General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhy can't Obama be more like Bush? Who is missing Dubya?

Matt Taibbi: 'Hands Down' Bush Was Tougher On Corporate America Than Obama"

"Tougher" as in the time Bush ignored the problem until the economy was at its breaking point, and then forced the government into having to bail out the banks.

"Tougher" as in when Bush triggered the mortgage crisis by gutting the Community Reivestment Act?

http://prospect.org/article/did-liberals-cause-sub-prime-crisis

As The Wonk Room has noted, the problem was actually the Bush administration’s failure to regulate the mortgage markets, while financial institutions developed ever-more sophisticated instruments for securitizing mortgage debt and selling it around the world.

http://thinkprogress.org/economy/2008/12/01/172489/bush-warnings/

by Joseph E. Stiglitz

December 2007

<...>

Whoever moves into the White House in January 2009 will face an unenviable set of economic circumstances. Extricating the country from Iraq will be the bloodier task, but putting America’s economic house in order will be wrenching and take years.

The most immediate challenge will be simply to get the economy’s metabolism back into the normal range. That will mean moving from a savings rate of zero (or less) to a more typical savings rate of, say, 4 percent. While such an increase would be good for the long-term health of America’s economy, the short-term consequences would be painful. Money saved is money not spent. If people don’t spend money, the economic engine stalls. If households curtail their spending quickly—as they may be forced to do as a result of the meltdown in the mortgage market—this could mean a recession; if done in a more measured way, it would still mean a protracted slowdown. The problems of foreclosure and bankruptcy posed by excessive household debt are likely to get worse before they get better. And the federal government is in a bind: any quick restoration of fiscal sanity will only aggravate both problems.

And in any case there’s more to be done. What is required is in some ways simple to describe: it amounts to ceasing our current behavior and doing exactly the opposite. It means not spending money that we don’t have, increasing taxes on the rich, reducing corporate welfare, strengthening the safety net for the less well off, and making greater investment in education, technology, and infrastructure.

<...>

Some portion of the damage done by the Bush administration could be rectified quickly. A large portion will take decades to fix—and that’s assuming the political will to do so exists both in the White House and in Congress. Think of the interest we are paying, year after year, on the almost $4 trillion of increased debt burden—even at 5 percent, that’s an annual payment of $200 billion, two Iraq wars a year forever. Think of the taxes that future governments will have to levy to repay even a fraction of the debt we have accumulated. And think of the widening divide between rich and poor in America, a phenomenon that goes beyond economics and speaks to the very future of the American Dream.

- more -

http://www.vanityfair.com/politics/features/2007/12/bush200712

Why can't Obama be more like Bush?

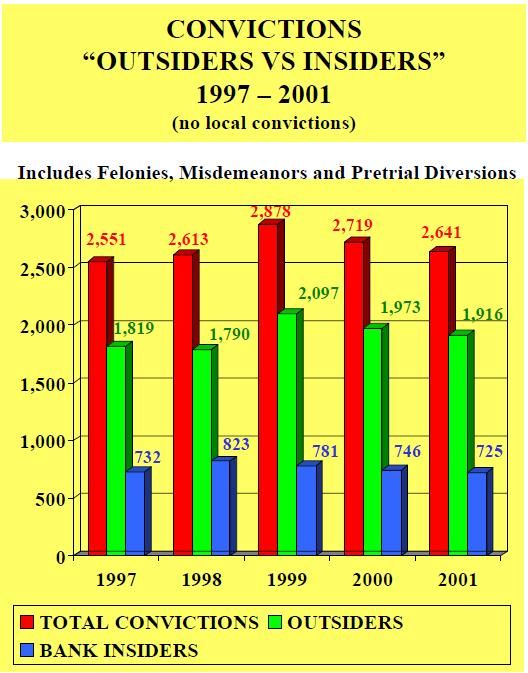

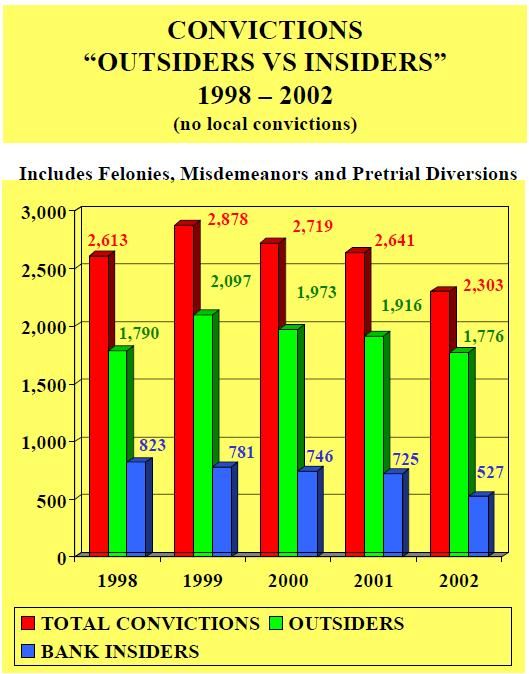

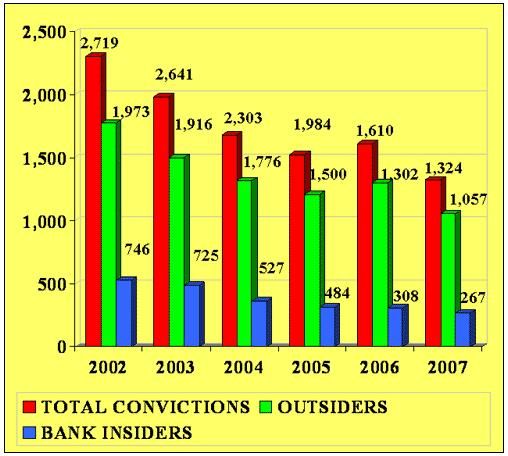

It's a little hilarious that a chart showing a steeper drop in the number of cases after 2001 is being used to hype Bush.

The chart shows that prosecutions started dropping after the repeal of Glass-Steagall, and it shows prosecutions, not convictions. It's also not conclusive because it doesn't state what specifically it includes and appears to be related to bank fraud. Here's the reference:

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

http://economix.blogs.nytimes.com/2011/11/15/prosecutions-for-bank-fraud-fall-sharply/

Remember Glass-Steagall? It was repealed and that was followed by the law that created the Enron loophole in 2000, which is likely why prosecutions dropped from the 1999 highs to less than half the number.

Many of the immoral activities were crimes before the repeal of Glass-Steagall. I simply can't understand how people can acknowledge that repealing a law caused the problem, but not understand the the law was what made the activities illegal.

I've seen that chart many times before. http://www.democraticunderground.com/1002990749#post4

I'll repost the full comment here...

Goldman Sachs is not a bank. Still, even if it is bank fraud, it does offer more evidence of Bush's "abysmal" record, as these prosecutions dropped significantly during his Presidency.

The following is from the Financial Institution Fraud and Failure Reports for each fiscal year.

http://www.fbi.gov/stats-services/publications/fiff_00-01

http://www.fbi.gov/stats-services/publications/fiff-2002

(b): Types of Subjects Convicted in FIF Cases During FY 2007*

SUBJECT TYPE NUMBER OF SUBJECTS

Legal Alien 8

Illegal Alien 20

All Other Subjects 1,038

Bank Officer 88

Bank Employee 179

International or National Union Officer 1

President 1

Business Manager 2

Office Manager 2

Financial Secretary 1

Federal Employee - GS 12 & Below 1

State - All Others 1

Local Law Enforcement Officer 1

City Councilman 1

Possible Terrorist Member or Sympathizer 1

Company or Corporation 7

Local - All Others 2

Total 1,354

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

Given yhe above charts and the break out for 2007, it appears that most of the convictions were not bank executives. In fact, the majority were bank "outsiders," likely meaning more bad-check writers and document falsifiers.

Also, bank fraud is separate from corporate fraud, mortgage fraud, and securities and commodities fraud.

The following is from the Financial Crimes Report to the Public for each fiscal year:

(Note: The 2005 report does not break out securities and commodities fraud. The 2010-2011 report is the only one that breaks out financial institution fraud. All reports show corporate fraud and mortgage fraud.)

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#MORTGAGE

_________

http://www.fbi.gov/stats-services/publications/fcs_report2006

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

___________

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

______________

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

_____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

Pending cases are important because they can still result in convictions.

The fact is that prosecutions that could go forward did.

President Obama’s Financial Fraud Enforcement Task Force STRIKES AGAIN! $200 Million Fraud

http://www.democraticunderground.com/1002844790

Former BofA Exec Indicted For Fraud

http://www.democraticunderground.com/1002990749

Allen Stanford Convicted in Houston for Orchestrating $7 Billion Investment Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-293.html

Former Chief Investment Officer of Stanford Financial Group Pleads Guilty to Obstruction of Justice

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-785.html

Former Corporate Chairman of Consulting Firm and Board Director Rajat Gupta Found Guilty of Insider Trading in Manhattan Federal Court

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120615.html

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

CEO and Head Trader of Bankrupt Sentinel Management Indicted in Chicago in Alleged $500 Million Fraud Scheme Prior to Firm’s 2007 Collapse

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-120601.html

Yahoo! Executive and California Hedge Fund Portfolio Manager Plead Guilty in New York for Insider Trading

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120521.html

Three Former Financial Services Executives Convicted for Roles in Conspiracies Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-620.html

Former Chairman of Taylor, Bean & Whitaker Sentenced to 30 Years in Prison and Ordered to Forfeit $38.5 Million

http://www.stopfraud.gov/news/news-06302011-2.html

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Former Chief Financial Officer of Taylor, Bean & Whitaker Pleads Guilty to Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Seattle Investment Fund Founder Sentenced to 18 Years in Prison for Ponzi Scheme and Bankruptcy Fraud

http://www.stopfraud.gov/iso/opa/stopfraud/WAW-120210.html

Former Hedge Fund Managing Director Sentenced to 20 Years for Defrauding 900 Investors in $294 Million Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-111117.html

Peter Madoff, Former Chief Compliance Officer and Senior Managing Director at Bernard L. Madoff Investment Securities LLC, Pleads Guilty in New York to Securities Fraud and Tax Fraud Conspiracy

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-1206291.html

Peter Madoff Is Sentenced to 10 Years for His Role in Fraud

http://dealbook.nytimes.com/2012/12/20/peter-madoff-is-sentenced-to-10-years-for-his-role-in-fraud

Enrique

(27,461 posts)i'm not convinced.

"i'm not convinced."

...you're not "convinced" that Bush ignored the economy and drove it into the worst economic crisis in more than 70 years?

You're not "convinced" that Bush triggered the mortgage crisis by gutting the Community Reivestment Act?

Thank, Obama?

stevenleser

(32,886 posts)articles, where the details absolutely do not support him, are convincing to you?

This is not about agreeing with me or Prosense about general philosophy, this is about whether Taibbi's journalism stands up to scrutiny.

Number23

(24,544 posts)If one is actively interested in being "convinced" of something, reading the first five words of 30 articles ain't the way to do it.

stevenleser

(32,886 posts)information that disputes his contentions, they're so enamored of his premises.

Cha

(297,244 posts)convinced that you don't care about facts if it contradicts little taibbi's tale of hogwash.

babylonsister

(171,066 posts)Cali_Democrat

(30,439 posts)ProSense

(116,464 posts)http://www.warren.senate.gov/files/documents/AFR%20Roosevelt%20Institute%20Speech%202013-11-12.pdf

http://www.democraticunderground.com/10024812296

ProSense

(116,464 posts)A California law imposed this standard, but credit card issuers challenged it in court in 2002, and the Bush administration's Office of the Comptroller of the Currency sided with the issuers. The comptroller argued that only federal regulators could impose such a restriction on nationally chartered banks and that his office did not plan to do so. The state lost the case.

Mr. Gordon said that some minimum payments were so low that they barely kept up with interest costs or fell behind them, in which case the balance could never be repaid.

Other changes proposed by the Kerry campaign would require lenders to forgo penalty charges when they allowed card holders to go beyond their borrowing caps. A cardholder with a $5,000 credit limit, for example, can face a penalty for reaching $5,200 even if the card company approved the charge that put the total over $5,000.

Mr. Kerry's principal mortgage proposal would prohibit lenders from using balloon mortgages in most subprime loans, which often go to low-income people at higher rates.

http://www.nytimes.com/2004/08/27/us/2004-campaign-democratic-platform-kerry-sees-credit-card-abuses-promises-steps.html

WASHINGTON D.C. – Senator John Kerry wrote to Treasury Secretary Paulson, asking him to provide a plan to address the national foreclosure crisis. Today, more than two million American families, including thousands in Massachusetts, risk losing their homes to foreclosure in the near future.

“I’m asking Secretary Paulson to take overdue action now before today’s housing crunch becomes tomorrow’s recession. They need to take aggressive action to save homeowners from foreclosure. So far, the Bush Administration has responded to the mortgage crisis just as they respond to most challenges - they protect their friends first while they play a shell game with those being hit hardest. The steps taken so far only scratch the surface of what the government could be doing to respond. Instead of helping banks and bondholders stay on top at all costs, the Treasury should be ensuring American families do not lose the roof over their heads.”

Only a paltry 1 percent of troubled subprime mortgages have been restructured by lenders. Kerry joined Sheila Bair, Chair of the FDIC, in asking for immediate action to develop a systematic approach for lenders to make loan modifications so creditworthy families can stay in their homes.

Kerry also called to immediately increase the portfolio caps for Fannie Mae and Freddie Mac by ten percent on a temporary basis, to insure that more families get access to fair, non-predatory mortgages. Unfortunately, this has been opposed by the Bush Administration.

Finally, he is pushing Congress to enact legislation to prohibit the most abusive and predatory lending practices that disclosures cannot protect against. Unfortunately, the Bush Administration has also opposed legislation to stop predatory lending.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x2087387

JustAnotherGen

(31,825 posts)Pssst - I always love how everyone overlooks Global Crossing - to include Taibbi. Maybe he put it in the book?

Pssst - Bush Co. - they let us get away with it.

Pssst - know how companies like Verizon are the 'evil empire' around here at DU. Psssst - where do these people including Taibbi think the WorldCom and G.C. employees ended up?

Bush Co did nothing to us or I would be on skid row right now. The Fed Gov was a joke when it came to the tech bubble burst. Trying to to tell me that people who I know first hand (end of my arm) were told "Don't you dare bill them - here's what we're gonna do with 360 Networks/Level 3/ etc. etc." - got it stuck to them by Bush Co when we are all making six figures right now at those "evil empire NSA telecoms" - Trying to tell me the kids who did as they were told got in 'big trouble' . . . That's a joke. We all made out like bandits at the end.

Actually - if you think about it Prosense - let's throw them a bone. Let's pretend Bush and Obama are EXACTLY the same. Let's pretend there is zero difference in either of these men on ANYTHING.

Bush did nothing. He doesn't get kudos for anything at DU.

Just like President Obama.

Cha

(297,244 posts)anything with "bad" Obama gets a hell yeah.. even if it puts bush in a good light.. the ODS is so pathetic.. ![]()

stevenleser

(32,886 posts)actually think about his contentions and research and look at the details, he is wrong more often than not. His contentions do not stand up to scrutiny.

Whether one agrees with his general bent, lack of corroborating evidence that stands up to scrutiny doesnt make the points he is trying to make.

JaneyVee

(19,877 posts)Sticking it to Wall Street, but he needs to stick to the facts and less hyperbole.

1StrongBlackMan

(31,849 posts)clicks, recs, and checks in the internutz world.

spanone

(135,838 posts)ProSense

(116,464 posts)Proud Liberal Dem

(24,412 posts)President Obama and Attorney General Holder may not be the super corporate crime fighters that we might want them to be (to me this seems like more of expecting him to be everything to everybody despite limited time, limited resources, leftover Bushies in government agencies, and extraordinary congressional obstructionism) but the idea that Bush was tougher on corporate America than President Obama has been just seems a bit too hard to swallow, esp. considering that, as I recall, Bush tended to stack many government agencies with people who used to lobby for corporate interests opposed to the agencies they were appointed to head. Oh and there is that little thing called the CFPB that President Obama aggressively pushed for and signed into law during the beginning of his Presidency...........![]()

Given how much corporate America and the Koch Bros in particular hate President Obama, I have to believe that he is doing something right.

ProSense

(116,464 posts)Proud Liberal Dem

(24,412 posts)He left a mess too big to be cleaned up adequately in 4 (or maybe even 8) years. His (P)residency should be "Exhibit A" for why we should never have a Republican in the WH ever again!

DanTex

(20,709 posts)ProSense

(116,464 posts)"I can't believe people here seriously think Bush was tougher than Obama on corporate malfeasance"

...if you don't believe the guy who drove the economy into the ground was "tougher," you're not cool.

![]()

Cha

(297,244 posts)Obamacare for ODS. ![]()

frazzled

(18,402 posts)Not by a few symbolic show trials and imprisonments. Putting Ken Lay in jail didn't stop the crazy derivatives markets or mortgage schemes from continuing as lax regulation and turning the other way led to a massive financial crisis and recession.

If you want to measure "toughness on corporations" through prosecutions of individuals, that is one measure; but the bigger measure is laws enacted to prevent financial misdeeds. The Dodd–Frank Wall Street Reform and Consumer Protection Act is more important, imo, than random calls for prosecution. Why? The kinds of trades and deals and compensation packages that the Bush administration turned a blind eye to were essentially legal. Putting a framework into place that limits risks that banks are able to take: that's a big deal.

We can play whack a mole, or we can build sound financial and economic laws. Actually we can do both. But "polemicist muckrakers" (I use TPM's descriptor of Matt Taibbi, and I would add agent provocateur) are not the people I listen to when evaluating complex machinations of administrations with respect to corporate America. On the other hand, ask yourself the simple question: who did corporate America prefer and support, GW Bush or B Obama? The answer probably tells you all you need to know.

yurbud

(39,405 posts)but you'd never know it from the way it's not enforced.

mcar

(42,333 posts)Sigh.

Jamaal510

(10,893 posts)Spazito

(50,344 posts)It is very disappointing to see DUers supporting Taibbi's false narrative that Bush was tougher on corporate America than President Obama. The contention is beyond ludicrous, imo.

Dawgs

(14,755 posts)The problem is that NEITHER Bush or Obama have been tough on corporate America; not that one was more tough than the other.

"The problem is that NEITHER Bush or Obama have been tough on corporate America; not that one was more tough than the other."

...but I disagree. Bush's policies facilitated the crisis, and he publicly opposed attempts to address the issues.

President Obama is cleaning up Bush's mess.

http://www.warren.senate.gov/files/documents/AFR%20Roosevelt%20Institute%20Speech%202013-11-12.pdf

http://www.democraticunderground.com/10024812296

Dawgs

(14,755 posts)Obama could do a lot more.

"Dodd-Frank is strong but still not nearly enough."

...that's equivalent to putting policies in place drive the economy into the ground as Bush did?

Dawgs

(14,755 posts)I said both of their records are weak. Bush more than Obama, but both are still weak.

ProSense

(116,464 posts)Dawgs

(14,755 posts)You aren't going to change your mind, which isn't surprising coming from you.

ProSense

(116,464 posts)"Not it's not, but whatever. You aren't going to change your mind, which isn't surprising coming from you."

...after the claim that Bush was "tougher" is hyped, you're implying that rejecting the claim that "both are still weak" is about being partisan. I don't accept that. The reality is that Bush was complicit.

Not only did Bush, who was responsible for the worst financial crisis in more than 70 years, stand in the way of prosecutions, he did everything to facilitate the abuses (http://www.democraticunderground.com/10024832745), gutting regulations and opposing efforts by Congress to address the issues (http://www.democraticunderground.com/10024828575#post4)

Bush had an opportunity to stem the mortgage crisis triggered by his actions, and he stood in the way. He could have addressed this in 2004 when the problem was evident.

http://www.democraticunderground.com/10024832738

"White House Must Be Investigated for Role in Enron’s Fraud"

http://www.democraticunderground.com/10024832745

Any equating Obama to Bush or hyping Bush over Obama on this issue or the economy is idiotic. There is no friggin comparison.

http://www.warren.senate.gov/files/documents/AFR%20Roosevelt%20Institute%20Speech%202013-11-12.pdf

http://www.democraticunderground.com/10024812296

Dodd-Frank also included the Volcker Rule, which is addressed here:

Brown, Warren Urge Fed To Address Risks Associated With Bank Ownership Of Physical Commodities

http://www.democraticunderground.com/10024831309

Obviously, as you said, Obama could do more, and clearly the process is ongoing.

Dawgs

(14,755 posts)Bush was much worse does not mean I can't also believe that Obama has done a poor job. I don't know why that logic is beyond your comprehension.

Just because Obama's performance is better than Bush's does not mean that it's acceptable.

MohRokTah

(15,429 posts)RandoLoodie

(133 posts)trash thread.

babylonsister

(171,066 posts)WhaTHellsgoingonhere

(5,252 posts)Last edited Wed Apr 16, 2014, 01:14 PM - Edit history (1)

Maybe there's more to what he said than the one sentence you found. Maybe not. But you might want to check into what he's saying. Maybe it's apples to apples, maybe not. Who knows, you only presented one sentence of his argument.

![]()

And, Taibbi was talking about people going to jail. We can give Maddoff the Lesner treatment and say Obama had no choice but to arrest him, so don't count Bernie in your totals.

![]()

WhaTHellsgoingonhere

(5,252 posts)that's a very impressive list.

Why the hush hush? ![]()

Someone being protected? It just seems like something the Dems and President could capitalize on.

I don't understand our Party. If someone argued we get what we deserve, they'd have a good case.

corkhead

(6,119 posts)From Wikipedia, the free encyclopedia

This article is about the logical fallacy. For other uses, see Straw man (disambiguation).

"Man of straw" redirects here. For the novel by Heinrich Mann, see Der Untertan.

A straw man, also known in the UK as an Aunt Sally,[1][2] is a common type of argument and is an informal fallacy based on the misrepresentation of the original topic of argument. To be successful, a straw man argument requires that the audience be ignorant or uninformed of the original argument.

The so-called typical "attacking a straw man" implies an adversarial, polemic, or combative debate, and creates the illusion of having completely refuted or defeated an opponent's proposition by covertly replacing it with a different proposition (i.e., "stand up a straw man"

This technique has been used throughout history in polemical debate, particularly in arguments about highly charged emotional issues where a fiery, entertaining "battle" and the defeat of an "enemy" may be more valued than critical thinking or understanding both sides of the issue.

http://en.wikipedia.org/wiki/Straw_man

"Straw man"

...debunking the idotic, moronic bullshit claim that Bush was "tougher" is a "strawman"?

WhaTHellsgoingonhere

(5,252 posts)Present your side as you like, but don't interject Taibbi into your argument because "who went to jail?" is the basis of Taibbi's claim.

We can give Maddoff the Steve Lesner treatment and say Obama had no choice but to arrest him, so don't count Bernie in your totals.

![]()

Vashta Nerada

(3,922 posts)1StrongBlackMan

(31,849 posts)Let's keep it directed towards President Obama ... You'll get more "recs" and "Yups" that way.

Vashta Nerada

(3,922 posts)President? You're funny.

1StrongBlackMan

(31,849 posts)or have done such a thing ... But you know who has? Those would be the folks saying other elevate President Obama to god status. And I have heard that in two quarters ... DU and the right-wing. Just saying ...

ProSense

(116,464 posts)I guess people are simply supposed to jump on the bandwagon elevating the Bush, the guy responsible for the worst economic crisis in more than 70 years, using mythology.

Vashta Nerada

(3,922 posts)There you go.

ProSense

(116,464 posts)"See the first graph in this OP."

...mean the "first graph" that shows cases under Bush dropping to less than half?

Bush set up the economy to fail, and did everything to ensure that it did. Bush is responsible for triggering the mortgage crisis.

As I posted above, here is Kerry addressing some of the issues in 2004 and again in 2007

A California law imposed this standard, but credit card issuers challenged it in court in 2002, and the Bush administration's Office of the Comptroller of the Currency sided with the issuers. The comptroller argued that only federal regulators could impose such a restriction on nationally chartered banks and that his office did not plan to do so. The state lost the case.

Mr. Gordon said that some minimum payments were so low that they barely kept up with interest costs or fell behind them, in which case the balance could never be repaid.

Other changes proposed by the Kerry campaign would require lenders to forgo penalty charges when they allowed card holders to go beyond their borrowing caps. A cardholder with a $5,000 credit limit, for example, can face a penalty for reaching $5,200 even if the card company approved the charge that put the total over $5,000.

Mr. Kerry's principal mortgage proposal would prohibit lenders from using balloon mortgages in most subprime loans, which often go to low-income people at higher rates.

http://www.nytimes.com/2004/08/27/us/2004-campaign-democratic-platform-kerry-sees-credit-card-abuses-promises-steps.html

WASHINGTON D.C. – Senator John Kerry wrote to Treasury Secretary Paulson, asking him to provide a plan to address the national foreclosure crisis. Today, more than two million American families, including thousands in Massachusetts, risk losing their homes to foreclosure in the near future.

“I’m asking Secretary Paulson to take overdue action now before today’s housing crunch becomes tomorrow’s recession. They need to take aggressive action to save homeowners from foreclosure. So far, the Bush Administration has responded to the mortgage crisis just as they respond to most challenges - they protect their friends first while they play a shell game with those being hit hardest. The steps taken so far only scratch the surface of what the government could be doing to respond. Instead of helping banks and bondholders stay on top at all costs, the Treasury should be ensuring American families do not lose the roof over their heads.”

Only a paltry 1 percent of troubled subprime mortgages have been restructured by lenders. Kerry joined Sheila Bair, Chair of the FDIC, in asking for immediate action to develop a systematic approach for lenders to make loan modifications so creditworthy families can stay in their homes.

Kerry also called to immediately increase the portfolio caps for Fannie Mae and Freddie Mac by ten percent on a temporary basis, to insure that more families get access to fair, non-predatory mortgages. Unfortunately, this has been opposed by the Bush Administration.

Finally, he is pushing Congress to enact legislation to prohibit the most abusive and predatory lending practices that disclosures cannot protect against. Unfortunately, the Bush Administration has also opposed legislation to stop predatory lending.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x2087387

ProSense

(116,464 posts)Not only is that a bizarre claim, it's even moreso coming from people trying to hype Bush.

stevenleser

(32,886 posts)And that goes for anyone who criticizes Democrats and Obama. They're contentions are not allowed to be challenged, not matter how obvious that the facts don't support them.

yurbud

(39,405 posts)those most responsible for for the economic collapse because of intentional fraud are untouched and even still dictating policy.

A couple or even one of the CEO's of the top seven or so banks needs to do prison time.

Missing Dubya, admiring Putin -- and some people have the gall to call us "authoritarians"!

Oy ![]()

SidDithers

(44,228 posts)Sid

ProSense

(116,464 posts)http://online.wsj.com/article/SB118860733605915338.html

<...>

Walker began his career on Wall Street when he joined Goldman Sachs in the Merger Department in 1992 and six years later, in 1998, became of one of the firm's youngest partners ever.[4] He held several senior positions at Goldman, including co-head of the firm's Wealth Management business, and head of Alternative Investment strategies. In May 2006, Walker resigned from Goldman Sachs to become global head of Lehman Brothers' Investment Management.

http://en.wikipedia.org/wiki/George_Herbert_Walker_IV

Chathamization

(1,638 posts)I also can't see how any progressive candidate would enthusiastically support fact-free statements saying Bush was tougher on corporations than Obama, and then willingly ignore a fact filled post like this. Nor how one could post this in support of these assertions:

Without mentioning that the chart includes crimes committed against banks, and not bother posting an image like this:

There's also Obama's relatively strong antitrust record compared Bush curtailing oversight, Obama pushing to lower emissions compared to Bush defending higher emissions, Dodd-Frank compared to Bush's deregulation efforts, and...seriously, this doesn't need to be explained to progressive Democrats.

It does make you wonder why we have posters here spreading disinformation in order to make Bush look better than Obama...

ProSense

(116,464 posts)"It does make you wonder why we have posters here spreading disinformation in order to make Bush look better than Obama..."

Yeah, it's utterly bizarre.

stevenleser

(32,886 posts)Cha

(297,244 posts)between you and SunsetDreams.. you've covered a lot of ground on the Obama Admin's action on corporate malfeasance!

http://www.democraticunderground.com/10024828126

Thank you!

ProSense

(116,464 posts)good chart: http://www.democraticunderground.com/10024832738

Prophet 451

(9,796 posts)Yes, he was a godawful president and yes, his VP was the incarnation of evil in human form and killed plants by his mere proximity but you have to admit, it was a golden period for political satire.

SunsetDreams

(8,571 posts)You went a whole lot deeper into it. I was tired last night. Thank you for for your excellent post.

ProSense

(116,464 posts)Thanks for your post.

SunsetDreams

(8,571 posts)davidpdx

(22,000 posts)He's a neo-con. ![]()

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=781616

Wow, the infestation is getting bad around here. Someone call the exterminator.

SunsetDreams

(8,571 posts)thanks for the link

nilesobek

(1,423 posts)A nice surplus replaced by Bush with a roaring deficit. Wars and tax cuts? This op is very well done.