General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsOBAMA ADVISER SAYS PRESIDENT WILL NOT EXTEND BUSH TAX CUTS, EVEN TEMPORARILY: ’100% COMMITTED’

Last edited Mon Jul 9, 2012, 10:07 AM - Edit history (1)

OBAMA ADVISER SAYS PRESIDENT WILL NOT EXTEND BUSH TAX CUTS, EVEN TEMPORARILY: ’100% COMMITTED’ | As House Republicans return to Washington to a vote on extending the 2001 and 2003 tax cuts for another year, Obama adviser Robert Gibbs insisted that the president would not support giving rich people another tax break. “Let’s make some progress on our spending by doing away with tax cuts for people who quite frankly don’t need them – tax cuts that haven’t worked,” Gibbs said during an appearance on CNN’s State of the Union. Obama is “100% committed” to that position, he insisted. White House Press Secretary Jay Carney made a similar pledge last month when he was asked directly if the president supports a temporary extension of the cuts, which expire at the end of the year. Carney said, “He will not. Could I be more clear?” Watch Gibbs:

http://thinkprogress.org/economy/2012/07/08/512612/obama-adviser-the-president-is-100-committed-to-not-extending-bush-tax-cuts/

UPDATE:

Obama To Call For Extension Of Tax Cuts For Middle Class

President Obama will begin pushing for a one-year extension of the Bush tax cuts for Americans making less than $250,000, reports the New York Times. The announcement from the Rose Garden Monday will signal the president’s emphasis on tax fairness as a major issue just four months from the election. Pushing the issue is also meant to make House Republicans look unreasonable as they move this month to vote on a full, permanent extension of all of the Bush tax cuts.

http://livewire.talkingpointsmemo.com/entries/obama-to-push-for-extension-of-middle-class?ref=fpa

NYC_SKP

(68,644 posts)Bush, I mean...

K/R!!!

.

had me laughing behind my computer! ![]()

Firebrand Gary

(5,044 posts)Thanks for the laugh, NYC_SKP

annabanana

(52,791 posts)I want very much for this to happen.

theaocp

(4,240 posts)on point

(2,506 posts)I believe it when I see it.

Let's hope a little backbone has finally grown.

hfojvt

(37,573 posts)He has not said what he will do about Bush tax cuts for "people making less than $1,000,000". Which would be about 99.5% of the Bush tax cuts. Even Obama's original plan, extending them for incomes below $250,000 extends about 73% of the Bush tax cuts.

Personally I don't want to extend more than about 20% of the Bush tax cuts. Or say the 17.3% of them that goto the bottom 60% of us.

Tigress DEM

(7,887 posts)A lot of the $250,000 range are the small business owners who are struggling to survive and treat their employees well at the same time. Below $250,000 is most of the population. ( 98% according to Tax Statistics)

People earning above $250,000 a year, Millionaires and above can fend for themselves. They have been sharing in approximately 700 billion a year in tax cuts. People making over a quarter of a million won't face the same hardship decisions as people under that line do, but they will be financially affected more than their millionaire/billionaire counterparts.

Most of us aren't greedy. The money that comes back to the 98% is going to go back into the economy or into a reserve fund to handle emergency situations. If we can pay for a roof over our heads, put gas in the car to go to work and still feed and clothe our family in a decent manner, we'll scrimp and save or work harder to get the extras.

<snip>

...tax rates for the rich (sic have) decline(d) over the past decade, primarily due to the Bush tax cuts of 2001 and 2003. About 2/3 of the dollar value of those tax cuts went to the top 20 percent of income earners. Drilling down further on the Bush tax cuts, we find that about 20 percent of the benefit, or tens of billions of dollars, went to the top 0.1 percent of earners.

hfojvt

(37,573 posts)If tax cuts are extended for all incomes below $250,000, then those who make MORE than $250,000 still get tax cuts on their first $250,000 in income.

If, on the other hand, tax cuts are only extended for incomes above $80,000, then those who make more than $250,000 will have to pay higher taxes on their income between $80,000 and $250,000.

As for that poor, poor small businessperson making $160,000 a year who has to pay higher taxes on $80,000 in income. Well, in 2010 I made about $11,000. In 1997, I owned a small business with gross sales of about $18,000. So a business with net income of $160,000 does not look very small to me, and it is really very, very hard for me to feel sorry for a person making $160,000 a year who has to pay a whole 1.5% more of their income in taxes.

Especially since they will get it all back and more from the accursed payroll tax cut which is likely to be a permanent gift to the rich.

In 2009, almost 80% of households made less than $100,000. Over 90% made less than $150,000.

Tigress DEM

(7,887 posts)It isn't about feeling "sorry" for anyone, as much as understanding small business management and the break thru phase where a business is getting really successful and starts having to lay out more cash and hire more employees, which is all good, but major changes to their finances or tax structure could make the difference between expansion and laying people off.

Also that may "seem" like a lot of money and I'd be happy to have it if it were me, but if we can get the bar even that low it will make a huge impact. It's a concession of sorts, to keep pounding away at the rest of the structure that diverts all breaks to the uber rich.

I think the tax structure has been set up to keep those without family money out of the big time. By taxing people in the $175,000 - $300,000 range at $35 percent a group is set up to think they are unfairly taxed - and they probably are because there are so many loopholes and cheats higher up in the system.

The "sweet spot" for rich folk paying taxes is found in the AMT Alternative Minimum Tax at $447,800 where you get your DEDUCTIONS at 35% but only pay 28% tax on the remaining income. (See AMT link above for details)

I don't think the Payroll Tax Cut helps the employer as much as the employee. <snip> For 2011 and 2012, employees will pay 4.2% of their wage earnings for the Social Security tax, instead of the normal 6.2% rate. Employers still pay the full 6.2% rate.

I'm sure there is more to it, but the point is to put more money in the hands of people who actually work for a living. THOSE are my people. lol.

Tig

MannyGoldstein

(34,589 posts)I can see some issues, such as not being able to deduct capital equipment right away, but that could be dealt with.

Tigress DEM

(7,887 posts)They are also usually in a community with the taxes they do pay going back into the community where they are based.

Say you have a "small business" like a local chain of 3 restaurants that employs around 50 people in total, they may be required to provide medical insurance or just want to do it to treat their people right. Tax breaks for this segment of the business community makes sense because a lot of them are at the "break thru" phase where their business is growing and changing and can come apart if lots of financing changes happen.

Besides the more "small businesses" in a community there are, the less big box chains make off a community and their tax dollars go back to the state of origin where the corporate office is located.

Tig

DCBob

(24,689 posts)He knowingly went against his word for the sake of the economy which was in an extremely fragile and precarious place at the time.

Sirveri

(4,517 posts)Gave up making work pay in exchange for tying Social Security to the General fund.

Effective tax increase on the poorest Americans to keep the tax break for the Rich.

Maybe the UI was worth it, maybe. Who can tell, deal was done.

DCBob

(24,689 posts)If he refused to go along with it who knows what might have happened. It wasn't worth the risk... imo.

phleshdef

(11,936 posts)Either you didn't know that, or you are conveniently leaving it out.

And hell yes the UI was worth it. The tea baggers were a month away from taking complete control of Congress. You think they would've given ANYTHING in terms of UI benefits? The past year and a half of a tea bagger controlled Congress and the stuff they've done during that time has done nothing but affirm 100% that the President made the right decision with that compromise.

mikekohr

(2,312 posts)and then selectively remember only those facts that bloster one's view point. It takes REAL backbone to stand up, to serve, and to be responsible. The spitballers? Not so much.

I wonder if Osama Bin Laden thinks the President has a backbone?

"We are the people we have been waiting for."

Obama and 25 in '12

morningfog

(18,115 posts)stop the kind of hostage taking that occurred last time? I am not overly optimistic. They need to expire, but only time will tell.

truedelphi

(32,324 posts)harun

(11,348 posts)Tigress DEM

(7,887 posts)I think it's good that people will hold him accountable even if it so much of it was not in his personal control. He's got to shore up his relationship with the DEMs in order to get anything done. It's like herding cats, but I think he's smart enough, just needs to learn to saunter off in the direction DEMs really want to go anyway and then every DEM will follow.

IF he ONLY gets the DEMs on board, I'll be convinced that electing a DEM Congress will seal the deal and give us the chance to actually get things done, once the obstructionists are gone.

Tig

Huey P. Long

(1,932 posts)otohara

(24,135 posts)it took 9 years to get rid of the "fake farmer" loophole in Colorado.

The 1% sure hates paying the same rate as the rest of us and will lie, cheat, or buy a goat if need be.

truedelphi

(32,324 posts)In the top One Percent pay nothing, you know it is time for a complete overhaul.

4th law of robotics

(6,801 posts)what good is altering the rate if you leave those open?

Really we need to lump a persons entire yearly income together and tax that regardless of where it came from.

Wages + capital gains + inheritance + gifts + that quarter you found on the street + any amount of money that finds it's way to your pocket in any way.

And then no exemptions or special rates.

cpwm17

(3,829 posts)Let's hope this is correct.

Lionessa

(3,894 posts)which I doubt, but I'm very cynical today.

truedelphi

(32,324 posts)Should not blame ourselves for that cynicism.

Actions speak far louder than words, and few of the actions of the Democratic Leaders, Senators and Executive Branch have gone the way of the working class, soon to be extinct.

I still have hopes because of people in Congress, but almost everyone else is part of the problem.

Lionessa

(3,894 posts)House of Reps, I agree. I think they did, and still try, to stay true(er) to the traditional Democratic ideals. I know she'd never make it, but I'd vote for Pelosi for president, she kicks some butt. Definitely has more balls than Obama, imo.

kentuck

(111,101 posts)Really?

Lionessa

(3,894 posts)kentuck

(111,101 posts)and will cause the demise of many programs that people at the lower end depend on for survival, including food stamps, and would cut government drastically. Maybe that is no problem?

obxhead

(8,434 posts)That is a problem.

AnotherMcIntosh

(11,064 posts)that he would not do so and (2) if the Obama Administration was actively working to extend the tax cuts for the less-than-rich.

What will be done is what was done before. When it is time to extend the tax cuts, it will be claimed that tax cuts are needed for the less-than-rich, that they don't have enough votes for that, and that their tax-cut extension for the super-rich will be only a temporary extenstion.

Robert Gibbs has no power to change this. What he says, in comparison to Obama's history of extending tax cuts for the rich, is worthless.

russspeakeasy

(6,539 posts)Time for change

(13,714 posts)hfojvt

(37,573 posts)is almost as bad as a full extension.

Obama's plan to extend them for incomes less than $250,000 gives 26.5% of the benefits to the richest 5%. That costs about $80 billion a year just for tax cuts to the top 5%. Which is close to a trillion dollars over ten years.

I was willing to accept that in 2008, while still hoping for more, but at this point that no longer seems acceptable.

Nor does it seem acceptable that that is the point where we are making our stand. That our original bargaining position is to extend 80% of the Bush tax cuts.

I would feel better if he/we were fighting to end the Bush tax cuts for incomes over $50,000, even though I, myself, am hoping to make over $50,000 in 2014. It is just kind of absurd that a total defeat for the Republicans would mean that 80% of the Bush tax cuts get extended including over $40 billion a year to the top 1%.

SickOfTheOnePct

(7,290 posts)If President Obama extends the cuts for only those making less than $250,000, how does any of that go to the top 1%? (looking at your $40 billion/year figure in your last sentence).

And how would 26.5% of the benefit of such a plan to the richest 5%, when the average income of the top 5% is around $210,000?

Not saying you're right or wrong, I just don't get where the numbers come from.

hfojvt

(37,573 posts)still get tax cuts on their first $250,000 of income. (At least those who make more than $250,000 a year do)

Thus, those who make more than $250,000 still end up with bigger tax cuts than those who only make $80,000, and those who make $120,000.

"My" numbers come from Citizens for Tax Justice, showing the distribution on page 1 of the "original Obama plan"

http://www.ctj.org/pdf/taxcompromise2010.pdf

13.3% to the top 1%

13.2% to the top 4%

27.7% to the next 15%

13.9% to the bottom 40%

Further, I am not even sure how the Obama plan works for dividends (or capital gains). Does it create another form to charge a different rate for people making over $250,000? Or does it still leave dividends taxed at a lower rate for everybody?

The first way seems excessively complicated (as well as a little bit unfair for people on the margins - if you make $245,000 your dividends are taxed at 15%, but if you make $255,000 your dividends are taxed at 28%.).

The second way still allows massive tax breaks for the wealthy.

My point is that dividends should just be taxed just like ordinary income.

So should capital gains.

truedelphi

(32,324 posts)Or more are already getting a mortgage break the rest of us no longer can ask for.

It is called the mortgage deduction, where whatever amount that pays down the interest on your house is deductible.

Many people who make less than 100K simply cannot afford to buy a home, especially in expensive markets in and around NYC, Boston, any big city in California,, Seattle, etc.

I am not saying the mortgage deductible is wrong - I am just trying to point out that the people making more than 100K already get themselves a very significant tax break more than the rest of us.

hfojvt

(37,573 posts)although I know that mortgage interest is deductible on Schedule A.

I have proposed getting rid of Schedule A and claim that most of the benefits of it goto higher income taxpayers.

http://journals.democraticunderground.com/hfojvt/151

"Then there's the other side. 321,294 filers make over $1,000,000, and almost 97% of them itemize their deductions. They are .28% of all adult taxpayers, but they get almost 11% of the total deductions. Since they pay at the highest rates, their deductions are also worth more. They get $141.6 billion in deductions whereas their standard deductions would be no more than $4 billion. Their itemized deductions are thus worth about $45 billion or about $141,000 per household.

The next richest group also does very well with itemized deductions. Those with incomes between $100,000 and $1,000,000. There are only 17.9 million of them which is only 15.4% of adult taxpayers, but they get 44.4% of the benefits as 88% of them itemize. They get $579 billion in itemized deductions versus the $204 billion they'd get from standard deductions. (and the $240 billion they'd get from the proposed higher deduction). That's about $118 billion a year in tax breaks going to a group that is in the top 20%."

My proposal was not very well received here.

truedelphi

(32,324 posts)One of the big survey companies had taken, and basically people were asked where they thought their household stood, in terms of their net worth, percentile-wise.

Seventy percent of the people queried thought they were in the top five percent!

BlueCaliDem

(15,438 posts)there'll be NO extension of tax cuts for the middle class and working poor and NO extension of unemployment benefits or whatever other program for the not-so-well-off the GOTP and RepubliDems can hurl at him to force him to sign an extension. You're okay with that, right?

Either way, Gibbs' statement is a true one, and one skeptics can take to the bank. Here's why . . .

1) Either President Obama gets re-elected, which in this scenario, he doesn't have to worry about running for re-election and curry favor with the masses - many who are still unemployed and need unemployment benefits - OR since the transportation has passed and 1 million more jobs will open up and the high speed rail in CA has been approved which will open tens of thousands, perhaps even hundreds of thousands of jobs, too, unemployment will be down and the GOTP and RepubliDems in Congress can't hold UE benefits hostage to force through tax cuts for themselves and their corporate masters like they did the last time;

or

2) President Obama does not get re-elected and he won't have the power to extend Bush's tax cuts anyway. An eventual (god I hope NOT) president R'money will most definitely extend Bush's tax cuts while raising them on the rest of us (he believes Ryan's bill is "marvelous" and that bill will do just that).

AnotherMcIntosh

(11,064 posts)BlueCaliDem

(15,438 posts)but fact of the matter is, that's exactly what happened the last time Bush's tax cuts had been extended.

Congress had stuffed the Bush tax cuts extension in the bill together with extending UE benefits for the unemployed at Christmas. President Obama had asked Congress, again and again, back in April/May of 2010 to work at extending U.E. benefits, but he was ignored as Mitchie played politics. The GOTP and RepubliDems kept kicking the can down the road until it came to a head in the crucial month of December 2010.

Don't forget, the 99ers were furious that their benefits had been cut off, too.

Had President Obama vetoed the bill our taxes would've risen on January 1, 2011 and, among other things, there'd be NO extension of U.E. benefits. Who do you think would get blamed for taking the food out of the mouths of American babies at Christmas time? The president or Congress? Judging by the anger directed at him for signing the bill that extended Bush's tax cuts while extending U.E. benefits, you've got your answer right there. For some strange reason, even among Liberals, Congress gets a pass each and every time, and President Obama gets trashed.

truedelphi

(32,324 posts)Or maybe I should say dead on the non-existent tracks.

At least as far as the present legislation now in the state legislature. (If you know differently please let me know. I gave up reading about it ten days ago because the reports coming out of Sacramento were so horrid and depressing. I'd love to be proven wrong on this.)

BlueCaliDem

(15,438 posts)In a vote of 21-16, lawmakers gave the go-ahead for the issuance of $2.6 billion in bonds, while Washington will provide an additional $3.2 billion. The bill also includes close to $2 billion in funding for local projects.

"Not only will California be the first state in the nation to build a high-speed rail system to connect our urban centers, we will also modernize and improve rail systems at the local and regional level. This plan will improve mobility for commuters and travelers alike, reduce emissions, and put thousands of people to work while enhancing our economic competitiveness," said Dan Richard, chair of the California High-Speed Rail Authority, a state agency.

http://articles.cnn.com/2012-07-06/travel/travel_california-high-speed-rail_1_california-high-speed-rail-authority-john-tos-cost-overruns?_s=PM:TRAVEL

truedelphi

(32,324 posts)Inner environmentalist. Yippee!

We just might join the rest of the world in terms of modern transportation.

BlueCaliDem

(15,438 posts)Wouldn't it be nice if we could have public transportation like they have in Western Europe, and make automobiles obsolete? In Holland, cars are a luxury and very unnecessary. Public transportation is so well connected that people can get to their destinations quicker using public transp. than driving!

JoePhilly

(27,787 posts)Let me explain why.

Obama made 2 promises about taxes as a candidate

(1) He said he would NOT raise taxes on those making under 250k.

(2) He said he would end the Bush tax cuts for the rich.

Now, the democrats in congress could have sent him a clean bill that preserved the tax cuts for those under 250k. But sadly, they decided not to do so, even though Obama DID pressure them to do so. This put him in a situation in which he could not keep both of these promises, at least not in 2010.

Let's think about it. Imagine he did let them all expire back in 2010. The media would have been playing clips of Bush #1 saying "read my lips", and then clips of Obama promising not to raise taxes on those under 250k. Those ads would have run side-by-side for the past 2 years NON-STOP.

Can you say "One term President?"

So Obama extended them all into the lame duck period at the end of 2012, why?

Because by doing so, they are no longer an election year issue. Win or lose, he can let them all expire. Then he can pressure Congress to re-instate those for people under 250k.

This is why Gibbs can be so adamant about this. Its pretty obvious if you think it through.

AnotherMcIntosh

(11,064 posts)Your imaginary scenarios don't apply to him. Nor do they obligate him to do anything.

JoePhilly

(27,787 posts)not.

Also ... the promises I refer to are REAL, not imagined. The actions of the Dem congress were exactly as I described, not imaginary.

And the media, this week is proving my point about the promise to not raise taxes on the middle class. They are letting the GOP claim that the ACA mandate breaks that promise.

Dig a hole ... bury your head. But at the end of this year ... you will know that I was right.

Tigress DEM

(7,887 posts)In an election year, that could be enough, but the GOP is just so much better at playing "chicken" with the country. Obama DOES care, so sometimes he goes for the compromise to get ANYTHING out of the crazy situation that actually helps anyone below the 1% line.

The GOP's ability to bypass all reality and simply go for the "kill" even though they eviscerate themselves in the process as well is mind boggling.

I want Obama to make this happen. What I don't know is will enough of US be able to get behind this and hold Obama's feet and Congress's feet to the fire long enough to overcome whatever shit-storm the GOP will throw at this common sense, reasonable proposal so that it WILL get through Congress in order to be signed into law by Obama?

Tig

JoePhilly

(27,787 posts)That the GOP's main tactic is to say that they will DO NOTHING so that some bad thing will happen. They won't pass Bill X, they won't raise the debt ceiling, so on.

The GOP uses inaction.

In this case, Obama can use inaction. The only way those tax breaks get extended is by ACTION. Obama can do nothing and let them expire, and because its in the lame duck, the GOP can't say he broke his promise to not raise taxes on the middle class ... the point will be MOOT, because the effect of the inaction will occur after the election.

Obama and the Dems actually have a good plan here, assuming that the congressional Dems show a tiny bit of backbone. Nancy and Chuck have already dropped their "1 million" cap version of this.

The GOP will need to ACT, and they hate taking action. And I think most Americans will notice.

Tigress DEM

(7,887 posts)SO House and Senate should present the best bills possible and Obama can VETO whatever doesn't work.

Tig

morningfog

(18,115 posts)Then new excuses can be made. I hope they are allowed to expire this time, but when the next critical issue arises and repubs hold progress hostage unless a deal on the tax cuts is reached....we'll see.

JoePhilly

(27,787 posts)Obama does not need Congress to pass anything between now and November. In fact, he knows that won't pass anything between now and then.

The GOP uses inaction to hurt America. In this case, inaction does not help them. It only leads to Obama allowing all the cuts to expire.

The only action on the table is an extension of the tax breaks for the middle class. Almost all of the middle class wants those extended. Which means they want action. The GOP hates action.

morningfog

(18,115 posts)We'll know in due time.

Orsino

(37,428 posts)I have a vague sense of deja vu, as well.

AnotherMcIntosh

(11,064 posts)BEAU1943

(61 posts)It will never get pass the House ........ what we need to do is let the Bush Tax Cuts expire, but before we do this we must vote Obama in with a Senate and House Democratic majority. After the Bush Tax Cuts expire then we pass the Obama Tax Cuts to give tax breaks to those making less than $250K...

Jake2413

(226 posts)any I may be crazy because if he can't eliminate the 1%'s tax breaks then don't extend any.

Laurian

(2,593 posts)bluestateguy

(44,173 posts)nt

Spitfire of ATJ

(32,723 posts)You should hear what Mike Malloy says about her. He worked at CNN.

alcibiades_mystery

(36,437 posts)The GOP Congress will never allow Obama to get just tax cuts for those under $250,000, and, quite frankly, in the financial straits we're in, we probably need to go back to the pre-2001 levels for everybody.

Unlike others in this thread, I saw Obama compromise away the tax cuts for very specific goals: extended unemployment for the needy and a vote to end DADT. He got both of those. It was a hard thing, but the notion that he's untrustworthy on this question is pure hokum from the uninformed or pure Obama hater rhetoric. But it looks like we're all going to have to eat it here: no tax cut extensions for anyone. That's a good thing, actually, in the long run: Obama may even leave office in January 2017 without a deficit. It's what we need. But there's no two ways about it. GOPers will not extend $250,000 and under, and Obama will not extend over $250,000, so all the tax cuts will be going away. Time for some people here to accept that.

Enrique

(27,461 posts)I agree with you that ending all the tax cuts has to at least be on the table, but Obama has never spoken of doing such a thing, he always reiterates his commitment to preserving the cuts below $250,000. But I disagree with you that those specific issues were what caused him to extend them last time, I think it was mostly his commitment to keeping the under-250,000 tax cuts in place. And that remains now, even at DU there are people that are unwilling to give those up. And if they are not on the table, then Obama has no leverage. He'll have to hope that the GOP gives him the upper end cuts out of a spirit of generosity.

Volaris

(10,272 posts)the tax cuts for the less than 250K bracket were a bribe anyway, to get the cut-rate for the top earners (at least they were smart enough to know THAT would be the only way it would get done).

BEAU1943

(61 posts)It is our job to reelect Obama and a Democratic House and a Democratic Filibuster proof Senate. Then after the Bush Tax Cuts expire Obama and Congress can lower taxes for the middle class making less than $250K.........it will be called the Obama Tax Cuts.

The middle class has to have more income and pay less taxes to make our economy grow and create jobs. The middle class buying goods and services is the only thing that creates private industry jobs.

Time for change

(13,714 posts)Let's hope it's true this time.

bahrbearian

(13,466 posts)bvar22

(39,909 posts)Wait until the Republicans take some small group hostage,

like those whose unemployment is about to expire.

THEN see what happens.

Our Republicans and Centrist Democrats are MASTERS at that Hostage Game.

"Give me the Key to the Ranch, or this Puppy dies!!!"

"OMG. We have to Save the Puppy.

Here are the Keys."

"Today the Democrats declared a HUGE Victory for Saving the Puppy."

The 1% walk away, laughing quietly, twirling the Ranch Keys on their finger,

saying, "We can do this ALL day long."

If anybody dares to say,

"Wait a minute. We could have fought the Puppy Killers

AND saved the Ranch",

they are immediately attacked as Puppy Haters.

Lather, Rinse, Repeat.

truedelphi

(32,324 posts)To be loving on them puppies!

In any case, + My household to your scenario.

Marrah_G

(28,581 posts)sad sally

(2,627 posts)expiration date closing in:

The child tax credit will fall from $1,000 to $500: "why do you hate kids?"

The alternative minimum tax (the "marriage penalty elimination"![]() will expire, which means:

will expire, which means:

the ceiling of the 15% bracket for married couples will fall, no longer double what it is for single filers and

the standard deduction for married people will fall - will no longer be double what it is for single filers: "why do you hate married people?"

The lowest 10% tax bracket will expire and will revert back to the 15% level: "why do you hate poor working people?"

The tax rate on long-term capital gains earned by middle- and upper-income people would rise from 15% to 20% and rate on qualified dividends earned by middle- and upper-income people would rise from 15% to ordinary wage tax rates: "why do you hate the idea of people making money on money?"

and so all the "puppies" will be dragged out to scare people, therefore making it necessary to kick them damn puppies down the road for another generation of smarty pants to figure this mess out.

bvar22

(39,909 posts)I had no intention of marginalizing the hostages.

I believe they are ALL worth fighting for.

What I object to is the binary choice Kabuki Theater scam.

The Democrats continually sell the cow for a handful of beans,

and then claim VICTORY!

"Look at ALL these wonderful beans we got,

and the might be MAGIC some time in the future!"

The Democrats have had several opportunities to take the 1% hostage,

and passed.

The best was the Wall Street Bailout.

We could have DEMANDED strong regulatory concessions BEFORE

giving them their money.

We had just rolled into the White House WITH a popular mandate,

and OWNED both Houses,

but NO.

Paulson delivered his 3 page hostage notice.

Our Democrats rolled,

and delivered the Trillion Dollar Ransom, no strings attached.

And our Party declared VICTORY on THAT one too!

In classic American mythology,

the Good Guy rides in,

vanquishes the villain,

and saves the hostage AND The Ranch.

I believe we could have done so with Health Care (Public Option), Taxes, Wall Street, and other issues IF the Party Leadership had chosen to FIGHT,

and taken that FIGHT to the streets.

[font size=5]Obama's Army, Jan. 21, 2009[/font]

[font size=5]"Oh, What could have been."[/font]

So friggin' on point it's ridiculous.

It's not JUST that they fail and fail miserably. It's that they try to sell us their failures as victories.

hay rick

(7,624 posts)And does it have anything with you not getting your pony?

COLGATE4

(14,732 posts)bluestateguy

(44,173 posts)And here is why:

The tax rates expire on January 1st. The worst case scenario is that he is voted out of office and would leave on January 20.

So if he loses, he's got nothing to lose by letting them all expire and the next president and Congress can deal with that mess, and Obama can rightfully claim to belatedly keeping a campaign promise to end the Bush tax cuts.

If he wins, he never has to face the voters again, and he can ignore the four alarm screaming that will come when everybody's paychecks are a little less on January 1st. Then he can calmly ask once again that tax rates for the lower 98% be restored to Bush era rates, while the other 2% can pay Clinton era rates. If Congress won't play ball, hey, not his problem anymore.

Please don't pee in my Wheaties.

RandySF

(58,896 posts)99th_Monkey

(19,326 posts)and Lucy is again promising she WON'T

swipe that football.

But I certainly hope Obama does the

right thing on this, otherwise he'll be

looking like a tool of the 1% and that

isn't going to impress voters in a positive

way.

kentuck

(111,101 posts)Just let them all expire for everyone. Don't wheel and deal and don't do anything until after the election.

NYC_SKP

(68,644 posts)Ahem.

Really people?

Watch and see, to every extent that he's allowed to by the RW, he will get this done.

Going forward, any sense of "pragmatism" he needed to employ during his first term carries far less weight than it did earlier in his administration.

I'm ashamed at the naysayers and their comments above. To me, they demonstrate a lack of depth of understanding of how things work.

We'll celebrate together, soon.

![]()

kentuck

(111,101 posts)It did nothing for the economy. It only added to the deficit and gave Repubs reasons to cut every program under the sun. A huge blunder.

JoePhilly

(27,787 posts)Obama promised to NOT raise taxes on those making under 250k. That's about 98% of all Americans.

If he let them all expire, he'd have broken that promise, and THAT promise is far more important to most Americans. If he did that, the media would be running clips of Bush #1 saying "Read my lips, no new taxes" ... and then clips of Obama promising to not raise middle class taxes, side-by-side, 24/7 from 2010, up until the election.

Obama would be a one term President for sure.

And the "mistake" you complain about was made by Dems in Congress. They could have passed a bill extended the tax cuts for those making under 250k ... they were too cowardly to do so ... and they got their butts kicked in the 2010 elections as a result.

Now that those cuts expire in the lame duck after the next election, Obama can let them all expire, whether he wins or loses the election. By extending them into the lame duck session, he ensured that they won't be an election issue.

sendero

(28,552 posts)... that this is not your Dad's "recession" and ALL HANDS ON DECK should have been working on JOBS JOBS and JOBS.

3 years later Obama is going to have to rely on a bumbling Romney to keep his office and really it is no ones fault but his own.

goclark

(30,404 posts)Since we don't have a clue what information he is given that we could not possibly know, I'll take his record on "timing."

Health Care issue with the Supreme Court ~ TIMING.

Osama Bin Laden ~ TIMING

http://www.slate.com/articles/news_and_politics/politics/2012/05/barack_obama_s_decision_to_go_after_osama_bin_laden_how_the_president_overruled_his_advisers_in_ordering_the_assassination.html

For those that think that Obama "shouldn't be trusted"

Hum ~ so who do we trust ~ Rmoney the sociopath?

![]()

Shadowflash

(1,536 posts)Fool me once and all that.

I hope he means it this time.

Marrah_G

(28,581 posts)Action not words

Words no longer mean a fucking thing when they come from a politician, especially one running for office.

When it actually happens Mr. President THEN I will applaud you and those who made it happen.

Zorra

(27,670 posts)Swede Atlanta

(3,596 posts)The Republicans are hell-bent on ensuring the taxes on their wealthy masters do not go up. I see zero likelihood that the tax cuts will expire on the wealthy but remain for the middle and lower classes. The Republicans believe in class warfare.

As the election nears the Republicans will become more and more unreasonable. I think Boehner boy said there is no need for the House to convene between now and selection day.

They truly believe they can convince most Americans that preserving tax cuts for the wealthy will somehow mean the poor will get a chicken in their pot. The rich have no intention of parting with any of their money. They hate the average American.

So while this is good fluff talk, if the President stands firm then taxes on everyone will go up. The Repukes will never, ever, ever, ever, ever agree to tax the wealthy. They are the bitches of the wealthy. Never forget that.

Blanks

(4,835 posts)He took action; they started going down. They're making noise about the deficit; he's going to take action.

Romney has tried and tried to make this sluggish economy Obama's fault (failed policies). The deficit and all of the problems that come with it are not an Obama policy. This is the time to make that clear, and this is a way to make that clear.

BTW, these 'job creators' the ones not creating jobs; are screwing themselves over by trying to hold the economy hostage and now they're gonna pay.

He'll do it; the republican plan has cuts to social security and Medicare. They're proud of that. He needs to make it clear that these are the choices:

1) Let the Mitt Romney's of the world keep the fortunes that they make outsourcing your job, and starve grandma.

2) Make the millionaires and billionaires pay as high a percentage of their taxes as working class folks.

It's hardly much of a choice.

SidDithers

(44,228 posts)And bookmarking so all the haters can eat crow.

Sid

doc03

(35,344 posts)bahrbearian

(13,466 posts)The Haters are starting to out number the Fan boys.

progressoid

(49,991 posts)It's skepticism based on past experiences.

Enrique

(27,461 posts)nothing wrong with being skeptical of a politician, and theres very good reason for it in this case. Gibbs in general is slippery and he isnt very straightforward in this intverview. And when people say theyve heard it all before, its true.

bahrbearian

(13,466 posts)unapatriciated

(5,390 posts)WilliamPitt

(58,179 posts)I will wait and see before I celebrate this particular 'victory.'

So sue me. I've learned better than to jump for joy at every press release.

I hope.

We'll see.

kellytore

(182 posts)The republicans crapped all over us 11 years ago, and we still are having trouble cleaning it up.

DirkGently

(12,151 posts)frogs

(5 posts)he was for gay marriage before he was against gay marriage, before he was for again. Trial balloon!

mick063

(2,424 posts)Is the way.

I agree with the conservative approach of eliminating loopholes. No more "incentives" to "lure" business. Especially at the state level. It becomes an "arms race" to give the biggest "incentive". In the end, all states lose.

On the national level, forget the carrot and go with the stick. Severly penalize companys that open manufacturing abroad and then ship the goods back home.

We can sock it to em' and eliminate loopholes. It is an idea that can be a good starting point for reaching the other side. Agree with eliminating loopholes to simplify the tax code. It can still be very progressive at the same time.

kentuck

(111,101 posts)as a progressive flat tax, I don't think?

But whatever they fix, the wealthy will find a way to exploit it. Just like they did with Reagan's plan in 1986. It is never beyond manipulating.

Igel

(35,317 posts)"Progressive" taxation schemes tie a rising income rate to increased income.

Make $10, you pay one rate; make $1000 and the tax rate increases.

Some want to make it a sharply rising income tax rate, but after simply stating a "rising" tax rate it all gets wobbly. Obviously a rate that increases by 0.01% for every $1 million isn't really progressive, but that doesn't mean we need to have the income tax at 99% by the time you hit $80k.

And you're right: People always find a way to work towards what they think is their best interests, and invariably find a way to rationalize "greed" as the "public good." Mostly because they're people.

Response to kpete (Original post)

AJTheMan This message was self-deleted by its author.

AJTheMan

(288 posts)It's time for those tax breaks for the very wealthy to be lifted. The middle class has seen our wealth deteriorate by 40% or more and yet the wealthy are making their highest levels since right before the great depression.

99Forever

(14,524 posts)I heard this song and dance before. The results suck.

Poll_Blind

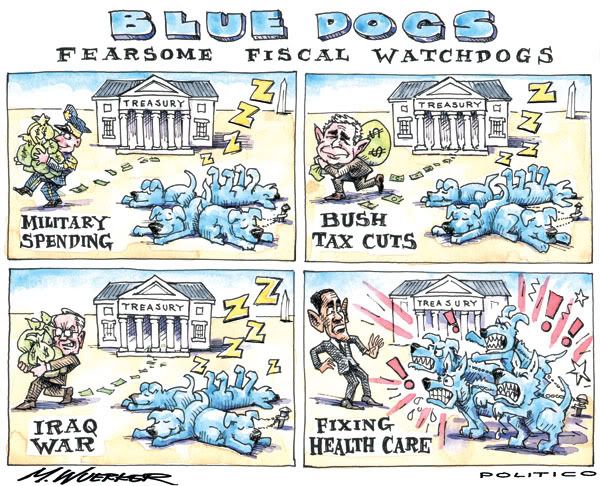

(23,864 posts)The Republicans will take hostages. Unspanked Blue Dog Democrats will join them.

The President will cave.

There will be no swat team rescue. There will only be one million dollars in unmarked bills and a fueled jet waiting on the tarmack.

People here will clamor "But, but Gibbs said the President was 100% committed!"

And the same people hyping the over-paraphrased quote in this thread now will pop up again later and remind the hurt and confused that they were foolish to think Robert Gibbs spoke for the President and, if they thought about it, the President can be committed to stopping something "100%", and still sign it into law.

As long as he does it with a sad face, as long as he says "You know, I really disagree with this" when he signs it, it's like we won that battle.

It's like we won.

PB

Poll_Blind

(23,864 posts)piratefish08

(3,133 posts)kentuck

(111,101 posts)Because I believe we are being played for suckers.

Also, this is doing great harm to the Democratic Party and everything we have worked for. We will have no choice but to cut every program so that we can give these taxcuts to the wealthy, including the Congressmen and the Senators.

I wish I could believe it was true.

Thanks a lot.

fascisthunter

(29,381 posts)Martin Eden

(12,870 posts)Hopefully that will be YOUR quote, brought to your attention after the Bush tax cuts expire.

I'm not placing any bets though ...

Huey P. Long

(1,932 posts)Kablooie

(18,634 posts)They all seem to think giving money to the rich is the most wonderful thing in the world while telling us it's terrible.

Obama is not being honest over this and it makes me more suspicious of his other statements.

If he wants to extend them, he should just say so and do it. Not pretend he doesn't want it.

Arkana

(24,347 posts)morningfog

(18,115 posts)bvar22

(39,909 posts)

Almost got it last time.

I must be losing my touch.

Next Time FOR SURE!!![/font]

Taverner

(55,476 posts)kctim

(3,575 posts)to raise taxes during an election year.

Our paychecks go down ANY, so does our willingness to vote for who made it so.

hughee99

(16,113 posts)He may extend them, he may not, but I'm 100% sure he's not 100% committed to a decision on that right now.

JDPriestly

(57,936 posts)If you can't afford to pay higher taxes on your income above $250,000, you need to review your budget and your expenses. Sorry to be so nasty about it, but lots of people get buy on a tenth of that amount and pay all kinds of taxes including payroll taxes on their earnings, sales taxes, property taxes, gas taxes, etc.

It's ridiculous for Republicans to whine about the deficit and insist on "protecting" incomes of the so-called job-creators from taxes when we have so much unemployment and so many receiving such low wages.

Obviously, the job-creators aren't creating enough jobs. We need to make them pay high enough taxes so that the government can create jobs. If the job-creators reuse to create jobs, let's ask the government to do it. That worked in the 1930s. It will work again.

woo me with science

(32,139 posts)there might actually be a chance of this happening...temporarily.

Keep the pressure on, and be alert for deals, loopholes, or mitigating corporate gifts that would kick in *after* election season. There is no way they seek to allow this to stand.

If we have learned anything, it is that we must watch them like hawks.

.

.

.

"...signed Friday by President Barack Obama..."

http://www.democraticunderground.com/1002921492

Huey P. Long

(1,932 posts)raised soon. R's will hold him hostage, oh what will he do? Poor thing, he had to!

woo me with science

(32,139 posts)I wouldn't put it past them, though, to devise some sort of temporary election year fake or delay so that they can crow about his resolve to voters through November. This game is so old that they have to realize voters are catching on and thoroughly disgusted.

The question is, do they really have any reason to care?

![]()

kentuck

(111,101 posts)He's not in the same league as they. He will fold and call it a "compromise". That's what they think. Maybe it will be different this time?

woo me with science

(32,139 posts)That's a given.

I agree with you that the hostage situations have worked and will be used again. They are unpalatable to the public, though, and I am thinking that, during an election year, another tactic like a delay could be attractive to both sides. Election time may be the ONLY time Republicans would rather not be seen as going to the mat for the obscenely wealthy, and corporate Democrats would also like to guarantee the extension while claiming to have been against it all along. I can very easily see both sides choosing to cut a deal together to delay the inevitable shafting of Americans again until after the election.

But you may be right. It is very possible that they just don't care what we think anymore, even during an election year.

steve2470

(37,457 posts)However, if I know Republicans, they are about two things:

1- Tax cuts for the rich and

2- getting re-elected.

My prediction is that they and their corrupt billionaire backers will mount a full court

press on this issue, and twist every arm and pull out all the stops. The Republicans know where most, if not all, the bodies are buried and won't be ashamed to resurrect the bones to accomplish their goal.

The Republicans will mount an ad campaign saying "OBAMA IS GOING TO

RAISE YOUR TAXES !!1!!!1". We can say, "only the top 2% are getting taxes raised and besides, it's a restoration of previous tax rates", but most will see it as a tax raise.

Many will believe that Obama is going to raise THEIR taxes. They won't bother to read DU or ThinkProgress or even dig into the news stories.

President Obama raises MY taxes ? Most won't vote for a President who does that, which is a sad fact. If that advertising campaign goes on long enough before the election, enough votes switch to the Rmoney column or enough Democrats don't vote, and bingo, Rmoney wins.

I hope I'm wrong.

krispos42

(49,445 posts)I'm getting caught up on my multi-year backlog of podcasts. Now that I'm caught up with "Best of the Left", "Wait Wait... Don't Tell Me!", "Car Talk", and "Real Time", I'm working my way through Rachel, Keith, and Cenk. I'm in September 2010, and I'm hearing the same discussion. Anybody remember how that ended?

Lemme remind you... Democrats too cowardly to make the conservatives (including the fucking Blue Dogs) take a stand, Democrats too cowardly to press an advantage, Democrats too cowardly to close the deal... and all the tax cuts get extended. Including the damn uber-wealthy, who I'm sure donated a small percentage of their massive tax savings to the conservatives.

Keith, Rachel, and Cenk screaming their heads off to the Democrats. "YOU HAVE THEM! PASS THE CUTS WE NEED! HAND THE MIDDLE CLASS A VICTORY AND THE CONSERVATIVES A DEFEAT! RETAIN MORE SEATS IN THE SENATE AND THE HOUSE!"

And the Democratic leadership quivering with excitement to give more tax cuts to the wealthy.

Doctor_J

(36,392 posts)Mostly bark. Let's see if he bites (the cons, not us)