General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums"Eliminating" the national debt is an idea so stupid I don't even know how to start attacking it

http://www.msn.com/en-us/news/politics/in-a-revealing-interview-trump-predicts-a-%E2%80%98massive-recession%E2%80%99-but-intends-to-eliminate-the-national-debt-in-8-years/ar-BBrgMgZ?ocid=spartandhpJesus Christ on a pogo stick.

Does this fucking moron have any idea the havoc that would be brought down on every single retirement fund in the country if the national debt were actually eliminated?

Is this the inchoate nihilistic rage we're actually facing? Wanting to burn it all rather than acknowledge that Mayberry is dead? I seriously sometimes fear moving back to the States in 3 months.

Bad Dog

(2,025 posts)that he thinks it's that easy. Countries can't go bankrupt. If they could there wouldn't be any vulture capitalists.

former9thward

(32,046 posts)It called defaulting on their bonds. It has happened many, many times in history. How do you think Jefferson got over 800,000 square miles of French territory in North American for the modern equivalent of 59 cents an acre? Napoleon was bankrupt because of war expenses. It has happened many times before and since. See Greece which in return for bailouts was forced to put in place austerity measures and do fire sales of assets.

Bad Dog

(2,025 posts)Certain debts can be written off, but a country can't go bankrupt like a person. Which is why when most creditors excuse liabilities vulture capitalists swoop in and demand the full price of their bonds.

The vulture funds bought up billions of dollars worth of Argentina’s debt in the early 2000s when the country’s economy was on its knees and its people were suffering horrendous poverty. Defaulting on its debts was the only option. 93% of lenders agreed to reduce Argentina’s debt burden, and the country’s economy has recovered. But vulture funds have spent more than a decade demanding the full amount plus interest and penalties. The decade-long legal battle has been called the ‘debt trial of the century’.

http://jubileedebt.org.uk/actions/support-argentinas-fight-against-vulture-funds

If Argentina could have gone bankrupt those bonds would have been written off long ago.

1939

(1,683 posts)1. The French needed the money

2. They were afraid if they didn't sell it, the British were going to take it away from them militarily.

3. They would rather the US get it than the Brits.

4. They preferred to use their military resources to try and hang on to Haiti which they considered more valuable than the whole Louisiana Territory (they lost Haiti anyway to a slave revolt).

NobodyHere

(2,810 posts)5. The territory was already occupied and France didn't have the resources to push them out, rendering the land useless to France anyways.

CompanyFirstSergeant

(1,558 posts)...I would have sensed some relation to reality.

Recursion

(56,582 posts)It's basically saying "we don't think the US economy will grow"

eniwetok

(1,629 posts)Yet you seem to believe it's the opposite.

We should NOT have to expect the US government to be the main driver of the economy... except as a last resort. We've sabotaged our economy with free trade and deregulation of Wall Street and we can't keep holding it together with rubber bands and masking tape.

Recursion

(56,582 posts)You should really think about this a little more. Public debt is a good thing.

eniwetok

(1,629 posts)More empty claims like the one that all retirement funds will collapse.

I think you're the one who's displaying an appalling amount of ignorance.

PETRUS

(3,678 posts)But I'd be interested to explore your thinking on this. Why do you think a Federal budget surplus is a "good thing?"

eniwetok

(1,629 posts)When we speak of a "surplus" it can mean either there's no debt... and we collect more in taxes for a rainy day fund. States often do this.

OR it can mean on an annual basis we take in more than we spend and use the rest to pay down debt.

If it's the latter then YES I'd prefer to pay down debt. It's unconscionable that we've pissed away 17 trillion on ourselves since Reagan and refuse to pay for it... instead dumping the debt on our kids and grandkids. And it's unconscionable that we'll be taxing ourselves to pay 800 billion in interest in 10 years when we we may only be spending 20-25 billion on NASA.

The other problem with massive debt is it undermines our ability to deal with emergencies... either economic, defense, or military. It prevents us from expanding the safety net.

Massive debt was a trap the far right wanted to create as part of their Starve The Beast strategy. I want to break out of that trap.

PETRUS

(3,678 posts)If it's any consolation, you're not alone. There are a lot of people out there with similar misunderstandings. Let me introduce you to a few key concepts.

Money is not a resource. It's just bookkeeping that represents claims on labor and real resources. The Federal government is not financially constrained. It is the source of US dollars and can never run out. It borrows in its own currency. When it spends more than it taxes it adds money to the economy (creating wealth). When it taxes more than it spends it removes money from the economy (destroying wealth). The only real limitation to Federal spending is the availability of labor (plus skills and knowledge) and natural resources. Overspending would mean creating demand that can't be fulfilled (i.e., the labor and resources aren't there), in which case we'd see increasing inflation. That might be a time to run a surplus. Otherwise, the government can run deficits indefinitely.

There's much that logically follows, and other things to be said, but that should be enough to get you started and explain why your hand wringing is hooey.

Springslips

(533 posts)Understanding of macroeconomics is way too low in our nation. People tend to think in terms of microeconomics, which they deal with everyday, when looking at budgetary and monetary policy but it doesn't apply. There is also the connection between money and debt--both private and public--which is even harder to understand.

PETRUS

(3,678 posts)A public education campaign would be money well spent. Unfortunately, the people pumping funds into media on this topic are using their influence to inflame anxieties and spread bullshit.

Recursion

(56,582 posts)The Federal Government literally cannot stand in need of a US dollar. It's an impossibility. That's not what debt or taxes are about; they are about allowing fiscal policy to have an input on monetary supply.

whatthehey

(3,660 posts)There seems to be little love on DU for either investing that fund elsewhere or reducing its holdings. What other option is there if we eliminated that debt?

eniwetok

(1,629 posts)And the DI program would be in better shape if the interest rate for the SS trust fund were higher... but not by much.

https://www.ssa.gov/oact/tr/2015/III_A_cyoper.html#105731

In 2013 the fund received a mere 3.3 billion in interest... yet was running a deficit of 30 billion. So even if interest doubled to 6.6 billion... or tripled to 9.9, the fund would still be in trouble.

hollowdweller

(4,229 posts)I think we should reduce out debt to GDP ratio.

However if the US got the gov't totally out of the economy we'd be quickly passed by, by other countries whose gov't were involved.

The gov't is an important part of the economy. We'd have been totally fucked without the Fed in this last crisis.

However right now gov't is more involved in subsidizing low wages for the working class where it should be building infrastructure and education.

eniwetok

(1,629 posts)My position is that when working well, the public and private sectors bootstrap each other. So of course public investments are important. But the right has destroyed this balance and sabotaged the productive parts of the economy... our industrial base with free trade and have deregulated Wall St so it diverts money into pointless speculation... such as on commodities and derivatives instead of productive activities. As such the economy becomes more dependent on massive government deficits to prop it up which only creates more debt... which sabotages government's future ability to be that partner in creating infrastructure needed for economic growth. The right doesn't care about debt as long as those it represents, the rich and corporations, are doing fine... and government money isn't diverted to helping the American people.

hollowdweller

(4,229 posts)Adrahil

(13,340 posts)I'm a Keynsian at heart. And like Keynes, I think that sovriegn debt should be reserved for times of need. In times of plenty, run a balanced budget, or surplus. Pay down sovreign debt. Then, when the economy stumbles, intervenes like a big dog. Run big deficits and increase the debt to kick-start the economy.

If you are consistntly running deficits, even in good times, you are taxing too little, or spending too much (or both). IMO, we tax the very wealthy WAY too little.

hollowdweller

(4,229 posts)Every time a dem gets the deficit down in good times then a republican comes along and uses the surplus for tax cuts and throws us into deficit.

Then when the dem comes back in they use the excuse of the deficit to either shut down the gov't or put off needed spending.

1939

(1,683 posts)Dried up from the Dot-Bomb bubble bust before GWB's tax cuts took effect.

The surplus was largely driven by taxes on capital gains made in the frenzied trading of Dot Bomb stocks. Remember "irrational exuberance"?

Take a look at a graph of federal income tax receipts, they always spike at stock market peaks as people are "earning" capital gains.

Income inequality graphs also have spikes at these peaks caused by capital gains being recorded by the top taxpayers.

Adrahil

(13,340 posts)eniwetok

(1,629 posts)I too am a Keynesian and we are taxing at too low a rate. The corporate Dems have joined the GOP in sabotaging the economy with free trade and seem to want to disguise the lower wages with irresponsible tax cuts.

Recursion

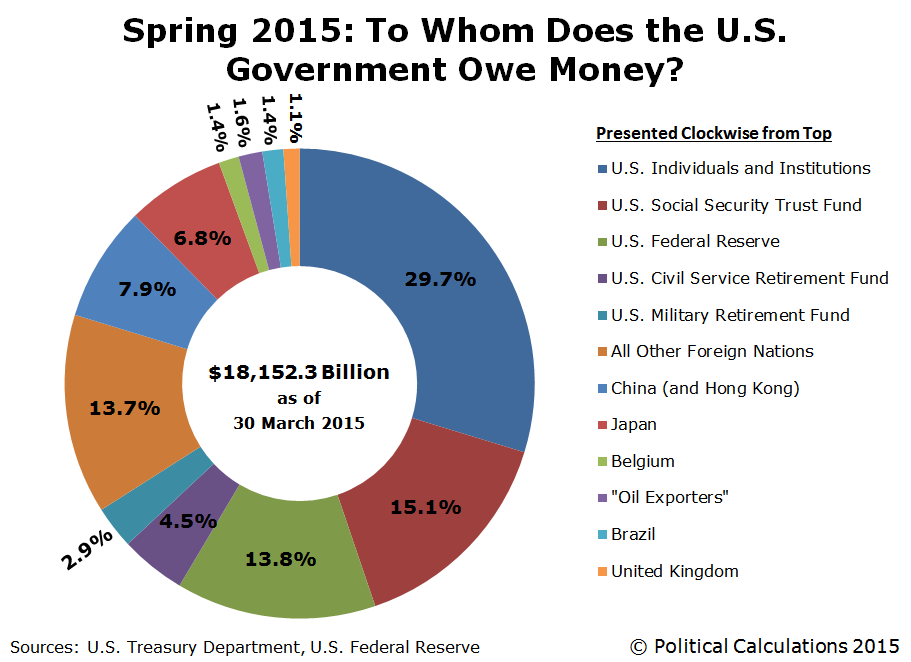

(56,582 posts)First off, actually eliminating the debt would mean SSA would be either sitting on a pile of cash (which is about the dumbest thing the government could do with cash) or investing in private equities and debt, which is problematic (and currently illegal).

Furthermore, driving nearly $20 Trillion out of the public debt market into the private debt market means private debt would be more expensive, lower yield, and riskier.

Adrahil

(13,340 posts)Spent of debt maintenence to strengthen social security and expand benefits. Right now, a great of that money goes to non retirees. If your concern is retirees, let's cut out the middlemen.

We're told that we can't strengthen SSI becuase we can't afford it. Well, let's be able to afford it!

geek tragedy

(68,868 posts)world wide wally

(21,749 posts)geek tragedy

(68,868 posts)Volaris

(10,273 posts)Short of that, those people are MorAns.

MH1

(17,600 posts)Trump is a very competent marketing charlatan. (con man)

It doesn't matter what is reality, what matters is what people in his target market think is real.

melm00se

(4,993 posts)

eniwetok

(1,629 posts)If we don't slash the debt... interest may soon be $500 billion by 2020... $830 billion by 2026... or a total of about 5.7 TRILLION from 2017 to 2026.

https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/51129-2016_Outlook_Summary.pdf

In comparison NASA spending is expected to be about 20 billion in 2020.

Interest on the public debt is the biggest waste of money in the budget.

Recursion

(56,582 posts)Should we just work until we die?

eniwetok

(1,629 posts)When it comes to Social Security I'm FOR the fund getting a higher interest rate.

http://www.democraticunderground.com/10027720281

Maybe you should speak to those who disagree.

As for the premise of this thread... YOU are the one claiming paying off all the debt will sabotage everyone's retirement.

Does this fucking moron have any idea the havoc that would be brought down on every single retirement fund in the country if the national debt were actually eliminated?

I think that's a laughable claim you've done NOTHING to prove.

For instance here are the investments made by Calstr... a CA public retirement fund.

http://www.calstrs.com/portfolio-holdings-asset-category

I see NO holdings in US treasuries. They may be some but they don't even register. Yet this is one of your retirement funds YOU claim will be brought down if we pay off debt. So are you suggesting that we create MORE debt to help these funds of yours? So how would that work? We spend what we don't have to to create more debt? We slash taxes to create more debt? We've done both... and we've pissed 18 trillion on ourselves that we refuse to pay for.

geek tragedy

(68,868 posts)jamzrockz

(1,333 posts)Social security can lend said money to many other organizations that can make profit with the money they borrow from SS and still pay out enough money to sustain it. The US is havng to borrow money more often because the interest is going up and up as time goes.

To show how bad it is, we cannot even make payments on the interest without raising the debt limit. The debt is just unsustainable and the sooner we realize that,, the better for all of us.

Sadly most democrat are like you and think its OK if we stay the course with regards to current debt

geek tragedy

(68,868 posts)If someone is calculating what our true debt is, they can cancel that part out.

eniwetok

(1,629 posts)We spent that SS money as part of the general fund. It WILL have to be paid back as the trust fund IOUs come due... and the trust fund is predicted to be used up by 2034.

Recursion

(56,582 posts)Right, so we issue new public bonds on a $1 for $1 basis with the ones SSA redeems, meaning the retirees get paid without any increase in total national debt. That was literally the whole point.

There is literally no need for the national debt to ever be smaller than it is.

eniwetok

(1,629 posts)It's shocking to see the ignorance here on such basic matters as debt and finance generally. Yup... debt is a free lunch... we don't have to worry about it... or in this thread, that paying down debt will destroy every retirement fund in the nation.

pnwmom

(108,988 posts)eniwetok

(1,629 posts)Leaving aside the difference between public and intragovernmental debt... the OPs claim was that paying down... I assume the public debt would devastate every retirement fund out there. So are you agreeing with THAT claim?

So how would this work? That EVERY retirement fund depends on the shit interest it now gets from the government? SS certainly isn't benefiting from these ultra low interest rates... which have actually gone down as far as 1.25% in 2012 for new funds... and have been below inflation.

As for the intragovernmental debt... I doubt if it can ever be paid down since it's the repository of excess money collected by the government for certain programs like SS, and other retirement funds.

And the OP didn't touch on the fact that interest payments for the entire debt may go up to 500 billion by 2020... while NASA is projected to get a mere 20 billion. If debt is not paid down... a larger and larger percentage of government spending will be pissed away just in interest. It will be Starve The Beast on steroids.

hfojvt

(37,573 posts)and impocerous.

That would require massive tax increases and massive spending cuts. If that was even going to be a goal, it would make more sense to shoot for 50 years.

There was some talk in the late 1990s about the massive surplus that ate New York. It was so gimormous that they said it might eliminate the national debt. And then suddenly it evaporated within two years, and was replaced by 16 years of deficits, sometimes absurdly massive deficits.

So yeah, by now any talk of getting rid of it in 8 years is absurd. People proposing it and people buying such a proposal are not grounded in reality.

Recursion

(56,582 posts)And the fixed income market depends on the public debt.

Eliminating the public debt means nearly $20 Trillion would be chased into the private debt market (I suppose some of it might go to equities, but really probably not much at all; you don't move from low-risk low-yield to high-risk high-yield.)

What happens when that much money pours into a market? The prices go up, the yields go down, and the risks increase. That screws every single retiree.

eniwetok

(1,629 posts)SS can lend money to what organizations? By law it must be lent to the general fund and the government is now paying shit for interest.

ohnoyoudidnt

(1,858 posts)However, if these other suggested organizations are corporations, it sounds like a way for Wall Street to get their hands on that money. It's not likely going to be guaranteed to make a profit. It could even lose value. Which may be the reason for the law in the first place.

eniwetok

(1,629 posts)But most interest goes to pay for PUBLIC debt.

Volaris

(10,273 posts)Not sure what an effective alternative would be without discussing the subject, but that just seems asinine to me.

eniwetok

(1,629 posts)When it it comes to public debt... that interest rate is out of our hands.

But when it comes to paying interest on money we're involuntarily taxed for... in this case Social Security... then there should be a floor beneath which the rate can't fall... perhaps 4%. It's insane to see rates as low as 1.25% for new monies being added to the trust fund. This is criminal mismanagement of Social Security.

jamzrockz

(1,333 posts)1.25%, then something is really wrong and yet not one of the candidates running right now is talking about it. When it comes to the debt, the democrats have ceded that position to the republicans. Now any mention that something has to be done and people would start looking like you like you've gone crazy.

eniwetok

(1,629 posts)More on those ultra low interest rates SS is getting here

http://www.democraticunderground.com/10027720281

When 3 years ago I first started looking into the abysmal interest rates the SS trust fund was getting I wrote and called who I thought would be the most likely to want to protect SS... Liz Warren, Bernie Sanders, Sherrod Brown, etc. None of them, to my knowledge, has brought this topic up as a concern.

And, yes, too many Dems have bought into a new narrative on debt. Where liberal Dems were in favor of paying down debt in 2000... it seems most have done a 180... that we can have those irresponsible Bush tax cuts... as long as Obama targets just the top... and debt doesn't matter. I look at all that money being pissed away on interest and want to cry knowing it could be used for some worthwhile purpose. Too many Dems have bought into the idea that debt is a free lunch... even as this helps the Right's Starve The Beast strategy.

madinmaryland

(64,933 posts)What they don't realize is that government provides services that the private sector cannot or will not provide. When the country is in a deep recession, it is government (federal) that steps in by "borrowing" money to keep the economy afloat. Conversely, when the economy is roaring they should be going the other way. Unfortunately the repub's think the government should "tighten its belt" during a recession which only compounds the problem.

There are a couple of ways to pay down the debt, though I don't know if it would work. Reduce spending? Well I suppose if you cut the military budget in half that would be a start, but what about the millions of people who would lose their jobs? How about raising taxes on the millionaires and billionaires and transferring the wealth in this country back to the lower and middle classes in this country. We have had 40 years of trickle down econonics and it has been an abject failures. Tax the wealthy and provide them with incentives to invest in this country, rather than giving them massive tax breaks that allows them to stash trillions of dollars overseas.

Ghost Dog

(16,881 posts)...And tax not just income but also accumulated unproductive capital

And, of course, use the proceeds wisely (ie., in the present context, vote Sanders, just for a start).

melm00se

(4,993 posts)the federal government can and should assist but shouldn't the converse be true? When the economy is trending upward the federal government should be able to cut back?

Unfortunately that does not appear to be the case.

The federal government outspends its revenue year after year regardless of economic growth. That is not a long term healthy situation.

eniwetok

(1,629 posts)Before we can even think about paying down the national debt we first have to dig ourselves out of the deficit hole... and in FY15 that deficit was $439 BILLION. http://crfb.org/document/fy-2015-deficit-falls-435-billion-debt-continues-rise

Obviously Trump gets confused with with all those zeros in 18 trillion and seems to believe they don't represent real dollars. From the OP's link

"He insisted that he would be able to get rid of the nation’s more than $19 trillion national debt “over a period of eight years.”

hedgehog

(36,286 posts)karynnj

(59,504 posts)Even that analogy ignores that the majority of families, including the majority of them in good fiscal health, have debt in the form of a mortgage. So, even insisting on the false analogy, the criterion should be whether the debt payments are manageable given the income.

In fact, debt now is down to smaller part of GDP than it was in the Bush years. Yet, the same people speaking of too much debt were not concerned that in 2003, the second of the big Bush tax cut bills passed, that one including the gradual elimination of the estate tax -- even though we were already in two wars. At the time, various Democrats .. and economists.. spoke of how illogical it was to pass big tax cuts as the costs of Iraq and Afghanistan were rising.

In reality, it seems that the people whining about the debt do so only when Democrats are in power and what they are really fighting for is a model of government that has fewer goals. The most extreme would eliminate almost all social welfare and regulatory functions. They would eliminate more than the 3 departments that were one too many for Perry to remember. In fact, they welcome tax cuts that increase the debt - as the then increased debt can be used to justify cutting more spending.

The US has two competing mythologies - one in which immigrants pitched in to help each other (modern version can be heard in Elizabeth Warren's you didn't build this speech); the other rigged individualism.

NobodyHere

(2,810 posts)Recursion

(56,582 posts)We do.

This is why the Eurozone (and Puerto Rico's territorial status) are bad for them.

The Greek and Puerto Rican governments can stand in need of a Euro or Dollar. The US Government literally cannot ever "need" a dollar, because they are the source of dollars, and can create as many as they want at any time.

(Yes, there would be problems with that, which is the point: debt allows the government to spend while avoiding many of the problems that would come with having money right now.)

Trust Buster

(7,299 posts)Recursion

(56,582 posts)The public debt is the basis of the fixed income market, which is what retirees actually retire on.

No T-bills means private debt becomes more expensive, riskier, less stable, and lower yield. Why on earth would you want that?

We should pay our bills on a timely basis.

Why? I mean, do you actually have a reason for thinking that? If creditors are willing to lend the government money, why on earth should the government not take on a reasonable amount of debt, particularly since creditors are literally paying us to lend us money right now?

Trust Buster

(7,299 posts)Next time you talk to a retiree, ask them how well their investments have been doing for them these past 8 years. Low interest rates have killed their investments.

bullwinkle428

(20,629 posts)EVERY SINGLE ELECTION CYCLE.