpose of the entire bill. You want to discuss the payroll tax cut...start your own thread.

"The trickle down economics part of it DID pass. "

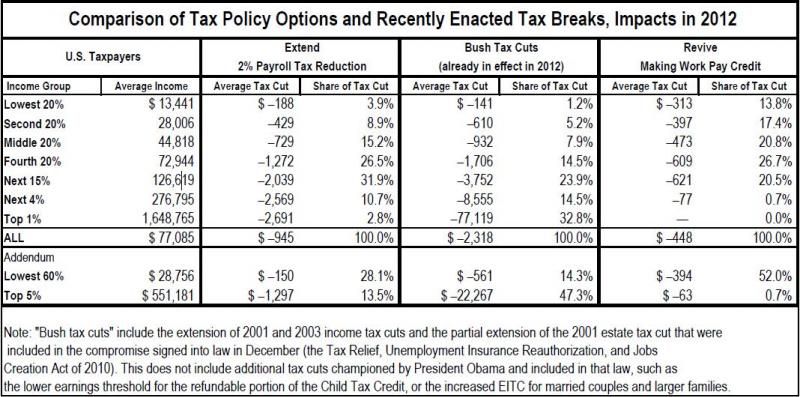

...you clearly don't know what that means. A payroll tax cut that affects income up to $110,000 is not "trickle down economics." That's a complete distortion of the concept. This is "trickle down economics":

http://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

More: http://www.democraticunderground.com/10024465391#post30

hfojvt

(37,573 posts)Trickle down economics is where most of the benefits go to the TOP and benefits are (in theory) supposed to trickle down to those below.

You know, like the accursed payroll tax cut

which gave

$32 billion to the TOP 10%

$55 billion to the top 20%

and only $14.5 billion to the bottom FORTY percent.

But you are right, it's not AS bad as full Reaganomics. More like trickle-down-lite.

The sort of thing you'd expect from politicians who are Republican-lite.

ProSense

(116,464 posts)The attempt to spin nonsense seems an act of desperation. Seriously.

hfojvt

(37,573 posts)claiming that $55 billion is bigger than $14.5 billion is nothing but spin.

I don't know why I expected people to fall for that kind of spin.

"I guess you are right"

...I'm right because claiming that a payroll tax cut, which is stimulative, is the same as "Reaganomics" is beyond ludicrous.

hfojvt

(37,573 posts)Reagan's "across the board tax cuts" are stimulative too.

You know what "spin" is. That's when you have policies that favor rich people - like the accursed payroll tax cut. And you find some way to sell them to the public.

Claiming that the payroll tax cut benefits the rich more than the poor is simple math. $55 billion simply IS bigger than $14.5 billion. But ooh, let's spin it as a "stimulus".

It's just a happy accident that this "stimulus" helps the rich more than the poor.

ProSense

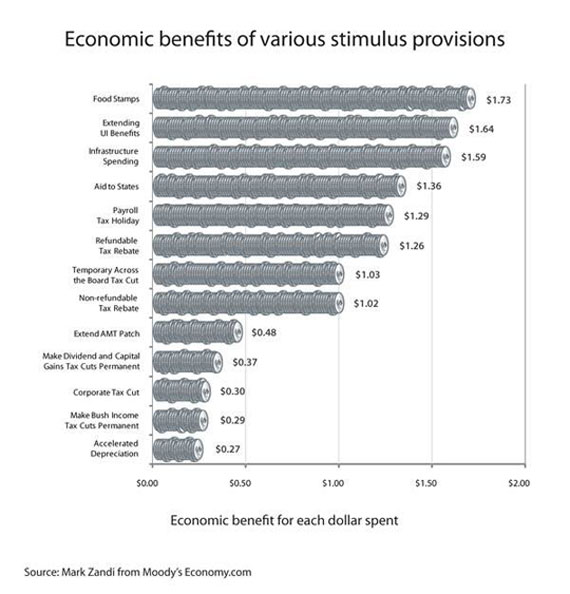

(116,464 posts)"according to your graph there Reagan's 'across the board tax cuts' are stimulative too. "

...according to my "graph," is this "stimulative":

http://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

More: http://www.democraticunderground.com/10024465391#post30

"You know what 'spin' is. That's when you have policies that favor rich people - like the accursed payroll tax cut. And you find some way to sell them to the public."

Yes, and I "know what" desperation looks like: trying to portray Reagan/Reaganomics as progressive.

hfojvt

(37,573 posts)and he ran on his program of Reaganomics in 1980, which was, according to your graph, the economic stimulus of "across the board tax cuts"

I am NOT the one trying to portray Reaganomics as progressive - that would be YOU. It's progressive, you say, if tax cuts that favor the rich come from Obama, because you can spin them as an economic stimulus.

MY claim, is that, using the very same spin that YOU are using, then Reaganomics was also stimulative. You know, the tax cuts known as ERTA, which were passed in 1981 and cut the top rate from 70% to 50% and the bottom rate from 15% to 11%.

What an economic stimulus.

In fact, that is exactly how that piece of excrement was sold. ERTA stands for Economic Recovery and Tax Act.

See, I think Reagan and Reaganites are full of crap when they claim that their policies which favor the rich are about economic stimulus. I demand economic stimulus which does NOT increase inequality.

And I don't change that just because a Democrat is in the White House.

Foolish consistency, eh?

ProSense

(116,464 posts)according to my "graph," is this "stimulative":

http://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

More: http://www.democraticunderground.com/10024465391#post30

"I am NOT the one trying to portray Reaganomics as progressive - that would be YOU. It's progressive, you say, if tax cuts that favor the rich come from Obama, because you can spin them as an economic stimulus.

MY claim, is that, using the very same spin that YOU are using, then Reaganomics was also stimulative. You know, the tax cuts known as ERTA, which were passed in 1981 and cut the top rate from 70% to 50% and the bottom rate from 15% to 11%. "

That's simply nonsensical spin to claim that an apple is an orange, therefore Reaganomics is stimulative.

ProSense

(116,464 posts)"Claiming that the payroll tax cut benefits the rich more than the poor is simple math. $55 billion simply IS bigger than $14.5 billion. But ooh, let's spin it as a 'stimulus'."

...to counter that nonsense.

http://www.ctj.org/pdf/payrolltaxholiday.pdf

hfojvt

(37,573 posts)did you miss this part?

Average payroll tax cut for various groups

Lowest 60% $ –150

Top 5% $ –1,297

Compared with the making work pay credit

Lowest 60% $-394

Top 5% $-63

Yeah, that payroll tax cut totally favors the bottom and leaves the top out in the cold.

Average payroll tax cut for various groups

Lowest 60% $ –150

Top 5% $ –1,297

Compared with the making work pay credit

Lowest 60% $-394

Top 5% $-63

Yeah, that payroll tax cut totally favors the bottom and leaves the top out in the cold.

Did you miss the part where the top one percent got 2. 8 percent vs. 97.1 percent for the 99 percent? Did you see that the top 5 pecent got 13.5 percent vs. 86.4 percent for the bottom 80 percent? Did you notice that the max benefit was $2,691?

Do you think that's significant for someone earning more than $1.6 million dollars?

Look again, and while you're at it, tell me who was responsible for the Making Work Pay Credit.

Coyotl

(15,262 posts)What's on the ballot makes a difference in off years. Any minimum wage initiatives? Marijuana legalizations?

ProSense

(116,464 posts)"What's on the ballot makes a difference in off years. Any minimum wage initiatives? Marijuana legalizations?"

...follow Colorado and Washington.

Voters also support 57 - 39 percent the legalization of small amounts of marijuana for personal use, the independent Quinnipiac (KWIN-uh-pe-ack) University poll finds.

There is a gender gap and a larger generation gap on the question of non-medical marijuana. Support is 63 - 33 percent among men and 51 - 44 percent among women. Support is 83 - 14 percent among voters 18 to 29 years old, with voters over 65 years old opposed 57 - 38 percent. Support is 65 - 32 percent among Democrats and 58 - 37 percent among independent voters, with Republicans opposed 55 - 39 percent.

- more -

http://www.quinnipiac.edu/institutes-and-centers/polling-institute/new-york-state/release-detail?ReleaseID=2008

rufus dog

(8,419 posts)Proven winner that increases turnout.

freshwest

(53,661 posts)shedevil69taz

(512 posts)ProSense

(116,464 posts)Democrats are at standing up for a minimum wage increase: http://www.democraticunderground.com/10024522318

gulliver

(13,181 posts)We should be clobbering the Republicans with their shutdown of the government and with the success of the ACA. We should clobber them on George W. Bush, the classic symbol of Republicanism. The Great Recession was their fault, and we should remind people of that. Todd Akin. Sarah Palin. The Tea Party. Killing immigration reform.

Raising the minimum wage is fine, but I don't think the voters are informed enough to see through the Republican fog machine when it comes to jobs plans. I think ACA success is going to be crystal clear by November and we need to go full speed on offense with it.