General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMorning laugh. Fox News math - NYC Mayor only paid 8.3% in taxes

Last edited Fri Apr 18, 2014, 09:32 AM - Edit history (1)

Flipping through the news channels this morning I happened upon Fox & Friends.

Big news! New York City Mayor Bill de Blasio only paid 8.3% in taxes!!!

Full segment including comment from Stuart Varney (he has an English accent you know). Then they put their graphic on screen:

de Blasio Income: $217,000

Taxes paid: $25,000

Rate: 8.3%

Cross comments about how de Blasio makes "a THOUSAND DOLLARS a week on rent" and how poor Mitt Romney was raked over the coals for his tax amount.

I sat there laughing. Remove 1 zero from the income (which is much less than I would have expected) -- 10% is $21,700. How the hell did they get 8.3%??? It actually works out to 12% which is about what my wife and I pay.

I see on a google search that The Daily Caller and Breitbart also have this story posted......so you know it must be true ![]()

JaneyVee

(19,877 posts)He tried raising taxes on himself.

AngryAmish

(25,704 posts)JaneyVee

(19,877 posts)Would cutting a check to the treasury do from one person?

1StrongBlackMan

(31,849 posts)even appearing on this bulletin board?

La Lioness Priyanka

(53,866 posts)which it does not

adieu

(1,009 posts)one cannot just overpay one's taxes. It's actually more of a pain for the IRS as they HAVE to refund you back the overpayment.

BootinUp

(47,156 posts)pinto

(106,886 posts)tridim

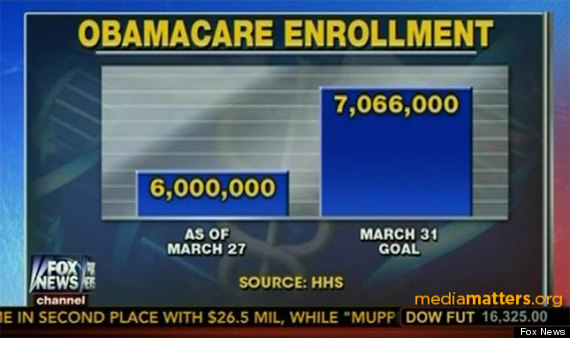

(45,358 posts)The GOP gave up math long ago.

They don't even do fuzzy math any more, which requires subtle manipulation of the results. It's easier to just use 100% pure ass-numbers.

Stallion

(6,474 posts)nm

former9thward

(32,016 posts)De Blasio had an income of 165k not 217k as the OP reported and paid 13,700 in federal taxes. My elementary school math makes that a 8.3% effective federal tax rate.

Rex

(65,616 posts)

underpants

(182,823 posts)Egypt moved to Iraq!!! ![]()

Rex

(65,616 posts)Uh sir...that is Egypt...maybe we should pick on somebody a little weaker?

WaitWut

(71 posts)When I get into discussions that turns to tax policy, I always ask what is your current tax rate?

9 out of 10 Armchair Pundits have no idea.

If you don't know the actual price of something how can you complain that it is too high? And if you don't know how much your rate is different from... say... Paris Hilton's... well, you don't know how bad you're getting ripped off.

seveneyes

(4,631 posts)That's more than 30% right off the top, not including property tax, sales tax etc. Shouldn't people like him making 200k+ be paying at least as much as the little guy?

dhill926

(16,339 posts)I pay a shitload more than 12% to the federal gov't. Not 200K, but more than 100K.

DefenseLawyer

(11,101 posts)A person whose income comes from a salary has fewer deductions for business expenses than someone that runs a business, for example, so the effective tax rate is lower for the business owner. Of course the person whose income is spent on business expenses ends up "keeping" less of his or her income than a salary earner without those necessary expenses, so at the end of the day it tends to balance out, until you get to the mega-rich, who deal with taxes in an entirely different way.

former9thward

(32,016 posts)And you are mixing up "effective tax rate". Effective tax rate is what you pay the federal government. De Blasio had an effective tax rate of 8.3%. His income was $165,000 -- not 217k as you reported and he paid $13715 in federal taxes. That is an effective tax rate of 8.3%. He paid about $25,000 in total taxes when you included all the taxes he paid state and local. But that is not the number that is used when comparing effective tax rates.

http://blogs.wsj.com/metropolis/2014/04/15/mayor-bill-de-blasio-releases-his-tax-returns/

underpants

(182,823 posts)Your link is slow for me but I will go with what you posted.

They showed exactly what I posted originally and then sat there nodding and agreeing with it. That is what I was making fun of.

former9thward

(32,016 posts)They must of added his 52k of rental income to his total income of 165k to get 217k. But the 52k is part of the 165k of total income.

underpants

(182,823 posts)They messed this all up but the point is to get the 8.3% in the viewers' heads

underpants

(182,823 posts)$13k paid plus $5,500 to charities rounded up to $19K. 19/165=12%.

He contributed to charities which is the way it is set up to work.

mylye2222

(2,992 posts)check and laugh OL!!!!

http://urlybits.com/2012/03/fox-news-wants-to-show-you-where-toolooz-is-epic-fail/

dilby

(2,273 posts)He is making 3 times more than me and paying just $6000 more a year in taxes than me. I need to have someone go through all my financials and really tell me where I can make some serious deductions.