Icelandís Economy now growing faster than the U.S. and EU after arresting corrupt bankers

http://americanlivewire.com/world-economic-news-icelands-economy-now-growing-fas/So Iceland decided not to follow the rest of the world by bailing out the bankers. Instead, they chose to arrest them. Now their economy is recovering faster than the EU and the United States. Hmmmm.

Remember when the United States government told the American people that immediate action was required to save the banks, and save our nation from complete collapse? An action in the form of Billions of dollars of National Debt? Yeah, we remember that! Now Trillions of dollars in National debt later, we are in the same position we were in 4 years ago, just more debt. As a matter of fact Federal Reserve Chairmen Ben Bernanke has called for yet another stimulus that will add more debt onto the mountain we already have.

At the start of the world wide 2008 economic collapse, Iceland was in worse shape than almost any other country in the world. Now they are one of the fastest growing economies in the world.

libodem

(19,288 posts)earthside

(6,960 posts)... was giving a pass to the corrupt, elite bankers that are now funding the Repuglican super PACs.

Baitball Blogger

(46,722 posts)Savannahmann

(3,891 posts)Which is how the bankers were able to soften the "wallstreet reform" until it was a toothless bailout. The overseers are not supposed to be friends with those who are overseen. One of these decades, we might learn it.

Bainbridge Bear

(155 posts)Obama's biggest contributor in 2008 was Goldman Sachs. He had an opportunity to rein in these greedy bastards when he invited them all to the White House but instead he ended up assuring them that the administration would do what it could accommodate them in the crisis. That was a big mistake.

robinlynne

(15,481 posts)kenny blankenship

(15,689 posts)If he failed to anticipate how fickle Wall St.'s criminal elites wouid be after doing his utmost to ingratiate himself with them, that may be an oversight, but I don't think for a moment that showing him the future with a crystal ball would have changed his mind. It's not like he's getting nothing from them, and a politician like this doesn't let the possibility of future betrayals interfere with the immediate benefits gained by selling his constituents out in the present. The criminal scum of Wall St. buys both sides, with no promise of loyalty to anyone, and could well afford to go on buying every viable political party even if these were to multiply by a hundredfold.

Nothing will slow the march to debt-serfdom for the 99% until they embrace a political party whose enmity to organized money is ideologically explicit and absolute.

Savannahmann

(3,891 posts)For one thing, they've all gotten sweetheart loans from the banks, which would implicate them should an investigation really get started. Corruption in this case crosses both aisles. Granted, when the politicos took the loans it didn't seem corrupt, it never does. Until the bankers called and said. "If you don't bail me out my books will be made public as part of the bankruptcy, and everyone will see you and how much favoritism you've gotten."

I'm sure there are a handful of good Democrats who didn't fall for it. But the rest were caught when they took the perk. You know, good parking spaces, private gyms, congressional junkets to find whatever facts exist in Paris over the Holidays. It was just one of the perks, until the hook was set.

So we won't follow in the wise footsteps of Iceland, because to many of our representatives are up to their necks in it.

Laelth

(32,017 posts)-Laelth

Cosmocat

(14,565 posts)This is BY FAR the main problem we face.

Baitball Blogger

(46,722 posts)it just makes it easier to take the appropriate action.

bankers amongst the 'leader countries' of the world are 'gods'. small g. arrest them? never. can't arrest a god!!!![]()

![]()

![]()

valerief

(53,235 posts)Laelth

(32,017 posts)I am convinced we would have been better off if we had.

More here: http://laelth.blogspot.com/2011/01/turning-american-ship-of-state.html

-Laelth

DhhD

(4,695 posts)girl gone mad

(20,634 posts)a very healthy company that could have easily withstood the crisis and taken the hit. Of course, that might have meant lost bonuses and clawbacks and lawsuits. Better to just loot the national cookie jar.

AllyCat

(16,189 posts)Would like to find out more.

tama

(9,137 posts)&feature=player_detailpage

&feature=player_detailpage

And lot more.

JDPriestly

(57,936 posts)kiting checks and what Wall Street and the banks did leading up to 2008?

Here is what check kiting is:

Check kiting is a form of check fraud, involving taking advantage of the float to make use of non-existent funds in a checking or other bank account. In this way, instead of being used as a negotiable instrument, checks are misused as a form of credit.

It is commonly defined as intentionally writing a check for a value greater than the account balance from an account in one bank, then writing a check from another account in another bank, also with non-sufficient funds, with the second check serving to cover the non-existent funds from the first account.[1] The purpose of check kiting is to falsely inflate the balance of a checking account in order to allow written checks that would otherwise bounce to clear.[2] If the account is not planned to be replenished, then the fraud is known as paper hanging instead. If writing a check with non-sufficient funds is done with the expectation that they will be covered by payday – in effect a payday loan – this is called playing the float.

Some forms of check fraud involve the use of a second bank or a third party, usually a place of retail, in order to delay the absence of funds in a transactional account on the day the check is due to clear at the bank. Such acts are frequently committed by bankrupt or temporarily unemployed individuals or small businesses seeking emergency loans, by start-up businesses or other struggling businesses seeking interest-free financing while intending to make good on their balances, or by pathological gamblers who have the expectation of depositing funds upon winning. It has also been used by those who have some genuine funds in interest-bearing accounts, but who artificially inflate their balances in order to increase the interest paid by their banks.

http://en.wikipedia.org/wiki/Check_kiting

Check kiting can get you into big trouble. But when banks misrepresent to their lenders how much they have and spend way, way more, they get bailed out.

Festivito

(13,452 posts)Too many losers think the opposite would happen.

Maybe they should look at what did happen.

mikki35

(111 posts)Of COURSE it is growing faster!!!!! When you start from being $billions$ in the RED, just about ANY growth is going to look fabulous!! This is a specious argument, at best. U.S. grows $10 - translates to 0.000000000000000001%. Iceland grows $10 - HOLY meathook, Batman, that translates to !,000% growth! WOO HOO! Happy days are here again! You've got to look at the totality of the situation. Notice they're not giving specifics...

Lydia Leftcoast

(48,217 posts)In 1997, several of the Little Tiger Asian countries went into deep recession as currency speculation damaged the value of their currencies. This was the so-called Asian Currency Crisis.

The World Bank and IMF prescribed their usual mix of more "free trade," more deregulation, and austerity for ordinary people.

One of the affected countries, Malaysia, said, essentially, "Fuck that!" and instituted currency controls and other regulatory measures against its financial institutions. Perhaps because it is about 1/3 Muslim, there was a deep-seated suspicion of the modern financial system to begin with.

Guess which Asian country recovered from the recession first.

Yup, Malaysia.

Angry Dragon

(36,693 posts)bhikkhu

(10,718 posts)the US is the world's largest and most diverse national economy, while Iceland is a tiny island, mostly involved in fishing. There really is no fair comparison for what it would take to move the numbers.

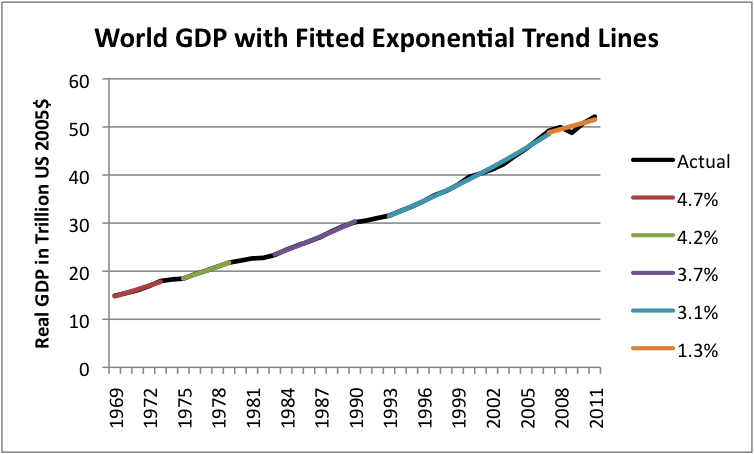

The world overall has slowed to 1.3% growth or so, averaged over the past few years:

Its probably a bit early to draw any certain conclusions from the recent sample size there, but I would say its possible we are seeing a paradigm shift away from the rapid exponential growth of past years.

Javaman

(62,530 posts)We should have broken them up and reorganized them.

then put them under government control until new regulations, rules and boards were elected.

by letting the banks fail you are willfully supporting the destitution of millions of middle class Americans who had money, pensions, 401k's etc in those banks. Which includes myself.

Trust me, when I say I'm extremely far from rich. I make in the low 5 digits.

The after effects of letting the banks fail in the US would have been felt world wide and would have plunged it into a massive depression.

Iceland doesn't have the nth economy the US does. What happens to them, effects other nations very very little.

What they did, worked well for them, but as someone stated above, there are no specifics in the article and Iceland started from the bottom of a hole, anything but up will read as positive in their growth.

you make social security dependent from casino capitalism, you get pwned by the bankster mafia. Which is the purpose. And the bankster mafia, you can bet on it, is not on your side.

girl gone mad

(20,634 posts)No, that's not how it works.

Several banks are put into receivership just about every Friday. Depositors are made whole. Pensions and 401Ks are not wiped out.

Preprivatizing banks would have involved losses to the shareholders, bondholders and executives of those institutions. That is where the writedowns occur, not with depositors.

Javaman

(62,530 posts)did I say anything about privitizing? no.

did I say they should go into recievership? no.

There is a whole cadre' of people here on DU that want to see those banks vanish. That's my point.

sevenseas

(114 posts)for the next time the banks belly up for another bailout.....they will get a huge "NO".....at least that is how it should be.

Savannahmann

(3,891 posts)They were too big to fail. Of course, no one yet admits if you are too big to fail, you're too big. Until we do, then we are doomed to repeat the same mistakes time and time again.

CrispyQ

(36,470 posts)"Inside Job" should be required viewing for every American. It explains the crisis in layman's terms & exposes the fraud in many of our institutions. They talked about Iceland & what they are doing compared to the rest of us.

The segment on some of our leading universities economic departments - unbelievable. These guys (heads & leading professors of economic departments) would state right into the camera that they didn't see any conflict of interest in accepting six figure checks for writing a paper that supported what the big banks wanted government to do. You will be soooooooo pissed off by the end of this movie.

It's available at Netflix. Watch it!

K&R

Bill USA

(6,436 posts)Uncle Joe

(58,364 posts)Thanks for the thread, hue.