General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWages have dropped nearly 8 percent since 2006

San Francisco was one of the nation's best cities for pay increases last quarter, Seattle-based PayScale reported Wednesday. Two other California cities also saw growth.

Nationwide, pay was up 0.5 percent in the second quarter from a year earlier, PayScale reported. But pay rose by much more in some metro areas, while falling in others.

"Our results show the economy is on a steady, but very tepid recovery with wage growth rising at a slow rate," Katie Bardaro, PayScale's lead economist, said in the report. "We anticipate the trend of sluggish overall wage growth to continue in 2014 with a few industries such as science, biotech, and healthcare showing periodic gains that are more significant. "

Adjusting for inflation, wages have dropped nearly 8 percent since 2006, she added. PayScale expects wages to rise 0.3 percent this quarter from the previous quarter and 0.8 percent year over year.

http://www.sfgate.com/business/article/San-Francisco-nears-top-for-pay-raises-5374043.php

The race to the bottom continues at full speed. Even the strongest wage growth lags inflation.

Fumesucker

(45,851 posts)

Jesus Malverde

(10,274 posts)Forest from the trees?

![]()

Aerows

(39,961 posts)Face on a palm tree.

Jesus Malverde

(10,274 posts)good one, over my head.

Thanks Aerows.

![]()

Demo_Chris

(6,234 posts)For getting things going again. Nor, it seems, do we have a plan for dealing with the long term unemployed. Or poverty in general. Hell, now that I think about it, I am at a loss to think of our plan for dealing with ANYTHING. At the national level we are pro free trade, pro NSA, pro war, pro drone war, pro Fracking, pro Frankenfood, we support allowing banks and other industries to regulate themselves, and the only vaguely liberal thing we endorse is raising the minimum wage.

Sorry, slowly and carefully raising the minimum, because lord knows we wouldn't want to lose the fast food franchise owner vote.

But then, all this is very depressing, so it's probably best I go back to sleep -- either figuratively or literally.

Laelth

(32,017 posts)-Laelth

n2doc

(47,953 posts)No raises for state employees in 5 years. Yet health insurance goes up each year, so paychecks have dropped every year, NOT accounting for inflation. They might give state employees a 1% raise this year. Don't spend it in one place, besides it will just go to increased premiums and taxes.

JoePhilly

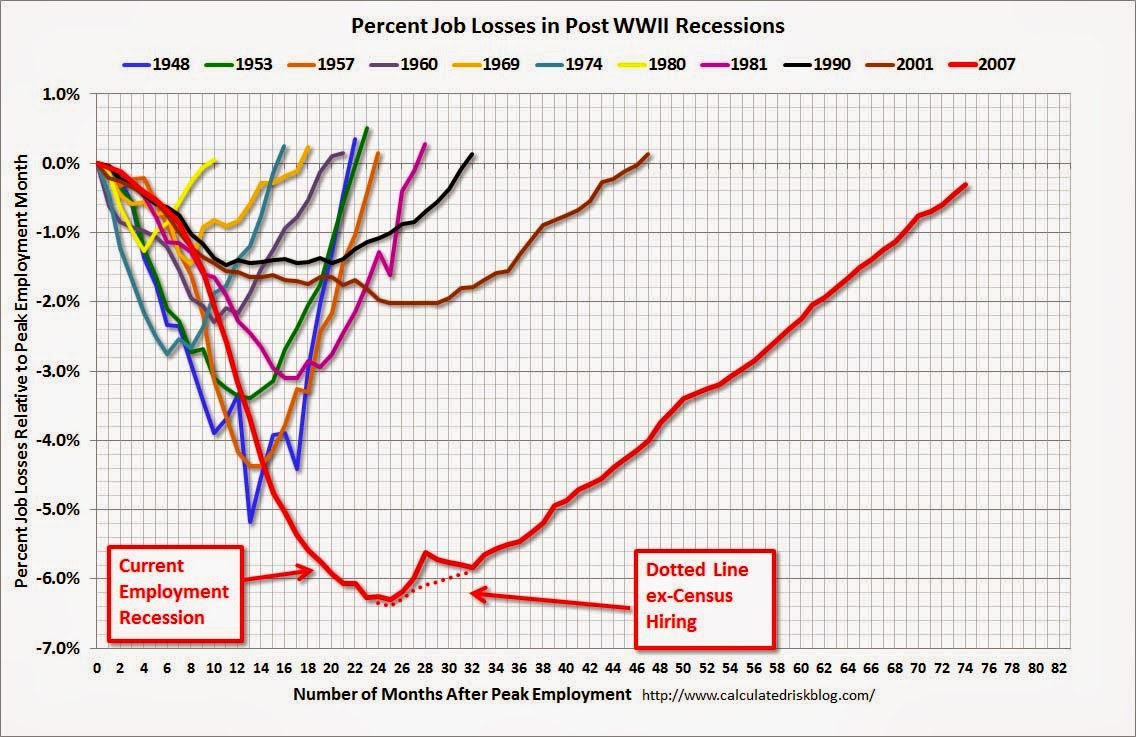

(27,787 posts)And have yet to return to pre-recession levels.

Who would have expected that?

Jesus Malverde

(10,274 posts)15% tax on capital gains. Some people are doing better than ever.

![]()

ProSense

(116,464 posts)"15% tax on capital gains. "

...is 20 percent, actually 23.8 percent with the health care tax.

- Restores the 39.6 percent rate for high-income households, as in the 1990s: The top rate would return to 39.6 percent for singles with incomes above $400,000 and married couples with incomes above $450,000.

- Capital gains rates for high-income households return to Clinton-era levels: The capital gains rate would return to what it was under President Clinton, 20 percent. Counting the 3.8 percent surcharge from the Affordable Care Act, dividends and capital gains would be taxed at a rate of 23.8 percent for high-income households. These tax rates would apply to singles above $400,000 and couples above $450,000.

- Reduced tax benefits for households making over $250,000 (for singles) and $300,000 (for couples): The agreement reinstates the Clinton-era limits on high-income tax benefits, the phaseout of itemized deductions (“Pease”) and the Personal Exemption Phaseout (“PEP”), for couples with incomes over $300,000 and singles with incomes over $250,000. These two provisions reduce tax benefits for high-income households. This sets the stage for future balanced approaches to deficit reduction, which could include additional revenue through tax reforms that reduce tax benefits for Americans making over $250,000.

- Raises tax rates on the wealthiest estates: The agreement raises the tax rate on the wealthiest estates – worth upwards of $5 million per person – from 35 percent to 40 percent, in contrast to Republican proposals to continue the current estate tax levels.

- The agreement’s $620 billion in revenue is 85 percent of the amount raised by the Senate-passed bill, if that bill had been enacted and made permanent: The agreement locks in $620 billion in high-income revenue over the next ten years. In contrast, the bill passed by Democrats in the Senate achieved approximately $70 billion through one-year provisions; these same provisions could have raised a total of $715 billion over ten years if Congress acted again to extend it permanently. However, the Senate bill itself locked in only one year’s worth of savings so would have required additional extensions to achieve those savings.

The health care law raised the payroll tax for high income earners and taxed investment income.

A new Net Investment Income Tax goes into effect starting in 2013. The 3.8 percent Net Investment Income Tax applies to individuals, estates and trusts that have certain investment income above certain threshold amounts. The IRS and the Treasury Department have issued proposed regulations on the Net Investment Income Tax. Comments may be submitted electronically, by mail or hand delivered to the IRS. For additional information on the Net Investment Income Tax, see our questions and answers.

Additional Medicare Tax

A new Additional Medicare Tax goes into effect starting in 2013. The 0.9 percent Additional Medicare Tax applies to an individual’s wages, Railroad Retirement Tax Act compensation, and self-employment income that exceeds a threshold amount based on the individual’s filing status. The threshold amounts are $250,000 for married taxpayers who file jointly, $125,000 for married taxpayers who file separately, and $200,000 for all other taxpayers. An employer is responsible for withholding the Additional Medicare Tax from wages or compensation it pays to an employee in excess of $200,000 in a calendar year. The IRS and the Department of the Treasury have issued proposed regulations on the Additional Medicare Tax. Comments may be submitted electronically, by mail or hand delivered to the IRS. For additional information on the Additional Medicare Tax, see our questions and answers.

http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions

Krugman: Obama and the One Percent

http://www.democraticunderground.com/10024391415

Jesus Malverde

(10,274 posts)doesn't kick in until we have a new administration. It's 1. something now right?

ProSense

(116,464 posts)Jesus Malverde

(10,274 posts)In 2014, the penalty is the greater of a flat $95 per adult and $47.50 per child under age 18, up to a maximum of $285 per family, or 1 percent of your family’s modified adjusted gross income that is over the threshold the requires you to file a tax return. That threshold is $10,150 for an individual, $13,050 for a head of household and $20,300 for a married couple filing jointly.

1% of "modified adjusted gross income" not even 1% of capital gains.

ProSense

(116,464 posts)Jesus Malverde

(10,274 posts)Prosense .."the Rich" have never been richer or more advantaged. It's an awesome time to be rich.

ProSense

(116,464 posts)Jesus Malverde

(10,274 posts)What is the ACA penalty in 2014?

What am I missing.

Did the senate pass a robin hood tax while I was away?

All the indicators , yachts, luxury houses, wall street bonuses say it's an awesome time to be rich and cashing in capital gains.

It sucks to be a wage earner AKA worker.

ProSense

(116,464 posts)"What is the long term capital gains rate?"

...I already stated that: http://www.democraticunderground.com/10024778782#post13

"What is the ACA penalty in 2014? What am I missing."

That the "penalty" has nothing to do with the "capital gains rate"

Real Median Household Income Rises 1.2% in February

http://www.democraticunderground.com/10024779959

Jesus Malverde

(10,274 posts)It says the 15% rate will expire in the future. The current rate is 15% which is awesome for those who invest.

The 39% rate is for people who earn "ordinary income". High net worth individuals make "capital gains" not "income".

The penalty for the ACA is 1 percent not whatever 3.9 you mention.

ProSense

(116,464 posts)"The current rate is 15% which is awesome for those who invest."

...it's not. The 20 percent rate on high income earners went into effect in 2013.

Capital gains and deductible capital losses are reported on Form 1040, Schedule D (PDF), Capital Gains and Losses, and on Form 8949 (PDF), Sales and Other Dispositions of Capital Assets. If you have a net capital gain, that gain may be taxed at a lower tax rate than your ordinary income tax rates. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. The term "net long-term capital gain" means long-term capital gains reduced by long-term capital losses including any unused long-term capital loss carried over from previous years. Generally, for most taxpayers, net capital gain is taxed at rates no higher than 15%. Some or all net capital gain may be taxed at 0% if you are in the 10% or 15% ordinary income tax brackets. However, beginning in 2013, a new 20% rate on net capital gain applies to the extent that a taxpayer’s taxable income exceeds the thresholds set for the new 39.6% ordinary tax rate ($400,000 for single; $450,000 for married filing jointly or qualifying widow(er); $425,000 for head of household, and $225,000 for married filing separately). For more information, refer to Publication 505, Tax Withholding and Estimated Tax.

There are a few other exceptions where capital gains may be taxed at rates greater than 15%:

1.The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

2.Net capital gains from selling collectibles (like coins or art) are taxed at a maximum 28% rate.

3.The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

Note: Net short-term capital gains are subject to taxation at your ordinary income tax rate.

http://www.irs.gov/taxtopics/tc409.html

"The penalty for the ACA is 1 percent not whatever 3.9 you mention. "

The "penalty" has nothing to do with tax increase, raising the payroll tax for high income earners and taxing investment income.

A new Net Investment Income Tax goes into effect starting in 2013. The 3.8 percent Net Investment Income Tax applies to individuals, estates and trusts that have certain investment income above certain threshold amounts. The IRS and the Treasury Department have issued proposed regulations on the Net Investment Income Tax. Comments may be submitted electronically, by mail or hand delivered to the IRS. For additional information on the Net Investment Income Tax, see our questions and answers.

Additional Medicare Tax

A new Additional Medicare Tax goes into effect starting in 2013. The 0.9 percent Additional Medicare Tax applies to an individual’s wages, Railroad Retirement Tax Act compensation, and self-employment income that exceeds a threshold amount based on the individual’s filing status. The threshold amounts are $250,000 for married taxpayers who file jointly, $125,000 for married taxpayers who file separately, and $200,000 for all other taxpayers. An employer is responsible for withholding the Additional Medicare Tax from wages or compensation it pays to an employee in excess of $200,000 in a calendar year. The IRS and the Department of the Treasury have issued proposed regulations on the Additional Medicare Tax. Comments may be submitted electronically, by mail or hand delivered to the IRS. For additional information on the Additional Medicare Tax, see our questions and answers.

http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions

I'm not sure why you're having such a hard time accepting the difference or the fact that the changes went into effect in 2013 as the above states.

Jesus Malverde

(10,274 posts)The medicare tax is not on capital gains.

Your not acknowledging that there are different types of income, taxed very favorably for the wealthy.

You also dismiss that life is awesome for the super rich and that we are back in a great Gatsby guilded era. What we used to call robber barons are today bankers, and hedge fund managers. The big difference is that the robber barons of old hired millions of workers. The robber barons today make billions and hire very few, after all it's all paper.

The wages of ordinary americans are being eaten up by inflation. The wages of the super rich are shooting up up and up.

It might be more effective if you made a point and linked to a cite rather than dump a wall of text and expect people to wade through it to find the point your trying to make. Its like you want me to make a point for you.

Capitals gains is 15%

The ACA penalty is 1%

Life is mega good for the Mega rich....

Labor actions for McJobs...How far we have fallen.

ProSense

(116,464 posts)Jesus Malverde

(10,274 posts)ProSense

(116,464 posts)Jesus Malverde

(10,274 posts)ProSense

(116,464 posts)there is change in the air, big boost for the poor and middle class.

http://www.democraticunderground.com/10024781130

JoePhilly

(27,787 posts)which is what happens in a recession.

They after the recession, as there are fewer workers competing for the same jobs, wages start to increase again.

Which is starting to happen.

And yes, income from investments should not be taxed at a lower rate than income from actual labor. I wonder when that started?

Jesus Malverde

(10,274 posts)Between outsourcing, robotics, and corporate efficiencies those JOBS are GONE forever.

There is no new industry. The latest battle is for McJob wages.

We are in a shift akin to the industrial revolution there is no "going back to normal".

Millions of truck drivers are next as we go with remotely piloted trucks.

Some people don't get it. We are really in a technological revolution that is changing the world.

progressoid

(49,991 posts)Any day...

Here it comes...

Jesus Malverde

(10,274 posts)

Proof is in the pudding...

Jesus Malverde

(10,274 posts)After-tax profits for American corporations hit another record high last year, rising to $1.68 trillion.

The profits have helped boost CEO pay: Among 50 public companies, they saw a 4.1 percent increase in pay at the median last year, netting $9.8 million at that mark. That’s after average CEO pay hit a record high in 2012.

But this wealth hasn’t trickled much further down. Despite the fact that workers have been increasing their productivity — helping to drive those corporate profits — they haven’t seen much of a reward. Wages are growing at the slowest rate since the 1960s, only just barely outpacing inflation.

http://thinkprogress.org/economy/2014/03/27/3420092/corporate-profits-record-2013/

Skittles

(153,169 posts)PLEASE

Jesus Malverde

(10,274 posts)The inequalities are real and ongoing. The economic trends are well established.

If we don't see a problem, we'll be unlikely looking for solutions to address them.

![]()

Skittles

(153,169 posts)and yes that is EXACTLY what he is doing

Autumn

(45,107 posts)ProSense

(116,464 posts)Wages in Minniapolis and Seattle grew most, 1.9 percent and 1.6 percent, respectively.

Lowest was Miami at -2.1 percent.

http://www.payscale.com/payscale-index/cities

(Dump Rick Scott)

Largest increase by industry: Information, Media & Telecommunications, 1.4 percent

Second: Healthcare & Social Assistance, 1.0 percent

http://www.payscale.com/payscale-index/industries

Largest increase by job category: Science & Biotech Jobs, 2.3 percent

Second: Healthcare Practitioners & Technical Healthcare Jobs, 1.8 percent

http://www.payscale.com/payscale-index/job-categories

Jesus Malverde

(10,274 posts)Somewhat surprising to me from the click through on the OP link was that Detroit was one of the places showing wage growth.

![]()

ProSense

(116,464 posts)Aerows

(39,961 posts)complaining that Congresspeople don't make enough money. (Like $174,000 a year is such a lousy salary)

They truly have no freaking idea what goes on away from the beltway.

Jesus Malverde

(10,274 posts)U.S. corporate profits hit new highs last year, driven by the tight lid firms have kept on hiring and spending almost five years into the economic recovery.

A closely watched measure of after-tax corporate profits rose to $1.9 trillion in the final three months of the year, the Commerce Department said Thursday. Corporate profits stood at 11.1% of gross domestic product, up a bit from the prior quarter.

The latest uptick underscored a factor that has dogged the economy since it emerged from recession: Many companies are guarding their cash rather than putting it back into the economy in the form of new hiring.

"Companies are continuing to squeeze productivity gains out of existing workforces," said Dan North, chief economist at credit insurer Euler Hermes ELE.FR +0.04% Americas. Many businesses continue to keep a tight grip on spending amid uncertainty about the economic outlook at home and abroad, he said.

http://online.wsj.com/news/articles/SB10001424052702303325204579465060613770396?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424052702303325204579465060613770396.html

Jesus Malverde

(10,274 posts)When it comes to executive pay, 2013 could be one for the record books, with 15 CEOs and other key members of publicly held companies gaining membership into the $100 million-plus compensation club, likely the most since before the 2008 financial crisis.

With proxy season in full bloom, companies are disclosing compensation payouts en masse. Depending on reporting methodology, the aggregate payouts and gains from stock and stock options that provide year-over-year compensation comparisons can vary widely.

USA TODAY's analysis of Standard & Poor's 500 companies headed by the same CEO the past two fiscal years shows 2013 median pay — including salary, bonus, incentive awards, perks and gains from vested shares and exercised stock options — jumped 13% to $10.5 million, a level buoyed by soaring stock prices that's likely to rise as more companies meet annual Securities and Exchange Commission filing deadlines.

An examination of a broader spectrum of companies filing proxy statements filed through April 3 found far bigger compensation gains among top executives, up to $3.3 billion for Facebook's hoodie-loving co-founder, Mark Zuckerberg. Moreover, unlike past years when huge compensation gains were concentrated among a few sectors, pay kings reign far from the deep-pocketed realms of Wall Street and Silicon Valley, including Starbucks CEO Howard Schultz, Discovery Communications' David Zaslav and Jim Gallogly, head of petrochemicals manufacturer LyondellBasell.

http://www.freep.com/article/20140404/BUSINESS07/304040046/Find-out-who-s-getting-richer-Millions-by-millions-CEO-pay-goes-up

Jesus Malverde

(10,274 posts)Stock Rally, Real-Estate Rebound Boost Market for Second Houses

Sales of vacation homes are surging again, the result of rising wealth in higher-income households and renewed confidence in the housing market.

The number of second homes acquired for part-time personal use jumped 30% last year to 717,000 homes, according to an annual survey by the National Association of Realtors. The gain was the largest since the association started tracking second-home sales in 2003.

Although the number of second homes sold last year is well short of the high point of nearly 1.1 million in 2006, last year's jump signals a rapidly changing sentiment about the value of residential real estate, which just a few years ago was considered a poor investment amid the broad market bust.

Economists note that the vacation-home market was a beneficiary of last year's big gains in the stock market and rising home values, bringing buyers more wealth and confidence. The Standard & Poor's 500 index of stocks posted a 30% increase last year, its largest since 1997. The median price of an existing home rose by 11.5%, the largest gain since 2005, according to the Realtors group.

http://online.wsj.com/news/articles/SB10001424052702303847804579477770226322860

Party time for the rich.

Response to Jesus Malverde (Original post)

Jesus Malverde This message was self-deleted by its author.

xchrom

(108,903 posts)Populist_Prole

(5,364 posts)Especially conservative ones and pols, as they studiously ignore the problem of underemployment. You also see this a great deal in the case of these red state "right-to-work" shit pits that have jobs relocated to there from other locations where compensation was higher....solely because of the lower wages. Makes for good headlines and slogans for those who don't follow through.

Jesus Malverde

(10,274 posts)job market as if they don't exist, the PTB use all kinds of games to make our McJob economy that is experiencing a wider divide between the very rich and the rest.

reformist2

(9,841 posts)bigwillq

(72,790 posts)And the rest of us just try to survive another day.

So very sad.

The country is a mess.

K and R

reformist2

(9,841 posts)bigwillq

(72,790 posts)Some of it due to outsourcing and corporate greed, others to technological advances.

We're all in a lot of trouble either way.

edited

Jesus Malverde

(10,274 posts)reformist2

(9,841 posts)In other words, I think the "real" economy has been deteriorating since the late 80s/early 90s, when global free trade took off, but that the damage was covered up with well-timed "bubbles" that kept the masses excited.

Now the bubbles have popped, and people see the reality. It's not pretty.

Jesus Malverde

(10,274 posts)Now that the "service economy" is laid bare for what it is (McJobs, part time, wal-mart associates, generation SNAP), the talk of transition, economic engines, growth and future of the american workers is not a topic to be explored. If there is no problem, there needs no solution.

Doing that might set people against "free trade" and globalization. Millennials are in for a bumpy ride.

ProSense

(116,464 posts)"This 8% drop looks permanent. I'm afraid what the next recession is going to do."

...it is. In fact, the source of the information is PayScale. Here is what information shows.

http://www.payscale.com/payscale-index/real-wage-index

There has been growth, but it hasn't kept pace with inflation. This isn't unusual coming out of a severe economic crisis.

The wage growth has been upward, but uneven.

http://www.payscale.com/payscale-index/

A more robust recovery and other factors will help to improve wage growth and bring it back in line with pre-recession trends.

pa28

(6,145 posts)We've destroyed the labor market in this country as a matter of policy. From now on every recession will bring higher permanent unemployment and lower real wages.

ProSense

(116,464 posts)pa28

(6,145 posts)RainDog

(28,784 posts)that especially impacts women, who hold many lower-wage jobs - and among women, minority women are hurt the most by this stagnant or retrograde wage issue.