The DU Lounge

Related: Culture Forums, Support ForumsAnyone familiar with Mortgage Fees/cost?

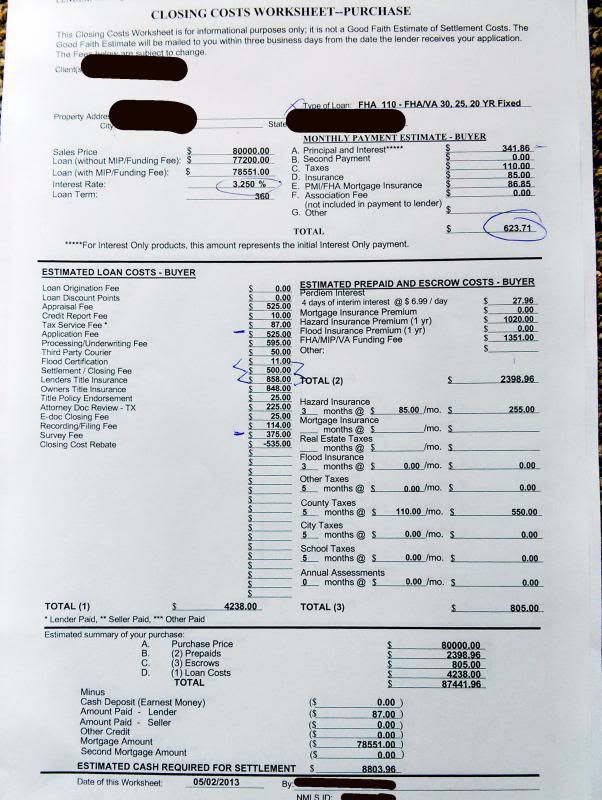

I'm purchasing my first home and I'm not too savvy on what to expect in terms of cost over and above the interest. I'd love to get comments from those in the know wrt the fees proposed in the worksheet below; are they fair? good? bad? average?

Thanks!

dr.strangelove

(4,851 posts)But here is what I think.

$525 is high for the appraisal cost. In NY we get to pick the appraiser and its about $300 - $400 for residential homes.

The Application Fee and Underwriting Fee are just charges by the lender to you. That is high, but when you figure the $535 credit at closing, its not crazy.

I have never seen the lender and Owner title policy cost the same. Usually the lender policy is just an endorsement and costs a lot less, but it might be different in your area.

The Survey fee sounds about right and the rest are about right.

Thats a good rate and otherwise seems a good deal. You can call and see if they can save you another hundred or two on the app/underwriting fee, but otherwise its not too bad.

Schema Thing

(10,283 posts)I may just print your post out and show it to my banker

dixiegrrrrl

(60,010 posts)You would do better to google for your info. since there is a TON of info. available on fees.

some of the 500 and 800 fees look way too high to me, but I bought my 2 houses in a lower cost state.

esp. the processing and the application and the settlement fees are pretty high and, looking at my mortgage right now, I did not even have an application fee...and my mortgage was with Countrywide!

Plus they are charging for both lender's and owner's title insurance.

The really really important thing is who is the lender? And what is their reputation?

The 2nd important thing is you need to pay your taxes and house insurance on your own and NOT thru escrow.

esp. do not let lender be the one who chooses the house insurance and sets the rate for it.

The basic requirement for a good mortgage is:

no escrow, that you want to find and buy your own hazard insurance and taxes. ( they may say they have to charge you for that favor),

NO early payment penalty.( that means you can choose to make an increased payment on the principal the first few years to reduce the massive total interest ayments over life of loan)

If they pay your insurance and taxes, it is a too common problem that your monthly payments get jacked up over and over and over.

Means you are not in charge of finding your own lower cost insurance.

cyberswede

(26,117 posts)I prefer to have the insurance and taxes built in as part of my mortgage payment - I don't want a big tax bill to arrive once or twice a year, nor do I want to have to worry about paying insurance premiums (not high, but a nuisance).

We chose our own insurance provider and policy - having the payment in escrow didn't affect that. Our monthly payments do change a little each year - when the escrow is MORE than the premium & tax bill, our payment goes down. If the escrow amount is less than the total, it goes up. If it were to go up every year, we could easily shop around for a different insurance provider/policy.

Your advice is great, though. ![]()

dr.strangelove

(4,851 posts)You get to pick your own insurance and negotiate the rates, and the escrow is free (built into the rate and closing fee)but they make you do it.

I also like to pay the monthly cost of insurance and taxes, but I negotiate the insurance every year and the taxes are what they are, but it gets spread out this way.

Schema Thing

(10,283 posts)This is Texas btw.

The lender is Chase. The bank is where I do my business checking and it's about 3 minutes from my house, so it's very convenient in that respect. The mortgage banker seemed very helpful and ran through any options I asked about, and it all seemed like this could be easier than I imagined (I'm self-employed and almost certainly could not have gotten a loan in the past couple of years), but I guess she is in sales mode at this stage...

I'll definitely make sure there is no pre-payment penalty. I would consider a 15year loan but I'd like the flexibility of speeding up payment as it is financially sound for me to do so, rather than be locked into the quicker payoff.

dr.strangelove

(4,851 posts)We make between one and two extra monthy payments per year and direct it to be used to reduce the principle. We have already taken 4 years off the loan and figure to take another 4 off before we are done, making the 30 year a 22 year loan anyway.

dixiegrrrrl

(60,010 posts)I have read of horror stories of people getting dinged by their bank/servicer for making early payments.

I went to an online calculator and found I could save around 18 K of interest by making 50.00 extra principle payment a month.

dr.strangelove

(4,851 posts)Has favorable rules on prepayments. A contract must be clear about any prepayment penalty and even then, they are only allowed in the first year on the loan, so you can not refinance or repay without at least one full year's interest on the loan, but you are right that it is important to be sure there is no prepayment penalty or what it is. Many pre-payment penalties phase out after 5 years of interest are paid, so in many cases, paying $50 per month extra on even a 15 year loan will not trigger the penalty. I imagine some states let the lenders do anything they want though, so it is probably bad in some locations.

dixiegrrrrl

(60,010 posts)I think it is....

means no or reduced property taxes for certain people...up to 10 acres urban for Texas.

each 'exemption" = x% of property taxes do not have to be paid.

you would get one exemption for being the owner ( you have to live in the house you are exempting)

Here in Ala. the head of household/owner of property gets a property tax discount

and any homeowner blind, or over 65, or disabled pays NO property taxes.

you have to file an affidavit each year when the tax bill comes, no big deal.

So, I have no property taxes, don't earn enough income for state or Fed. income taxes,

and have a very nice home on one acre for an incredibly low mortgage payment.