No more orders or austerity from Europe, Greek PM says

Source: Reuters

Greek Prime Minister Alexis Tsipras tore into his European Union allies on Thursday, pledging to "put an end once and for all" to the EU's austerity policies.

In a defiant first speech to his left-wing parliamentary group after returning empty-handed from a European tour, Tsipras said Athens was no longer open to being told what to do.

"Greece won't take orders any more, especially orders through emails," he said. "Greece is no longer the miserable partner who listens to lectures to do its homework. Greece has its own voice".

In an apparent reference to the tough stance taken by the European Central Bank and others, Tspiras said: "Greece cannot blackmailed because democracy in Europe cannot be blackmailed."

Read more: http://www.reuters.com/article/2015/02/05/us-eurozone-greece-tsipras-idUSKBN0L91U620150205

bigworld

(1,807 posts)PoliticAverse

(26,366 posts)uhnope

(6,419 posts)Taitertots

(7,745 posts)Expansionary monetary and fiscal policies. The Troika has demanded contractionary monetary and fiscal policies.

The Troika (EU) is the only thing preventing policies that would cause recovery.

uhnope

(6,419 posts)But I suspect the underlying problems of non-payment of taxes and rampant corruption will interfere

Taitertots

(7,745 posts)Or are you just ignoring the fact that being in the euro means Syriza has almost no control over those policies.

uhnope

(6,419 posts)as significant, if not the significant, problems in Greece. It's not like all of Europe became basket cases because of the Euro. Greece was already a basket case and should not have been allowed into the Eurozone in the first place. But it might be instructive to see what the difference is between Greece and the other EU countries that are doing fine with the Euro. Then we get back to those endemic problems

Taitertots

(7,745 posts)1) I haven't addressed corruption and taxes because the impact wouldn't be significant.

We can estimate the impact by using estimates for the value of taxes dodged as a percentage of GDP and use a multiplier (quantitatively determined) to determine the impact of the change. From this we use a quantitatively determined Okun's law coefficient to determine the effect on unemployment. Even if we use the most generous coefficients, the amount of tax avoidance would have to be unbelievably huge to have a small impact on unemployment and GDP.

In 2012 it was estimated at 5% of GDP. Stopping all corruption and avoidance does almost nothing to stop the Greek Depression. http://uk.reuters.com/article/2012/12/15/uk-greece-taxation-idUKBRE8BE0C120121215

I'm going to go back to disregarding tax avoidance and corruption (as a solution to the crisis) until you provide a coherent explanation for how it will solve their problems.

2)Monetary and fiscal policy have a profound impact on the economy.

We can estimate the effect of expansionary monetary and fiscal policy using modified IS-LM analysis. I'm not going to try to explain IS-LM economic modeling to you.

3)Greece is different

Greece was hit harder by the economic crisis of 2008. A short list of reasons: Geographical limitations on agriculture, the capital in-flows from the EU core pre-2008, the post 2008 reduction in tourism was larger than other countries.

Monetary and fiscal policy in the EU is both too tight for Greece and Optimal for the EU core. Of course people are not complaining while they set monetary policy that causes low inflation in their country and internal deflation/disinflation in Greece.

If Greece (and the whole periphery) were treated the same as the core, than there would be higher inflation in Germany to prevent disinflation/deflation in Greece. In the past, there was higher inflation in the periphery to prevent disinflation/deflation in the core. My googling skills are failing me and I can't find the link to Paul Krugman presenting this in his blog (w/ inflation data).

Ghost Dog

(16,881 posts)The Reuters article refers to an EU bureaucrat's conversation with a newspaper. The EU bureaucrat refers to tax evasion (and not 'avoidance') as currently defined, it would seem, and mentions specifically small business owners and the self-employed such as plumbers and electricians. The article reports estimates that "a shadow economy lying outside Greece's tax system amounted to more than a quarter of annual output in 2011."

This data would appear to entirely exclude such heavyweights in the Greek economy which pay, as I understand it, little or no tax such as the Greek Orthodox Church (a huge landowner amongst who knows what other interests) and the Greek shipping industry.

Funny how fat-cat, power-broker and decision-maker cronyism and corruption get treated with kid-gloves, if ever even mentioned, and those to blame are the little people who perhaps out of sheer necessity could be seen as merely emulating their 'betters'.

Funny, not.

Taitertots

(7,745 posts)Keep in mind that to end their depression the tax revenue increase would have to be more than 30% of GDP (estimate using the most generous coefficients and zero enforcement cost). Even if they taxed the shadow economy at 100%, it wouldn't be enough to get them to full employment.

By all means, stop the corruption and avoidance. Just don't pretend it will end the depression when all the evidence and economic modeling suggest that it won't.

Ghost Dog

(16,881 posts)(the depression, the 'crisis of (unregulated) capitalism, is, after all, much larger than just Greece). But yes, let's by all means stop the corruption, evasion and avoidance (starting, please, at the highest level). Moral, ethical, socio-psychological reasons also count as much, if not more so, than economic and other 'practical' reasons, for the sake of a more healthy polity than at present... including in the USA, wouldn't you agree?

Creditors as well as debtors ought to take responsibility for irresponsible lending.

Fred Sanders

(23,946 posts)Isn't Syriza the party and the policies and the election result progressives want in America?

Or is that just for show?

If you are not getting behind Greece you are not getting behind liberalism.

elleng

(130,974 posts)Ed Suspicious

(8,879 posts)FLPanhandle

(7,107 posts)It's easy to make speeches.

However, there are some hard problems to resolve.

1) If they don't take more loans, how do they plan to fix their budget deficit without some spending cuts?

2) They could default, but will still need to solve problem #1

3) If they just trade EU bailout money for Russian/Chinese bailout money (and conditions), eventually that will come due too.

I'll get more on board with the Greeks when they actually show they can do more than make speeches. If they pull it off and actually keep their promises, great. I wish them the best, but let's see if they sell out to be Putin's EU puppet or something before I get totally on board.

Fred Sanders

(23,946 posts)"speeches", but you may be getting your information from the America state run media.

And by "state" I mean corporations.

azmom

(5,208 posts)Fred Sanders

(23,946 posts)

azmom

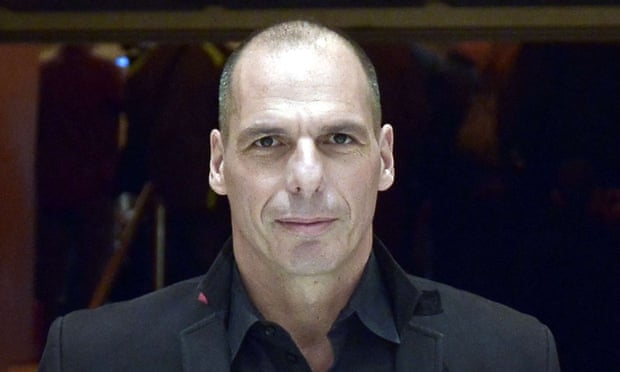

(5,208 posts)EPHRAIM HARDCASTLE: Dishevelled Greek finance minister Yanis Varoufakis creates a stir on Twitter for his handsome looks

Read more: http://www.dailymail.co.uk/debate/article-2937274/EPHRAIM-HARDCASTLE-Dishevelled-Greek-finance-minister-Yanis-Varoufakis-creates-stir-Twitter-handsome-looks.html

freshwest

(53,661 posts)

And this other guy:

What can I say? If I hold these things inside, they just fester, ya know...

libdem4life

(13,877 posts)twice. And that slight accent with perfect English...oh yeah. These two yahoos don't have a brain between them.

freshwest

(53,661 posts)But where were you able to see him talk about things?

I haven't seen the video here at DU. He may appear more impressive in real life or video.

So many of these guys look the same, they freak me out.

At least he's not got a name that is a variation of Scott, Paul or Ryan as we're afflicted with here and appears to care about his fellow citizens.

The current crop of Ayn Rand Pau lRyan and Scotts is simply appalling in America now. And they just keep on coming...

libdem4life

(13,877 posts)very impressive. Both here on DU...I'm terrible at saving things/links, but Richard Wolfe introduced him at the last one I saw. Hopefully someone more DU savvy than I can find them. Both were, I think, within a thread.

libdem4life

(13,877 posts)magical thyme

(14,881 posts)

NickB79

(19,253 posts)

I think it's the nose.

Fred Sanders

(23,946 posts)I am actually kind of changing my mind given the comments...could be a dreamboat I guess, and suddenly being in charge of a Citizens Revolt against German banks is an attractive trait.

What about Prime Minister Alexis Tsipras?

azmom

(5,208 posts)http://www.reuters.com/article/2015/02/09/us-eurozone-greece-varoufakis-germany-idUSKBN0LD1RI20150209

jeff47

(26,549 posts)1) They already did fix their budget deficit. They've been running primary surpluses the last several years. The only thing making them "in the red" is interest payments.

2) Actually, default completely solves problem #1.

3) Russia has no money with which to bail them out. China has no reason to bail them out. Also, the EU needs Greece to remain stable and in the Euro, or the Euro falls apart. If Greece shows there's a way out, the rest of the nations being screwed by Germany will take it.

FLPanhandle

(7,107 posts)To date, they have made massive improvements, and Greece is projecting a 2015 budget surplus, however, the EU's numbers were still projecting them with a deficit in 2015.

jeff47

(26,549 posts)Interest putting them in the red. Default removes interest.

Germany made bad loans to Greece. Germany is insisting Greeks suffer for Germany's bad decisions.

FLPanhandle

(7,107 posts)Greece willingly borrowed over and over.

Germany didn't want to loan more to them but reluctantly did based on promises from Greece.

jeff47

(26,549 posts)Germany and others were happy to lend to Greece before 2008. That's the bad loans.

Fred Sanders

(23,946 posts)hack89

(39,171 posts)defaulting and getting kicked out of the EU means they immediately blow a 4 billion Euro hole in their budget.

jeff47

(26,549 posts)If they defaulted, why would they keep paying interest on the defaulted debt?

hack89

(39,171 posts)but it is certainly their right to do it.

I think it is just posturing on their part to get a better deal from the EU. The notion that they can fix their problems by withdrawing from the eurozone and reintroducing the Drachma is pure fantasy.

jeff47

(26,549 posts)Oh wait......

Greece is already being destroyed by Germany. If their choice is some suffering by leaving the EU, or continued destruction by Germany, the former is better.

Especially because of the cascade this would cause in other EU countries. The other countries currently being hurt by Germany would have large debt problems as Greece demonstrates EU membership is not permanent. Causing those countries to have to make the same choice as Greece.

Germany has been fucking over the rest of the continent since 2008. They can either stop fucking over the rest of the continent, or they can blow up the EU.

hack89

(39,171 posts)and borrowed billions from the IMF to stabilize their currency and stimulate their economy. The Icelandic government had a very healthy debt situation with a 6% budget surplus.

It was private banks that collapsed - Iceland refused to bail out the banks. So the comparisons between Greece and Iceland collapse under any rational and non-superficial analysis.

jeff47

(26,549 posts)would be caused by Greek banks collapsing?

hack89

(39,171 posts)which was not the case in Iceland. The Icelandic government had the means to manage the collapse of their banking system and come out the other side in excellent shape. Greece does not have that ability - too much sovereign debt and lousy credit ratings.

jeff47

(26,549 posts)would manifest in the form of Greek banks collapsing.

Sovereign debt would not be a problem, because the Greek government would default. They're running a primary surplus, so they have about as much money coming in as they need to "keep the lights on". The default would cause problems in the Greek banking system.

Greece borrowed too much money when Germans and other Europeans were flooding the country with cash. In 2008, that flood stopped. And then Germany and other austerity champions demanded Greece pay everyone back in full.

As if Greece was the only party at fault. Problem is when you borrow money, there is a borrower and a lender. The lenders on bad loans are also at fault. They knew how much Greece was borrowing, and still loaned more money.

Like Iceland, the lenders that made these bad loans are going to have to take a hit. The difference is the loans in Greece were to the country, whereas the loans to Iceland were to Iceland's banks. If Germany sticks to it's position of the lenders not taking a hit, then the EU will be gone.

hack89

(39,171 posts)they were a condition of the EU bailout - they are the direct result of the austerity that you decry. If the Greeks back off austerity measures then the surpluses disappear.

jeff47

(26,549 posts)At least not instantly. The Greek government is bringing in more money in taxes than it is spending in services. The only reason they have deficits at the moment is interest payments on their debit. Defaulting ends or reduces those interest payments.

The danger of defaulting/leaving the EU is that it could greatly damage the Greek economy via bank runs, resulting in lower tax receipts and the possibility of a death spiral.

The reason this isn't a terrible idea is the Greek economy is already being severely damaged by austerity, resulting in lower tax receipts and heading towards a death spiral.

Germany's fucking over everyone else in the EU. Either Germany stops doing that, or the EU disintegrates.

hack89

(39,171 posts)or will they resort to deficit spending as a means to solve their unemployment and economic woes? There is enormous public pressure to restore all the government spending on social programs that were rolled backed due to austerity. Can the government say no? If they say yes, where does the additional money come from other than the surpluses?

hack89

(39,171 posts)so no - the creditors did not know how much debt Greece had.

Secondly, the original creditors all took a 75% haircut when the various EU governments bought the debt from them. That is why German is pissed at Greece - the German tax payers payed to bail out Greece and expect to get some of that money back.

hack89

(39,171 posts)and still had to implement austerity to get out of the hole they were in. And we are talking about a country with a healthy economy. So the notion that a Greek bank collapse would not have significant economic impact is pure fantasy. Care to guess who actually holds most of the debt for the Greek banks? You got it - the Greek government. So when the banks collapse, taking with them everyone's savings, who is going to make the Greek people whole again?

jeff47

(26,549 posts)Iceland's economy was almost entirely based on its banks. Its banks were destroyed by the bad loans they made. It was so bad that a company that makes an MMO was a very large part of their GDP.

Iceland's economy is healthy now, because Iceland told its bank's creditors, "Sucks to be you".

Leaving the EU lets Greece go back to making it's own currency. That gives them lots of options that are unavailable while they remain in the EU.

hack89

(39,171 posts)what will most likely happen is that the EU will back down and restructure the debt once again. The Greeks will still pay but at a reduce annual cost to them.

jeff47

(26,549 posts)Austerity has killed Greece's GDP, which killed their ability to pay. The "troika" believed austerity would mean Greece's economy would be back at pre-2008 levels in about 3 years. Instead, it's been awful for 6 years.

hack89

(39,171 posts)until they find away to significantly increase government revenue. That is the truly hard part here - can the government resist public demands to immediately roll back all austerity measures.

jeff47

(26,549 posts)Probably. Loosening some of them will probably be sufficient to spur the Greek economy, which should reduce demands to drop them all.

muriel_volestrangler

(101,321 posts)ie if they had no interest payments to make, they'd be taking in more revenue than their spending. So they could do without loans at the moment, and put what surplus they have towards rebuilding the economy. However, if they did stop all interest payments (and, presumably, said they'd never pay back loan principals) without negotiation, then they'd almost certainly get thrown out of the eurozone and the EU; Greece overall receives more money from the EU budget than it contributes (this says 2.9% of GDP, though I don't know how accurate that is), so leavign the EU would be another problem for it.

freshwest

(53,661 posts)By good, I mean for Greece, and bad for those Europeans who put forth the money for them with their own taxes. I still think the austerity programs are class warfare from the top, though.

uhnope

(6,419 posts)Manifest Destiny

(139 posts)Go Greece go!

uhnope

(6,419 posts)More here http://www.democraticunderground.com/1017240537

It's not black and white...

"socialist" doesn't mean much. They also call themselves "radical left." And yet they are voicing support for Putin--who is the opposite of liberal and is becoming outright fascist. They could descend into the usual cult of personality, or get into playing politics instead of solving problems.

We'll see in a year if they have achieved even half of their plans, and if they are really "liberal"

No mention of the bailed out French and German banks. No mention of Germany's trade policies. No mention of the housing bubble in southern Europe that was inflated by those French and German banks, which necessitated a bailout of them by laundering the money through Greece. A claim they support a quote-unquote fascist with no mention of the actual Greek fascist party they've consistently opposed for the last few years. No mention of Merkel's threats to Papandreou in 2011 over the referendum. No mention of the fact that austerity policy was previously tried in Europe in the 1930s and failed spectacularly.

Don't mind me. I just wanted to add a bit to your story. You know, just to round out the picture.

GliderGuider

(21,088 posts)katsy

(4,246 posts)is neither democratic nor especially is it "underground" anymore. It used to be a vibrant intelligent community, but no more. Now anyone that dares look anywhere beyond the most mainstream of corporate media press releases is attacked and driven away by mass hysteria and nastiness.

And speaking of Greece, they are now back to trotting out the old crap about Greeks not paying taxes and retiring early. It doesn't matter that it never was true. I guess if the MSM repeats it enough it becomes "science" though.

Manifest Destiny

(139 posts)I have lurked for years. The site has swung hardcore centrist-right. I barely see any true liberal activism here. Unfortunately, it's mostly cheerleading for the obviously failing status quo, militarism and turn to the right combined with a multitude of childish, petulant GIFs. I can't say it is serious political debate at all. For that I go to FDL these days. Funny how things always seem to change for the worse as DU once was really good back around the early 2000's when it began.

I'm of the mindset that the owners of DU would be better off setting up a new 'Progressive Underground' with a focus on the problems of the state and the world at large. A site that took an objective, well reasoned look at geopolitics and the real issues that plague us in general.

arikara

(5,562 posts)set up a decent Progressive site. I checked out that other site they started and didn't even bother to post.

There are still a few people remaining here whose ideas I appreciate so I hang around, but less and less all the time. All the nastiness towards people who don't go along with the hysterical groupthink is getting to me.

![]()

Nihil

(13,508 posts)Having seen how much funding from certain EU nations have been funnelled

into certain other EU nations, it is very easy indeed to turn around and say

"Enough is enough" (or "Fuck Greece" if not in as nice a mood).

Seeing how much lying has been going in the Greek case (e.g., by their past

oligarchy willingly supported by Goldman Sachs et al), there is just about nothing

that would persuade most Europeans of the non-PIGS, non-Eastern Bloc countries

that handing over their own tax money to bankers & the obscenely rich rulers

is a good idea.

The other PIGS and the Eastern Bloc states will be more complex as on the one

hand, they want a bailout of Greece to form a precedent for their own imminent

failure whilst on the other, they can afford such a bailout even less than the majors.

It is a complex situation with a bigger history than most DUers can grasp so

dumb-shit comments about "not getting behind liberalism" are just pitiful.

![]()

Fred Sanders

(23,946 posts)DeSwiss

(27,137 posts)...the EU has more at stake than Greece. That's why Draghi's got his printer running OT. And it's all for naught.

- Fiat. Fiat. Fiat.

- Fiat. Fiat. Fiat.

K&R

fasttense

(17,301 posts)Give'em HELL Tsipras!

Austerity is merely another word for oligarchs keep spraying golden showers on the working class. It's a ruse to hide the fact that the uber rich created this mess and are profiting from the mess. Austerity is all about the uber rich NOT paying taxes while the poor and middle class are bled dry. The uber rich are pushing it here too.

Nice to see someone stand up to the banksters for a change. I hope he keeps doing it and doesn't turn into an appeaser.

blkmusclmachine

(16,149 posts)potone

(1,701 posts)Yes, Greece is partly to blame because of widespread tax evasion and bloated bureaucracy, but the broader goal of the financial institutions was the privatization of state property, to be sold at fire sale prices, and particularly the privatization of precious resources, in particular, water. There was a very interesting documentary on this called "Krisis". You may be able to see it on You Tube.

Tsipras, Varoufakis and the rest of Syriza's cabinet and MPs are determined to put a stop to that agenda. Tsipras has a very difficult job ahead of him, but if he succeeds in getting Greece out of the austerity trap this could be the beginning of the end of the ascendency of neoliberal economic theory and policies. That is why Greece is under so much pressure by Germany and is being watched so closely by the rest of Europe. It is the mouse that roared! If they succeed, others--almost certainly Italy and Spain--will follow.

I celebrate their victory in the election and I wish them all the best! ![]()

glinda

(14,807 posts)woo me with science

(32,139 posts)It's about time.

azmom

(5,208 posts)In his blog he talks about receiving death threats in 2012.

Thirdly, the death threats to members of my family that followed my insistence to discuss publically the Greek bankers’ latest scandals. Taken together, these three factors meant that the time had come to move out of Greece once again.

http://yanisvaroufakis.eu/about/crisis-and-its-personal-impact/

I read that he was told recently to stop blogging and he is refusing to do so.

woo me with science

(32,139 posts)closeupready

(29,503 posts)freshwest

(53,661 posts)I suspect Greece will find a way to survive this crisis, and with the trial of Golden Dawn criminals, they have turned the corner. I don't understand why anyone would object to them handling their own affairs.

It may be even rougher for a while but one must hope for the people to work together to get out of the rut they've been in as far as borrowing is concerned.

snappyturtle

(14,656 posts)The Federal Reserve is doomed. We were snookered in 1913 and been paying for it ever since. This is why I am so interested in the revelations to come from Greece. Iceland is doing well.......

I think the entire globe is awakening to the slavery these central banks have inflicted upon the people.

sabbat hunter

(6,829 posts)The fed reserve plays very important roles

1) makes sure we have an elastic money supply.

2) is the lender of last resort

3) maintain accounts and provide various payment services, including collecting checks, electronically transferring funds, and distributing and receiving currency and coin. For the federal government, the Reserve Banks act as fiscal agents, paying Treasury checks; processing electronic payments; and issuing, transferring, and redeeming U.S. government securities

Even Iceland has a central bank, it is called the Central Bank of Iceland. That is basically what the fed reserve is, the US central Bank.

candelista

(1,986 posts)I'd like a piece of the Parthenon, ???????ώ.

Fred Sanders

(23,946 posts)snappyturtle

(14,656 posts)Thanks for posting. Just before turning in last night I read an article on Zero Hedge. I will try to find it and put it up as a separate OP. The date to be watching for is Feb. 25th. If, I think it is more like when, the ELA will be withdrawn Greece will be left with nothing for back-up from the ECB. There was mention of bank runs. If I find the article I will link it here. Found it:

http://www.zerohedge.com/news/2015-02-04/ecb-pulls-trigger-blocks-funding-greece

ELA- Emergency Liquidity Assistance

Here's an interesting article about ELA: http://euronomist.blogspot.com/2014/04/why-ela-is-nothing-but-deposits-for.html

snip....

Here's what should be noted though: running out of liquidity is nothing unusual for banks. That's why interbank loans and discount windows exist. In the first case, the bank obtains a short-term loan from another bank with more liquidity available in order to maintain a minimum until more money are returned (via deposits or through loan installments) while in the second case, the same occurs but the bank borrows from the Central Bank. In both cases, borrowing from either source actually has less cost for most banks, especially in the periphery (in countries like Germany and the UK, the interbank lending rate is usually very close to the deposits rate).

more at link....

Meanwhile, Russia is supposedly interested in helping Greece if it goes on its own with money and food support. Oh boy...! I will try to find links supporting this. I heard it on a discussion in an economic podcast.

Here's a link about Russia's offer: http://www.zerohedge.com/news/2015-01-17/russias-modest-proposal-greece-exit-europe-and-we-will-lift-food-import-ban

edit-insertion of link

Manifest Destiny

(139 posts)Zero Hedge has been out front on what has occurred in Greece. They predicted it well beforehand and also have predicted and been accurate about quite a few recent European and global affairs, but for some strange reason the site is considered not worthy of being used as a source at DU. I posted an Op yesterday citing Zero Hedge and received a hide for using it. I find that to be completely ridiculous considering this is supposed to be a progressive board. If anyone has an answer as to why one of the best financial, political blogs for analysis and predictions is banned at DU I would be glad to hear it. Zero Hedge is a jell of a lot more sound than CNN these days, or Fox which still gets used here.

snappyturtle

(14,656 posts)If people do not want to know what is being said across the board to distill their opinions...so be it. No one is forced to open a link to Zero Hedge or RT for that matter....but they DO! And then, they complain. ![]()

arikara

(5,562 posts)rogerashton

(3,920 posts)Sorry, no links, all from memory (and I will not have time to track down the links.) But the ECB has announced that it will not provide liquidity to meet runs on Greek banks -- an act of malpractice on the part of a central bank, as any reader of Milton Friedman can attest. This will force a return to the Drachma, which will inflate rapidly, but this is the least evil in the situation. By scheduling a return to the drachma, Greece could control the bank runs, by limiting convertibility and giving priority to bank accounts over cash hoards.

WillyT

(72,631 posts)cascadiance

(19,537 posts)When Argentina was defaulting on its debt or converting its bonds to those worth a lot less than the older ones, the vulture capitalists were the ones that were screwing them at the time, and likely will try to step in to Greece to do the same...

http://www.economist.com/news/americas/21637438-argentina-may-spurn-chance-settle-its-creditors-lets-not-make-deal

It would seem that this is something that perhaps Obama and his justice department might look in to to stop some of the wealth grabs that are happening all over the world. Perhaps find some way of putting in place regulations on the vulture capitalists operating from our shores.

potone

(1,701 posts)Varoufakis has written about it, as have others, including Naomi Klein.

hack89

(39,171 posts)that came about as part of the first round of Greek debt restructuring where the creditors took a 75% haircut in exchange for the European governments taking the debt off their hands.

TooPragmatic

(50 posts)Greece unfortunately doesn't have the upper hand. I hope the EU will give them something they can deal with. Otherwise its going to be a steep down hill from here. I'm guessing Merkel and Germans haven't been happy with being called nazies.

AtheistCrusader

(33,982 posts)Iceland is the ONLY working model for how to unwind this sort of shitstorm.

Throw the bankers in jail, bail out the people, seize and liquidate the misbehaving companies, and put the burden where it belongs. On the assholes that created the mess, and the investors that rode on their backs seeking profits.

bigworld

(1,807 posts)Not sure if that's an advantage or disadvantage though!

fbc

(1,668 posts)But they should probably leave the Euro, or at least threaten to leave the Euro and see if the ECB lightens up.

TooPragmatic

(50 posts)And it can't go out the same way. Island had a banking crisis. Greece has a Government budget crisis. Island nationalized the banks and cut the foreign debts. Island as a country didn't default and was able to provide assistance to its citizens. Greece doesn't have the money and Greek banks could fail because of the government, not the other way. No Greek bankers can be blamed for this mess.

If Greece defaults, banks will fail and people who haven't withdrawn their Euros will be left with Drachmas that will most likely lose 30-70% of its value. This will make Greece cheap for tourism, but all foreign goods will be that much more expensive. And one still has to think what happens to Greeces EU status. Will they be kicked out completely and if so what kind of tolls will there be? What happens to all Greek citizens who currently enjoy from the free movement? There are several questions and if Greece defaults, those answers won't be pretty. I hope it doesn't go that way and a compromise is reached

snappyturtle

(14,656 posts)I assume so. I think the gov't corruption along with the help of Goldman Sachs. et.al. and the swap derivatives to hide gov't debt has resulted in the banking crisis. I may agree that the banks were not the originating party to this corruption but at some point they had to 'wonder' (if not know) the source of the origination....I don't think they blew the whistle either, however, I could easily be wrong on that.

Welcome to DU ! ![]()

TooPragmatic

(50 posts)I had wrong language settings on on my phone and autocorrect screwed me over.

I agree that Goldman and the government should have been made accountable for their actions. However because of the governments involvement, official statistics were also fudged. Because of that I don't think other banks or entities should be held accountable for relying on those statistics. And everyone got screwed over big time. Especially those Greeks who have paid the ultimate price.

But defaulting is not the answer and I hope that all sides would come to an agreement on some form of debt negotiations so that Greece could provide more growth driven policies. But also they should pay their debts in a flexible manner. If Greece defaults it could harm Podemos in Spain because of the consequences of the default. But it would also undermine EU as an institution since they would seem cruel and ruthless.

Ultimately a default could benefit right wing protest parties who could point out these failures and get people to go against the EU favouring nationalism. And that hasn't been that good in the past either.

Europe rather than be divided should be more integrated. People should also care about voting in the parliamentary elections, since many heads in EU get their position through that parliament. But there should be checks against lobbying so that it wouldn't get the same flaws that the US congress currently has. Then Greece wouldn't have had to go through all this and things would be a bit better.

snappyturtle

(14,656 posts)I agree with you, in a way. I think the Greek people are saying the banks shouldn't be held accountable for the official statistics too.

There is such a thing as odious debt....I just wonder............

Art_from_Ark

(27,247 posts)

MFrohike

(1,980 posts)It was always obvious that Varoufakis and Tsipras had a really bad choice: beg for mercy from the austerians or threaten to blow up the Euro. The mercy option depends on the austerians not being stupid. The last five years should have proved that Merkel, Draghi, and the rest are morons. They're busy building the foundation for a right-wing backlash they can't imagine. They honestly think they can grind the population of Europe into penury and everything will be fine. They're fools, just like their predecessors 80 years ago.

The only real option, other than hoping Podemos wins and gives the anti-austerity drive a push, is to threaten the Grexit. They'll probably need to do a referendum to get support, given that they campaigned on a platform of staying in the Eurozone. The threat of a referendum alone will probably put Brussels and Berlin over the edge, given how they reacted when Papandreou proposed one in 2011. That being said, the people of Greece should really have the final say in whether they're going to continue to be persecuted for the next 20 years or whether they'll take a chance and accept a few more years of hardship which might be followed by better times. It's a bad choice either way, but one option has a chance of success while the other has the certainty of failure.

hughee99

(16,113 posts)DeSwiss

(27,137 posts)woo me with science

(32,139 posts)Fred Sanders

(23,946 posts)Blue_Tires

(55,445 posts)As an aside, did the Greeks ever get their tax code and enforcement straightened out? Years ago the fact that nobody was paying any taxes was a huge factor in their financial shortfall...

libdem4life

(13,877 posts)a real economist FM, with a PhD, with the personal and political savvy to create and speak intelligently about a paradigm shift, is amazing. He never misses a beat, explains and answers questions, he's not radical...hope it works.

Here's a site for those interested in some good reads on Europe's Left and the possible future ... https://zcomm.org/znetarticle/is-the-fear-in-europe-finally-changing-sides/