Dow Jones record may boost spending by wealthy; others still wary

Source: Reuters

6 Mar, 2013, 07.28AM IST, Reuters

NEW YORK: About an hour after the Dow Jones industrial average hit a record high on Tuesday, Overland Park, Kansas-based financial adviser Brad Stratton got an e-mail from a client asking how she could "make hay while the sun shines."

Stratton, a former Merrill Lynch broker who set up his own firm last year, said he's been fielding a lot of such calls lately. Many are from clients who want to capitalize on stock-market gains by purchasing second homes or investment properties. "They're seeing opportunity, both as an investment and as a lifestyle change," he said.

With US stock market indices more than doubling since the financial crisis and the American housing market recovering, there are increasing hopes on Wall Street that a wider "wealth effect" could set in. That would see people with stock portfolios and homes feeling richer and more confident, prompting them to spend more on everything from home improvements to luxury cars and meals in restaurants, creating jobs in the process.

The Dow hit a record closing high on Tuesday, part of a broad market rally that has lifted the oldest US market gauge nearly 9 percent so far this year. The achievement is particularly noteworthy given it is set against a background of government spending cuts and tax increases.

Read more: http://economictimes.indiatimes.com/news/international-business/dow-jones-record-may-boost-spending-by-wealthy-others-still-wary/articleshow/18825209.cms

Snip~ "The missing ingredient, many say, is corporate spending. Despite strong earnings and sales, non-financial U.S. companies had $1.7 trillion of liquid assets, or cash, on their books at the end of the third quarter."

Selatius

(20,441 posts)All economies are built on consumer spending, except possibly North Korea. The more money workers have in their pockets, the better that economy will run. Those workers are consumers, and they don't do that if their weekly wages have stagnated, or they're unemployed.

Art_from_Ark

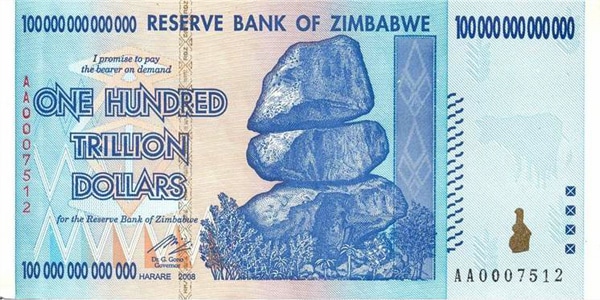

(27,247 posts)But there are sometimes cases where consumers have so much "money" that it becomes worthless

http://www.businessinsider.com/10-hyperinflation-stories-of-the-20th-century-2011-3?op=1

Selatius

(20,441 posts)A functioning economy has to have some redistributive elements to be healthy. Anti-trust laws against monopolies and unfair competition, a progressive tax structure, Medicaid, food stamps, unemployment insurance, Medicare, and Social Security are examples of redistribution.

Simply creating money like Zimbabwe did would ultimately have the opposite effect, as rapid inflation itself would act as a form of regressive taxation in a practical sense and throttle economic activity.

However, redistributing money that is currently in the economy, through taxation and jobs programs for instance, would serve the purpose of putting money into the pockets of workers without the threat of inflation that would be the case if the government simply created money and then circulated it a la Zimbabwe or the Weimar Republic.

Art_from_Ark

(27,247 posts)And imposing an ever-increasing financial burden on the people at the bottom of the totem pole is not a good thing.

I'm all for a more equitable society. That is one reason why I hold the Great Society in such high esteem ![]()

L0oniX

(31,493 posts)BTW Reuters ...you've become a shill for the rich. O yea we can't wait for the crumbs to fall off the tables of the rich ...and be thankful for them.

"prompting them to spend more on everything from home improvements to luxury cars and meals in restaurants, creating jobs in the process"

Oh yea that will help make our country prosperous again like it used to be. What they will be spending money on is personal and property security guards, tall fences and bullet proof windows

Nye Bevan

(25,406 posts)are better than no new jobs at all.

bluedigger

(17,086 posts)Can we expect some of this good fortune to "trickle down" to us? That would be great! ![]()

brooklynite

(94,594 posts)we're hiring a local contractor to do home renovation...

AND paying higher taxes.

BadGimp

(4,015 posts)hobbit709

(41,694 posts)harkonen

(36 posts)Last edited Wed Mar 6, 2013, 02:46 AM - Edit history (1)

and all that offshore money that the "wealthy" and that corporations want to repatriate back into the Stock Market is also contributing to the now seemingly limitless shooting star trajectories of the DOW and the NASDAQ.

dtom67

(634 posts)The ones that get fleeced? I thought trade volumes were fairly low, indicating hesitancy of real investors. I think the market is totally driven by Fed QE4evr and the hf algos, and that it is an artificial inflation at best. If you see the 1% 'ers withdrAwing from the market, look out for the crash.