Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsElizabeth Warren allies march outside Citi: 'Break big banks'

Elizabeth Warren allies march outside Citi: 'Break big banks'

11/18/14

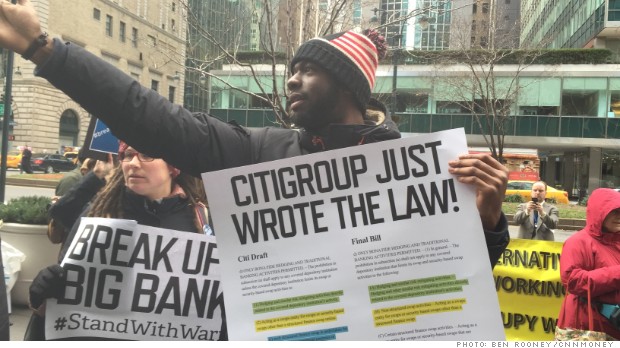

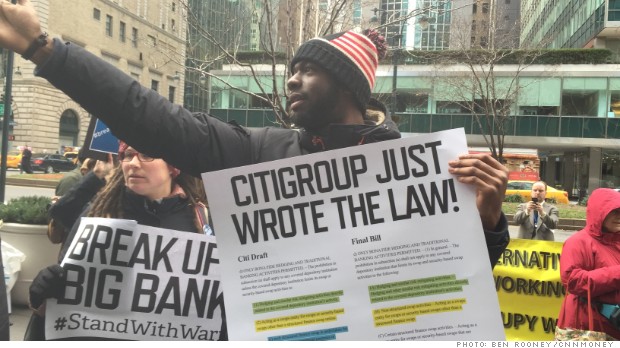

A group of protesters gathered outside Citi's headquarters in New York chanting "break big banks."

Made up largely of Senator Elizabeth Warren's supporters, the protesters on Thursday specifically targeted Citigroup (C) because of the bank's role in watering down Wall Street regulation.

We need to break up the big banks that have too much power in our democracy," said Tim Hernandez-Tarafas, one of the protest organizers. "They literally wrote the law and Washington let them do it."

Warren, a Massachusetts Democrat, has blasted her fellow lawmakers for passing legislation that undoes a central piece of the Dodd-Frank financial reform law.

"I believe banks have too much concentrated power in our democracy and we want it back," said Emmett Grant, pictured below, a 52 year-old from Mount Vernon, NY.

Organizers called for a modern day Glass-Stegall Act, the 1933 legislation that separated the money lending banks from investment banks. They claimed to have 15,000 signatures on a petition calling for this sort of law to be reinstated...

http://money.cnn.com/2014/12/18/investing/citi-protest-elizabeth-warren-break-banks/index.html

11/18/14

A group of protesters gathered outside Citi's headquarters in New York chanting "break big banks."

Made up largely of Senator Elizabeth Warren's supporters, the protesters on Thursday specifically targeted Citigroup (C) because of the bank's role in watering down Wall Street regulation.

We need to break up the big banks that have too much power in our democracy," said Tim Hernandez-Tarafas, one of the protest organizers. "They literally wrote the law and Washington let them do it."

Warren, a Massachusetts Democrat, has blasted her fellow lawmakers for passing legislation that undoes a central piece of the Dodd-Frank financial reform law.

"I believe banks have too much concentrated power in our democracy and we want it back," said Emmett Grant, pictured below, a 52 year-old from Mount Vernon, NY.

Organizers called for a modern day Glass-Stegall Act, the 1933 legislation that separated the money lending banks from investment banks. They claimed to have 15,000 signatures on a petition calling for this sort of law to be reinstated...

http://money.cnn.com/2014/12/18/investing/citi-protest-elizabeth-warren-break-banks/index.html

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

8 replies, 1637 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (41)

ReplyReply to this post

8 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Elizabeth Warren allies march outside Citi: 'Break big banks' (Original Post)

RiverLover

Dec 2014

OP

Teddy Roosevelt broke up the trusts. It's time to break up the "too big to fail" corporations,

Faryn Balyncd

Dec 2014

#2

This is Bill Clinton's take on it, looking back, after signing the repeal of Glass-Steagall.

RiverLover

Dec 2014

#8

ucrdem

(15,512 posts)1. Stand with Warren?

That sounds awfully familiar. . .

Faryn Balyncd

(5,125 posts)2. Teddy Roosevelt broke up the trusts. It's time to break up the "too big to fail" corporations,

starting with the big banks that are now using their powers to write the laws.

RiverLover

(7,830 posts)3. Even a former Citi CEO says break up big banks

Sherrod Brown with Vitter attempted this is 2012, but the bill failed.

Elizabeth Warren sponsored a bill to break up big banks in 2013, it failed.

Bernie is calling for it again right now~

Break Up Big Banks, Sanders Says as Senate Debates Bill to Gut Wall Street Reform

http://www.sanders.senate.gov/newsroom/recent-business/break-up-big-banks-sanders-says-as-senate-debates-bill-to-gut-wall-street-reform

But we have to SUPPORT their efforts against the Wall Street Rethugs & dems.

Faryn Balyncd

(5,125 posts)6. As has Paul Volcker, the most successful Fed Chairman in history.

Volcker ... was Chairman of the Federal Reserve under Presidents Jimmy Carter and Ronald Reagan from August 1979 to August 1987. He is widely credited with ending the high levels of inflation seen in the United States during the 1970s and early 1980s. He was the chairman of the Economic Recovery Advisory Board under President Barack Obama from February 2009 until January 2011.....

Volcker was an economic advisor to President Barack Obama, heading the President's Economic Recovery Advisory Board. During the financial crisis, Volcker has been extremely critical of banks, saying that their response to the financial crisis has been inadequate, and that more regulation of banks is called for. Specifically, Volcker has called for a break-up of the nation's largest banks, prohibiting deposit-taking institutions from engaging in riskier activities such as proprietary trading, private equity, and hedge fund investments.

http://en.wikipedia.org/wiki/Paul_Volcker

Volcker was so good that after he became Fed Chairman and began to bring the inflation of the 70's under control, Reagan re-appointed him. Obama sought and heeded his advise during the financial crisis through 2011, appointing him to head the President's Economic Recovery Advisory Board.

Unfortunately, Volcker's advice to break up the largest banks has not been heeded, and restrictions on risky banking activities are now being reversed (risks which have and likely will result in future bailouts paid for again by the 99%).

Volcker left the board when its charter expired on February 6, 2011, without being included in discussions on how the board would be reconstituted.

http://en.wikipedia.org/wiki/Paul_Volcker

RiverLover

(7,830 posts)8. This is Bill Clinton's take on it, looking back, after signing the repeal of Glass-Steagall.

And then he tried to walk it back, after Rubin & Summers went nuts. Oops, he accidentally told the truth!

turbinetree

(24,703 posts)4. No More

No More

We are not going to be couch potatoes anymore.

All you hypocrites that voted for this, your 174,000 dollar taxpayer job is gone, your 244 day vacations gone.

You will not be able to hide behind door anymore and have a lobbyists create and pull the strings, we are really tired of this stuff, really tired, and we will NOT take anymore, just watch

![]()

![]()

![]()

![]()

WillyT

(72,631 posts)5. K & R !!!

ananda

(28,866 posts)7. I stand with Warren!

...