Warning sign: Stocks take nosedive

Source: CNN

Forget the snow. Investors are getting a blizzard of earnings today, and so far it's a gray mess.

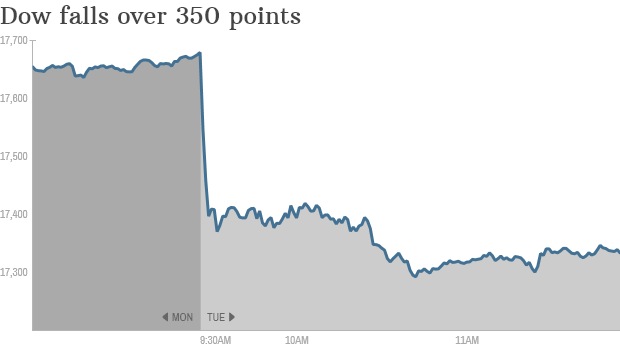

The Dow tanked as much as 380 points Tuesday morning as Microsoft (MSFT, Tech30), Caterpillar (CAT) and Procter & Gamble (PG) all disappointed heavily in their results. If the Dow closes down more than 350 points (it's currently falling about 230), it would be the worst day since June 2013.

The market is reacting to three prongs of bad news: falling oil's impact on companies, more signs of a weakening global economy and corporations cutting their outlook for 2015.

Caterpillar is expecting a big hit on its construction equipment business as China slows down and demand drops off from oil producing parts of the world. Profits for the fourth quarter are already down 25% from a year ago.

FULL story at link. Video: http://money.cnn.com/video/investing/2015/01/27/dow-dive-earnings.cnnmoney/

Read more: http://money.cnn.com/2015/01/27/investing/stock-market-dow-dive/

lamp_shade

(14,841 posts)SheilaT

(23,156 posts)And right now (12:10pm MST) it's only down 243.74 (1.38%).

You've posted exactly the kind of chart that is highly misleading.

Ron Obvious

(6,261 posts)Using a chart that doesn't use 0 as baseline to make it look as though the DOW lost half its value.

I'd advise anybody to read that classic little book. All the techniques are still use.

jakeXT

(10,575 posts)

arcane1

(38,613 posts)When the vertical axis starts at 17,200, it seems considerably more dramatic than it is.

Darb

(2,807 posts)Markets swing on news, sometimes a pretty large swing, especially these days with electronic trading and so many day trading scaredy cats.

That chart is a joke.

onehandle

(51,122 posts)Most of Wall Street is based on nothing.

Not good...

bobalew

(322 posts)I've been watching this pattern for years. This is part of the "Fix" on Wall Street.

Sell enough Naked short Sales (Yeah I KNOW that's illegal, but it still happens) to manipulate the market on Key Buoyant stocks, and then have a free fall Short party, on those, Betting against them on BORROWED stock, making more money on the way down, than they did on the way up. Hedge funds have been stripping all of the hard working companies of their value like this for several years, causing unnecessary volatility, and stealing from us. This is how the powerful & extremely rich do it. Manipulate the market. Solution? OUTLAW SHORT SALES by LARGE entities.

Darb

(2,807 posts)There was a time during that show where the gansters were manipulating certain things in the penny stock market or somewhere. I think there is a whole lot of gangster shit being pulled in the markets these days. It is a free for all.

lamp_shade

(14,841 posts)Response to Omaha Steve (Original post)

Corruption Inc This message was self-deleted by its author.

olddad56

(5,732 posts)happyslug

(14,779 posts)The point of that statement was the Stock Market had little to do with the economy, the Stock Market reacts to the economy NOT the economy to it, thus this means NOTHING. It does mean people who invest in the Stock Market (Who tend to be the 1%) have lost money, but almost no one else did. Thus the Stock Market goes down at times when the economy goes down, at times when the economy goes up and at times when the moon raises (or falls), they is often no reason for the decline or increase.

The real economy has been in tatters since the 2008 recession and has NOT recovered, the Stock Market has but NOT the real economy.