General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhy You Should Care About The Collapsing Russian Ruble (Russian Economy On The Brink Of Collapse)

Plunging oil prices and economic sanctions have pushed Russia's economy to the brink of collapse. "Couldn't happen to a nicer dictator than Vladimir Putin," you might be thinking, but it could have repercussions for all of us.

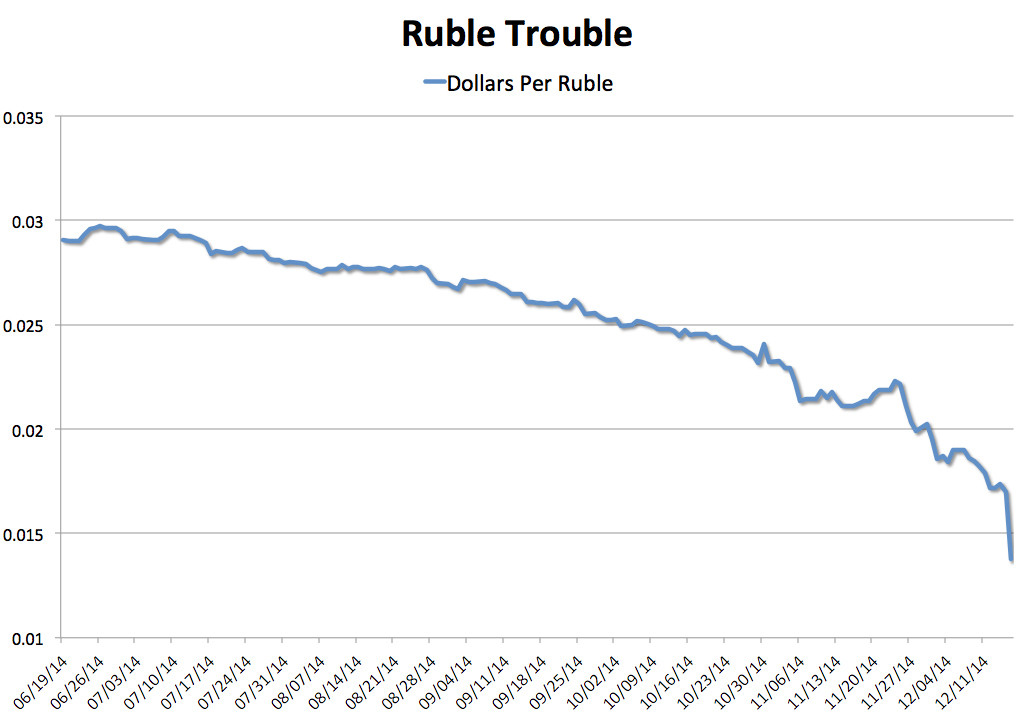

Russia's currency, the ruble, crashed to record lows against the U.S. dollar on Tuesday, accelerating a months-long selloff. Russia's central bank jacked up interest rates in the middle of the night, desperately trying to stanch the bleeding by enticing investors to keep cash in the country. The bank raised its key rate to 17 percent from 10.5 percent, the biggest hike since Russia's ruble crisis in 1998. If that effort did any good, it was hard to tell. (Story continues below chart.)

The central bank's failure means it will have to keep trying, either by raising rates again or potentially by cracking down on the flow of capital out of the country. Neither option is good, as they can stifle borrowing and economic growth, which was already in deep trouble.

Russian GDP might shrink by a terrifying 4.5 percent next year, the central bank said Monday, especially if the price of crude oil hangs around $60 a barrel.

Read more: http://www.huffingtonpost.com/2014/12/16/russia-ruble-collapse_n_6333546.html

Ward

(28 posts)Shouldn't you at least include the reason?

I can't think of a reason why I would give a fuck.

I don't do Huffington's POS site.

Erich Bloodaxe BSN

(14,733 posts)it's because of the sort of anti-social behaviours that surge in times of trouble. Scapegoating, attacks on immigrants, gays, the 'intelligentsia', surging nationalism. A good part of why Hitler rose to power was an economy in the toilet. Grabbing land was a way to bring in the bucks. Given that Putin is already in power, well-liked at home, and prone to wanting to carve off pieces of nearby countries, this could give him the excuse to go for more.

jollyreaper2112

(1,941 posts)Looks like the sort of situation that calls for a short, victorious war to take minds off the home front troubles.

dixiegrrrrl

(60,010 posts)in which there was a provision that bank's gambling losses would be covered by FDIC.

In other words, there would be no losses for gambles.

Consider that banks have made millions of loans to the fracking industry, which is now facing loss of any profits due to low price of oil.

Consider that many pension funds are invested in the debts that the banks make, and if the loans go south, so do pensions, and city and state bonds that have been sold.

Consider that when a huge economy like Russia falls down and goes boom, the ripple effects result in job losses in Europe and in the USA.

pampango

(24,692 posts)Russia has not diversified its economy much and it's economic health is still dependent on factors outside of its control like the international price of the natural resources that it sells. Not only is Russia "too big to fail", it a "too big to fail" entity that is armed with nuclear weapons. Even CitiBank did not have nuclear weapons.

dixiegrrrrl

(60,010 posts)It IS big enough to drag down Europe and even a lot of the US when it does fail.

Ukraine will be trashed, but it was getting trashed anyhow.

I am saying that we now have a global economy, which results in ever present chance of contagion when other countries hiccup, much less trip and fall.

Putin is gonna have a lot on his plate for some time now.

pampango

(24,692 posts)the definition of "too big to fail" applied by some to large financial institutions and the effect that their failure posed to th US economy.

PoliticAverse

(26,366 posts)dixiegrrrrl

(60,010 posts)The banks are planning on a "bail IN".

The head of the Europe Central Bank and the head of Central banks here both were in the news for saying

"Good news..there will be no more taxpayer bailouts".

Which is true, kinda sorta.

What they are planning is that if a bank goes bust, it will use shareholder's and depositor's money to try to fix the problem.

What they will do is the same as they did in Greece...spin off a "bad" bank that owes all the debt, and keep the "good bank" that has

all the money.

20 some years ago, the huge power company in Cal. went bust, and divided itself into 2 entities, just as I have described.

You wanted some money they owed you, you had to go to the "bad" company. Which of course declared bankruptcy.

General Motors did the same thing after 2008.

so, no matter what they call it, the big banks will get their money and/or be bailed out by a over compliant FDIC, which is what the Sat. passage of the Budget bill in Congress guarantees.

And with the continuing collapse of oil prices, looks like the timing was perfect for the banks.

Naturally.

Dyedinthewoolliberal

(15,577 posts)what the hell can I do about it? ![]()

Cali_Democrat

(30,439 posts)WinkyDink

(51,311 posts)dixiegrrrrl

(60,010 posts)Which hit a new low of 33 to the dollar.

Ykcutnek

(1,305 posts)Better stock up on popcorn.

![]()

roamer65

(36,745 posts)Better stock up on more than popcorn.

Major Hogwash

(17,656 posts)Both in 1 post!!

So there!