Goldman Sachs Agrees to Pay $5 Billion + To Settle Mortgage Securities

Source: Department of Justice

The Justice Department, along with federal and state partners, announced today a $5.06 billion settlement with Goldman Sachs related to Goldman’s conduct in the packaging, securitization, marketing, sale and issuance of residential mortgage-backed securities (RMBS) between 2005 and 2007. The resolution announced today requires Goldman to pay $2.385 billion in a civil penalty under the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) and also requires the bank to provide $1.8 billion in other relief, including relief to underwater homeowners, distressed borrowers and affected communities, in the form of loan forgiveness and financing for affordable housing. Goldman will also pay $875 million to resolve claims by other federal entities and state claims. Investors, including federally-insured financial institutions, suffered billions of dollars in losses from investing in RMBS issued and underwritten by Goldman between 2005 and 2007.

“Today’s settlement is another example of the department’s resolve to hold accountable those whose illegal conduct resulted in the financial crisis of 2008,” said Principal Deputy Assistant Attorney General Benjamin C. Mizer, head of the Justice Department’s Civil Division. “Viewed in conjunction with the previous multibillion-dollar recoveries that the department has obtained for similar conduct, this settlement demonstrates the pervasiveness of the banking industry’s fraudulent practices in selling RMBS, and the power of the Financial Institutions Reform, Recovery and Enforcement Act as a tool for combatting this type of wrongdoing.”

Read more: https://www.justice.gov/opa/pr/goldman-sachs-agrees-pay-more-5-billion-connection-its-sale-residential-mortgage-backed

[center]

[font size=6] What a C R O C K [/font]

[br]

[/center]

The Department of Justice is REALLY pissing me off. In reading this today, and thinking about how to stop Racketeering Romney from running, it occurs to me that I shouldn't be going after Goldman Sachs and Romney/Bain, to stop their frauds. They OWN United States Federal System of Justice revolving doors with SEC, DOJ (and = obviously = impotent FBI).

Here's note from the DOJ - that nails the proverbial head....

The picture and Federal Judge Jed S. Rakoff, says it all. His Honor Jed S. Rakoff stated

"Just Delayed is Justice Denied"

As noted by His Honor;

Relatedly, criminal prosecution of corporations inevitably engenders collateral consequences that often seem at odds with the purposes of the criminal law. Since a corporation cannot be put in jail, the primary penalty is usually a monetary penalty, which is ultimately borne by the usually innocent shareholders. In addition, the greater the monetary penalty, the more likely the company will have to discharge many likewise innocent employees. Why should the criminal law be used to punish the innocent?

White Collar Crime executives don't give a flying chit if their company (in reality - the investors) pay fines.

They care about going to jail....

In order to put Romney's Bain & Goldman Sachs fraudsters in Jail.... it is the corrupt inept feds that are the problem

[center]

Moi is now going to go after incompetent/corrupt - Dept. of Justice...

stay tuned.......

[br]

[hr][br]

scottie55

(1,400 posts)You can bet they will do it again.

Scuba

(53,475 posts)Oh, wait. Did I say handcuffs? I meant cufflinks. Specifically, White House cufflinks.

WHO would've thunk?

.

DAM

awake

(3,226 posts)Leaving the rest of us to in a essence pay their bill.

![]()

![]()

sarge43

(28,941 posts)Doesn't even count as a slap on the wrist.

awake

(3,226 posts)No one responsible will pay.

GummyBearz

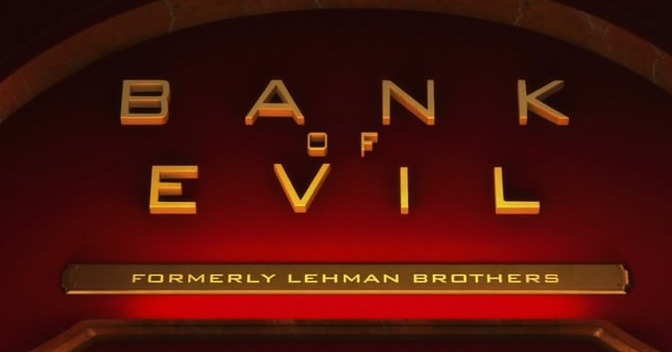

(2,931 posts)I wish I came up with it...

1. make sure washington DC places your friends and colleagues in the treasury department

2. commit business fraud by using insider trading and fraudulent mortgage ratings to make hundreds of billions of dollars

3. pay back 2% of what you made as the penalty

4. write off the penalty against your future gains

5. profit

6. repeat

Anyone taking money from these slimy bastards is unqualified to be president of the country they are raping.

packman

(16,296 posts)just like the BP oil spill in the Gulf of Mexico, Goldman & Sachs will find a way to make this a tax-deductible item in its books, somewhat like an "operating/business expense".

DAMNIT AWAKE - you beat me by a one minute posting.

laserhaas

(7,805 posts)to rush it in.

Thank you - for being on the correct pathway....

appalachiablue

(41,146 posts)laserhaas

(7,805 posts)All Bull....100%

BofA actually wrote of bad loans - thrice...

They took the foreclosures - sold them to friends (making kickbacks)

wrote of the purported losses

and THEN - wrote of BofA's share of the $25 Billion settlement;

by saying they paid their part - from the (already closed case) foreclosures that they padded onto the $25 Billion promise

NCjack

(10,279 posts)they did not commit a crime to get it. Yet, Goldman Sachs robbed millions, and it gets to live by paying a paltry fine. No trial for us to see the details of what they did. Part of the legacy of the Obama Administration. Vote Bernie2016.

appalachiablue

(41,146 posts)Clinton's ties with Wall Street and repeal of the historic firewall Glass-Steagall Banking Act of 1933. Absolute CORRUPTION, FRAUD and ROBBERY.

A friend of the family, a lawyer who lost her job in 2009 from cutbacks and the single mother of two young children, one a little girl seriously ill with cancer and on chemo applied for a loan modification on their home in a large metro area. The bank approved a $30 a month mortgage reduction. I kid not. Just Criminal.

~ Break up the corrupt, dangerous TBTF Banksters before they crash again! Even bankers on WS like financier Asher Edelman (model for Gordon Gekko) and others, also leading economists know how risky the concentrated, monopoly Big Banks are to the US and global economies.

JDPriestly

(57,936 posts)seven years or so. No opportunity to buy a house or start a new business or borrow for other purposes.

Meanwhile, the banks and mortgage companies that sold prospective homeowners on those adjustable mortgages? They pay fines that are small compared to the profits they made.

The credit of the banks is not ended or even harmed by the fact that they caused so many homeowners to go into bankruptcy.

What a sick system. Just sick.

think

(11,641 posts)Department of Justice

Office of Public Affairs

FOR IMMEDIATE RELEASE

Monday, April 11, 2016

Goldman Sachs Agrees to Pay More than $5 Billion in Connection with Its Sale of Residential Mortgage Backed Securities

The Justice Department, along with federal and state partners, announced today a $5.06 billion settlement with Goldman Sachs related to Goldman’s conduct in the packaging, securitization, marketing, sale and issuance of residential mortgage-backed securities (RMBS) between 2005 and 2007. The resolution announced today requires Goldman to pay $2.385 billion in a civil penalty under the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) and also requires the bank to provide $1.8 billion in other relief, including relief to underwater homeowners, distressed borrowers and affected communities, in the form of loan forgiveness and financing for affordable housing. Goldman will also pay $875 million to resolve claims by other federal entities and state claims. Investors, including federally-insured financial institutions, suffered billions of dollars in losses from investing in RMBS issued and underwritten by Goldman between 2005 and 2007.

“This resolution holds Goldman Sachs accountable for its serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail,” said Acting Associate Attorney General Stuart F. Delery. “This $5 billion settlement includes a $1.8 billion commitment to help repair the damage to homeowners and communities that Goldman acknowledges resulted from its conduct, and it makes clear that no institution may inflict this type of harm on investors and the American public without serious consequences.”

“Today’s settlement is another example of the department’s resolve to hold accountable those whose illegal conduct resulted in the financial crisis of 2008,” said Principal Deputy Assistant Attorney General Benjamin C. Mizer, head of the Justice Department’s Civil Division. “Viewed in conjunction with the previous multibillion-dollar recoveries that the department has obtained for similar conduct, this settlement demonstrates the pervasiveness of the banking industry’s fraudulent practices in selling RMBS, and the power of the Financial Institutions Reform, Recovery and Enforcement Act as a tool for combatting this type of wrongdoing.”

“Today’s settlement is yet another acknowledgment by one of our leading financial institutions that it did not live up to the representations it made to investors about the products it was selling,” said U.S. Attorney Benjamin B. Wagner of the Eastern District of California. “Goldman’s conduct in exploiting the RMBS market contributed to an international financial crisis that people across the country, including many in the Eastern District of California, continue to struggle to recover from. I am gratified that this office has developed investigations, first against JPMorgan Chase and now against Goldman Sachs, that have led to significant civil settlements that hold bad actors in this market accountable. The results obtained by this office and other members of the RMBS Working Group continue to send a message to Wall Street that we remain committed to pursuing those responsible for the financial crisis.”

The $2.385 billion civil monetary penalty resolves claims under FIRREA, which authorizes the federal government to impose civil penalties against financial institutions that violate various predicate offenses, including wire and mail fraud. The settlement expressly preserves the government’s ability to bring criminal charges against Goldman, and does not release any individuals from potential criminal or civil liability. In addition, as part of the settlement, Goldman agreed to fully cooperate with any ongoing investigations related to the conduct covered by the agreement.

Of the $875 million Goldman has agreed to pay to settle claims by various other federal and state entities: Goldman will pay $575 million to settle claims by the National Credit Union Administration, $37.5 million to settle claims by the Federal Home Loan Bank of Des Moines as successor to the Federal Home Loan Bank of Seattle, $37.5 million to settle claims by the Federal Home Loan Bank of Chicago, $190 million to settle claims by the state of New York, $25 million to settle claims by the state of Illinois and $10 million to settle claims by the state of California.

Goldman will pay out the remaining $1.8 billion in the form of relief to aid consumers harmed by its unlawful conduct. $1.52 billion of that relief will be paid out pursuant to an agreement with the United States that Goldman will provide loan modifications, including loan forgiveness and forbearance, to distressed and underwater homeowners throughout the country, as well as financing for affordable rental and for-sale housing throughout the country. This agreement represents the largest commitment in any RMBS agreement to provide financing for affordable housing—a crucial need following the turmoil of the financial crisis. $280 million will be paid out by Goldman pursuant to an agreement separately negotiated with the state of New York.

The settlement includes a statement of facts to which Goldman has agreed. That statement of facts describes how Goldman made false and misleading representations to prospective investors about the characteristics of the loans it securitized and the ways in which Goldman would protect investors in its RMBS from harm (the quotes in the following paragraphs are from that agreed-upon statement of facts, unless otherwise noted):

Goldman told investors in offering documents that “[l]oans in the securitized pools were originated generally in accordance with the loan originator’s underwriting guidelines,” other than possible situations where “when the originator identified ‘compensating factors’ at the time of origination.” But Goldman has today acknowledged that, “Goldman received information indicating that, for certain loan pools, significant percentages of the loans reviewed did not conform to the representations made to investors about the pools of loans to be securitized.”

Specifically, Goldman has now acknowledged that, even when the results of its due diligence on samples of loans from those pools “indicated that the unsampled portions of the pools likely contained additional loans with credit exceptions, Goldman typically did not . . . identify and eliminate any additional loans with credit exceptions.” Goldman has acknowledged that it “failed to do this even when the samples included significant numbers of loans with credit exceptions.”

Goldman’s Mortgage Capital Committee, which included senior mortgage department personnel and employees from Goldman’s credit and legal departments, was required to approve every RMBS issued by Goldman. Goldman has now acknowledged that “[t]he Mortgage Capital Committee typically received . . . summaries of Goldman’s due diligence results for certain of the loan pools backing the securitization,” but that “[d]espite the high numbers of loans that Goldman had dropped from the loan pools, the Mortgage Capital Committee approved every RMBS that was presented to it between December 2005 and 2007.” As one example, in early 2007, Goldman approved and issued a subprime RMBS backed by loans originated by New Century Mortgage Corporation, after Goldman’s due diligence process found that one of the loan pools to be securitized included loans originated with “[e]xtremely aggressive underwriting,” and where Goldman dropped 25 percent of the loans from the due diligence sample on that pool without reviewing the unsampled 70 percent of the pool to determine whether those loans had similar problems.

Goldman has acknowledged that, for one August 2006 RMBS, the due diligence results for some of the loan pools resulted in an “unusually high” percentage of loans with credit and compliance defects. The Mortgage Capital Committee was presented with a summary of these results and asked “How do we know that we caught everything?” One transaction manager responded “we don’t.” Another transaction manager responded, “Depends on what you mean by everything? Because of the limited sampling . . . we don’t catch everything . . .” Goldman has now acknowledged that the Mortgage Capital Committee approved this RMBS for securitization without requiring any further due diligence.

Goldman made detailed representations to investors about its “counterparty qualification process” for vetting loan originators, and told investors and one rating agency that Goldman would engage in ongoing monitoring of loan sellers. Goldman has now acknowledged, however, that it “received certain negative information regarding the originators’ business practices” and that much of this information was not disclosed to investors.

For example, Goldman has now acknowledged that in late 2006 it conducted an internal analysis of the underwriting guidelines of Fremont Investment & Loan (an originator), which found many of Fremont’s guidelines to be “off market” or “at the aggressive end of market standards.” Instead of disclosing its view of Fremont’s underwriting, Goldman has acknowledged that it “undertook a significant marketing effort” to tell investors about what Goldman called Fremont’s “commitment to loan quality over volume” and “significant enhancements to Fremont underwriting guidelines.” Fremont was shut down by federal regulators within several months of these statements.

In another example, Goldman was aware in early-mid 2006 of certain issues with Countrywide Financial Corporation’s origination process, including a pattern of non-responsiveness and inability to provide sufficient staff to handle the numerous loan pools Countrywide was selling. In April 2006, while Goldman was preparing an RMBS backed by Countrywide loans for securitization, a Goldman mortgage department manager circulated a “very bullish” equity research report that recommended the purchase of Countrywide stock. Goldman’s head of due diligence, who had just overseen the due diligence on six

Countrywide pools, responded “If they only knew . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .”

Meanwhile, as Goldman has acknowledged in this statement of facts, “[Around the end of 2006], Goldman employees observed signs of uncertainty in the residential mortgage market [and] by March 2007, Goldman had largely halted new purchases of subprime loan pools.”

Assistant U.S. Attorneys Colleen Kennedy and Kelli Taylor of the Eastern District of California investigated Goldman’s conduct in connection with RMBS, with the support of the Federal Housing Finance Agency’s Office of the Inspector General (FHFA-OIG) and the Office of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP).

“Goldman Sachs had a fiduciary responsibility to investors, which they blatantly side stepped,” said Deputy Inspector General for Investigation Rene Febles of FHFA-OIG. “They knowingly put investors at risk and in so doing contributed significantly to the financial crisis. The losses caused by this irresponsible behavior deeply affected not only financial institutions but also taxpayers and one can only hope that Goldman Sachs has learned the difference between risk and deceit. Two Federal Home Loan Banks suffered significant losses so we are pleased to see both entities receive a portion of this settlement. We will continue to work with our law enforcement partners to hold those accountable who have engaged in misconduct.”

“Goldman took $10 billion in TARP bailout funds knowing that it had fraudulently misrepresented to investors the quality of residential mortgages bundled into mortgage backed securities,” said Special Inspector General Christy Goldsmith Romero for TARP. “Many of these toxic securities were traded in a taxpayer funded bailout program that was designed to unlock frozen credit markets during the crisis. While crisis investigations take time, SIGTARP is committed to working with our law enforcement partners to protect taxpayers and bring accountability and justice.”

The settlement is part of the ongoing efforts of President Obama’s Financial Fraud Enforcement Task Force’s RMBS Working Group, which has recovered tens of billions of dollars on behalf of American consumers and investors for claims against large financial institutions arising from misconduct related to the financial crisis. The RMBS Working Group brings together attorneys, investigators, analysts and staff from multiple state and federal agencies, including the Department of Justice, U.S. Attorneys’ Offices, the FBI, the U.S. Securities and Exchange Commission (SEC), the Department of Housing and Urban Development (HUD), HUD’s Office of Inspector General, the FHFA-OIG, SIGTARP, the Federal Reserve Board’s OIG, the Recovery

Accountability and Transparency Board, the Financial Crimes Enforcement Network and multiple state Attorneys General offices around the country. The RMBS Working Group is led by Director Joshua Wilkenfeld and five co-chairs: Principal Deputy Assistant Attorney General Mizer, Assistant Attorney General Leslie R. Caldwell of the Justice Department’s Criminal Division, Director Andrew Ceresney of the SEC’s Division of Enforcement, U.S. Attorney John Walsh of the District of Colorado and New York Attorney General Eric Schneiderman. This settlement is the fifth multibillion-dollar RMBS settlement announced by the working group.

Learn more about the RMBS Working Group and the Financial Fraud Enforcement Task Force at www.StopFraud.gov.

laserhaas

(7,805 posts)and full text doesn't diminish the fact - of what is REALLY going on here

just sayin...

think

(11,641 posts)Again. Wasn't trying to step on any toes. Just wanted to post it in it's entirety since it is public information.

Cheers..

laserhaas

(7,805 posts)As noted (below) this is DOJ vaseline

global1

(25,253 posts)“Today’s settlement is another example of the department’s resolve to hold accountable those whose illegal conduct resulted in the financial crisis of 2008".

For everyone else - "llegal conduct" means jail. There is a double standard for Bankster's. They get a fine that they can write off as a tax deduction. And we The People are left with the bill.

Enough is enough.

Support Bernie Sanders!!!!

Feel the Bern!!!!!

laserhaas

(7,805 posts)protected by United States Attorney corruption

Helen Borg

(3,963 posts)...

laserhaas

(7,805 posts)This is what Dimon was smiling about, when he talked to Senator Warren

and she said - your breaking the law...

According to Senator Warren, - JP Morgan's CEO - Dimon - sat back and said

"so fine me"

chapdrum

(930 posts)I'll take that over having the government shut me down.

(Not clear to me that the government even has that power.)

laserhaas

(7,805 posts)Just think about that - Indicting Romney or Goldman's Blankfein

WOW

JEB

(4,748 posts)laserhaas

(7,805 posts)Oh poor, poor Goldman $achs (of chit) - please take this rub down as proof of DOJ (revolving door) sympathy

![]()

JEB

(4,748 posts)laserhaas

(7,805 posts)Thread posting - shortly

turbinetree

(24,703 posts)as David cay Johnston said in his book "The Fine Print" on page 150 on Rule 23A and 23B and the subsequent paragraphs after all this, people, a lot of home owners or the former are still living on the streets, or standing on street corners begging for food because of what this firm and many others did ----------it's that simple.

And if I am correct.......................not one apology.

Somehow the media spin is going to say, see, they had to pay 5 Billion----------------this is from there Third Quarter 2015......................on what this firm made .............................

http://www.goldmansachs.com/media-relations/press-releases/current/pdfs/2015-q3-results.pdf

Honk----------------------for a political revolution Bernie 2016

![]()

![]()

laserhaas

(7,805 posts)turbinetree

(24,703 posts)Honk---------------------for a political revolution Bernie 2016

![]()

![]()

Downwinder

(12,869 posts)laserhaas

(7,805 posts)Ya know - it would be a crying shame if Lloyd only had 1 pool & patio

Dems to Win

(2,161 posts)GummyBearz

(2,931 posts)I mean... if that is the new law, everyone should rob a convenience store for a few hundred bucks, then pay the $5 penalty associated with it. Then repeat

laserhaas

(7,805 posts)and repeat.

Our eToys and Kay Bee have been in bankruptcy - multiple times

stiffing all victims/ creditors

winding back up at Bain (this time under Toys R Us umbrella)

SoapBox

(18,791 posts)that is a member of her team, this weekend.

Nice...very nice. ![]()

laserhaas

(7,805 posts)SocialLibFiscalCon

(92 posts)The worst thing Goldman Sachs did in my opinion was sell these RMBS backed securities to their clients, then turn around and bet AGAINST these same securities in the derivative/credit default swap market, where they made a killing when the loans and related bonds all tanked!

That is called FRAUD. How anyone would possibly still trust this company with a dime of their money is beyond me!

laserhaas

(7,805 posts)But Circuit order the District Court judge to do so...

scottie55

(1,400 posts)And "she" takes money from them for "speeches".

We're so screwed.

laserhaas

(7,805 posts)And she'll never punish Goldman Sachs

.

And IMO ..Romney's coming.

.

Fer sure he won't prosecute Bain, nor Sachs...

.

Bernie IS our only hope

AlbertCat

(17,505 posts)So...

Who's going to jail???

AgerolanAmerican

(1,000 posts)laserhaas

(7,805 posts)you know

pests

AgerolanAmerican

(1,000 posts)zero bankers in jail

Goldman's ABACUS deal alone justifies shutting down the company as a corrupt organization. There are no fewer than four separate and distinct acts of fraud involved. Any company with any sort of oversight should have shut it down long before it saw the light of day.

If Hillary keeps her transcripts we can only assume the speeches were about how to get away with it.

laserhaas

(7,805 posts)But DOJ is covering it all up - including mayhem and homicides related.

This is just another whitewash

JudyM

(29,251 posts)laserhaas

(7,805 posts)But judge said she didn't care - because she knew that Goldman Sachs and Bain Capital had an ace in the hole.

MNAT.com was GSachs and Bain Capital law firm that admitted supplication of false affidavits

Partner of MNAT was Colm Connolly - who was then sneaked in to be the very U.S. Attorney over our eToys case.

Colm Connolly, for 7 years, refused to investigate and/or prosecute Goldman Sachs & Bain Capital.

When we found proof (his resume at DOJ) that he was a partner of MNAT.. we reported it to the

DOJ Public Corruption Task Force - that was then SHUT DOWN

See L.A. Times story "Shake-up roils federal prosecutors".

jtuck004

(15,882 posts)you're making progress ...

― Malcolm X

laserhaas

(7,805 posts)no pun intended - but okay to stay

Javaman

(62,530 posts)speeding up toward the cliff.

laserhaas

(7,805 posts)All we need is - just one - decent federal agent/judge to say what happened in eToys

Just one comment that fraud is fraud

and MANY dominoes will fall

chapdrum

(930 posts)To me, this begs the question: Why can't a corporation be DISMANTLED?

It (like ALL of them) was created out of NOTHING, by humans.

It is NOT an immutable law of nature, BUT we receive AND treat it as such.

laserhaas

(7,805 posts)They still believe Mitt may become POTUS

and revolve their doors to the wealth of Alvarez

felix_numinous

(5,198 posts)laserhaas

(7,805 posts)AllyCat

(16,189 posts)Everything be made whole in every way. Then send these crooks to PRISON and revoke any license they have to handle anyone's money. Ever. Not even a cashier position.

laserhaas

(7,805 posts)that keep winding up in trouble - or in bankruptcy.

But - as Judge Rakoff said -

there's plenty of laws to prosecute Wall Street frauds

but there's no prosecutors who care to try

chapdrum

(930 posts)"No greater mistake can be made than to think that our institutions are fixed or may not be changed for the worse. ... Increasing prosperity tends to breed indifference and to corrupt moral soundness. Glaring inequalities in condition create discontent and strain the democratic relation. The vicious are the willing, and the ignorant are unconscious instruments of political artifice. Selfishness and demagoguery take advantage of liberty. The selfish hand constantly seeks to control government, and every increase of governmental power, even to meet just needs, furnishes opportunity for abuse and stimulates the effort to bend it to improper uses. ... The peril of this nation is not in any foreign foe! We, the people, are its power, its peril, and its hope!" -Charles Evans Hughes, jurist and statesman (11 Apr 1862-1948)

laserhaas

(7,805 posts)foreign threats

and - DOMESTICs

JDPriestly

(57,936 posts)was during the negotiation of this settlement.

That is the moment to obtain an agreement that the bank or investment house will sell off or divest itself of some of its assets.

Why didn't the Obama administration make breaking up this huge, overbearing financial institution a part of the settlement?

Bad negotiating techniques. Again.

libdem4life

(13,877 posts)He can bring the intent, energy, and start the process. And anyone who makes fun of "unicorns and free stuff" isn't paying attention.

And no, he doesn't have all the details. No one does because it involves a Lot of People and Bureaucrats to even get it started. There will be massive resistance.

But anyone who started this race at 4 percent and is now in a dead heat has a lot of inner and outer conviction and power.

See, that's where we the People come in. Bernie speaks and we trust him to do the right thing and we'll follow his lead.

laserhaas

(7,805 posts)You're our ONLY hope!

libdem4life

(13,877 posts)bbgrunt

(5,281 posts)laserhaas

(7,805 posts)....

Dustlawyer

(10,495 posts)KansDem

(28,498 posts)Last edited Tue Apr 12, 2016, 10:52 AM - Edit history (1)

The fines will be tax deductible!

We, the American taxpayers, will be paying Goldman Sachs' fines. ![]()

Spitfire of ATJ

(32,723 posts)laserhaas

(7,805 posts)(except ..maybe....for those leap off the roof execs ..worldwide).

.

Petters 50 years..Madoffs 125 years...is bogus.

.

Guve them 10 years and forbid return to finance markets

Spitfire of ATJ

(32,723 posts)It survived after the demise of Lehman Brothers.

laserhaas

(7,805 posts)But it would set a far better example..to set GSachs straight

.

Then to kill it.

.

Hundreds of billions in dollars would be lost ..if it were killed

.

Bain Cap. ....on the other hand.....has been. Racketeering

From the outset

And if you RICO'd Bain Cap...its not like other Ponzi

Romney & Bain own Clear Channel, Burlington Coat Factory, Dunkin Donuts, Guitar Centers etc., etc.

.

All us vuctims would get compensated

Ferd Berfel

(3,687 posts)If the Heads of these Criminal cabals don't go to jail, for extended periods, it just doesn't count. If they don't' go to jail, there is no reason to change the behavior.

Fines are simply a cost of doing business. And most of the time these 'fines' are tax write-offs so we end up paying.

![]()

laserhaas

(7,805 posts)DOJ personnel getting away with future benefits

harun

(11,348 posts)laserhaas

(7,805 posts)And...in our case...wrists weren't even slapped

truebluegreen

(9,033 posts)FighttheFuture

(1,313 posts)harun

(11,348 posts)

laserhaas

(7,805 posts)Enthusiast

(50,983 posts)laserhaas

(7,805 posts)and revolving door co-conspiracy.

.

I've been going about this all wrong

Silver_Witch

(1,820 posts)To those who lost their homes, NO. To those who lost their investments, NO! Too those who lost their Jones, NO!

IT goes to the government to pay for WAR!

laserhaas

(7,805 posts)About greatest settlement ever

.

Where does the money go..

And who audits it