Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 30 April 2012

[font size=3]STOCK MARKET WATCH, Monday, 30 April 2012[font color=black][/font]

SMW for 27 April 2012

AT THE CLOSING BELL ON 27 April 2012

[center][font color=green]

Dow Jones 13,228.31 +23.69 (0.18%)

S&P 500 1,403.36 +3.38 (0.24%)

Nasdaq 3,069.20 +18.59 (0.61%)

[font color=green]10 Year 1.93% -0.01 (-0.52%)

[font color=black]30 Year 3.12% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)First rec. Now back to my cocktail and the pool!

Demeter

(85,373 posts)Happiness is a warm pool of clean water.

Roland99

(53,342 posts)Brithday parties for the kids are so much fun...esp. when the adults take a turn on the bounce house water slide!

![]()

Demeter

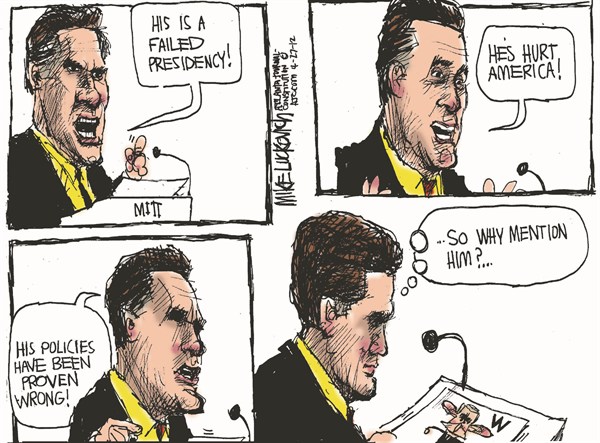

(85,373 posts)Why indeed? Even better: why run?

tclambert

(11,087 posts)They insist on pushing the same ideas that failed so staggeringly during the Bush administration, which were themselves resurrected from the Hoover administration. How can Republicans not see they need some new ideas?

Oh, I forgot, they came up with the war on women. I guess there was a double coupon sale at the Stupid Ideas Store.

Demeter

(85,373 posts)....

PROBLEM: The winners will push economies into Depressions rather than give up their gains. They will continue "business as usual." The creditors will not write down debt. Instead, they embrace the notion of "austerity."

But austerity makes debts harder to pay. A shrinking economy has less tax revenue, and this exacerbates the budget deficit and leads to calls to cut back spending. Cutting back spending drains money from the economy, adding a tax drain to the debt drain. If you repay debt, the money doesn't get used to buy goods and services, markets shrink, and a declining spiral results. Without writing down the debt, the debt overhead and imposed austerity will shrink economies and polarize nations even further between debtors and creditors.

The choice: Write down debts or suffer a chronic, severe recession. There's no way to recover while the debt overhead remains in place.

That all debts can be repaid is an illusion.

Michael asserts that our economic models are quite flawed. In the U.S. 40% of the American labor budget goes to housing, about 15% goes to wage withholding for Social Security and medical care; other debt services (credit cards, student loans) is about 10%, and other taxes (income, sales) are about 10 to 15%. Of the take-home budgets of American workers, 75% is spent on non- goods and services. Only 25% is available for spending in the market. U.S. labor cannot compete with labor in economies that are less financialized, that have lower housing costs, where the government picks up infrastructure costs, and where the government basically has a lower cost structure.

The problem is POLITICAL. There's NO fair solution that everyone gains on.

We cannot grow our way out of debt with a debt burden as enormous as it is today. Someone has to lose. In the U.S. the banks are blocking a solution. Michael argues that under today's conditions in the U.S., we are robbing the 99% to pay the 1%. That is the political setting. And that political setting is supported by a large portion of our population in terms of power and voice. Just read the comments to Bruce Krasting's "A Different Buffett Rule - One That Would Work" (posted at ZH) to see the strong reactions against Bruce's idea of taking some extra tax money from the richest folks to provide benefits to disabled people with devastating diseases - people qualifying for the Compassionate Allowance program of Social Security Disability.

The negative reaction seems to be based on the premise that the very rich fairly earned all their money, the poor are lazy, and the evil government should get out of the way. But the system as it is operating now is stacked against the lower 99%; the playing field is hardly level. And how is that? The government that dictates taxes also provides the framework, the laws and regulations governing our political, economic and financial systems. It created a system of crony capitalism that has enabled the 1+%ers to get to where they are and stay there. (I think the problem is at level higher than the top 1%, so I write 1%+.)...The government provides the freedom and assistance (deregulation, failure to enforce laws, bills that help perpetuate quasi-monopolies) that enable the top 1%+ to continue accumulating more and more of the country's total wealth. It is also charged with keeping those at the top safe from the rage brewing at the bottom.

The structure of our economy needs to be taken down and rebuilt. This not just a problem of debt but a problem of theory.

Demeter

(85,373 posts)Nobel Prize-winning economist Joseph Stiglitz said Europe is in a “dire” situation as a focus on austerity pushes the continent toward “suicide.”

“There has never been any successful austerity program in any large country,” Stiglitz, 69, said in Vienna on Thursday. “The European approach definitely is the least promising. I think Europe is headed to a suicide. ”

Politicians across the 27 European Union members are implementing austerity measures totaling about 450 billion euros ($600 billion) amid a sovereign-debt crisis. At the same time the debt of the euro region rose last year to the highest since the start of the single currency as governments increased borrowing to plug budget deficits and fund bailouts of fellow nations. If Greece was the only part of Europe that was having austerity, authorities could ignore it, Stiglitz said, “but if you have UK, France, you know all the countries having austerity, it’s like a joint austerity and the economic consequences of that are going to be dire.”

While euro-area leaders “realized that austerity itself won’t work and that we need growth,” no actions have followed and “what they agreed to do last December is a recipe to ensure that it dies,” he said, referring to the euro. “The problem is that with the euro, you’ve separated out the government from the central bank and the printing presses and you’ve created a big problem,” Stiglitz said, adding that “austerity combined with the constraints of the euro are a lethal combination.”

The economist said he sees a core euro area of “one or two countries” made up of Germany and possibly the Netherlands or Finland as the “likely scenario if Europe maintains the austerity approach,” he said. “The austerity approach will lead to high levels of unemployment that will be politically unacceptable and will make deficits get worse.”

Youth unemployment in Spain has been at 50 percent since the crisis in 2008 with “no hope of things getting better anytime soon,” said Stiglitz, who is a professor for economics at Columbia University. “What you are doing is destroying the human capital, you are creating alienated young people.” To push for growth, European leaders could refocus government spending to “fully utilize” institutions like the European Investment Bank, introduce taxes to improve economic performance and use balanced budget multipliers, he said.

COMMENT:

Give a man a gun and he can rob a bank. Give a man a bank and he can rob everyone!!

Demeter

(85,373 posts)Apr 17, 2012

WASHINGTON — The International Monetary Fund issued a clarion call to bickering US politicians Tuesday, urging them to solve the country's debt problems before a still-vulnerable economy is tipped over the brink. In a hallmark semi-annual report, the Washington-based fund warned policymakers on the other side of the US capital that, while the world's largest economy is improving, they invite trouble by not addressing a looming debt crisis.

"The first priority for US authorities is to agree on and commit to a credible fiscal policy agenda that places debt on a sustainable track over the medium term," the IMF said.

So far the United States has avoided the type of debt crisis that has ravaged Europe -- with the dollar's safe-haven status and moderate growth providing a sizable safety net even as agencies have downgraded the country's credit rating. But with Washington hurtling toward November presidential polls, and with the country's politicians gripped by a culture of permanent campaigning, time may be running out to find a solution. US debt is expected to balloon to 90 percent of total economic output by 2020, "an uncomfortably high burden," according to the IMF.

"Given the lengthy election season and ongoing gridlock in the US Congress there is little chance of meaningful medium-term debt reduction before 2013," the IMF acknowledged.

But there was some good news. The IMF raised US growth projections for this year to 2.1 percent, that was up three tenths of a percentage point from a January estimate.

Still, the IMF warned: "Should growth disappoint, the lack of fiscal consolidation strategy may increase the US risk premium, which could have spillover effects for other major economies."

Warpy

(111,267 posts)As Stupid's reckless tax cuts are allowed to expire as quietly as possible on Dec. 31, much of the deficit crisis will be over.

Well, it will be with one very glaring exception: the balance of trade. That's the one that will eventually kill us.

Jacking up taxes on billionaires will do only so much about that. Other strategies that need to be pursued are admitting both parties have been wrong about unrestricted trade because it was a game we were playing but nations that ended up with US manufacturing jobs were not. Common sense tariffs will have to be instituted, it's the only way to discourage importation and encourage point of consumption manufacturing. Once you end the massive advantage of going after cheap labor, jobs will come home.

Putting the Pentagon on a diet is also vitally necessary. Superpowers throughout history have been bankrupted by their need for a bloated military to protect trade routes if not actual conquered land mass. Abandoning our role as world cop will also add to the uncertainty of foreign importation and spur rebuilding our own industry.

Increasing corporate taxes through tariffs is one mechanism. The other way to get them to invest in their companies and workforce is to raise taxes on net profit, something the New Dealers knew and all the wonks since then have forgotten.

Whatever happens, whether we cede empire gracefully or have it grabbed away from us, we are going to be living in very interesting times, both short and long term.

Demeter

(85,373 posts)As for Stupid's tax cuts, I was so hopeful LAST TIME that they would die a quiet death, and IT DIDN'T HAPPEN! And we all know why.

That's why I have no hope and see no future for this Administration.

Warpy

(111,267 posts)After all, he's not Stupid. He's a very smart man.

Congress will be back in session and making as much mischief as they can before the teabaggers go home forever. That doesn't mean he's going to sign anything, not with a new and quite possibly more reasonable Congress seating within a couple of months.

Of course, if fools keep sending Republicans to Congress, we are sunk.

Demeter

(85,373 posts)I have seen no sign that he's learned a thing...all I've seen is an inkling that he MIGHT be thinking something is rotten in Denmark, but he's not sure. Certainly, he's made no substantive changes in policies, practices, or personnel. He's still throwing out the baby and swilling the dirty bath water.

Demeter

(85,373 posts)but it sends cold chills down my spine.

Po_d Mainiac

(4,183 posts)in an illiterate world.

Demeter

(85,373 posts)http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/16_John_Williams_-_Real_Earnings_Collapse,_Nearly_50_Below_1973_files/shapeimage_22.png

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/16_John_Williams_-_Real_Earnings_Collapse,_Nearly_50_Below_1973_files/Picture%2059.jpg

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/16_John_Williams_-_Real_Earnings_Collapse,_Nearly_50_Below_1973_files/Picture%2056.jpg

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/4/16_John_Williams_-_Real_Earnings_Collapse,_Nearly_50_Below_1973_files/Picture%2051.jpg

I want KWN readers globally to look at the last chart one more time. Not only is SGS unemployment in the US above 22%, only comparable to the Great Depression, but for those who are working, their real earnings have been collapsing for more than a decade. Real earnings are nearly 50% below 1973.

That chart is critical for readers around the world to understand the systematic destruction of the middle class in the United States. This is what depressions look like. Do not believe lies from the mainstream media. There will be no recovery in the United States for the foreseeable future.

Egalitarian Thug

(12,448 posts)really going on. Glad to see he is keeping up the work.

K&R

Demeter

(85,373 posts)the dollar strengthens yet again. Uncle Ben is foiled again.

Demeter

(85,373 posts)Despite all of its best hopes, Wall Street will never escape what’s happening in the Eurozone. The 1 trillion euro ($1.3 trillion) slush fund created to keep the chaos at bay is not big enough. And it never was. Spanish banks are now up to their proverbial eyeballs in debt and the austerity everybody thinks is working so great in Greece will eventually push Spain over the edge. Spanish unemployment is already at 23% and climbing while the official Spanish government projections call for an economic contraction of 1.7% this year. Spain appears to be falling into its second recession in three years. I’m not trying to ruin your day with this. But ignore what is going on in Spain at your own risk. Or else you could go buy a bridge from the parade of Spanish officials being trotted out to assure the world that the markets somehow have it all wrong. But the truth is they don’t.

EU banks are more vulnerable now than they were at the beginning of this crisis and risks are tremendously concentrated rather than diffused...European banks reportedly will have more than 600 billion euros ($787 billion) in redemptions by the end of the year. They come at a time when the banks have sustained billions in capital losses they can’t make up.

Worse, they’ve borrowed a staggering 316.3 billion euros ($414.9 billion) from the ECB through March, which is 86% more than the 169.8 billion euros ($222.7 billion) they borrowed in February. This accounts for 28% of total EU-area borrowings from the EU, according to the ECB.

There will undoubtedly be more borrowing and more losses ahead as interest rates rise further.

The process will not be pleasant:

Unfortunately, this vicious cycle is already under way...Spanish credit default swaps touched record levels, reaching 502.46 basis points according to Bloomberg News. That process actually began in February when traders starting upping the ante on Spanish debt...Wall Street sells them as insurance against default. In reality though, they are like buying fire insurance on your neighbor’s house, in that you now have an incentive to burn it down...

The big boys are going on the offensive and pushing the cost of insuring Spanish debt to new highs because they know that the Spanish government prefers more bailouts to pain. It’s the same thing they did with Greece, Ireland and Italy. At the same time, they’re shorting Spanish debt knowing full well that there will be massive capital losses as Spanish bonds deteriorate. What these fiscal pirates are counting on is the ECB and Spanish government riding to the rescue. At that point, they will sell their swaps and go long Spanish bonds, thus netting themselves a two-fer.

Demeter

(85,373 posts)Britain's Office for National Statistics confirmed today (Wednesday) that in the first quarter of this year Britain's economy shrank .2 percent, after having contracted .3 percent in the fourth quarter of 2011. (Officially, two quarters of shrinkage make a recession). On Monday Spain officially fell into recession, for the second time in three years. Portugal, Italy, and Greece are already basket cases. It seems highly likely France and Germany are also contracting...Why should we care? Because a recession in the world's third-largest economy, combined with the current slowdown in the world's second-largest (China), spells trouble for the world's largest. Remember -- it's a global economy. Money moves across borders at the speed of an electronic impulse. Wall Street banks are enmeshed into a global capital network extending from Frankfurt to Beijing. That means that notwithstanding their efforts to dress up balance sheets, the biggest U.S. banks are more fragile than they've been at any time since 2007. Meanwhile, goods and services slosh across the globe. If there's not enough demand for them coming from the second and third-largest economies in the world, demand in the U.S. can't possibly make up the difference. That could mean higher unemployment here as well as elsewhere.

What's the problem with Europe? Don't blame it on the so-called "debt crisis." There was no debt crisis in Britain, for example, which is now experiencing its first double-dip recession since the 1970s. Blame it on austerity economics -- the bizarre view that economic slowdowns are the products of excessive debt, so government should cut spending. Germany's insistence on cutting public budgets has led Europe into a recession swamp. German Chancellor Angela Merkel, who has led the austerity charge, and other European policy makers who have followed her, have forgotten two critical lessons: First, that the real issue isn't debt per se but the ratio of the debt to the size of the economy. In their haste to cut the public debt, Europeans have overlooked the denominator of the equation. By reducing public budgets they've removed a critical source of demand -- at a time when consumers and the private sector are still in the gravitational pull of the Great Recession and can't make up the difference. The obvious result is a massive slowdown that has worsened the ratio of Europe's debt to its total GDP, and is plunging the continent into recession. A large debt with faster growth is preferable to a smaller debt sitting atop no growth at all. And it's infinitely better than a smaller debt on top of a contracting economy.

The second lesson Merkel and others have overlooked is that the social costs of austerity economics can be huge. It's one thing to cut a government budget when unemployment is low and wages are rising. But if you cut spending during a time of high unemployment and stagnant or declining wages, you're not only causing unemployment to rise even further -- you're also removing the public services and safety nets people depend on, especially when times are tough. And with high social costs comes political upheaval. On Monday, Netherlands Prime Minister Mark Rutte was forced to resign. U.K. Prime Minister David Cameron is on the ropes. The upcoming election in France is now a tossup -- incumbent Nicolas Sarkozy might well be unseated by Francois Hollande, a Socialist. European fringe parties on the left and the right are gaining ground. Across Europe, record numbers of young people are unemployed -- including many recent college graduates -- and their anger and frustration is adding to the upheaval. Social and political instability is itself a drag on growth, generating even more uncertainty about the future. What European policy makers should do is set a target for growth and unemployment -- and continue to increase government spending until those targets are met. Only then should they adopt austerity.

What are the chances that Merkel et al will see the light before Europe plunges into an even deeper recession? Approximately zero. The danger here for the United States is clear, but there's also a clear lesson. Republicans have become the U.S. party of Angela Merkel, demanding and getting spending cuts at the worst possible time -- and ignoring the economic and social consequences. Even if the U.S. economy (as well as President Obama's reelection campaign) survives the global slowdown, we're heading for a big dose of austerity economics next January -- when drastic spending cuts are scheduled to kick in, as well as tax increases on the middle class. But the U.S. economy isn't nearly healthy enough to bear this burden. If nothing is done to reverse course in the interim, we'll be following Europe into a double dip.

***************************************************************************

Robert Reich, Chancellor's Professor of Public Policy at Berkeley and former

Secretary of Labor, is the author of Beyond Outrage. His widely-read blog can be found at www.robertreich.org.

Ghost Dog

(16,881 posts)In a nutshell.

Demeter

(85,373 posts)are fools. He who has the most to lose had better not go riling up the peasants.

Demeter

(85,373 posts)

Tansy_Gold

(17,860 posts)(It's an inside joke.)

Demeter

(85,373 posts)Demeter

(85,373 posts)My sister's contribution:

This is the same doormat, from two directions...very clever!

DemReadingDU

(16,000 posts)my dogs chewed the corners of the old one

Demeter

(85,373 posts)Demeter

(85,373 posts)In Spain, the unemployment rate among workers under 25 is more than 50 percent. In Ireland almost a third of the young are unemployed. Here in America, youth unemployment is “only” 16.5 percent, which is still terrible — but things could be worse. And sure enough, many politicians are doing all they can to guarantee that things will, in fact, get worse. We’ve been hearing a lot about the war on women, which is real enough. But there’s also a war on the young, which is just as real even if it’s better disguised. And it’s doing immense harm, not just to the young, but to the nation’s future.

Let’s start with some advice Mitt Romney gave to college students during an appearance last week. After denouncing President Obama’s “divisiveness,” the candidate told his audience, “Take a shot, go for it, take a risk, get the education, borrow money if you have to from your parents, start a business.”...There is, however, a larger issue: even if students do manage, somehow, to “get the education,” which they do all too often by incurring a lot of debt, they’ll be graduating into an economy that doesn’t seem to want them.

You’ve probably heard lots about how workers with college degrees are faring better in this slump than those with only a high school education, which is true. But the story is far less encouraging if you focus not on middle-aged Americans with degrees but on recent graduates. Unemployment among recent graduates has soared; so has part-time work, presumably reflecting the inability of graduates to find full-time jobs. Perhaps most telling, earnings have plunged even among those graduates working full time — a sign that many have been forced to take jobs that make no use of their education. College graduates, then, are taking it on the chin thanks to the weak economy. And research tells us that the price isn’t temporary: students who graduate into a bad economy never recover the lost ground. (CLASS OF 1976--LIVING PROOF--DEMETER) Instead, their earnings are depressed for life.What the young need most of all, then, is a better job market...

What should we do to help America’s young? Basically, the opposite of what Mr. Romney and his friends want. We should be expanding student aid, not slashing it. And we should reverse the de facto austerity policies that are holding back the U.S. economy — the unprecedented cutbacks at the state and local level, which have been hitting education especially hard....Yes, such a policy reversal would cost money. But refusing to spend that money is foolish and shortsighted even in purely fiscal terms. Remember, the young aren’t just America’s future; they’re the future of the tax base, too. A mind is a terrible thing to waste; wasting the minds of a whole generation is even more terrible. Let’s stop doing it.

Demeter

(85,373 posts)The plan to segregate problematic property loans into one or more asset management companies seeks to relieve the burden on struggling lenders

Read more >>

http://link.ft.com/r/NA70KK/ZGQWCN/LSLXF/C4J8G7/C4BUK6/7V/t?a1=2012&a2=4&a3=30

Demeter

(85,373 posts)To meet its financing needs, the Spanish government needs the confidence of foreign and domestic investors. Those private investors must believe that Spain has a credible programme to eliminate the annual fiscal deficits and a back-up plan to deal with the maturing debt if there is a shortfall of buyers. If investors know there is such a plan that could be triggered in an emergency, it might never be needed. The Spanish government should quickly reduce its near-term fiscal deficits and develop an operational plan to deal with its needs in following years.

Read more >>

http://link.ft.com/r/R5WAEE/SPWZ8F/7ZY85/WTAQQ4/AMTL9F/YT/t?a1=2012&a2=4&a3=30

Demeter

(85,373 posts)\

Standard and Poor's multi-notch downgrade of Spain’s sovereign credit rating was largely shrugged off by markets. That is the good news. The bad news is that S&P’s reasoning speaks to dynamics on the ground that are likely to worsen if a more balanced Spanish policy mix is not accompanied by targeted external support.

Read more >>

http://link.ft.com/r/CTBPCC/MSA66Q/K91WR/2OWNNZ/16JS86/GX/t?a1=2012&a2=4&a3=30

Demeter

(85,373 posts)Poor Spain.

Tansy_Gold

(17,860 posts)

Demeter

(85,373 posts)NBG chief launches a last-ditch attempt to fend off a wipeout of private shareholder control as lenders struggle to absorb losses

Read more >>

http://link.ft.com/r/NA70KK/ZGQWCN/LSLXF/C4J8G7/TUKMTW/7V/t?a1=2012&a2=4&a3=30

Demeter

(85,373 posts)The spread betting operator had moved 80% of clients’ money out of segregated accounts at the time of its failure, the group’s chairman said

Read more >>

http://link.ft.com/r/NA70KK/ZGQWCN/LSLXF/C4J8G7/YBQK6Q/7V/t?a1=2012&a2=4&a3=30

Demeter

(85,373 posts)German engineers launch warning strikes over pay demand

Read more >>

http://link.ft.com/r/9ULF66/ZGQ4QS/YGZ3O/8ZETL6/8Z1F7D/W1/t?a1=2012&a2=4&a3=30

xchrom

(108,903 posts)

Demeter

(85,373 posts)Between the thunderstorm, and the cat pulling my hair so I'll get up and feed her, I'm awake.

xchrom

(108,903 posts)and then the weather is just Blech.

Tansy_Gold

(17,860 posts)is enough to inspire a novel!

Demeter

(85,373 posts)xchrom

(108,903 posts)Tansy_Gold

(17,860 posts)Demeter

(85,373 posts)Occupy protesters chanting “we pay taxes and you should too” interrupted General Electric CEO Jeffrey Immelt ... during a speech in Detroit before the SAE World Congress. Other protesters in the hall chanted “we are the 99 percent” before being escorted off the premises by police.

“We pay 29 per cent,” Immelt responded. A GE spokesman later told CBS that “the 29 percent tax rate was what the company paid globally in 2011. In the U.S., the rate was 25 percent.”

However, that doesn’t jive with what Citizens for Tax Justice found in a recent report. CTJ calculated that GE paid an 11.3 percent tax rate in 2011, which is actually a huge increase over previous years. In 2010, for instance, GE paid -76.6 percent. In 2009, it was -52.9 percent. So in each of those years, the government subsidized the hugely profitable mega-corporation:

GE’s low taxes stem mainly from its finance arm, GE Capital, which makes big profits, but generates huge tax “losses” that reduce GE’s taxable income from its other operations. Over the past decade, GE has paid virtually nothing in federal income taxes, paying a paltry 2.3% tax rate on its $83 billion in pretax U.S. profits.

26 major corporations, GE included, had no federal income tax liability for the period between 2008 and 2011 (thought they might have owed something in an individual year), while they made billions in profits. Occupy protesters plan to protest GE’s annual shareholders’ meeting in Detroit tomorrow.

xchrom

(108,903 posts)

The Conservative former defence secretary Liam Fox is gaining a hearing for his calls to remove employment protection. Photograph: Suzanne Plunkett /Reuters

As we enter another recession, economics is now firmly in three camps. There are the rightwing supply-siders who want to cut employment protection to force people into work alongside tax cuts that encourage more private spending. There are the Keynesians, who cheerlead for the state and argue that only the government can restore confidence and stimulate growth. And there is a school of thought that justifies governments sitting on their hands.

This tactic, adopted by the Treasury with the backing of the Bank of England governor, Mervyn King, recommends policymakers do whatever the money markets tell them, which in the UK means a deflationary freeze on spending for seven years. Sit tight and wait for the private sector to shake off its debts. While Whitehall obsesses about balancing its books, the inevitable upturn will magically appear.

This last group has come to dominate economic thinking not only in the UK, but also in the main capitals of Europe over the three years since the collapse of the G20's Keynesian consensus.

George Osborne is not alone in thinking that politicians, sandwiched between the markets and change-resistant voters, have nowhere else to go. From Finland to Austria and the Netherlands to Germany, it is the policy du jour.

Ghost Dog

(16,881 posts)Herman Van Rompuy, president of the EU, on Friday hinted at what is blindingly obvious to everyone else: that growth remains elusive and this fact should be recognised and debated. Merkel told a German newspaper that while she had not shifted her position, generating growth would be her chief economic concern at the summit of EU leaders in June.

See also:

/... http://www.democraticunderground.com/111611869

Demeter

(85,373 posts)and economic idiots.

Demeter

(85,373 posts)Two years after oil from a BP well began gushing into the Gulf of Mexico, the U.S. Department of Justice has filed criminal charges alleging that a former BP employee destroyed critical evidence in the early days of the unfolding disaster. The charges are the first to be filed in what the Obama administration has called the worst environmental disaster in American history, and they are significant because they target employee for his actions...According to an affidavit and complaint filed today in a Louisiana court, Kurt Mix, a former drilling and completions engineer, deleted email and text messages he had sent to senior BP managers estimating that the amount of oil spewing into the Gulf was many times greater than the amount stated publicly. Mix was specifically instructed by attorneys contracted by BP to retain his records before he deleted them, the affidavit states.

In a statement released to reporters, U.S. Attorney General Eric Holder indicated that more charges are likely, describing the indictment as "initial charges" in an ongoing investigation, and saying that the Department of Justice "will hold accountable those who violated the law."...A spokeswoman for the agency declined to say when more charges might be expected, or to explain why the case against Mix was the first to be made public...BP issued a statement saying that the company was cooperating with federal investigators and that "BP had clear policies requiring preservation of evidence in this case and has undertaken substantial and ongoing efforts to preserve evidence."

According to an FBI affidavit submitted to the court along with the indictment, Mix, who worked for BP until January 2012, was directly involved in BP's efforts to understand how much oil was flowing out of the broken Macondo well. On April 21, 2010, Mix estimated that between 68,000 and 138,000 barrels of oil were leaking each day — far more than the 5,000 barrels that were estimated publicly at the time.

On April 22, Mix received the first of six legal notices instructing him to retain his electronic records. Yet, according to the affidavit, in early October, Mix allegedly deleted a string of more than 200 text messages on his iPhone that he had sent to a supervisor. The deleted texts, which the Department of Justice said were recovered forensically, included sensitive — and pessimistic — internal BP information sent while the company was attempting what it called a "Top Kill" effort to stop the gushing oil on May 26, 2010. Mix wrote that the effort — which he was directly involved in — was unlikely to succeed. "Too much flow rate — over 15,000 and too large an orifice. Pumped over 12,800 bbl of mud today plus 5 separate bridging pills. Tired. Going home and getting ready for round three tomorrow."

At the time, BP said publicly that the measure had a 70 percent chance of success.

Mix, 50, was arrested in Katy, Texas today. If convicted, he faces a maximum penalty of 20 years in prison and a fine of up to $250,000 on each of the two counts he is charged with.

Demeter

(85,373 posts)xchrom

(108,903 posts)Unemployment has risen in two-thirds of European countries since 2010 as austerity hit growth and jobs, the International Labour Organisation has said.

In its annual world of work report, the Geneva-based ILO warned that the weaknesses in the labour market were becoming ingrained, with high levels of long-term and youth unemployment.

The study found there were still 50 million fewer jobs in the global economy than before the recession began in 2008 and it was unlikely that growth would be strong enough in the next two years to find jobs for an extra 80 million people looking for work.

Raymond Torres, director of the International Institute for Labour Studies and author of the report, said: "This is not a normal employment slowdown. Four years into the global crisis, labour market imbalances are becoming more structural, and therefore more difficult to eradicate. Certain groups, such as the long-term unemployed, are at risk of exclusion from the labour market. This means they would be unable to obtain new employment even if there were a strong recovery."

Roland99

(53,342 posts)Chicago PMI dropped in April to 56.2% from 63.3% in March to reach a 29-month low, as gauges for production and new orders slowed dramatically, ISM-Chicago said Monday. Though still well over the 50% mark denoting expansion and contraction, economists polled by MarketWatch expected a 60.8% reading. The national Institute for Supply Manufacturing report is due for release Tuesda

Roland99

(53,342 posts)xchrom

(108,903 posts)Manufacturing activity declined in the Southwest, new data out of the Federal Reserve Bank of Dallas shows.

The key general business outlook index declined to -3.4 from 10.8 a month earlier, indicating largely worsening conditions in the region.

Across the board, manufacturers reported slower results, with employment, new orders and production falling.

Below, key output from the report.

Read more: http://www.businessinsider.com/dallas-fed-2012-4#ixzz1tXRBu4V3

xchrom

(108,903 posts)Chicago PMI is out, and the number is 56.2. That's well below the 60.0 reading that was expected. And that's well down from 62.2 last month.

From the Chicago ISM...

April 2012: The Chicago Purchasing Managers reported the April Chicago Business Barometer decreased for a second consecutive month. After five months above 60, the Chicago Business Barometer fell to 56.2, a 29 month low. The index has remained in expansion since October 2009.

BUSINESS ACTIVITY:

• PRODUCTION lowest level since September 2009;

• PRICES PAID down from March's 7 month high;

• INVENTORIES down in 6 of last 7 months;

• SUPPLIER DELIVERIES lowest since September 2011.

BUYING POLICY:

• PRODUCTION MATERIAL lowest lead times since June 2010.

Read more: http://www.businessinsider.com/april-chicago-pmi-2012-4#ixzz1tXRwLhuE

xchrom

(108,903 posts)The Portuguese government reduced spending limits for next year as part of its effort to curb debt and regain access to bond markets.

The government will reduce its primary spending limit by 3.2 percent in 2013 and lower the limit for total spending by 2.1 percent, according to a statement handed out to reporters after a Cabinet meeting in Lisbon today. The plans are included in the government’s budget outline for the 2013-2016 period.

The economy will be in a recession this year and 2013 will be the start “of the economic recovery,” Finance Minister Vitor Gaspar said at a press conference today. Gaspar also said the government is sticking to its target for a budget deficit of 3 percent of gross domestic product in 2013, when the ratio of debt-to-GDP is forecast to peak.

Portugal is cutting spending and increasing taxes to comply with the terms of a 78 billion-euro ($103 billion) aid plan from the European Union and the International Monetary Fund. Prime Minister Pedro Passos Coelho said on March 5 that if the country can’t access bond markets by September 2013 due to “external reasons,” it would be able to count on continued support from the IMF and the EU.

xchrom

(108,903 posts)This year’s planned increase in the national minimum wage will leave it lower than it was in 2004 after inflation is taken into account, according to a new report by LSE professor Alan Manning for the independent think tank the Resolution Foundation.

The minimum wage will rise in cash terms from £6.08 to £6.19 this October, its third successive below inflation increase, leaving it 6 percent below its 2009 peak in real terms.

The report, Minimum wage: Maximum Impact, acknowledges that recent caution on increases is justified but finds the impact of the national minimum wage (NMW) has now stalled:

- after sharp increases in the 2000s, the value of the UK national minimum wage has now flat lined at just over 50 per cent of median (middle) earnings;

- the UK rate sits in the middle of the pack internationally, lagging France and New Zealand where the NMW is closer to 60 per cent of median earnings;

- around 10 per cent of 22 year olds are paid the NMW compared to around 3 per cent by age 30.

Citing overwhelming evidence that the national minimum wage has reduced wage inequality without damaging employment, Professor Manning considers options for future reform to ensure maximum impact without risking job losses:

- introducing a higher rate for workers aged over 25 or 30;

- introducing a higher rate for London and the South East;

- asking the Low Pay Commission to publish an estimate of the minimum wage that big companies in different sectors could afford, raising pressure to pay more than the legal minimum.

Egalitarian Thug

(12,448 posts)I've only posted this 1,000 times or more, all over the web...

The minimum wage is going to be The Wage, so we had better focus on getting that much much higher. It is the only short-term remedy we have any chance of making happen.

Demeter

(85,373 posts)saves time and hunting.

Off to kick ass. See you later, if I survive.

girl gone mad

(20,634 posts)Lifter from Corrente:

tclambert

(11,087 posts)But I can't go shopping? Bummer.

Can I make cookies? Or is that too much like work? I'm trying to perfect oatmeal cookies. Oatmeal cookies with dried cherries, pecans, coconut, double cinnamon and double vanilla has worked out best so far. Oatmeal bacon cookies didn't work out as well as I hoped. (Somebody told me bacon makes everything better. They lied.) I've been threatening to make broccoli cheddar oatmeal cookies. But I think chocolate mint oatmeal cookies will be the next experiment.

I measure the experimental results by how long it takes my co-workers to finish off a batch. The best recipe disappeared in two days and Tom ate all the crumbs left in the ziploc bag. If any remain after a week, I throw them out and write off that experiment as a failure.

DemReadingDU

(16,000 posts)I go for raisins, double vanilla and double cinnamon. Nuts are good too. Haven't tried dried cherries, but that sounds tasty!

Bacon story

My son dropped over with a box of donuts from the local small-town bakery. There was this one round donut, looked like it had maple icing and strange looking nuts on top. Nope, it was chopped bacon.

Not the best idea in donuts, lol.

Fuddnik

(8,846 posts)I'm thinking the Wicked Witch will make a showing for May Day.

Demeter

(85,373 posts)It was heavy lifting, too. All that labor for a measly 35 points...didn't even get back to the beginning.

bread_and_roses

(6,335 posts)I mean, the holy Market was down all of - what? - thirty points or so? CAN'T HAVE THAT! Or something. Being as there's no "there" there except the willful self-delusion of total solipsism ....