General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsCongress passes major change to law on union pensions

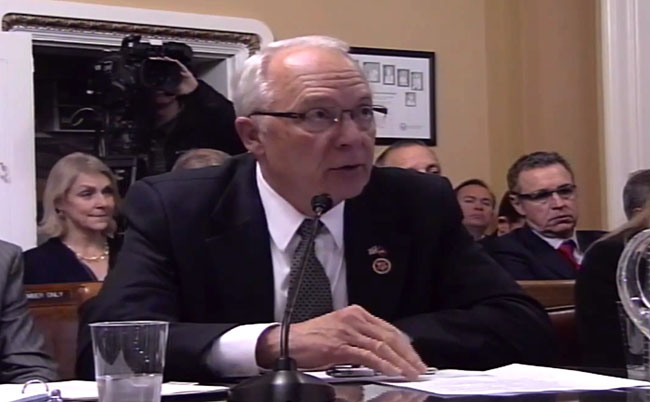

House Education and Workforce Committee chair John Kline (R-Minn.) explains the pension proposal he cosponsored with Rep. George Miller (D-Calif.)

http://nwlaborpress.org/2014/12/congress-passes-major-change-law-union-pensions/

Dec 16, 2014

By DON McINTOSH, Associate Editor

Severely underfunded union pension plans will be allowed to reduce current retiree benefits in order to avoid future insolvency, under a last-minute amendment attached to the $1.1 trillion federal government appropriations bill known as the “CRomnibus.”

The amendment was sponsored by an unlikely duo: anti-union House Education and Workforce Committee chair John Kline (R-Minn.), and pro-union former committee chair George Miller (D-Calif.), who was serving out his final days of office after 20 years. The 161-page amendment came under the unwieldy name of Amendment 1 to H Res 776 (which itself governed consideration of HR 83). The proposal had support from a number of unions, and opposition from others. It was drawn up by committee staff based for the most part on “Solutions, Not Bailouts” — a proposal introduced last year by the National Coordinating Committee for Multiemployer Plans (NCCMP), a group representing union benefit plans.

Amendment 1 covers multi-employer pension plans — plans that unions jointly sponsor with employer groups, overseen 50-50 by trustees appointed by the union and employers. Employers contribute under the terms of collective bargaining agreements, and the funds are invested so that the plans have enough to pay guaranteed monthly benefits when employees retire. All told, about 10 million people are in multi-employer plans, which are common in unionized construction, trucking, grocery, and service industries. They’re much easier for small employers to join up, and they’re much more stable than single-employer pensions, which fail when the single company fails. But today, many multi-employer plans are in crisis, thanks to stock market downturns and declining employment in union industries. Like single employer pension plans, multi-employer pensions are insured through the Pension Benefit Guaranty Corporation, but PBGC pays out only a fraction of promised benefits when a plan runs out of money, and PBGC is itself in danger of insolvency.

Amendment 1 would shore up PBGC finances by doubling the per-participant premium paid by multi-employer pension plans to $26 per person per year.

FULL story at link.

belzabubba333

(1,237 posts)antigop

(12,778 posts)mountain grammy

(26,623 posts)we better worry. the last time I used the term "white men in suits" I got an alert, but the truth is, these men have lost any and all touch with working people trying to retire on a damn pittance which can be reduced at any time.

midnight

(26,624 posts)to pay guaranteed monthly benefits when employees retire."

Or I should say who gets to invest them? Wallstreet?

former9thward

(32,017 posts)Badly, sometimes.

Recursion

(56,582 posts)If they don't invest them then there's no sense taking them in the first place.

blackspade

(10,056 posts)and now there has to be a 'reduction' to maintain 'solvency.'

Right..... ![]()

former9thward

(32,017 posts)The Unions dictated where the money went. They could have put it in T-Bills if they wanted.

blackspade

(10,056 posts)Wall Street then crashed the economy causing pension funds lose massive amounts of value.

They have not recovered.

So yes, as has been detailed for the last 6 years in a variety of places, Wall Street ripped these pension funds off.

former9thward

(32,017 posts)No one made them do it. They could have invested in T-bills. And Wall street has recovered. The Dow is at its highs.

blackspade

(10,056 posts)I'm not sure what your point is.

Are you saying that the trustees should have known in advance that Wall Street was going to crash the economy?

And yes, Wall Street has recovered, but that recovery was due to bailouts that were not passed on to shareholders.

There is a wealth of info out there detailing this stuff.

A HERETIC I AM

(24,370 posts)Unfortunately, it is clear you don't understand any of it.

Sorry to say.

blackspade

(10,056 posts)Or are you just in snark mode today?

![]()

A HERETIC I AM

(24,370 posts)Last edited Sat Dec 20, 2014, 12:29 PM - Edit history (1)

"Care to clarify what I'm not understanding?"

Based on what you typed in your previous responses to this thread......all of it.

As an example, NO ONE that has any real understaanding of how a Pension Fund is invested, how they are managed and how they work in general would say;

Really? Invested in Wall Street, eh? In what fashion? Are they part owners of the actual real estate itself?

I get that you know Wall Street is a real place, but I don't see that you have any real understanding of what those nasty people who work there every day actually do.

Bullshit. "Causing Pension Funds...." Really? Which pension funds? All of them? Every sngle one? And how exactly did "Wall Street crash(ed) the economy"?

Do you understand that if you had a broad portfolio in September of 2007 and made absolutely no changes whatsever over the last 7 years, your balance would be higher today than it was then?

So by what mechanism exactly is it that you are relying on to posit "They have not recovered"?

More bullshit. I know it sounds great and it perfectly suits your righteous indignation, but the New York Stock Exchange and "Wall Street" is not a thinking, calculating, vengeful entity. It's a street with buildings on it. Are there crooks that work there and in the securities industry at large? Without a doubt. Was there criminal activity in the last decade and before? Absolutely. Is the downturn/recession/bad times as well as the difficulties some pension funds are now experiencing SOLELY the responsibility of "Wall Street"?

No. No they aren't.

And FWIW, the article in the OP refers to a way to keep the pension funds in question SOLVENT

Perhaps the alternative would be preferred?

blackspade

(10,056 posts)All you did was pick at my opinions with your own opinions.

So enjoy them, because your own 'righteous indignation' at critics of Wall Street is falling on deaf ears.

joeglow3

(6,228 posts)Were they stupid and pulled it out at the lows?

WinkyDink

(51,311 posts)steve2470

(37,457 posts)countryjake

(8,554 posts)WorseBeforeBetter

(11,441 posts)mythology

(9,527 posts)Is the underfunding due to the decrease in union membership and due to people living longer/having more health needs due to living longer, or were the companies underfunding the pensions?

But if the options are getting some of what you were promised, as opposed to none, I guess it's better for retirees to get a percentage.

But if we had a more functional government I think the correct solution would be to have the government fund the pensions where there is a gap, but that would create an incentive for companies to cook the books to look broke and shift the retirement off onto people.

Again if we had a more functional government, the better solution would be to take employment out of retirement funding so that a company couldn't either intentionally or unintentionally leave their retirees out in the cold. But I don't trust Republicans to not then cut those benefits.

Omaha Steve

(99,658 posts)I hope they chime in.

Most of this is companies not keeping up with their contracted pension payments. Rmon$y types come alone and raid the pension funds. Sell what is left of the company without caring about what they are doing to the little people that worked a career giving blood, sweat, and yes tears to the company!

OS

NoJusticeNoPeace

(5,018 posts)will run out of accomplices and then something will be done.

former9thward

(32,017 posts)These were union run. In some cases union membership decreased. For example the Teamster Central States fund has 5 retirees for every one still working. That is completely unsustainable. In other cases the money was invested badly. In a few cases criminal activity occurred such as when the Teamsters invested in Las Vegas hotels run by mobsters.

Omaha Steve

(99,658 posts)former9thward

(32,017 posts)They are multi-employer funds. The definition of multi-employer funds are those that are union based not company based.

Omaha Steve

(99,658 posts)Bottom of the article. I'll be back later.

http://www.nationaljournal.com/congress/labor-unions-accuse-congress-of-sneak-attack-on-pensions-in-lame-duck-20141208

Opponents—including the United Steelworkers union, the Laborers' International Union of North America, the AARP, and the Pension Rights Center—suggest that such a major decision by Congress should undergo hearings and other public airings and not be made in the waning days of a lame-duck session as an attachment to a spending bill. Some opponents have even issued alerts in recent days to their members to call their lawmakers.

And cutting retiree benefits is not the only element of the "Solutions Not Bailouts" plan that is drawing fire. There is opposition to other changes, including what some groups are calling a "pension tax." As being described, it would raise the multiemployer plan premium to PBGC from $13 per participant for 2015 to $40.

"Making sweeping changes to current pension law that will affect millions of retirees without the benefit of the regular process in Congress—no hearings, no mark-ups, and no public release of the text of the legislative language now evidently being considered, and in a lame duck session no less, is extraordinary and dangerous," said Newton Jones, president of the International Brotherhood of Boilermakers, Iron Ship Builders, Blacksmiths, Forgers and Helpers, in a letter Monday to House and Senate leaders.

Not all unions necessarily opposed the plan, though. The International Brotherhood of Carpenters and Joiners of America, in a letter Monday to lawmakers from its general president, Douglas McCarron, wrote that this proposal "protects taxpayers by avoiding a massive taxpayer funded bailout that could cost billions." He also noted that all of the plan's decisions require buy-in from both labor and management.

"The longer we wait, the more severe the impact on retirees and workers will be, especially those who are part of plans in the worst financial shape," the letter argued.

This article appears in the December 9, 2014 edition of NJ Daily.

former9thward

(32,017 posts)I understand the opposition of the Steelworkers, etc. They don't want to pay the increase in the per capita tax for funds they manage. But that money is needed to keep the PBGC solvent. Currently they have a project deficit of $42 billion and they have put their odds of going broke by 2025 at 90%. If that happened the maximum PBGC pension payment would drop to $1500 a year. That would be a disaster.

Omaha Steve

(99,658 posts)

http://search.pbgc.gov/search/InsuredPlans/InsuredPlans?query=&ipcol=nc&filter=c&tab=ip&ip_type=c&page=1

The plans on this list are managed by a plan administrator, not PBGC, and we do not have the names of individual workers and retirees in these plans. We have only limited information about these plans, drawn from their premium filings. More information is available in their required reporting to the U.S. Department of Labor. If you have questions about your plan's provisions or your specific benefit, call your plan administrator at the phone number provided.

To find out for sure if your pension plan is insured by PBGC, ask your plan administrator for a Summary Plan Description. The Summary Plan Description states whether your plan is covered by PBGC.

If you have called your plan administrator and still need help from PBGC, please call our Participant Customer Contact Center at 1-800-400-7242. If you are a plan administrator and have questions about this list please contact our Practitioner Contact Center at 1-800-736-2444.

Lower right: Download List of Insured Plans

Single-Employer List

Sorted By Plan Name

Multiemployer List

Sorted By Plan Name

former9thward

(32,017 posts)employer plans and multi-employer plans. I get a pension from the PBGC because I worked at one employer (Republic Steel which became LTV Steel) and when they went bankrupt they turned over their plan to the PBGC. The PBGC employer based plans are in better financial shape than the multi-employer ones.

Omaha Steve

(99,658 posts)doc03

(35,344 posts)little over $500 is a multi-employer plan the (Steelworkers Pension Trust) which I think is funded pretty well. I get a $200 pension from the PBGC from a plan that was terminated back in 1985. I get an $1100 pension from the former owner of the company that the PBGC froze in 2003. Since I retired 4 years ago the percentage of funding in that Defined Benefit Plan has dropped every year, I think it was around 70% last year. The company has somehow gotten a waiver from the IRS for funding the last few years claiming hardship but they are making big profits. The Steelworkers Pension Trust was originally a fund set up for small employers but over the years as imports and union busting killed off the Defined Benefit Plans and dumped them on the PBGC they have been picking us up. The way I understand it the Defined Benefit Plans are insured buy the PBGC up to a pretty high limit. But I believe only about 30% of the multi-employer benefits are covered by the PBGC. I get a report that explains it every year but unfortunately I haven't kept them. So after 40 years I get a little over $1800 a month and every one of them is potentially on the chopping block. Oh we also lost our health insurance when the company liquidated a couple years ago. Fortunately I was only 8 months from Medicare so I made out fairly well. I ran into one of my co-workers yesterday his wife is not 65 yet and he said he pays $1400 a month for her insurance.

Omaha Steve

(99,658 posts)It would also allow severely underfunded plans (those expected to run out of money in 20 years or less) to reduce benefits for existing retirees — if that would prevent the plan from becoming insolvent. Plan trustees would not be allowed to cut benefits for disabled retirees or retirees 80 years or older. And the cuts for retirees ages 75 to 79 would be less than younger retirees. Benefits could not be cut to a level below 110 percent of PBGC’s minimum benefit, but that could still be a pretty hefty cut. And the consequences could be widespread: Up to 3 million people are in plans that are regarded as severely underfunded.

One part of Amendment 1 came at Miller’s insistence, and was not part of the Solutions Not Bailouts proposal: In plans with more than 10,000 participants (retirees and active workers), participants would have a chance to vote to reject the proposed cuts. But the cuts would only be rejected if more than 50 percent of participants voted against them, not 50 percent of those voting. Even then, the U.S. Treasury Department can override the vote and go forward with the cuts if it concludes that impending plan insolvency poses “systemic” risk to PBGC.

The legislation was supported by the Building Trades of North America, as well as Associated General Contractors; United Association of Plumbers and Pipefitters; International Union of Operating Engineers; International Union of Painters and Allied Trades; United Brotherhood of Carpenters; Service Employees International Union; and United Food and Commercial Workers, as well as Kroger Corporation.

“This is a tool for trustees of plans that can be made solvent long-term,” said Randy DeFrehn, executive director of NCCMP, the multi-employer trade group that originated the proposal. DeFrehn said a bailout, or other fixes, might have been preferable, but when the Democrats were in charge of the House, his group was unable to get anywhere with proposals for the government to step in to guarantee the PBGC. “I think the Republicans did this because they don’t want … PBGC to go bankrupt and have to write a $40 or $100 billion check in the future.”

doc03

(35,344 posts)a good part of the problem came from the deregulation of the trucking industry and union busting. I worked in the steel industry

as steel companies were driven out of business from illegal steel dumping many of us also lost our company DB plans and were dumped on the PBGC. After that the Steelworkers Pension Trust ( a multi-employer plan) picked us up. As of last year's report that plan was in good shape. It all goes back to Reaganomics.

former9thward

(32,017 posts)Jimmy Hoffa used Teamster pension money to "invest" in Las Vegas hotels run by mobsters. The very same mobsters that put him into office starting in the late 1940s. The history of Teamster pensions is criminal and a scandal.

I worked in the steel industry also. There was certainly no union busting there. I remember going to D.C. during the Bush administration for a Steelworker Union demonstration asking the government to impose tariffs on imported steel. Bush did exactly what the union asked him to do. Steel was done in by global competition by countries which don't allow any effective unions such as China.

doc03

(35,344 posts)relations with Cuba and how they don't have any human rights and freedom. Well what the fuck is with China? We made a living wage in the steel industry and had to compete with China making 50 cents an hour. There wasn't union busting in the steel industry that is what that free trade stuff is all about.

doc03

(35,344 posts)remember how we begged Bill Clinton for years to do it and he did nothing. Before Clinton left office there were 40

major steel companies that liquidated or went chapter 11. Then the day after Bush put tariffs on he commenced in giving waivers on

hundreds of steel products. That is the main reason I am not too excited about getting another Clinton in office.

Hissyspit

(45,788 posts)spanone

(135,844 posts)nc4bo

(17,651 posts)Fucking ratfuckers.

![]()

![]()

WillTwain

(1,489 posts)lobbied for the bill. This cannot be lost in the story. I voted for the man twice so he could attack my pension.

doc03

(35,344 posts)that around his neck just as they did when Clinton signed NAFTA (a Republican plan).