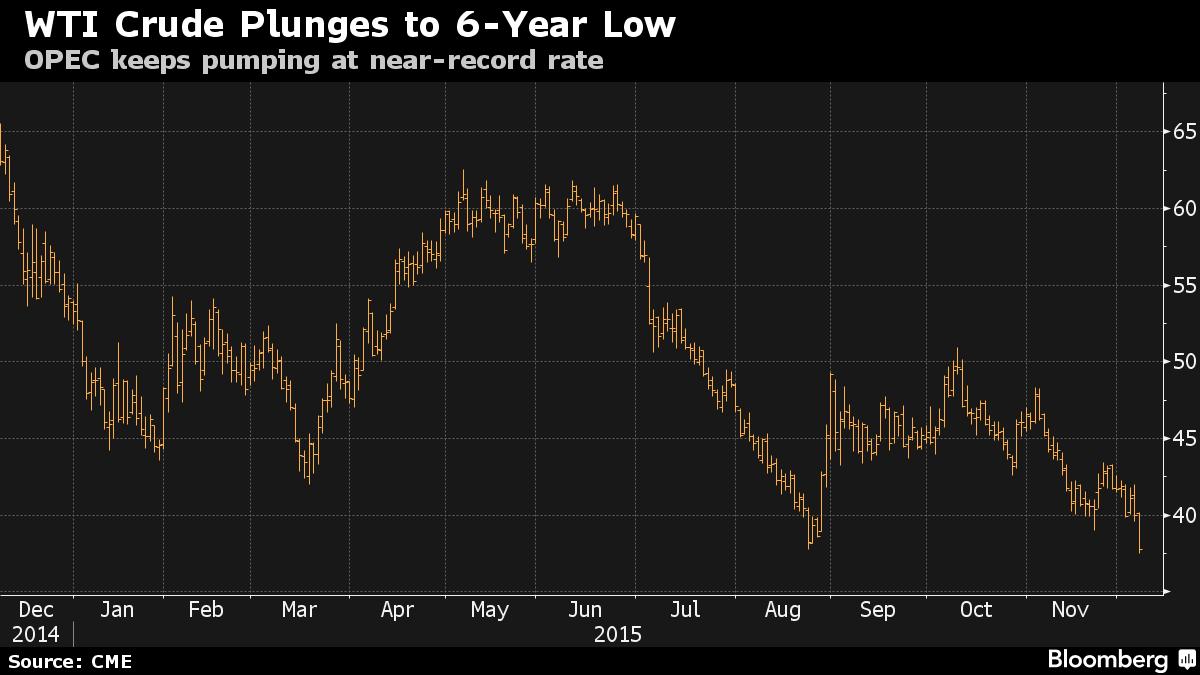

Oil Tumbles to Six-Year Low as OPEC Abandons Production Target

Source: Bloomberg

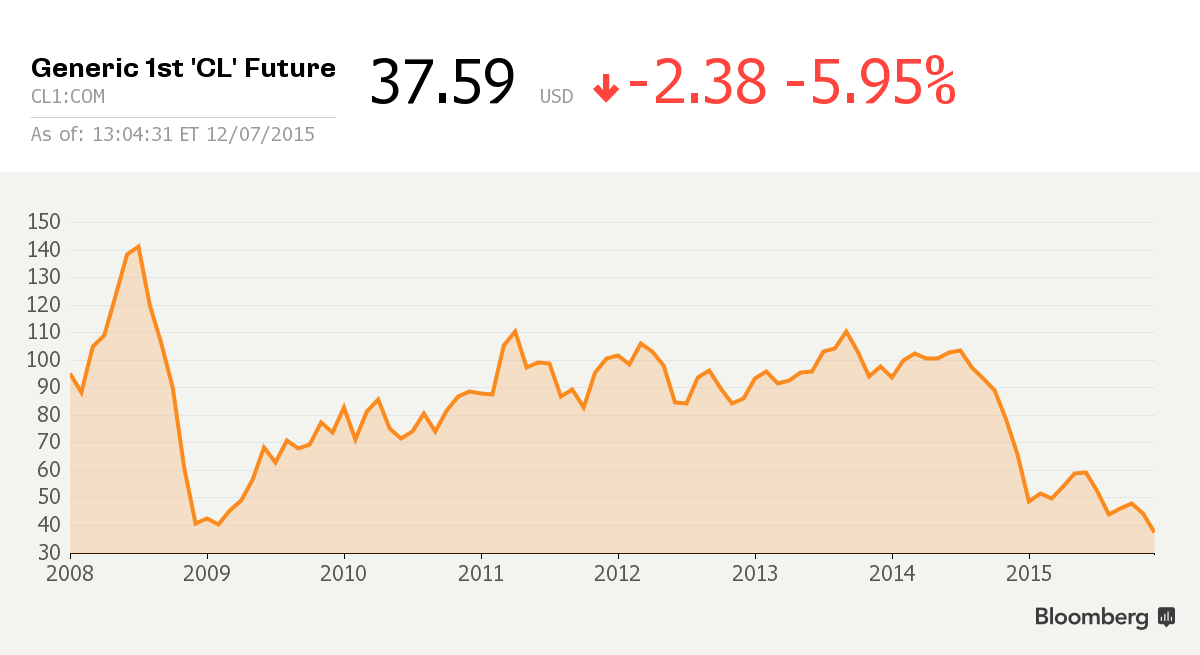

Oil fell to the lowest level in more than six years amid speculation that a record global glut will be prolonged after OPEC effectively abandoned its longtime strategy of limiting output to control prices.

The Organization of Petroleum Exporting Countries will keep pumping about 31.5 million barrels a day, President Emmanuel Ibe Kachikwu said Friday after a meeting in Vienna. OPEC is setting aside its output quota of 30 million barrels a day, a target it’s breached the past 18 months, until members gather again in June. Declines accelerated as the dollar rose on prospects for higher U.S. interest rates. Gasoline and diesel also closed at the lowest levels since the financial crisis of 2008 that sent the country into a recession.

Oil has slumped more than 40 percent since Saudi Arabia led OPEC’s decision in November 2014 to maintain output and defend market share against higher-cost U.S. shale producers. Global stockpiles have expanded to almost 3 billion barrels as the Saudis, Russia and Iraq increased supply, according to the International Energy Agency.

"We’re plunging with the dawn of an OPEC without quotas," said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund. "The Saudis doubled down on their strategy of driving out higher-cost producers. They are prepared to play a long game to return to dominance."

Read more: http://www.bloomberg.com/news/articles/2015-12-06/oil-extends-losses-below-40-as-opec-abandons-production-target

philosslayer

(3,076 posts)One can hope after all.

Purveyor

(29,876 posts)A lot of debt was written against $75 oil not to mentions the mortgages and car/truck notes that very well could go into default.

I love these lower prices (heat with heating oil) but it may not be a good think economically in the long run.

A recession in 2016 would be devastating for dems in the come election time.

philosslayer

(3,076 posts)$1.80 a gallon for gas will put the economy into overdrive.

jonno99

(2,620 posts)Venezuela and some of the other OPEC members would REALLY like the price of oil to increase.

This over-production scheme is not sustainable...

Plucketeer

(12,882 posts)We're just riding the back of a bucking bull. Wait'll he kicks again. BUT..... in the meantime - all those MEGA-Truck and performance car sales in the offing. Wahooooooooooooooooooooo........

jonno99

(2,620 posts)that doesn't "suck the gas"...

(he's maturing ![]() )

)

Plucketeer

(12,882 posts)It gets about 18MPG on the hiway with it's original overdrive tranny and V8. I could opt for a Toyota or some such, but I use the ol' Stude very infrequently, so I can't see layin' out more money for something I use maybe twice a month. And too.... there's that ecological balance of not needing to scrape the earth to build my next truck. I've owned this one since '89 and it'll be a part of my "estate" in a few years.

cstanleytech

(26,336 posts)the next 5 years which i dont see happening.

This will mainly delay development of alternatives to oil which gives the big oil producing countries a chance to buy up the ones that currently exist at rock bottom prices which means the oil countries will still end up winning.

yallerdawg

(16,104 posts)Decades of unimaginable profits and price-gouging to support instability and terrorism.

I think the OPEC nations are learning they have better things to do now! (see Arab Spring)

Javaman

(62,534 posts)the drop in prices was a direct result of the U.S. attempting to become "energy independent".

when they dropped the price of crude, the tar sands and the shade deposit mining tanked.

last reported the Saudi's have a 5 year cash flow.

so in other words, in 1 or 2 years the price of crude will rocket up again as their cash flow slows.

we will be back into the boom bust boom bust boom bust of the oil industry here in the states.

we will ratchet up productions to "cure ourselves of the need for foreign oil" and the crazy rhetoric will start all over again. it's a very predictable cycle.

the Saudi's play us like puppets on a string.

pampango

(24,692 posts)to drive the alternatives out of business increasing production thus lowering the price of oil.

If successful, they can raise the price of oil back up which, in time, will bring back fracking and renewables to compete. It's ridiculous cycle which we could tame by a gas tax (particularly at a time of low oil/gas prices) that would provide some certainty for investments in renewables.

FLPanhandle

(7,107 posts)It makes fuel savings less important thus increasing greenhouse gases, it makes it harder for alternative energy projects to be competitive.

On the upside, it'll be a lot cheaper to fill up the boat.

MosheFeingold

(3,051 posts)There is a happy medium to oil, somewhere in the $70-95 range.

The only people who get rich with low oil are the giant mid-stream/refining companies (e.g., BP, Exxon).

Yes, the price of oil they own goes down, but 1/3 of that goes to the mineral owner (usually scattered families, but also largely states and the federal government), 1/3 goes to various taxes, and they get hit on 1/3.

So, long way of saying 2/3 of the hit of a low oil price is on people who are not oil companies.

Not to mention lots and lots of jobs.

The cheap, cheap oil producers are in places like Saudi where they don't give a rats ass about the environment -- and it's cheap because they don't do anything to protect their environment.

erronis

(15,382 posts)There are much bigger games played here than spot prices based on production or capacity. There are major players (multinational, large nationals) that are looking at 2-10 year prices and trends within the developed and developing countries.

OPEC was just learning how to walk when the 70's crisis was created. At that point the major powers didn't really know how to force the issues - how to thread the fine line between gluttony and scarcity.

In the 40+ years, there has been a lot of tweaking and understanding of market reactions. The ability to model producer and consumer behaviors has improved(?) tremendously.

While we all get comfortable with home heating, automotive in the $1-$2/gal range, don't expect it to last. This is a tickler for a future "gotcha".

IMHO.

yallerdawg

(16,104 posts)Now it's time for good old American innovation and entrepreneurship to find cheap alternatives!

We found a glut of oil.

Let's find a glut of something else!

jonno99

(2,620 posts)Elmer S. E. Dump

(5,751 posts)Gas in my area is 1.879 which is the lowest in so many years I forgot. Keep it coming House of Saud, and watch your own back, because we've been selling you our best weapons for a long time.

erronis

(15,382 posts)Wonder if we'll ever find out how deep the tendrils of the houses of Bush/Saud extended into the countries they controlled.

Oh, why don't we all go out and buy that SUV since fuel will stay so low for the next 5-10 years?

<smilingly>

Elmer S. E. Dump

(5,751 posts)I'm disgusted with them. 15 / 17 = 88% SA

BumRushDaShow

(129,672 posts)this might also lead to a positive impact in the states (including mine - PA) that have gasoline taxes. In fact, just found out that PA has highest gasoline taxes in the nation @50.9 cents/gallon (with a total state + federal = 68.9 cents/gallon).

So with more fill ups (due to lower cost to fill), that may mean more revenue for the state since gasoline is taxed per gallon regardless of price per gallon... and the funds are supposedly used for roads, bridges, public transit, etc. Hopefully this will allow for more infrastructure work to be planned and carried out (meaning more jobs - a "dividend" of sorts).

I'm still glad to have found a station selling @$2.29/gallon so am not complaining after the years of > $3.xx/gallon.

Octafish

(55,745 posts)Works like a charm.

http://www.gregpalast.com/obama’s-secret-war-profiteering-tax/

Turbineguy

(37,375 posts)Saudi Arabia will need IS to help it get funds.

Xolodno

(6,406 posts)When the cost was high, less people took to the roads, used public transportation, freeways less congested and auto insurance was starting to drop in price (less car's on the road = less accidents).

Now all the major carriers are reporting combined ratios well above 100% for auto insurance. I suspect next year we will see some stark increases.