Crash-O-Matic Finance | James Howard Kunstler

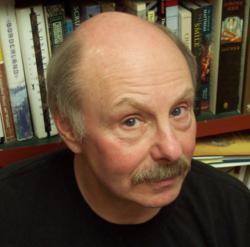

James Howard Kunstler

James Howard Kunstler -- World News Trust

Dec. 15, 2014

"Oil prices have dropped $50 a barrel. That may not sound like much. But when you take $107 and you take $57, that’s almost a 47 percent decline…!”

–James Puplava, The Financial Sense News Network

May not sound like much? I guess when you hunker down in the lab with the old slide rule and do the math, wow! Those numbers really pop!

This, of course, is the representative thinking out there. But then, these are the very same people who have carried pompoms and megaphones for “the shale revolution” the past couple of years. Being finance professionals they apparently failed to notice the financial side of the business, for instance the fact that so much of the day-to-day shale operation was being run on junk bond financing.

It all seemed to work so well in the eerie matrix of zero interest rate policy (ZIRP) where investors desperate for “yield” — i.e. some return more-than-zilch on their money — ended up in the bond market’s junkyard. These investors, by the way, were the big institutional ones, the pension funds, the insurance companies, the mixed bond smorgasbord funds. They were getting killed on ZIRP. In the good old days of the late 20th century, before Federal Reserve omnipotence, they could depend on a regular annual interest rate churn of between 5 and 10 percent and do what they had do — write pension checks, pay insurance claims, and pay clients, with a little left over for company salaries.

more

http://worldnewstrust.com/crash-o-matic-finance-james-howard-kunstler