U.S. Oil Rigs Decline by Most in a Week Since 1991

Source: Bloomberg

By Lynn Doan Jan 9, 2015 1:20 PM ET

U.S. drillers idled rigs seeking oil this week as an expanding glut of supply in the global market pushed crude prices below $50 a barrel for the first time in more than five years.

Rigs seeking U.S. oil declined by 61 to 1,421, Baker Hughes Inc. (BHI) said on its website today. It was the largest drop in rigs since February 1991. Those drilling for natural gas rose by one to 329, and miscellaneous rigs dropped by one to zero. The total fell 61 to 1,750.

The price of U.S. benchmark West Texas Intermediate oil has plunged by more than half since June, imperiling a shale boom that has brought the nation closer to energy independence than it has been in almost three decades. Facing escalating competition from the Organization of Petroleum Exporting Countries and the rest of the world’s suppliers, U.S. drillers laid down the most rigs last quarter since 2009.

“Very little works at $50 WTI,” R.T. Dukes, an upstream analyst at Wood Mackenzie Ltd., said by telephone from Houston yesterday. “It’s not that nothing works, but very little works. Most of the U.S. is under water.”

Read more: http://www.bloomberg.com/news/2015-01-09/u-s-oil-rigs-decline-by-most-in-a-week-since-1991.html

Fred Sanders

(23,946 posts)

nichomachus

(12,754 posts)Fred Sanders

(23,946 posts)so long?

GitRDun

(1,846 posts)You are using proved reserves as support for your statement the US does not matter.

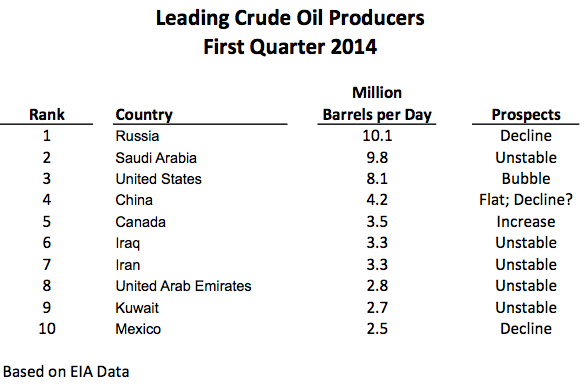

Actual production is what dictates the supply / demand balance, and the US is currently the largest producer.

http://www.bloomberg.com/news/2014-07-04/u-s-seen-as-biggest-oil-producer-after-overtaking-saudi.html

The dramatic lay down in rigs will have an impact within 12 months. These Bakken and other shale wells are characterized by losing 90% of initial production with 12-18 months. Without new drilling, US production will go down by as much as 1 million + barrels per day.

Further, I don't see any data in your post that indicates a breakeven price for the proved reserves each country has. If a lot of the Venezuelan crude is off shore and Canada reserves tar sands, they will not be developed unless a higher price is restored.

Fred Sanders

(23,946 posts) ?w=640

?w=640GitRDun

(1,846 posts)Even at the third largest producer position, a 1 million plus bpd reduction in US production will absolutely have an impact on prices.

Fred Sanders

(23,946 posts)mahatmakanejeeves

(57,505 posts)I don't know about the country as a whole, but a few numbers have been cited for production in two well known shale formations, Bakken and Eagle Ford.

Plunging Oil Prices Test Texas’ Economic Boom

Focus on top spots to boost US oil output even as well permits fall

By Reuters Media on Dec 6, 2014 at 1:12 a.m.

WILLISTON -- U.S. energy firms are swiftly shifting drilling rigs away from less productive areas and hunkering down in sweet spots of North Dakota and Texas shale oil fields as they try to lift output and cut costs in response to the toughest crude market in years.

Rig deployments or applications for new well permits fell by half in recent months in parts of North Dakota's Bakken formation and the Eagle Ford and Permian Basin in Texas, but the most prolific areas are holding up, according to officials and data from the two top crude-producing states.

....

Sweet spots

North Dakota regulators say prices would have to slide to $40 per barrel before most producers started losing money there.

Consultants at Woods Mackenzie say the breakeven level for Eagle Ford in Texas could be as low as $50 per barrel.

misterhighwasted

(9,148 posts)New pipeline another step toward Mexican energy independence

While Mexico is opening up 169 land and offshore oil and natural gas leases to foreign investors, which would boost international business, an increase in domestic natural gas would cut down drastically on imports. According to the San Antonio Business Journal, about 40 percent of natural gas imported by Mexico comes from the Eagle Ford Shale in South Texas.

(snip) While Mexico is opening up 169 land and offshore oil and natural gas leases to foreign investors, which would boost international business, an increase in domestic natural gas would cut down drastically on imports. According to the San Antonio Business Journal, about 40 percent of natural gas imported by Mexico comes from the Eagle Ford Shale in South Texas.

AND THIS:

http://bakken.com/news/id/229471/mexicos-pemex-proposes-import-us-crude/

Mexico’s Pemex proposes to import US crude

Mexico’s state oil company wants to import about 100,000 barrels of light U.S. crude a day to mix with this country’s heavier oil as a way to improve refinery processes.

State-owned Pemex said Thursday that the deal was proposed last year and would simply trade heavier Mexican crude for light U.S. oil.

(snip) Mexico exported an average of about 803,000 barrels of oil a day to the United States in 2014.

--------------------------------------------------------------

My Question after reading these articles is how Mexico's development impacts the US in terms of KXL, Bakken & Texas light crude, and is there a coordination between Canada, US & Mexico Oil development that would make the three countries, major players against OPEC Nations?

Is this why the latest visit from Mexico's President Nieto? Why the absolute push for KXL? to complete the picture between the three NAmerican Countries?

Is this what threatened the Saudis to drop the price per barrel in hopes of undermining what may be developing here between Canada, US, and Mexico's oil, gas, & shipping ability?

Am I seeing a Big Picture here that may be some truth or just my imagination?

??

Thanks

misterhighwasted

(9,148 posts)Explains why OPEC is so Pissed.

Suppose the TPP is in the mix also???

Deny and Shred

(1,061 posts)Lets hope they unwind a little better than the CDO/MBS debacle. Wall ST firms on the wrong side of the related deribatives could be collecting the next wave of bailouts - very soon.

Good article

http://truth-out.org/news/item/28406-russia-blamed-us-taxpayers-on-the-hook-as-fracking-boom-collapses

Alhena

(3,030 posts)a lot of governments such as Russia which rely on oil to pay their bills are ramping up production as much as they can in order to keep afloat. I read a few days that Russia was producing more oil now than at any time in the last couple of decades. Yes, that will just hurt them in the long term, but governments tend to care about the here and now, and especially their political survival, over their country's long-term interests.

CANDO

(2,068 posts)What a fucking joke that line is/was. Energy independence is another. Political bilge water. As we are witnessing, it's more about production costs vs returns than it's ever about any other factor.