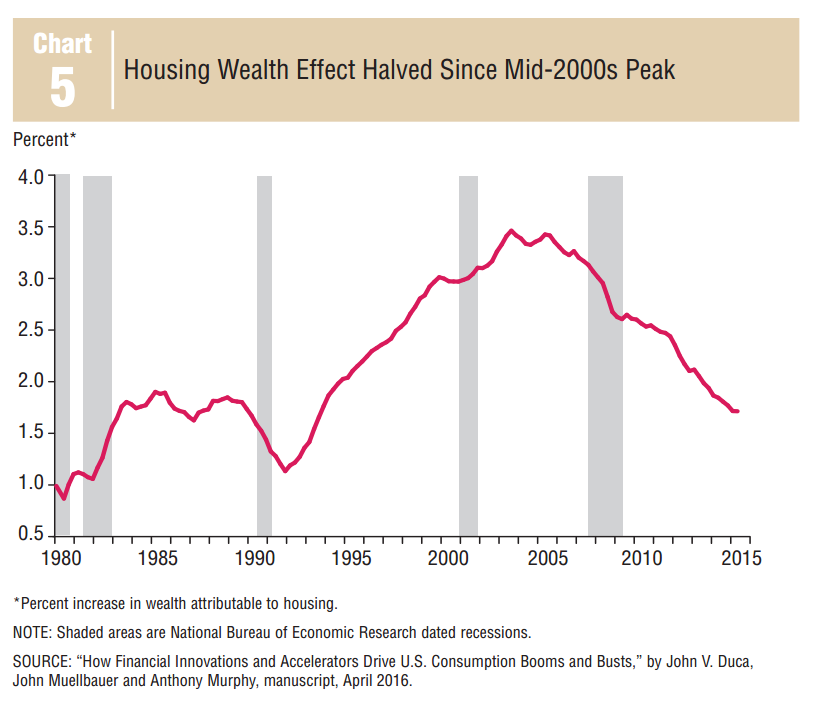

America's Wealth Effect From Rising Home Prices Has Been Cut in Half

The U.S. consumer might be the engine of global growth — just not the roaring V12 it used to be.

From the fourth quarter of 2003 through 2006, amid the real estate bubble, personal consumption expenditures grew at an average annual clip of 3.5 percent. Since the S&P/Case-Shiller Composite 20-City Home Price Index bottomed out in March 2012, however, personal consumption expenditures have increased by just 2.3 percent, on average.

In an economic letter published by the Federal Reserve Bank of Dallas, economists John Duca, Anthony Murphy, and Elizabeth Organ identify one reason why this American muscle car has lost its nitrous oxide.

The researchers found that the wealth effect from real estate — that is, the extent to which home price appreciation juices consumer spending — has been cut in half since the mid-2000s:

more...

http://www.bloomberg.com/news/articles/2016-04-21/america-s-wealth-effect-from-rising-home-prices-has-been-cut-in-half

grasswire

(50,130 posts)Hoyt

(54,770 posts)levels of a few years ago. One reason is that no one wants to lend money to riskier borrowers as before. It might prevent the next housing bubble, which is a good thing. But it also impedes economic growth too.

Baobab

(4,667 posts)Also, building automation might do something similar. Lots of building automation technology is in the pipeline.

It will soon be possible to build large buildings with automated quadcopters, etc.

Hoyt

(54,770 posts)AgerolanAmerican

(1,000 posts)people believed all the "housing can never go down" propaganda and borrowed obscene amounts of money to hop on the free money gravy train

Problem is that if housing always goes up faster than inflation, the next generation gets priced out of the market in just a few short years, leading to an implosion in the market as the number of buyers collapses.

Housing had to go down sometime, it was mathematically inevitable. Unfortunately we have a nation of innumerates who can't resist the idea of getting something for nothing.

Hoyt

(54,770 posts)prices would rise. Even those who feared they might not be able to afford a house believed -- or were led to believe -- that even if they got in trouble down the road, they could sell their house and walk away with equity. When prices fell, they were left holding a bag, as were investors who bough pooled mortgages believing the principle was not at risk because of ever increasing housing prices.

Bursting that belief is probably why housing will never return to past levels.