General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThese Are the 13 Cities Where Millennials Can't Afford a Home

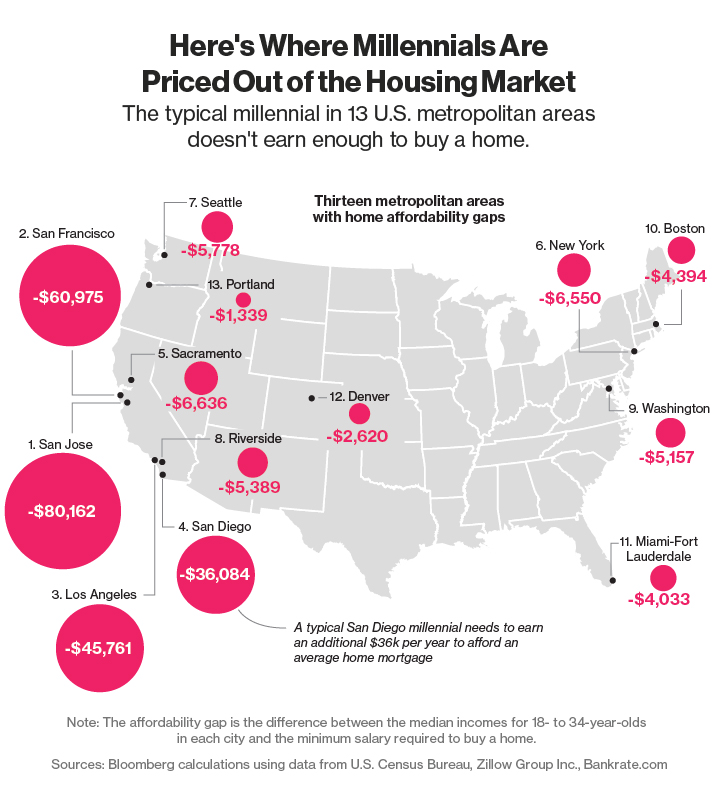

These Are the 13 Cities Where Millennials Can't Afford a Home

Soaring home prices and stagnant wages combine to make home-buying in some cities a pipe dream for young adults

(Bloomberg) There's no place like home — except when you can't afford one.

Millennials have been priced out of some of the biggest U.S. cities, with residential real estate prices rising even as wage growth remains elusive.

Bloomberg used data from the U.S. Census Bureau, Zillow Group Inc. and Bankrate.com to quantify how much more money millennials would need to earn each year to afford a home in the largest U.S. cities. The good news is that out of 50 metropolitan areas, 37 are actually affordable for the typical 18-34 year-old.

The bad news is that the areas that often most appeal to young adults are also the ones where homeownership is the most out of reach.

The biggest disparities are on the West Coast. Take the three Californian hubs of San Francisco, San Jose (the heart of Silicon Valley), and Los Angeles (where a developer is trying to sell one of the biggest homes in U.S. history for a record $500 million). The typical young adult in those cities doesn't even make half of what's needed to afford a home. .................(more)

http://www.bloomberg.com/news/articles/2015-06-08/these-are-the-13-cities-where-millennials-can-t-afford-a-home

leveymg

(36,418 posts)that pays enough to live like an early career graduate used to. Most Bachelors degrees are practically without value these days, except that they are required for virtually all "professional" jobs.

It's also an extraordinarily difficult job market for most people over 50, regardless of experience. Employers want fully qualified people who don't have to be paid more than median salary, except the IT and financial industries.

Go Vols

(5,902 posts)My 26 year old made over 100k last year with no college.

leveymg

(36,418 posts)

yeoman6987

(14,449 posts)That is a problem the DNC and Democratic Party needs to fix. Democratic cities should be the fairest cities in the United States.

haele

(12,659 posts)Areas also tend to be separated more on religiosity than straight-up politics, which makes the republican/democratic split less distinct in the city. Lots of old-school republicans and democrats in the city who aren't willing to just vote party line if faced with what they think is radicalism. But the city does tend to vote center-left if the developers don't get involved in a ballot cause.

Also, the military influx can skew both politics and the cost of housing.

In politics, while most enlisted tend to be democrats and a bit more liberal, most officers are republicans and a bit more conservative. Frankly, the officers are more likely to make a homestead in the area than the enlisted, so they're more likely to vote locally.

In cost of housing, the military encourages living on the economy, so they provide their members with a housing and cost of living allowance that encourages landlords and relators (who know very well what the allowance rates are) to keep housing prices high because even though most military and locals make the same amount, the military families will get up to an extra $2K or more a month tax free to rent or make a mortgage payment on. The military population with that subsidy may only be just shy of 95000, but they make a big impact on the economy and the politics - especially counting the at least 500,000 to 600,000 more retirees who are also collecting similar amounts in some sort of post-retirement allowance or full retirement from the military in addition to their other wages, which many landlords figure in when establishing rents locally. This really prices locals making the average who are not military or retirees out of the market.

Haele

WHEN CRABS ROAR

(3,813 posts)Rents for converted garages in the Pacific Beach area are now 2,000 - 2,500 a month! That's for a converted garage, not for an apartment or a house. We moved to Oregon ten years ago and never looked back.

1939

(1,683 posts)haele

(12,659 posts)don't get. Most of my co-workers are military retirees, and get anywhere from $1200 to $3000 a month from their retainer or retirement on top of what they're making at a civilian job.

It's not an allowance, but a 45 year old retiree will take a follow-on job as an engineer or manager, and will typically just plunk retainer into the mortgage payment or in his/her kid's college funds. Not to mention all the other VA benefits and the Tricare medical and dental benefits that go with being able to last 20 years.

I retired after 10 years of Navy Reserves with 10 years prior Active Duty Navy (so I've got max points for my time in service). In 3 1/2 years, I'll be getting 40% of my base pay as it was in 1999 (when I was officially retired) - which gives me an automatic retirement payment of around $1400 a month (maybe more), and I'll be eligible for any COLAs from that point on. If I let them take out $250 or so a month until I'm 70, my spouse and any custodial dependents (we have custody of a grandchild who's just turning 4, so that is an important consideration) I have are eligible for my VA survivor's benefits, which will be half that.

Plus my dependents and I will be eligible for Tricare for Life and a few other benefits (especially MWR) that lower our monthly and annual out of pocket costs in our normal day-to-day life.

My point is, there are very few careers that have that sort of benefit available to that majority of the workforce that is able to stay employed with one organization that long. And in military towns, everyone who makes money for providing a critical service knows that if there's a large military presence, they've got in effect a captive customer base in which there is an established cash flow threshold to set prices to.

So they can jack up rental rates; they know there is a reasonable chance that there will always someone looking for rent who has a reliable cushion of "extra money" to pay the rates they set without too much complaint.

We were renters for a long time. We have experienced first hand the difference of treatment potential renters got from property managers - there were always hemming and hawing, questioning of whether or not you could keep up with the lease, showings of substandard "affordable" properties - until they saw the military I.D.

Then, hey - you could rent the property you want, and who cares what your credit score might be. They'll even give you a 2% discount the first year to make up for the 4% rent hike you'll experience the every year after - thankyouforyourservice.

Haele

Chathamization

(1,638 posts)It's become a major issue here, and there's been progress, especially recently.

econoclast

(543 posts)The data compare AVERAGE home price to MEDIAN incomes.

Because lots of these markets have a high-end that is eye-popingly high, it skews the AVERAGE home price very high.

While there might be something to this story, I'd like to see what things look like comparing MEDIAN home price to MEDIAN incomes.

Note -I assume the median home prices are (a) readily available and (b) when using median home prices the story fizzles out ... Thats why they are using average not median home prices.

Gormy Cuss

(30,884 posts)But yeah, 'average' is totally wrong for this comparison.

econoclast

(543 posts)The graphic says "average home mortgage". And I naively thought they said what they meant.

Though the section on methodology also says it computes median home prices for "detached single family" houses. Yikes!!!!

Forget millenials ... I have made a very good living for a very long time and I would have a tough tome trying to afford a detached single family house in SF or LA or SD or NY. Condo or townhouse...no problem. But detached single family ... Nope.

Gormy Cuss

(30,884 posts)because attached housing (SFA) levels vary so greatly by metro area.A careful assessment would have at least footnoted the report to indicate differences in the medians when SFAs are included.

I agree, for this comparison the median should have included both SFDs and SFAs because SFAs are more common and more affordable in high cost areas than SFDs, thus likely to be more accessible as first home purchases.

frazzled

(18,402 posts)In terms of salary, the difference between Boston and LA is not nearly as great as the Bloomberg chart would suggest. Of course, maybe that is because the median millennial salary in Boston is way way higher than the median salary in LA. Populations differ greatly.

What I predict is increased migration to cities where housing is very cheap. We've already seen this story with respect to Buffalo. It's a chance for cities outside the coasts to develop some new talent. Perhaps we should see this as an important corrective in the demographics of the nation. Pretty soon, LA and SF will be filled with boring, upper income drones, while Kansas City and Cleveland develop vibrant art scenes. Should be interesting.

At any rate:

http://www.hsh.com/finance/mortgage/salary-home-buying-25-cities.html

marmar

(77,081 posts)..... artists fleeing the high rents in NY, Seattle, SF, Boston et all are moving in. The famed Galapagos art space left Brooklyn and set up shop in Detroit. So yes, there's an upside for the non-coastal cities.

It's what I had in mind.

Chan790

(20,176 posts)Specifically, Hartford. We're near NYC and Boston. We're a modern city in a liberal state with great home prices, LGBTQ-friendly laws, great social services and an established art-scene.

The way people turn up their noses at Hartford...you'd think the entire city smelled like sewage or something.

Artists and professional young millenials...come to CT! We'd love to have you.

1939

(1,683 posts)Art doesn't add much to the economy. Art doesn't provide much in the way of employment for the unskilled or semiskilled. Detroit needs a few dozen of the factories that are now in China or Mexico.

Bluenorthwest

(45,319 posts)It's not the future, the future is now.

alarimer

(16,245 posts)Both are subject to skewing by higher salaries and prices.

But I think the larger point still stands. Housing is unaffordable in most places, to most people with normal salaries.

on edit: I see that they actually did that, they were just sloppy in labeling.

canoeist52

(2,282 posts)No wonder we have three generations pooling their meager income and living under one roof.

tridim

(45,358 posts)snooper2

(30,151 posts)LOL

Tierra_y_Libertad

(50,414 posts)olddots

(10,237 posts)toss in robotics and we're really screwed .![]()

KamaAina

(78,249 posts)geek tragedy

(68,868 posts)Not sure of the exact percentage, but it seems likely that the vast majority of home buyers are two-income households.

AwakeAtLast

(14,130 posts)It took me 12 years to be able to afford a house after graduation from college. Thanks Bush 1!

But also I think housing prices are out of control. Double-edged sword.

CBHagman

(16,984 posts)I'm in the D.C. area and after 2001 prices went completely insane, and I'm not just talking about single-family housing, either.

1939

(1,683 posts)I graduated from college in 1961 and bought my first house in 1973. Should I thank JFK, LBJ, and Nixon??

Historic NY

(37,449 posts)but you can bet they could get a place in the burbs for a lot less.

SoCalDem

(103,856 posts)they team up with a couple more millennials and buy a fixer..live in it a few years and share the profit when they sell ![]()

My son and two friends did this 3 times in 4 years, and each ended up with a tidy sum to put down on their own places when they married and needed their own place![]()

Comrade Grumpy

(13,184 posts)jwirr

(39,215 posts)buy a home. Doesn't have to be a city.

Recursion

(56,582 posts)There's not a huge cohort of millennials making $7.25.

jwirr

(39,215 posts)a city thing.

Recursion

(56,582 posts)Seriously.

Is there really a section of America in which owning the place you live is kind of a normal thing? I have trouble imagining that.

I think of home ownership as like an insanely-rich-person bonus, which is why I kind of don't respond to "he lost his home" stories like I guess most of the nation does.

But, seriously: you guys think of owning the place you live as normal?

B2G

(9,766 posts)It's cheaper than renting and you get tax deductions. It's not "an insanely-rich-person bonus" in most of the country.

Recursion

(56,582 posts)It's just kind of unimaginable to this coastal guy...

JanMichael

(24,890 posts)We are well above any medians or means and we kept our mortgage low intentionally. Hence no special mortgage interest benefits to speak of.

The myth is there to entice people to spend what they are told they can "afford" which is insanely high. We could get a mortgage 4 to 5 times higher than our current one. No thank you.

This is all part of the giant swindling machine that is America.

geek tragedy

(68,868 posts)For homeowners in NYC the mortgage interest deduction essentially discounts the interest rate by 40% (28% federal and 10-12% state+local marginal rates).

So, if the interest rate is 3.5%, then the effective interest rate is 2.1%. The question then is pretty straightforward--do you expect the value of the home to appreciate greater than 2.1% annually?

If you do, you essentially live in the house for free--for every dollar you pay in interest expense, you earn at least one dollar in asset appreciation.

Go Vols

(5,902 posts)Most I know, own their own homes also.

Recursion

(56,582 posts)Go vols. How are you guys liking the SEC?

Go Vols

(5,902 posts)win the Women's College World Series/softball

Hopefully UT will play better football this year with their second year coach.

Starry Messenger

(32,342 posts)Renters get bubkis. I agree that it shouldn't be the default choice, but the structure of the taxes in the US really makes it practically the only thing a middle-class family can do to have an asset that (usually) appreciates and also allows itemized deductions.

In the Bay Area, it is definitely getting to be a luxury, but my mom, who raised two kids herself, is in her own home here in the Bay Area and we were not insanely-rich or even rich at all.

Recursion

(56,582 posts)I literally can't imagine a chain of events in which I would ever own a house. Rent is just kind of a given for me. ![]()

Starry Messenger

(32,342 posts)My husband and I rent. Most people could pay their mortgage in a non-coastal state on what we pay in rent for a 1bd.

I can't remember if you said you were a vet; I have friends who did buy up in Sacto with help from a veteran loan program. They are teachers, so they aren't rolling in it either.

Recursion

(56,582 posts)The professional situation kind of rules that out right now (we'll be on overseas assignments for the next 20 years or so), but even without that I think I'd have to move away from the coasts for it to be feasible, and I'm not really interested in that.

Starry Messenger

(32,342 posts)Rationally, I know we are just pouring money into nothing to rent here, but the jobs we do are here, and I can't imagine living so far away. I am a Bay Area girl at heart.

Recursion

(56,582 posts)And, for that matter, one of them is in Fremont, which is a place we'd be OK retiring...

geek tragedy

(68,868 posts)When you account for inflation, ownership is much more affordable--mortgage payments don't go up, rent does.

Recursion

(56,582 posts)Most of my friends worked at for-profits (I've almost never done that) and make about 3 times much as me (six figures or so -- I've always hovered around $50-$60K). A lot of them bought, and most of them are now underwater.

mortgage payments don't go up

They certainly can, depending on your mortgage.

geek tragedy

(68,868 posts)The risk position of renting is that you're long on the value of the dollar and short on inflation.

To me, that is a very risky position to hold long term. The rent always goes up.

Recursion

(56,582 posts)I enjoyed keeping that flexibility.

geek tragedy

(68,868 posts)My wife and I have zero plans/interest in moving--her professional practice is specific to NYC--so that cost is rather low for us.

Admittedly, we got very lucky--we bought in a then-underappreciated part of Brooklyn during the trough of 2009-2010. Our mortgage payment is less than the rent for apartments half the size of ours.

Recursion

(56,582 posts)And I probably would have done that if I had faced a similar situation. Good catch!

1939

(1,683 posts)Due to virulent inflation, for many folks ten or fifteen years into their thirty year mortgage,. property taxes made up a bigger portion of their mortgage payment than the principal, interest, and insurance parts did.

geek tragedy

(68,868 posts)was also increasing.

1939

(1,683 posts)There was virulent inflation the whole decade.

geek tragedy

(68,868 posts)

Romulox

(25,960 posts)Recursion

(56,582 posts)I mean, I know 2/3rds of households own their own home. I've just lived in DC, NYC, Boston, and the Bay Area, where that is a crazy idea.

Romulox

(25,960 posts)OK. Maybe read a book before making proclamations, then? Your personal experience is a limited data set.

Recursion

(56,582 posts)Romulox

(25,960 posts)1939

(1,683 posts)Can't imagine owning a car.

shanti

(21,675 posts)when i bought my first home, small and modest, in a suburb of sacramento. never thought i'd be able to do it, but i gave it a shot, and it just happened. it's had its ups and downs, but the equity really helped me out of a few jams, and it helps with taxes.

i suppose if you grew up with your parents never owning a home it might seem normal though. mine always did, so that was my norm...YMMV

Recursion

(56,582 posts)Just in time for the divorce (sad trumpets), but, yeah: it's just not something I grew up with.

obnoxiousdrunk

(2,910 posts)Right ?

Recursion

(56,582 posts)Some of my friends worked at for-profits (I've almost never done that) and have made three times as much as I did, in general, and bought a house. Most of them are underwater, even given how much more money they make than me. It just never seemed like a feasible plan for me, and I find it difficult to relate to the parts of the country where it's normal.

bunnies

(15,859 posts)The stars aligned with our jobs and I had prepared our credit. In a year we had saved up enough for a down payment. But nothing was left after that was paid. It was a very small window that I had to take advantage of. Bunnies Mr. lost his job the week we closed on the house. Our mortgage is $200.00 more a month than our rent was... but there are so many other bills we hadn't counted on. Heat is the worst thing. We bought an 18th century house. In NH. Its beautiful and I feel lucky to live here. In the summer.

We live week to week now. Again. We have to get a new roof this year or we lose our homeowners insurance. And we have to buy pellets and wood for the coming winter. Its thousands of dollars. I used to think $350 a month in the winter for gas heat was a lot. Now between oil, pellets and wood... we spend 3 times that.

The killer is: only a couple hundred dollars a month go to the principal on the mortgage. Over a thousand goes to the interest. I had no idea it worked that way. NOW I understand how easy it is to lose your home. 30 Years from now Ill be 72.

Its the American dream.

edit: and my credit score dropped 70 points. Across the board. Not a benefit.

Travis_0004

(5,417 posts)I love my house, and have a few acres where I can do what I want. My mortgage is 350 a month, so I dont have to be rich to afford it, and it will never go up.

I pay a bit more on the mortgage, so I will live here for free (just pay property tax), before I turn 50.

PasadenaTrudy

(3,998 posts)I know very few people who own. Starter homes in So. Pasadena run $600k on up. I never had enough money or interest. Also, everyone I know either teaches or is a fine artist.

Throd

(7,208 posts)All I could afford was a crappy house in a marginal (at times scary) neighborhood but it was the start I needed. I was able to use it as a starter home and then get a nicer one a few (6) years after that. Owning your home is not without its challenges and isn't for everyone, but for me, it beats the shit out of renting.

taught_me_patience

(5,477 posts)we don't have enough supply of homes for the growing population. Another, "I got mine FU" to the next generation by the boomers.

Recursion

(56,582 posts)in order to allow wider buildings. I said "why not just build up?" and that sank like a stone. The Victorian-style architecture that made since when SFO's population was 300,000 probably doesn't make as much sense now.

LeftyMom

(49,212 posts)Much of the city is on seismically unstable fill that isn't suitable for heavier structures than single family homes.

That's part of why tearing down Candlestick and condo developing the fuck out of Bayview Hunter's Point is going to be the big new gentrification clusterfuck.

nadinbrzezinski

(154,021 posts)this is not about millenials. It also affects working class, chiefly single women, who have to work two to three jobs just to scratch a living.

Omaha Steve

(99,649 posts)Great info.

IDemo

(16,926 posts)Nobody pays high enough wages for tech jobs to even consider home ownership in any urban area unless you're in a multiple income family.

Snobblevitch

(1,958 posts)KentuckyWoman

(6,679 posts)You want higher wages...... you support unions. Period. We been there done this already.

Instead Americans decided to tell union workers they were greedy moochers and ran off walk in closets fulls of slave labor made shit.

Remember the 80s? Outsource the jobs, destroy the unions, tell the union worker to haul their butts to college if they want to make a decent wage. Yadda yadda.

Now they stuck it to the college people and the outrage is in full bloom. Why on earth is anyone surprised?

Truth is Millennials are getting a shit deal all the way around and will likely never recover. Their parents will have it better than them at every stage of life..... generally speaking. Makes me very grateful I don't have kids. Leaves me more time to fight my fellow boomers for the well being of everyone's kids......

eridani

(51,907 posts)DesertFlower

(11,649 posts)could have afforded a home there unless we went to the burbs -- not the close burbs but the ones where it took an hour or more to get to the city for work. at age 48 hubby and i moved to phoenix where we bought our first home. it was a "down" market at the time ('89) and we got a new home (2400 sq. ft.) on 1/2 acre with swimming pool, spa and many other upgrades for $164,000.

we put 20% down. the interest rate was 9% and our payment was a little under $1300 a month. when interest rates went down we refinanced -- actually refinanced 2x. the first few years most of the mortgage payment goes toward interest.

before we bought we were getting killed with taxes. had a decent income between the 2 of us. accountant said "you've got to buy something".

my friends live in NYC -- they pay $3300 for a 1 bedroom -- no doorman -- nothing fancy amd that's a bargain. NYC is only for the rich now. even if you go to brooklyn or queens the rents are high.

hobbit709

(41,694 posts)alarimer

(16,245 posts)I've never made enough money to buy a house on my own. And at my current salary, I can barely afford rent in Annapolis. I have an MS in biology and work for a state agency. I've always worked in the public sector and people who say public employees make too much money are fucking LYING.

These things would be achievable with two salaries, but as an eternally single person, that has until recently been out my reach as well.

kiva

(4,373 posts)to get attention. What about "Here are 13 metropolitan areas where most Americans can't afford to live"?

noiretextatique

(27,275 posts)it is affecting everyone, including this baby boomer.