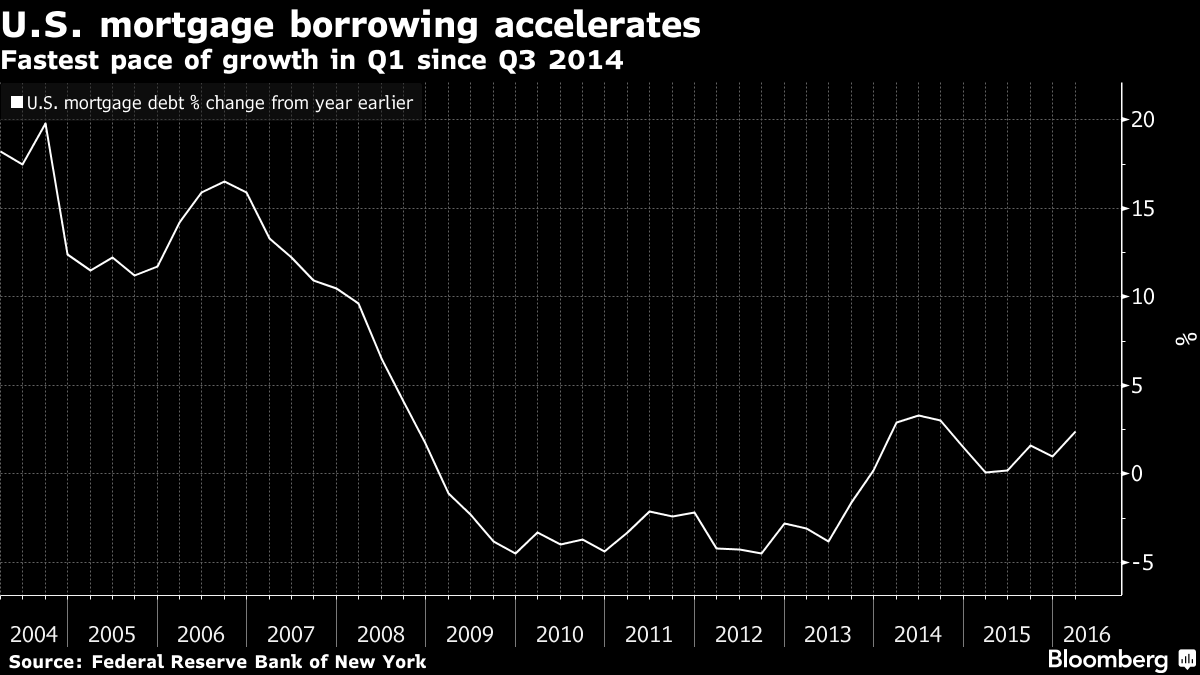

U.S. Households’ Mortgage Debt Rises to Four-Year High, Fed Says

Source: Bloomberg

Increased mortgage borrowing was behind a 1.1 percent rise in U.S. household debt in the first quarter, with slowdowns in other areas such as credit-card balances and auto loans, according to the Federal Reserve Bank of New York.

Total mortgage debt rose 1.5 percent from the final quarter of 2015 to $8.37 trillion, marking the highest level since the third quarter of 2011, according to the New York Fed’s quarterly report on household debt and credit, released Tuesday. Auto-loan debt rose to a record high of $1.07 trillion in data going back to 2003, but logged the smallest percentage increase since 2012.

“Delinquency rates and the overall quality of outstanding debt continue to improve,” Wilbert van der Klaauw, senior vice president at the New York Fed, said in a statement.

Five percent of outstanding debt was in some stage of delinquency, the lowest amount since the second quarter of 2007, the New York Fed said.

Read more: http://www.bloomberg.com/news/articles/2016-05-24/u-s-households-mortgage-debt-rises-to-four-year-high-fed-says

JDPriestly

(57,936 posts)But remember, wealthy people make money on your debt. Collecting interest as long as the economy is good enough for people to pay the interest they owe, is a great way for people to make money with little effort.

Being a landlord requires repairing and maintaining house. Being a creditor requires writing a good credit agreement, sending notices and collecting -- as long as the debtor remains solvent.

Too much debt is bad for an economy for many, many reasons.

If people don't borrow in the wage and work structure we now have, the economy will slow down.

But what happens when many people can't repay their debts?

An economy built on debt but also offering only low wages that make repaying the debt or making payments on the debt very difficult and in some crises impossible will fail eventually. It's just a matter of time.

Wages have to be in balance with debt and investment or the entire economic edifice will crumble.

That's my opinion for what it is worth. I am not an economist and welcome comments about this.

RKP5637

(67,111 posts)I think people are maxing out again. Around here they drive super expensive cars, for example. I bet they are strapped to monthly payments for them, and not cheap. And housing prices are soaring. It feels like the SOS again. And then the recent posting about who can afford an emergency $400 or $1000. Maxed out with many jobs that pay sh** these days.

PSPS

(13,603 posts)IronLionZion

(45,457 posts)so people often have smaller down payments as a percentage of the total mortgage because that's all we can afford.

But this can also be a sign that more people are buying homes, which is a good indicator of an improving economy. There are benefits to home ownership if they have a low fixed rate.