Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 6 September 2012

[font size=3]STOCK MARKET WATCH, Thursday, 6 September 2012[font color=black][/font]

SMW for 5 September 2012

AT THE CLOSING BELL ON 5 September 2012

[center][font color=green]

Dow Jones 13,047.48 +11.54 (0.09%)

[font color=red]S&P 500 1,403.44 -1.50 (-0.11%)

Nasdaq 3,069.27 -5.79 (-0.19%)

[font color=black]10 Year 1.59% 0.00 (0.00%)

30 Year 2.70% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)The New York attorney general has opened an investigation into numerous private equity firms, including Bain Capital, according to an official familiar with the inquiry, CBS News has confirmed.

Attorney General Eric T. Schneiderman is examining whether the firms used a tax strategy to avoid paying hundreds of millions of dollars in taxes. The practice involved converting some fees collected for managing accounts into fund investments, resulting in a tax rate of 15 percent instead of 35 percent.

Republican presidential candidate Mitt Romney co-founded the private equity firm in 1984. He ran the organization until 1999, although documents show that he remained the sole owner, president and chief operating officer until 2002...Though Romney collects benefits as a Bain retired partner, the inquiry isn't focused on the time he ran Bain.

The New York Times first reported the investigation of more than a dozen firms. The report indicates that some observers think it is a political motivated investigation by a Democratic attorney general with relations with President Obama, while others say Schneiderman is seeking additional tax revenue for New York.

Tax experts tell the Times they have differing views about the strategy's legality. The New York Times estimates that Bain saved more than $200 million in taxes.

Demeter

(85,373 posts)... The attorney general, Eric T. Schneiderman, has in recent weeks subpoenaed more than a dozen firms seeking documents that would reveal whether they converted certain management fees collected from their investors into fund investments, which are taxed at a far lower rate than ordinary income. Among the firms to receive subpoenas are Kohlberg Kravis Roberts & Company, TPG Capital, Sun Capital Partners, Apollo Global Management, Silver Lake Partners and Bain Capital, which was founded by Mitt Romney, the Republican nominee for president. Representatives for the firms declined to comment on the inquiry.

Mr. Schneiderman’s investigation will intensify scrutiny of an industry already bruised by the campaign season, as President Obama and the Democrats have sought to depict Mr. Romney through his long career in private equity as a businessman who dismantled companies and laid off workers while amassing a personal fortune estimated at $250 million.

Some executives at the firms said they feared that Mr. Schneiderman, a first-term Democrat with ties to the Obama administration, was seeking to embarrass the industry because of Mr. Romney’s roots at Bain. Others suggested that the subpoenas, which were issued by the attorney general’s Taxpayer Protection Bureau, might be part of an effort to recover more revenue for New York under state tax law. The attorney general’s office does not have the power to enforce federal tax laws... The tax strategy — which is viewed as perfectly legal by some tax experts, aggressive by others and potentially illegal by some — came to light last month when hundreds of pages of Bain’s internal financial documents were made available online. The financial statements show that at least $1 billion in accumulated fees that otherwise would have been taxed as ordinary income for Bain executives had been converted into investments producing capital gains, which are subject to a federal tax of 15 percent, versus a top rate of 35 percent for ordinary income. That means the Bain partners saved more than $200 million in federal income taxes and more than $20 million in Medicare taxes.

The subpoenas, which executives said were issued in July, predated the leak of the Bain documents by several weeks and do not appear to be connected with them. Mr. Schneiderman, who is also co-chairman of a mortgage fraud task force appointed by Mr. Obama, has made cracking down on large-scale tax evasion a priority of his first term...

MORE JUICY DETAILS AT LINK

OH, THE INDIGNITY OF DEMANDING TAXES OF OUR "JOB CREATORS"!

Demeter

(85,373 posts)Today, Acting FHFA Director Ed DeMarco wrote to Congress, after due consideration, reaffirming his position that he will not permit Fannie and Freddie to lower principal balances of mortgages of borrowers that are delinquent. This is despite the fact that the top analyst in this space, Laurie Goodman, has determined that principal modifications are the most effective form of mortgage modification, resulting in much lower refault rates than interest rate mods or capitalization mods. And that makes sense. Why should a borrower struggle to hang on to a home when even if they make all the payments, when they sell they they are stuck with a big tax bill? And as we’ve stressed, private label investors are overwhelmingly in favor of deep principal mods for viable borrowers, and that’s because foreclosure is costly and leaves them worse off.

So it’s more that a bit puzzling to see DeMarco nix principal mods, particularly in light of a Treasury program that provides subsidies to investors of 18% to 63% of the amount forgiven, depending on the loan to value ratio of the loan. With those kinds of[S] bribes[/S] subsidies, how could DeMarco say no?

Well, DeMarco has. His logic is twofold. First, bag considering the subsidies, they are just a transfer from one pocket (Treasury) to another (Fannie and Freddie) and therefore don’t count as far as the conservatorship mandate of saving taxpayer dollars is concerned. Second, he goes into dueling model mode, and not being able to see his model and model assumptions, one can’t tell how hard his team has gone in tweaking assumptions to produce the desired result. (if I get my hands on his 18 page letter, which I’ve seen referenced but not posted, I will update the post if it gives more insight on this matter). He concedes in his letter that if you do mods for borrowers that are now delinquent, you see a “small” net benefit (Treasury claimed $1 billion even after the cost of subsidies; it would be telling to see what DeMarco came up with). However, he contends the taxpayer could come up much worse off if people who were current defaulted in order to qualify. His bottom line: “We concluded that the potential benefit was too small and uncertain, relative to the known and unknown costs and risks.”

As much as this blogger is firmly of the view that this is a poor economic decision (deep principal mods are a sound idea, as long as you have a decent approach for vetting borrower income and other debt payments to see if they are viable with a mod), I have to hand it to DeMarco as a bureaucratic infighter. He is effectively throwing the abortion of HAMP results in Treasury’s face. Recall that HAMP did not require borrowers to default in order to qualify for mods, yet many did out of misdirection by servicers. Now in fact, servicers are unlikely to play that game this time, since a principal mod reduces their servicing income. But the fact, as detailed by Neil Barofsky in his book Bailout, that Treasury was indifferent to how homeowners fared under HAMP, and merely saw this as a vehicle for “foaming the runway,” meaning spreading out the number of foreclosures over time, rather than saving borrowers, led to irresponsible actions (like ordering servicers to sign up people for trial mods initially without even qualifying them), numerous changes in program design (disastrous for highly routinized servicers) and lack of concern with the fact that many people lost their homes by virtue of HAMP who might have kept them, has produced some data (in particular, informed estimates of the number of people who defaulted to qualify for HAMP) against the Administration. And notice in its speedy rebuttal letter to DeMarco, Geithner concedes that DeMarco has the power to take this action: “…you have the sole legal authority to make this decision.”

Demeter

(85,373 posts)If there’s any way for banks to cut the cake to work to their advantage, they do.

One example that has not gotten attention is that servicers will complete all the steps of a foreclosure, sometimes even scheduling the sheriff’s sale, and then not put in a bid. The reason? The home is of so little value that at even a $100 price, the bank deems it to be not worth the trouble.

But keeping houses in limbo is a horror show for the old homeowner, who unknown to them, still owns the property (meaning they could have lived in in it and maintained it, preventing neighborhood blight) and is still on the hook for property taxes. And of course, these abandoned homes damage the value of neighboring properties. And needless to say, because they aren’t on the market, these houses are also not considered to be part of official inventories. Foreclosure experts in Florida have told me they see a lot of houses where the banks take the home up to the final step of foreclosure, then let it languish. This story, from Cleveland.com via April Charney, is confirmation that this is a broader phenomenon. Notice that this is a long standing practice; the article cites examples dating from 2006 and 2007. Key extracts:

These so-called “bank walkaways” are another troubling development in the foreclosure crisis, particularly in cities like Cleveland with weaker housing markets, say housing advocates and government officials.

Lenders or mortgage companies decide they don’t want homes they have already foreclosed on, sometimes because the value has plummeted or they believe the homes could become costly liabilities if they are socked with housing code violations.

But without that sale, the property can languish abandoned and ripe for vandalism. As liens and liabilities mount — creating a so-called “toxic title” — it becomes even harder to transfer the property. Neighborhoods and local governments are left to deal with the mess….

Some of the fallout that results when properties languish vacant and abandoned shows up in Cleveland Housing Judge Raymond Pianka’s courtroom.

“I see shocked people every single week,” Pianka said. “They thought the burden was lifted because they filed bankruptcy or because somebody somewhere told them they’re no longer responsible, and then they’re pulled back in facing criminal code violations.”

His court also has worked with such owners on moving the property into the hands of another owner such as a nonprofit agency, the city land bank or the next door neighbor.

But trying to transfer a problem to somebody else can become a thorny and protracted process if the long-gone owner can’t be found or the foreclosed house is saddled with so many financial obligations that it is too expensive to touch.

Notice that there is a remedy, and I hope more states push for it:

Some judges are also taking matters into their own hands:

“I think it’s a big problem,” Russo said. “It’s creating more abandoned homes with nobody responsible for taking care of them.”

It’s not clear whether she has the jurisdiction to issue such orders. But Russo — who was not aware of Murray’s initiative when she began hers — believed it was time to start a discussion.

The more straightforward approach is for places like Cleveland to fine servicers. It would help to work with someone who understood how pooling & servicing agreements worked to construct it in such a way that it would be difficult for them to pass it on to investors. Oh wait, what am I thinking? Servicers pass on all sorts of impermissible fees to investors as it is. The more likely point of short-term leverage is for the city to identify which servicers have been the worst actors and to have community groups encourage businesses, churches, and foundations to move their accounts away from the banks that own them. Losing that type of customer has a vastly bigger impact on banks than individuals moving their money.

AnneD

(15,774 posts)if someone pays the back taxes to the city state annd county...the property should be theirs free and clear with a special title given to the person that pays the taxes. The bank could not seize the property because they basically abandoned it themselves.

Demeter

(85,373 posts)Michael Hudson spoke with Max Keiser about what he calls “fictitious capital” which is essentially lending backed by inadequate capital, such as collateral that has fallen in value. This is an idea he has explored in his previous papers, such as “From Marx to Goldman Sachs” and now in his new book, The Bubble and Beyond. For German readers, Hudson was also interviewed in FAZ.

VIDEO AT LINK: http://www.nakedcapitalism.com/2012/08/michael-hudson-on-fictitious-collateral.html#lVcgz7p9D3UZd5vO.99

AnneD

(15,774 posts)Has been hotter than normal lately, especially since that economist got canned for being on his show.

Demeter

(85,373 posts)If the Presidential campaign seems vacuous to you, that’s because it is. Here are some questions that “we” — by which I mean the legacy party campaigns, their enablers, and our famously free press — can’t seem to bring ourselves to ask during the campaign. So, I’m going to ask them now:

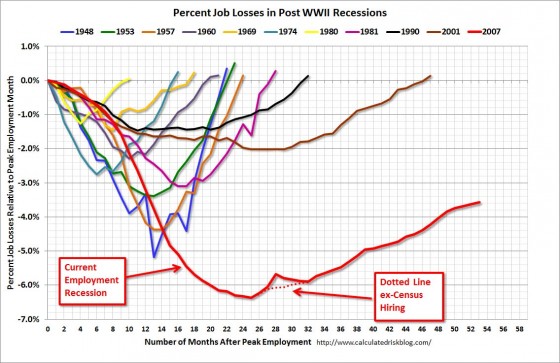

1. How did 8% nominal unemployment become the new normal? Here’s last month’s version of the most frightening chart in the world from Calculated Risk:

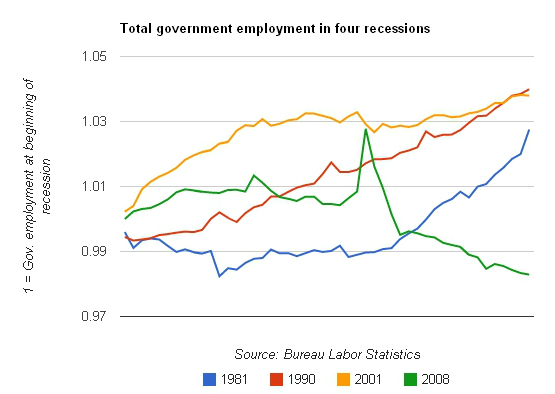

From where I sit, the employment market flatlined in 2008 and never recovered, and the 2007-2012 curve looks like successfully achieved public policy. Clearly, that’s true for government employment, where the current powers that be, uniquely for the four recessions since 1981, engineered a decrease in public sector employment, as Ezra Klein (of all people) points out:

Republicans, as Klein also points out, honor “shrinking government” during a recession more in the breach than the observance. Obama, a Democrat, actually implemented their policies, by commission at the Federal level, and by omission at the State level, since he bailed out the banks instead:

Anyhow, corporate profits are high and wages are low, so what’s not to like?

2. Why can’t we prosecute the executives of major banks for accounting control fraud? NC readers are thoroughly familiar with WIlliam R. Black’s “accounting control fraud” construct, and Yves has shredded the Obama administration’s refusal to deal with it, so I need not review that material. Instead, I’ll quote William Black from a terrific summary of his speech the MMT conference held recently in Italy:

Indeed. How’d that happen?

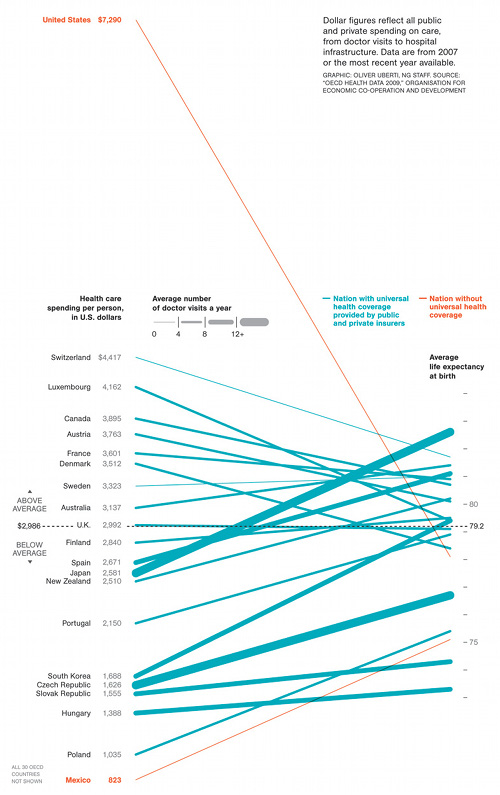

3. Why do we have to deliver health care through the private health insurance industry? Here’s the chart:

Here at least is one case where American Exceptionalism turns out to be true: The American system of health care is both exceptionally expensive and uniquely lethal. Why can’t we talk about, instead of diverting ourselves by arguing about the misfeatures of a “reform” that mostly kicks in two years from now, and has the main virtue of only throwing some few millions under the bus? And don’t talk to me about meanie Republicans; if the Democrats had wanted to pass real legislation, they would have abolished the filibuster in 2009, when they had the House, the Senate, and a mandate...

5. Why can’t we restore the tax brackets of the Eisenhower era? Here they are:

Romney:“What I’m saying is, don’t raise taxes.” Obama: “Ask the wealthy to pay a little more.” A little? Why not a lot? NOTE: I know from MMT that taxes don’t “fund” spending. However, a higher tax rate for the wealthy is good for two other reasons: (1) They can’t use all their loose cash to buy the government, and (2) preventing an aristocracy of inherited wealth is good.

http://www.nakedcapitalism.com/2012/07/thirteen-ways-of-looking-at-a-clang-bird.html#Ghmj3xEgolqgOQ6P.99

bread_and_roses

(6,335 posts)picked up off YAHOO, of all places - though originally from US News & World Report - though that, too, is surprising.

http://news.yahoo.com/one-person-whos-better-off-under-president-obama-173017737.html

True, this: "One Person Who's Better Off Under President Obama: Mitt Romney"

But of course, they have to get in a BIG LIE

And then: "Who's better off under President Obama?"

http://www.usnews.com/news/blogs/rick-newman/2012/08/22/whos-better-off-under-president-obama

Top three:

Big business. Corporate profits tanked at the end of 2008, but they recovered strongly in 2009 and have been rising ever since...

CEOs. For all the criticism of sky-high CEO pay, the boss keeps getting richer...

And who's worse off?

http://www.usnews.com/news/blogs/rick-newman/2012/08/22/whos-worse-off-under-president-obama

Top three:

A lot of displaced workers. ... there are nearly 5 million more unemployed people today, plus 3 million more who work part time because they can't find full-time work...

Homeowners. The typical family has endured a crushing loss of net worth, mostly from the erosion of home values...

Roland99

(53,342 posts)DOW +0.4%

NASDAQ +0.4%

Roland99

(53,342 posts)Roland99

(53,342 posts)DRAGHI - BOND-BUY PROGRAMME INCLUDES, FOR EXAMPLE, 10-YEAR BONDS WITH 3 YEARS LEFT TO MATURITY

DRAGHI - BREAKDOWN BY COUNTRY TO BE PUBLISHED ON MONTHLY BASIS

DRAGHI - WILL PUBLISH WEEKLY AMOUNTS OF PURCHASES

DRAGHI - NO QUANTITATIVE LIMITS SET ON SIZE OF BOND BUYS

ECB'S DRAGHI - WILL ACT IN ACCORDANCE WITH MON POL MANDATE

ECB'S DRAGHI - NECESSARY CONDITION IS CONDITIONALITY ATTACHED TO EFSF/ESM PROGRAMME

DRAGHI - AFTER FULL ASSESSMENT, ECB WILL DECIDE ON START, CONTINUATION OF BOND PURCHASES

DRAGHI - ECB BOND PURCHASES WILL BE CONDUCTED UNDER CONDITIONALITY

ECB'S DRAGHI - IMF INVOLVEMENT WILL BE SOUGHT IN MONITORING, SETTING CONDITIONS

ECB'S DRAGHI - GOVERNMENTS MUST STAND READY TO ACTIVATE EFSF/ESM

ECB'S DRAGHI - WE WILL ACT INDEPENDENTLY

ECB'S DRAGHI - EURO IS IRREVERSIBLE

ECB'S DRAGHI - WE ARE STRICTLY WITHIN MANDATE, WE ACT INDEPDENDTLY

Ghost Dog

(16,881 posts)... DRAGHI: "As we said a month ago, we need to be in a position to safeguard the monetary policy transmission in all countries across the euro."

8:33: Draghi introduces the OMT program: Outright Monetary Transactions.

This is the official name of the new bond buying scheme. It's the successor to the SMP.

Draghi says he will release a press release momentarily on how it works.

8:36: Now Draghi is talking about the economy, and he just revised GDP expectations to -0.4% from -0.1%. And he says risks remain to the downside.

Calls on governments to fully implement

Inflation risks are "broadly balanced."

8:39: Still talking growth and so forth. Everything is either bad or subdued.

Keep refreshing for the latest...

8:42: Draghi is now introducing Outright Monetary Transactions...

Conditionality. Strict and effective conditionality is attached to ECB purchases of sovereign debt. What this means is: No country gets to have their bonds purchased unless they submit to outside oversight on fiscal matters. IMF observation will get re-elected. Draghi threatns to terminate actions in non-compliance.

Unlimited purchases of 1 to 3 years.

ECB is no longer senior. ECB expects the same Pari Pasu treatment.

Sterilization: The liquidity created through outright transactions will be sterilized.

Transparency: Purchases to be revealed on a weekly and monthly basis.

8:48: Draghi now talking about collateral. ECB suspends collateral rating requirements for countries...

Read more: http://www.businessinsider.com/ecb-decision-day-2012-9#ixzz25hC8dH4N

GD Note: None of this goes into effect without German Court Ok, formal requests by governments (ie. Spain), and presumably negotiated yet further 'austerity' (ie. civil unrest) measures.

Ghost Dog

(16,881 posts)6 September 2012 - Technical features of Outright Monetary Transactions

As announced on 2 August 2012, the Governing Council of the European Central Bank (ECB) has today taken decisions on a number of technical features regarding the Eurosystem’s outright transactions in secondary sovereign bond markets that aim at safeguarding an appropriate monetary policy transmission and the singleness of the monetary policy. These will be known as Outright Monetary Transactions (OMTs) and will be conducted within the following framework:

Conditionality

A necessary condition for Outright Monetary Transactions is strict and effective conditionality attached to an appropriate European Financial Stability Facility/European Stability Mechanism (EFSF/ESM) programme. Such programmes can take the form of a full EFSF/ESM macroeconomic adjustment programme or a precautionary programme (Enhanced Conditions Credit Line), provided that they include the possibility of EFSF/ESM primary market purchases. The involvement of the IMF shall also be sought for the design of the country-specific conditionality and the monitoring of such a programme.

The Governing Council will consider Outright Monetary Transactions to the extent that they are warranted from a monetary policy perspective as long as programme conditionality is fully respected, and terminate them once their objectives are achieved or when there is non-compliance with the macroeconomic adjustment or precautionary programme.

Following a thorough assessment, the Governing Council will decide on the start, continuation and suspension of Outright Monetary Transactions in full discretion and acting in accordance with its monetary policy mandate.

Coverage

Outright Monetary Transactions will be considered for future cases of EFSF/ESM macroeconomic adjustment programmes or precautionary programmes as specified above. They may also be considered for Member States currently under a macroeconomic adjustment programme when they will be regaining bond market access.

Transactions will be focused on the shorter part of the yield curve, and in particular on sovereign bonds with a maturity of between one and three years.

No ex ante quantitative limits are set on the size of Outright Monetary Transactions.

Creditor treatment

The Eurosystem intends to clarify in the legal act concerning Outright Monetary Transactions that it accepts the same (pari passu) treatment as private or other creditors with respect to bonds issued by euro area countries and purchased by the Eurosystem through Outright Monetary Transactions, in accordance with the terms of such bonds.

Sterilisation

The liquidity created through Outright Monetary Transactions will be fully sterilised.

Transparency

Aggregate Outright Monetary Transaction holdings and their market values will be published on a weekly basis. Publication of the average duration of Outright Monetary Transaction holdings and the breakdown by country will take place on a monthly basis.

Securities Markets Programme

Following today’s decision on Outright Monetary Transactions, the Securities Markets Programme (SMP) is herewith terminated. The liquidity injected through the SMP will continue to be absorbed as in the past, and the existing securities in the SMP portfolio will be held to maturity.

ZH continues... http://www.zerohedge.com/news/ecb-releases-smp20-aka-outright-monetary-transactions-details

[center]

[/center]

[/center]

...

AnneD

(15,774 posts)I am sure it is getting interesting.

Ghost Dog

(16,881 posts)AnneD

(15,774 posts)One of my favorite Collins songs, made even more poignant these days. Every time I hear the news from Spain or England, I think of you and some others that are in that part of the globe.

Roland99

(53,342 posts)Roland99

(53,342 posts)Private companies in August brought on 201,000 new workers in August. This is considerably higher than economists’ forecasts: Observers predicted 149,000 jobs added last month. July’s gain was upwardly revised by 10,000 to 173,000.

Small and medium-sized businesses contributed the lion’s share of the growth. Large corporations added only 8%, some 16,000.

The greatest growth came in the service sector, where 185,000 workers found employment. Manufacturing’s expansion was halved, falling from to 3,000 new jobs from 6,000 a month earlier.

mnhtnbb

(31,404 posts)75 of his co-workers were phoned at home and told not to come into work.

He survived that purge only to get the phone call himself a couple weeks later.

bread_and_roses

(6,335 posts)But hey, who cares? The stock market is a-roarin'!!!! I hear tell that's good for all of us! I'm sure it's cheering her up a LOT, don't you know?

Roland99

(53,342 posts)DemReadingDU

(16,000 posts)the bigger the crash when it implodes.

DemReadingDU

(16,000 posts)Daughter was a research scientist at a children's hospital and son was a policeman. Too much stress. So there are 2 openings for someone else.

AnneD

(15,774 posts)Count them 22 openings for School Nurses. The word has gotten out as to how crappy we are paid and worse still, how horrid we are treated. There will be more beatings until the morale improves.

Fuddnik

(8,846 posts)Roland99

(53,342 posts)full paper: http://www.bostonfed.org/economic/ppdp/2012/ppdp1205.pdf

Hotler

(11,445 posts)Ah. And this one's for all you young, naive, kids:

AnneD

(15,774 posts)deNile?