Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 20 November 2012

[font size=3]STOCK MARKET WATCH, Tuesday, 20 November 2012[font color=black][/font]

SMW for 19 November 2012

AT THE CLOSING BELL ON 19 November 2012

[center][font color=green]

Dow Jones 12,795.96 +207.65 (1.65%)

S&P 500 1,386.89 +27.01 (1.99%)

Nasdaq 2,916.07 +62.94 (2.21%)

[font color=green]10 Year 1.61% -0.01 (-0.62%)

30 Year 2.76% -0.01 (-0.36%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I may not know until Weds. It's Board Meeting night! We get to appoint two new board members to fill vacant chairs. We even have two volunteers for the jobs. They might even be good at it.

Life is a crap shoot. Although why one would want to shoot it is beyond me. Seems messy and unsanitary.

Demeter

(85,373 posts)We’ve written at length how the Obama Administration claim that it couldn’t prosecute bank CEOs and senior executives because they didn’t do anything illegal is utter hogwash. Sarbanes Oxley, passed in the wake of Enron, was designed to prevent CEOs and other top executives from escaping liability by claiming they were clueless face men. And it provides for a clear path to criminal prosecutions.

But the way Sarbanes Oxley was defanged is by making it an exercise in form over substance. Public firms engage in compliance theater while the SEC sits on its hands as far as enforcement is concerned (Note that the SEC did fail on its lone effort to use Sarbox against a CEO in the case of Richard Schrusy and Healthsouth. But that case was tried before a jury in Birmingham, Alabama, and I will spare readers the long form account as to why you can’t generalize from these results). Both the MF Global collapse and the JP Morgan Chief Investment Office fiasco look like slam-dunk Sarbox cases, yet we’ve seen nary a sign of interest from the SEC.

Occupy the SEC has used House Financial Services Committee hearings this week on the tenth anniversary of the passage of Sarbanes Oxley to raise pointed questions as to why the SEC has not launched a probe of JP Morgan. I have a sneaking suspicion that this line of thinking won’t get any air time, and instead the Congresscritters will focus on how the nasty law inconveniences fine upstanding major corporations.

I hope you’ll read their succinct and forceful letter. AT LINK

Read more at http://www.nakedcapitalism.com/2012/07/occupy-the-sec-urges-the-sec-to-investigate-jp-morgan-over-likely-as-in-bloomin-obvious-sarbanes-oxley-violations-ows.html#z9iAP3Eizy7MO1RI.99

Demeter

(85,373 posts)Today's minimum wage is epic in its injustice and Dickensian in its cruelty. It's a shame that Dickens himself isn't here to write about it. Oh, and we almost forgot: Keeping it this low isn't very smart, either. A new report provides a good opportunity to revisit the subject, which leads to an inescapable conclusion: Raising the minimum wage isn't just the right thing to do. It's also economic common sense.

Sen. Tom Harkin and Rep. George Miller have a new minimum-wage proposal that's worth fighting for. Here's why:

Most low-wage workers work for large corporations, not Mom-and-Pop businesses.... 66 percent of low-wage employees work for companies with more than 100 employees. That includes a handful of very large corporations which collectively employ nearly 8 million low-wage employees. The largest of those mega-corporations is, unsurprisingly, Wal-Mart, with 1,400,000 employees. The next-largest is Yum! Foods, which owns Taco Bell, Pizza Hut, and KFC. After Yum! Foods comes McDonald's. Also on the list is Staples, Inc., the corporation where Mitt Romney boasts that he "created jobs" before his retroactive resignation from Bain Capital...These employers are "job takers," not "job creators." Staples, like Wal-Mart and most other corporations on the low-wage list, doesn't really "create" jobs. Smaller enterprises of all kinds are crowded out by the unchecked growth of mega-corporations, which often use their volume to undercut the locals on price until they're driven out of business. Then they raise them again. In other words, Staples and the other giant corporations are taking those jobs from other businesses - those entrepreneurial Mom and Pop shops which will soon vanish into American folklore unless we do something.

...As Dave Johnson explains, corporations like Staples are masters at "marking down" the value of their employees. "Average Staples salaries for job postings nationwide are 51% lower than average salaries for all job postings," he writes. And remember: Staples doesn't just hire entry-level or unskilled workers. It employs sales people, accountants, purchasing directors, and IT people, as well as managers at the store, local, regional, state, and national levels. Among those employees, you'll probably find the "Moms" and "Pops" which Staples put out of business - that is, if Mom and Pop have jobs at all.

The minimum wage has dropped 30 percent - almost a third - since 1968. So where are the jobs?

As the NELP project notes, today's minimum wage has 30 percent less purchasing power than it did in 1968. Corporate defenders say that raising the minimum wage will hurt employment. What does the evidence say? We checked: The official US unemployment rate in 1968 was 3.6 percent. Today that figure is 8.2 percent. (The real employment figures, including discouraged workers and the under-employed, are even worse.) A weak minimum wage increases poverty and shatters families. What does this mean in real life? Let's go back to Staples, where a jobs website reports that cashiers make $8.17 per hour, so-called "Easy Techs" make from $8.76 to $9.08 per hour, and the highest paid reported job ("Easy Tech Expert"

They've got the dough. The NELP reports notes that 92 percent of the 50 largest low‐wage employers in the country were profitable last year. And they've more than recovered from the recession: 75 percent are collecting more revenue, 63 percent are earning higher profits, and 73 percent have higher cash holdings. They've got the money. They just don't want to spend it....

MORE

Demeter

(85,373 posts)By Marshall Auerback, a hedge fund manager and portfolio strategist.

*************************************************************

A raise in the minimum wage is smart economics and beneficial to society. So what are we waiting for?

In recent months, a number of states have again taken the lead on measures to raise the minimum wage. Massachusetts is moving toward a minimum of $10 per hour. Other measures are on the table in New York, Illinois, New Jersey, Connecticut and Missouri. Meanwhile Sen. Tom Harkin, D-Iowa, is pressing for the federal minimum wage to rise to $9.80 per hour by 2014. This is far more sensible policy than symbolic nods to the left through gimmicks such as the so-called Buffett Rule, which might raise new revenues from the mega-wealthy through taxes, but will likely amount to very little because gazillionaires can hire clever accountants to help them get around it. No, we need policies that clearly do something for hard-working people who have been clobbered by a financial crisis they didn’t create.

Here are five reasons why we should cheer for working America getting a raise.

1. Good for Families: According to economist James Galbraith, raising the minimum wage would raise the incomes of 28 million Americans. Women would particularly benefit because they tend to work for lower wages than men. As Galbraith sees it, raising the minimum wage is family friendly policy:

2. Good for Economic Recovery: To get the economy back on track, spending power has to be in the hands of those who actually spend in the real economy. That means regular people, not the super-wealthy who tend to hoard wealth or invest in financial products. The minimum wage story is not just a story about income inequality, but rather it’s about an elite that has hijacked the economic system and made it work less productively than before while redistributing more of what is working to themselves. The problem with our economy today is that the growing gap between the real wages and productivity has violated the traditional relationship between real wages and consumption. So if the productivity of each worker is rising strongly, yet that worker’s capacity to purchase (the real wage) is lagging badly behind – how does economic recovery which relies on growth in spending sustain itself? Which is why policy should be more directed toward programs that increase the minimum wage and less of discredited neoliberal “trickle-down” economics. Trickle-down economics is largely counterproductive because it shifts more resources into the hands of those who have less propensity to spend and keep the economy moving.

3. Helps People Get Out of Debt: During the early part of the post-war period, particularly the 1950s and 1960s, entrepreneurship was more concerned with building productive capacity and putting workers to work actually making useful things as opposed to creating financial Frankenstein products like credit default swaps. As our economy has become increasingly directed toward Wall Street and the so-called FIRE (finance, insurance, real estate) sectors, more wealth has migrated to the top 1 percent. On top of that, real wages have increasingly lagged behind the growth in productivity. It is also clear that hours worked and persons employed in the “productive” sector have been in decline over the last few decades.

Prior to the 1970s, when flawed neo-liberal ideas started to gain prominence, the growth of real wages largely tracked productivity growth, which meant that as the productive capacity of the system expanded, the capacity of the workers to maintain consumption standards out of wages also grew in proportion. There were high incomes produced, but these typically came from success in building things and spreading the gains (somewhat to workers). Today, high incomes come from the financial sector capturing an increasing share of national income and using it to shuffle financial assets in the financial markets casino which adds about zero to productive output.

An increase of a couple of dollars per hour or more in the minimum wage could make huge improvements in the difficult existence of the working poor, perhaps allowing them to exit the debt treadmill and stand a better chance of eventually rising into a revitalized middle-class. Admittedly, corporate profits might suffer a little and some businesses at the lowest end might disappear. That said, corporate profits as a percentage of national economic output are already at an all-time record levels. And it’s questionable whether such levels of profitability can be sustained. Firms have lots of unused capacity lying around because people can’t afford to buy products and services. Sluggish sales growth is directly connected to lagging wage rates.

At the same time, dependence on food stamps has surged by over 14 million over the same period. And “financial engineering” has helped to create a significant escalation in debt being borne by the private sector, particularly consumers. Surely we need a better model than that?

4. Protects Workers From Abuse: A higher minimum wage would also help to mitigate the abusive, exploitative working practices of a number of employers, who take advantage of the currently low minimum wage to seek cut-rate help. Such employers often use undocumented labor, which further undermines America’s working poor.

5. Justice for Working Americans: Most of all, a big jump in the minimum wage would be a reparation. Because let’s be clear: class warfare has already been undertaken on behalf of the 1 percent. The past 30 years have witnessed a dramatic redistribution of national and personal income in favor of profits for the rich. At the same time, this period has been associated with a dramatic decline in the performance of the US economy. To raise the minimum wage would be literally the minimum we could do for those who have suffered from the economic crisis: the working population. It would be an act of justice.

Read more at http://www.nakedcapitalism.com/2012/07/marshall-auerback-top-5-reasons-why-raising-the-minimum-wage-is-good-for-you-and-me.html#ye63V3OQtE1ZOcMU.99

Demeter

(85,373 posts)The world's 20th richest man declared recently that a living wage bill passed (over his veto) by New York's city council was the next best thing to Communist central planning. Michael Bloomberg, who's also made news recently trying to ban large sodas, today took the next step in proving how serious he is about keeping wages low--I mean, keeping New York City a "business-friendly" climate.

Bloomberg is suing to prevent not just the living wage bill, but a companion "prevailing wage" bill that the City Council also passed over his veto, from going into effect. The living wage bill requires employers that get more than $1 million in taxpayer subsidies to pay their workers at least $10 an hour with benefits or $11.50 an hour without them, and the prevailing wage bill would up wages to $20 an hour for certain building services workers in buildings that receive subsidies of over $1 million or where the city leases a significant amount of property.

The Wall Street Journal reports:

Council spokeswoman Zoe Tobin said the council is confident that it acted within its authority under state law and the City Charter. "These laws were passed over the mayor's veto with overwhelming support in the council and it is disappointing that the mayor has chosen to challenge these laws rather than enforce them," she said.

In April, Mr. Bloomberg delivered an unusually sharp rebuke to the council as he vetoed one of the bills, lecturing its backers on "the way the free market works."

Bloomberg would know how the free market works, after all--it apparently works by handing out millions of dollars of taxpayer money to big businesses so that they'll stick around and continue to pay low wages. FreshDirect, as we reported, got nearly $129 million in city money to stay in town, despite paying its drivers and warehouse workers around $8 or $8.50 an hour. (FreshDirect managed to get exempted from the living wage law anyway, as Council speaker Christine Quinn maneuvered to make it more palatable to business.)

Of course, Bloomberg is dead wrong on the merits--the "economic growth" that he claims to be protecting would in fact be boosted if New Yorkers could actually, you know, afford to spend some money. $8 an hour won't let them do that--nor, truly, will $10 an hour. A recent report from the National Low Income Housing Coalition recently noted that it would require 88 hours of work a week to afford a 2-bedroom apartment in New York working at minimum wage--the same minimum wage that Bloomberg thinks these workers, at massively tax-subsidized companies, should get.

mother earth

(6,002 posts)been an issue of the "too big to fail" entities that are sucking the life out of everyone, even those who are employed by them. I wonder what this country would look like with a return to small business, small banking, family business, mom & pop shops who actually care about what they sell, who they sell to & the bottom line profit margin not being the end all & be all. We've forgotten what it's like to live with values, in every way imaginable. We're being fed a media diet of money trumps all, unless it's in the form of living wages.

It seems it's not enough for slave wages, the slaves must make their bottom line work even if it means poverty levels. Bloomberg may as well be saying "let them eat cake".

Warpy

(111,383 posts)as both income tax revenue and OASDI contributions rise with income. Starving the government has largely been a case of starving ourselves. It has not worked. Unacceptably low wages are a large part of the starvation diet.

Demeter

(85,373 posts)POLITICAL ASPECTS OF FULL EMPLOYMENT By M. KALECKI

http://courses.umass.edu/econ797a-rpollin/Kalecki--Political%20Aspects%20of%20Full%20Employment.pdf

So, it is to my great discredit that I had not read Kalecki’s Political Aspects of Full Employment (LINK ABOVE) before clicking through from a (characteristically excellent) Chris Dillow post. There is little I have ever said or thought about economics that Kalecki hadn’t said or thought better in this short and very readable essay.

Here is Kalecki describing with preternatural precision the so-called “Great Moderation”, and its limits:

Dude wrote that in 1943.

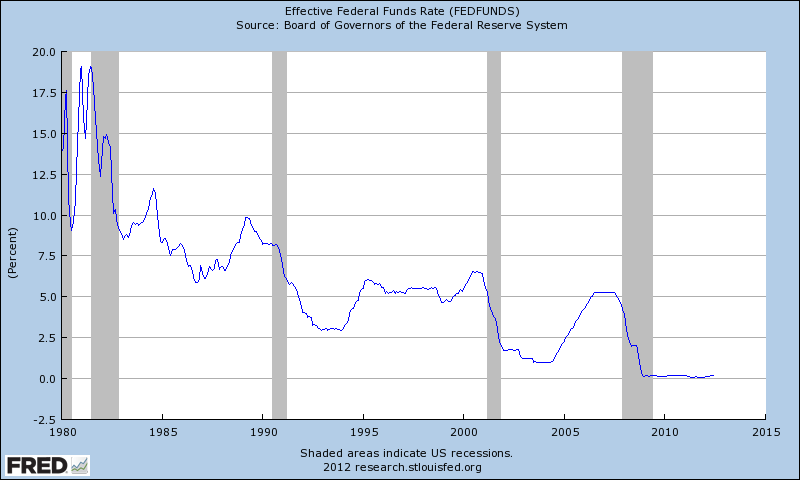

Let’s check out what FRED has to say about interest rates during the era of the lionized, self-congratulatory central banker:

Yeah, those central bankers with their Taylor Rules and DSGE models were frigging brilliant. New Keynesian monetary policy was, like, totally a science. Who could have predicted that engineering a secular collapse of interest rates and incomes tax rates (matched, of course, by an explosion of debt) might, for a while, moderate business and employment cycles in a manner unusually palatable to business and other elites? Lots of equations were necessary. No one would have guessed that, like, 70 years ago.

The bit I’ve quoted is perhaps the least interesting part of the essay. I’ve chosen to highlight it because I hold a churlish grudge against the “Great Moderation”.

Bloggers say this all the time, but really, if you have not, you should read the whole thing.

Roland99

(53,342 posts)Demeter

(85,373 posts)It was a corporation holding its breath until it turned blue...

on the other hand, management should have the place taken away from them. Before they really kill it.

Demeter

(85,373 posts)Greece is spiraling into the kind of decline the U.S. and Germany endured during the Great Depression, showing the scale of the challenge involved in attempting to regain competitiveness through austerity.

The economy shrank 18.4 percent in the past four years and the International Monetary Fund forecasts it will contract another 4 percent in 2013 as Greece struggles to reduce debt in exchange for its $300 billion rescue programs. That’s the biggest cumulative loss of output of a developed-country economy in at least three decades, coming within spitting distance of the 27 percent drop in the U.S. economy between 1929 and 1933, according to the Bureau of Economic Analysis in Washington.

“Austerity has been destroying tax revenue and therefore thwarting the intended effect,” said Charles Dumas, chairman of Lombard Street Research, a London-based consulting firm. “There’s no avoiding austerity, though, because these people have no borrowing power. The deficits are there.”

Greece’s restructured bonds have benefited amid speculation that creditors are poised to release more bailout funds. Greek bonds maturing in 2023, which yielded more than 30 percent at the end of May, now yield about 16.4 percent. The next block of aid is slated to total 31 billion euros ($40.5 billion), mostly to recapitalize the nation’s banks....

Demeter

(85,373 posts)Defying charges of heresy, Spanish economist Lorenzo Bernaldo de Quiros has penned a piece in El Mundo that more or less calls for Spanish withdrawal from the euro – unless Mario Draghi conjurs up real magic at the ECB.

My rough summary/translation:

"Inside the euro and without financial resources, a debt reduction is pointless. The Spanish economy would have to go into deepening internal deflation, with cuts in prices and salaries, to restore competititeness. This is impossible, or at least improbable."

The process would take too long. Capital flight would continue. It would lead to another debt resturturing in short order (as in Greece). "The snake would bite its own tail in a diabolic spiral," he said.

Mr Bernaldo de Quiros — who heads Freemarket Corporate Intelligence — seems to assume that there will not fact be a eurozone rescue (or that the Rajoy government will refuse to accept Troaika terms). He contemptuously rebuts the "apocalyptic casuistry" of those who claim that the banking system would necessarily collapse, or that real interest rates would surge, or that Spain would succumb to hyperinflation.

He notes the success of Britain, and the Scandinavian states in leaving the Gold Standard in 1931 – and those Latin American states that did so later (perhaps a better parallel, since Spain today has net external debt near 100pc of GDP). Their recoveries were in stark contrast to those like France, Poland, Belgium, Italy, and the Netherlands that clung to the dysfunctional fixed-exchange system until the bitter end, trapped in perma-slump.

He cites a study from the Centre for Economic Policy Research studying 13 cases of devaluation shocks over the last two decades. Output exceeded its previous level within three years in ten of the countries, with an average growth rate of 10.3pc (ie, even more than the oft-cited growth rate of Argentina, post-liberation).

Nothing is foreordained, either way. What matters is the policy pursued afterwards. "It would be in our hands whether it would be a success or failure."

MORE

Demeter

(85,373 posts)Even notice nothing is ever said in the mainstream media about Argentina’s economy, save that it had a big default? You’d never know the following about Argentina:

What is particularly striking is how quickly Argentina’s economy rebounded after its default. From a paper by Mark Weisbrot, Rebecca Ray, Juan A. Montecino, and Sara Kozameh (hat tip reader Thomas Ross):

Argentina’s real GDP reached its pre-recession level after three years of growth, in the first quarter of 2005. Looking at twenty-year trend growth, it reached its trend GDP in the first quarter of 2007.

By contrast, the US economy contracted 6.8% in the fourth quarter of 2008, and shrank 2.6% in 2009. The US only now has reached its pre-downturn level of GDP, meaning nearly four years later versus Argentina’s three. In addition, Argentina has regained its trend line of growth, while it is not clear whether the US ever will. The Carmen Reinhart and Kenneth Rogoff work on severe financial crises has found that they result in “permanent” falls in the standard of living, but that has not been the case with Argentina.

...Shorter version: sacrificing your economy on the altar of the Bond Gods may not be such a good idea...

The paper closes by stressing the implications for other debt-burdened nations:

No wonder the IMF and the banksters don’t want Argentina to get good press. The Eurozone countries they are wringing dry might get ideas.

Demeter

(85,373 posts)The majority of the consumer complaints filed with the Consumer Financial Protection Bureau during its first 11 months in existence relate to mortgage debt, the CFPB said in its semi-annual report to Congress. CFPB data shows the bureau received 55,300 consumer complaints from July 21, 2011, through June 30.

Of those complaints, 43% involved mortgage issues. Credit cards ranked second in terms of complaint volume, representing 34% of all first-year calls. Student loans represented only 4% of all calls to the CFPB, while bank accounts and service issues drove 15% of the agency's complaint traffic. Consumer loans and other loan types made up the remaining 4% of complaints, with consumer loans making up only 2% of the CFPB's overal complaint traffic in the past year.

About 44% of the complaints were submitted to the CFPB via its website, while 11% of those with issues phoned in their complaints. The rest of the complaints arrived via mail, email or fax.

Demeter

(85,373 posts)OR, HOW TO BE THE NEXT ROMNEY

https://www.nytimes.com/2012/07/29/magazine/my-big-fat-belizean-singaporean-bank-account.html?_r=1&ref=todayspaper&pagewanted=all

Earlier this month, I decided to see how hard it would be to set up my own offshore bank account. I figured it would be pretty difficult, because I’m not rich and don’t have a team of tax lawyers to oversee my money and because the E.U. and U.S. governments have been cracking down on tax havens by imposing stricter tax-sharing requirements. So I proceeded with some caution. First, I Googled “company registration tax haven” and randomly picked three firms that set up accounts in offshore jurisdictions. Then I called each and explained that I was hoping to minimize my tax exposure and didn’t want anyone to know anything about my finances. Each company quickly noted that I should consult a lawyer to make sure that I wasn’t breaking the law. Then they calmly explained how to create an account that, it seemed to me, was unlikely to be discovered by the I.R.S. or any other authority.

I ended up working with A&P Intertrust, a Canadian company that I chose largely because I liked its Web site the best. (The other two companies’ sites appeared stuck in a late-’90s style with lots of flashing boxes.) A&P works with the governments of Panama, the British Virgin Islands and Belize. (Other companies that I contacted prefer the Seychelles, Cyprus or the Cayman Islands, where Mitt Romney has been reported to have money.) I decided to start my shell company in Belize because it would be exempt from all Belizean taxes and, as A&P’s site explained, “information about beneficial owners, shareholders, directors and officers is not filed with the Belize government and not available to the public.” And I’ve been to Belize and like the place.

Setting up the company was a lot cheaper than I expected. A&P charged $900 for a basic Belizean incorporation and another $85 for a corporate seal to emboss legal documents. For $650 more, A&P offered to open a bank account to stash my fledgling operation’s money in Singapore — a country, the Web site also noted, that “cannot gather information on foreigners’ bank accounts, bank-deposit interest and investment gains under domestic tax law.” And for another $690, it offered to assign a “nominee” who would be listed as the official manager and owner of my business but would report to me under a secret power-of-attorney contract. Then an A&P associate asked me to fill out the incorporation information online, just so she wouldn’t type in anything incorrectly. The whole thing took about 10 minutes Amazingly neither A&P nor I broke any law in Canada, Belize, Singapore or the United States. The company required, in compliance with international legal standards, that I e-mail it a notarized copy of my passport, driver’s license and some other identity documents. But a company representative also reassured me that these would not be visible to any tax authority. Just before they processed the paperwork, I explained that I was a journalist working on an article about offshore tax havens, and I haven’t heard from them since. (A representative from A&P declined to comment for this article, but he did note in an e-mail that the company was still “happy to serve [me] as a client.”)

Setting up an account may be easy, but managing one is expensive. Following the law requires a team of lawyers and accountants to carefully monitor tax laws in dozens of countries and maintain accounts that stay on the safe side of confusing rules. It’s not really worth the cost for anyone other than wealthy investors looking to put aside money, tax-free, for future generations. Or for large multinationals who prefer to centralize their global cash-flow stream in a place that doesn’t tax corporations or require a lot of financial reporting. Why would a huge company like G.E. want to pay U.S. taxes every time its Spanish subsidiary sells parts to a company in Belarus when it could avoid them by incorporating offshore? It’s easy to imagine that most other kinds of offshore activity are shady, but there is no definitive way to know, because we don’t even know how much money is in these centers. The estimates, however, are striking. The Bank for International Settlements, which collects voluntary reports from banks in 44 countries, offers the best single source of data. It counts around $31 trillion of foreign-owned assets in the world’s banks and estimates that about $4 trillion is in offshore financial centers. An estimated $1.5 trillion is in the Cayman Islands alone. The country of 52,000, which is about the size of Blaine, Minn., has more foreign-owned deposits than Japan or the Netherlands. By the B.I.S.’s own estimation, the data — which do not include reports from Belize, the Seychelles and other offshore havens — are quite incomplete. The Tax Justice Network, a global research firm that advocates against such havens, suggests that the amount hidden offshore is between $21 trillion and $32 trillion. If properly taxed, that could yield more than $200 billion in revenue around the world. Furthermore, because a 2010 McKinsey & Company report estimated the world’s financial assets at about $200 trillion, somewhere around 10 percent or more of the world’s wealth is effectively invisible. And it’s also almost certainly in the hands of the people and institutions that most actively influence major investment decisions.

MORE ON THE REGULATIONS.....

*******************************************************

Adam Davidson is co-founder of NPR's “Planet Money,” a podcast, blog and radio series heard on “Morning Edition,” “All Things Considered” and “This American Life.”

Demeter

(85,373 posts)Economist Woody Brock says that a nation’s GDP growth is based mainly on whether or not it follows the rule of law. Economist and investment adviser John Mauldin notes:

One of the very real problems we face is the growing feeling that the system is rigged against regular people in favor of “the bankers” or the 1%. And if we are honest with ourselves, we have to admit there is reason for that feeling. Things like LIBOR are structured with a very real potential for manipulation. When the facts come out, there is just one more reason not to trust the system. And if there is no trust, there is no system.

Dr. Brock is not alone. Economists have thoroughly documented that failure to enforce the rule of law leads to a loss of trust … which destroys economies.This is true whether it is in the West, in Nigeria or any other country.

We’re Number … What?

Economic historian Niall Ferguson notes:

It’s an astonishing yet scarcely acknowledged fact that on no fewer than 15 out of 15, the United States now fares markedly worse than Hong Kong. In the Heritage Foundation’s Freedom Index, too, the U.S. ranks 21st in the world in terms of freedom from corruption, a considerable distance behind Hong Kong and Singapore. [Transparency International puts the U.S. at 24th.]

Perhaps the most compelling evidence of all comes from the World Bank’s Indicators on World Governance, which suggest that, since 1996, the United States has suffered a decline in the quality of its governance in three different dimensions: government effectiveness, regulatory quality and the control of corruption.

Compared with Germany or Hong Kong, the U.S. is manifestly slipping behind.

Indeed – as we’ve extensively documented – the rule of law is now as weak in the U.S. and UK as many countries which we would consider “rogue nations”. MULTIPLE SUPPORTING LINKS AT SOURCE This is a sudden change. As famed Peruvian economist Hernando de Soto notes:

In a few short decades the West undercut 150 years of legal reforms that made the global economy possible.

How Did We Slip So Fast?

Of course, the repeal of the basic laws which enforced the rule of law among financial players is a part of the problem. Virtually everyone – other than those currently working for the big banks or on their payroll – is calling for reinstatement of the separation between banking and speculative gambling. Free market libertarians – like everyone else – are demanding prosecution of criminal fraud using basic fraud laws. Yet the government has made it official policy not to prosecute fraud. People have lost trust in the system, because government corruption is as widespread as Wall Street corruption … and many of those in power in D.C. have the same sociopathic traits as those they supposedly regulate on Wall Street. And as Professor Ferguson notes, draconian national security laws are one of the main things undermining the rule of law:

Of course, many of this decades’ national security measures have not been taken to keep us safe in the “post-9/11 world” … indeed, many of them started before 9/11. And America has been in a continuous declared state of national emergency since 9/11, and we are in a literally never-ending state of perpetual war. LINKS In fact, government has blown terrorism fears way out of proportion for political purposes, and “national security” powers have been used in many ways to exempt big Wall Street players from the rule of law rather than to do anything to protect us.

Is it any wonder that we’re still in an economic crisis?

Demeter

(85,373 posts)

Demeter

(85,373 posts)A LIST OF THE ELITE WHO WANT TO DO US IN....AND WHAT THEY SAY

Roland99

(53,342 posts)DOW +0.0%

NASDAQ +0.2%

Demeter

(85,373 posts)Probably fear (hope) of a shooting war in the Middle East....

Roland99

(53,342 posts)Perhaps it's dropping due to the claim that Egypt is apparently brokering a cease-fire?

xchrom

(108,903 posts)

Demeter

(85,373 posts)It really doesn't matter which day it is, anymore. They are all work days, and they bring no progress. Just standing still is taking all the strength I've got. I hope it's externally caused, and not just sign of the inevitable decrepitude of life.

xchrom

(108,903 posts)Instead of pleasure.

And it seems like there is no time for anything.

xchrom

(108,903 posts)Moody's credit rating agency has stripped France of its coveted AAA rating and declared that the country's economic outlook remains "negative".

In what will be a severe blow to Socialist president François Hollande, the agency said it was reducing the country's rating from AAA to AA1, claiming France's ability for economic growth was being hampered by "structural challenges" including its lack of competitiveness, high unemployment, public debt and market rigidity.

It said it was not confident Hollande's government could – or would – introduce the necessary structural reforms and spending cuts to improved its rating in the medium term and expressed concern over France's exposure to risks from other ailing eurozone countries.

Moody's decision follows Standard & Poor's downgrading of France's rating a notch in January.

xchrom

(108,903 posts)Casino magnate Steve Wynn is cashing in some chips as he bets the row over the fiscal cliff in Washington will cost shareholders dear next year. He is not alone.

Tomorrow Wynn Resorts will pay out a $750m special dividend to shareholders as the company tries to get ahead of possible rule changes that could increase taxes on dividends. Wynn, who last year accused president Barack Obama of conducting "class warfare" against the rich, looks set to be joined by a record number of company bosses making payouts ahead of possible tax hikes.

Others including HCA Holdings, the world's largest private healthcare operator, chemicals firm LyondellBasell and asset manager Waddell & Reed, have all announced special dividend payments ahead of the year end.

Obama and Republican leader John Boehner are currently trying to forge a compromise over the fiscal cliff, the year-end expiration of Bush-era tax cuts and the imposition of deep spending cuts aimed at tackling the US's $16tn debts. Unless Congress reaches a deal by the end of the year, dividend taxes will rise from 15% to 43.4%.

xchrom

(108,903 posts)SPIEGEL: Mr. Sinn, Chancellor Angela Merkel feels as though economists have left her in the lurch. She once said that the advice that she receives from economists is "about as diverse as it gets." Can you see where she is coming from?

Sinn: No.

SPIEGEL: Excuse me? Economists have completely different ideas about how the euro can be saved. You suggest, for example, that countries should temporarily leave the euro zone until they have re-established their competitiveness. Others, by contrast, recommend collectivizing debt across the euro zone. How should politicians deal with such contradictory advice?

Sinn: There are differences in the recommended therapies, but fewer divergences in the analysis. There is considerable agreement today on the euro's defects.

SPIEGEL: But not on how the euro can be saved, or even whether it should be.

Sinn: I hope that it can be fixed. The euro crisis proceeds in phases, and we are always told that there is no alternative to the next phase, because otherwise the euro would crumble. So there was supposedly no alternative when the European Central Bank (ECB) granted its TARGET loans, when it forced the German central bank, the Bundesbank, to purchase sovereign bonds from Southern European countries against its will, and when increasingly larger rescue funds were approved. Now, they are planning to create a banking union to socialize the debts of banks in Southern Europe. The next step will be the introduction of euro bonds …

xchrom

(108,903 posts)Have you ever wished there was a set of standards by which budgets could be assessed that didn’t have to do with deficit hawks and stimulus sparrows pecking each other’s eyes out in the constricted ring of corporate opinion?

A noble little park opened in New York City last month: Four Freedoms Park. In the coverage of the Louis Kahn structure (which seems to rise like a ship out of Manhattan's East River), remarkably little was made of the title. From Franklin Delano Roosevelt’s address to Congress in 1941, “the Four Freedoms” are core requirements for humane political and economic existence:

“For there is nothing mysterious about the foundations of a healthy and strong democracy,” said Roosevelt. “The basic things expected by our people of their political and economic systems are simple. They are: Equality of opportunity for youth and for others. Jobs for those who can work. Security for those who need it. The ending of special privilege for the few. The preservation of civil liberties for all. The enjoyment of the fruits of scientific progress in a wider and constantly rising standard of living.”

The “four freedoms” FDR named (which would eventually be incorporated into what became the Universal Declaration of Human Rights), were freedom of speech and expression, freedom of worship, freedom from want, and freedom from fear. The last of those FDR defined as “a world-wide reduction of armaments to such a point and in such a thorough fashion that no nation will be in a position to commit an act of physical aggression against any neighbor--anywhere in the world.”

xchrom

(108,903 posts)Hotler

(11,452 posts)mahatmakanejeeves

(57,664 posts)Just when you thought it couldn't get any worse.

HP Alleges Fraud In Autonomy Deal; Takes $8.8B Charge; Shrs At 10-Year Low (Updated)

http://www.forbes.com/sites/ericsavitz/2012/11/20/hp-alleges-fraud-in-autonomy-deal-takes-8-8b-charge/

Eric Savitz, Forbes Staff

Covering the intersection of tech and investing.

CIO Network |11/20/2012 @ 7:47AM

Hewlett-Packard this morning asserted that there were substantial instances of financial fraud in connection with its acquisition of the software company Autonomy in 2011 for more than $10 billion.

The company also reported October quarter profits slightly ahead of Street estimates, but cautioned that January quarter profits will be below consensus estimates.

Specifically, HP today disclosed $8.8 billion in non-cash charges “linked to serious accounting improprieties, disclosure failures and outright misrepresentations at Autonomy … that occurred prior to HP’s acquisition of Autonomy and the associated impact of those improprieties, failures and misrepresentations on the expected future financial performance of the Autonomy business over the long-term.” In effect, the company is writing down close to 90% of the value of the transaction.

....

HP this morning is down $1.52, or 11.4%, to $11.78. The stock now trades at the lowest level since 2002.

So, where is the bottom? Is there one?

Demeter

(85,373 posts)Any lower than that, and we've lost the talent for tools....

Demeter

(85,373 posts)The self-interest of the alcoholic is to keep drinking. Is this truly in his best interests? The answer illuminates the pathology of power in America.

If we ignore the lip-service showered on "reform," we find that there is really only one strategy in America: extend and pretend. Individuals, households, communities, cities, states, enterprises and the vast sprawling Empire of the Federal government and its many proxies--all are engaged in extend and pretend.

The closest analog is a seriously ill alcoholic who tells himself he just has a hang-over when it's abundantly clear he is suffering from potentially terminal cancer. With a hang-over, extend and pretend is the only strategy that works: you can try various "magic potions" to relieve the symptoms, but the only real cure is to give the body enough time to cleanse itself of the toxins you've created and pretend to be functioning in the meantime. In the case of aggressive cancer, then extend and pretend is the worst possible strategy: ignoring the rapid progression of the disease only makes eventual treatment more difficult and uncertain. The only way to treat cancer is to face it straight-on, learn as much as you can about the disease and the spectrum of treatments, consider the side-effects and consequences of various treatment strategies, and then get to work radically transforming your entire life, mind, body and spirit to effect the cure. Why do we perpetrate the delusion of a hang-over when it's painfully clear we have cancer? We're afraid, of course; we fear the unknown and find comfort in the belief that nothing has to really change. We call this denial, but it arises from fear and risk aversion.

In the moment, amidst all the swirling chaos of fear and uncertainty, we choose extend and pretend because it seems to be in our self-interest. This is the ontology of extend and pretend: a delusional view of our self-interest. The drunk is terrified of not being able to drink himself into a stupor; in that dysfunctional state of being, then he perceives his self-interest as denying he has cancer because he knows that treatment will require him to stop drinking. In effect, what he perceives as acting in his self-interest is actually an act of self-destruction. Political and social revolutions occur when the productive classes realize the Status Quo no longer serves their self-interests. In other words, the revolution is first and foremost an internal process of recognition and enlightenment: all the propaganda issued by the Status Quo, i.e. that it serves the best interests of the productive classes, is finally recognized as false. As this awakening begins, a divergence between the definitions of self-interest by the Power Elites (financial and political) and the productive classes begins to open. This is extremely dangerous to the Power Elites, who are fundamentally parasitical and predatory: their wealth and power all flow from the labor, taxes, debt service and passivity/complicity of the productive classes.

.......................................................................................

The Power Elites' time-honored strategy to protect their own wealth and grip on power has three components: one is to pursue a strategy of pervasive, ceaseless propaganda to persuade the productive classes that the system is sound, fair and working for them; the second is to fund diversionary "bread and circuses" for the potentially troublesome lower classes, and the third is to harden the fiefdoms of power and wealth into an aristocracy that is impervious to the protests of debt-serfs and laborers below. In addition to "the system is working for you" social control myth, the wealth/power aristocracy also invokes various fear-based social control myths: external enemies are threatening us all, so ignore your debt-serfdom and powerlessness, etc. In the ideal Power Elite scenario, a theocracy combines faith and State: not only is it illegal to resist the Aristocracy, you will suffer eternal damnation for even thinking about it.

Ask yourself this: how much influence do you as a citizen, voter and taxpayer have over the Federal Reserve? If we're honest, we must confess that the Federal Reserve is as remote to us as any branch of the North Korean government: we have zero influence over it, and the same can be said of our elected representatives. This is the definition of an aristocracy, oligarchy (a power structure in which power is held by a small number of people), kleptocracy, etc. The Power Elite has a key advantage over the citizenry: its own self-interest is clear. The citizenry must entertain this question: is the Status Quo really working for me or not? The Power Elite aristocracy has no such confusion: the Status Quo is working beautifully for them, and the only threat to their wealth and power is the possibility that the productive classes might opt out and stop paying the taxes and debt service which funds the parasitical Power Elite. Thus the Power Elite has a single goal: to persuade and coerce the citizenry into accepting their powerlessness and debt-serfdom as a pathological form of self-interest.

There is another dynamic to the Power Elite aristocracy's grip on concentrated wealth and power: the self-selecting, self-perpetuating pathology of the aristocracy and the Upper Caste that so slavishly serves them. Author Chris Sullins identified this dynamic as one of self-propagating fractals (The MacRib is Back! September 23, 2008):

Once a populace accepts a self-definition that strips out their participation as anything but passive consumers, then the maintenance of power boils down to test-marketing new social control myths and fear-mongering. This sophisticated level of marketing and predation requires a highly trained class of servants: an Upper Caste of technocrats, middle managers, marketers, lobbyists, "creatives," engineers, etc. who do the heavy lifting that keeps the Power Elite's wealth and status not just intact but expanding. The reward for this service is a hefty salary that enables the purchase of the signifiers of upper-middle class existence and an intoxicating proximity to power and status visibility, i.e. some measure of recognition as "being somebody important." Until very recently I reckoned this Upper Caste of loyal servants comprised about 20% of the American populace, but upon closer examination of various levels of wealth and analysis of advert targeting (adverts only target those with enough money/credit to buy the goods being offered), I now identify the Upper Caste as only the top 10% (the aristocracy is at most the top 1/10th of 1%). Wealth and income both fall rather precipitously below the top 10% line, and as globalization and other systemic forces relentlessly press productivity into fewer hands, then the rewards aggregate into a smaller circle of laborers. As noted yesterday in Social Fractals and the Corruption of America (February 8, 2012), you cannot aggregate healthy, thrifty, honest, caring and responsible people into a group that is dysfunctional, spendthrift, venal and dishonest unless those individuals have themselves become dysfunctional, spendthrift, venal and dishonest. This is the ontology of the pathology of power: If you want to join the elite levels of the Upper Caste, where "doing God's work" is a daily practice of fraud, embezzlement, misrepresentation, collusion, purposeful obfuscation, all in service of a pathologically self-destructive notion of self-interest, then you must become dysfunctional, venal and dishonest (with becoming spendthrift in service of acquiring signifiers of status a close fourth).

Since non-pathological people will quit or be fired, then these fractals of corruption are self-selecting and self-perpetuating. This is true not just of financial America but of elected officialdom. Anyone who is still naive or delusional enough to think that getting elected to Congress or the state legislature will empower "doing good" will soon learn the ropes: the next election is less than two years away, and if you want to retain your grip on power you're going to need a couple million dollars. And if you want to "get something done," you will need to take orders from your party leadership and service your donors.

MORE

ANOTHER GEM FROM THE PAST--FEBRUARY, TO BE EXACT

Demeter

(85,373 posts)...workers need more than coffee to see them through. They

need wages and pensions. How big do they need to be? In a time of

drooping wages and wavering pensions, we need to know. Let’s approach the wages, retirement and pension discussion by simplifying it as much as possible. Let’s assume that the work life extends from age 20 to 60. The work that people do before and after those ages is balanced by people who are not able to work at all, for whatever reason. We’re talking averages here, spread across 33 million Canadians. So for half your life you work, and for half (birth to 20, and 60 to 80) you don’t. As you can see, on average every person working must earn double what it costs him to live. That extra money pays for the child the worker is before he goes to work, and the senior he is afterwards. For the population of Canada to stay level, each Canadian must raise one child, and he must support himself once he retires. What it costs to do that is the “lifetime wage.”

How can we calculate that?

Well, to start we can set a lower limit. Each individual must earn or

somehow acquire no less than what he needs to stay alive. A rough

guess for that number is around $800/month. That’s in the range of

what single welfare recipients receive. I have no idea how they live

on that, but thousands of them do. Full time minimum wage is roughly double that, about $1600/month before taxes, about $1350 after. (Manitoba minimum wage currently $10/hour.) This is still not enough to be a lifetime wage. Also, most minimum wage jobs are not full time or continuous employment, so the effective income from minimum wage employment is closer to welfare rates.

Canadians are being exhorted to live responsibly, only bearing

children if they can afford to raise them, saving for their education

and also for the their own retirement. The smallest sufficient income

to accomplish this seems to be about double current minimum wages, or about $20/hour in Manitoba, $35,000 to $45,000 per year averaged over a working life. Business won’t pay such wages if they aren’t forced to. But somebody must. Why? Not for moral reasons, we’re not dealing with morality here, just practicality. Whatever way you try to jig the numbers, half the population depends on the other half just to live. In a nation, these life-stages overlap so the burden levels out over time, but effectively one half is always supporting the other.

Paying out to each worker less than double the bare cost of living in

a closed system will result in collapse or shrinkage of the system.

But suppose you don’t treat your nation as a closed system? Maybe you can outsource some of the cost at the two “nonproductive” ends of the lifespan. If you want to cut your costs to the bone so your workers

can be paid only their immediate costs of living, you have to tackle

the problem at the child end and the senior end.

At the child end, you can outsource the production of new workers to

other, poorer countries – i.e. depend on immigration for population

growth. That’s one thing Canada is doing...The hard lifting of childbirth and childrearing and child mortality was done by other countries with no cost to Canada. In fact, immigrants pay a small but significant landing fee, $500 to $1000 depending on entry class. We further maximized the value of the outsourced new citizens by selecting capable applicants free of serious medical problems.

At the senior end of the lifespan, you can cut elder supports as much

as possible. This is harder to do because elders are aware of the

process and often have younger relatives to advocate for them, but

though it’s going slowly, it is a work in progress. A maximally efficient economy in a non-closed system would be one where you import all your workers, keep them as long as you need them, and repatriate them afterwards. But that is not a nation. Nations grow their own people, they don’t rent them.

ANOTHER KEEPER-IT CUTS THROW ALL THE BS

MORE AT LINK

Demeter

(85,373 posts)Looking for a new place to call home? Spain is hoping to give you a little bit more than a welcome basket of baked goods if you decide to move there. In an attempt to reduce the country's bloated stock of unsold homes, the government is set to offer permanent residency to any foreigner provided they buy a house or apartment worth more than €160,000 ($200,000). The plan, unveiled by Trade Ministry secretary Jaime Garcia-Legaz Monday and expected to be approved in the coming weeks, would be aimed principally at Chinese and Russian buyers. Spain has more than 700,000 unsold houses following the collapse of its real estate market in 2008 and demand from the recession-hit domestic market is stagnant.

Prime Minister Mariano Rajoy stressed Monday that the plan has not yet been finalized, but added that Spain "needs to sell these homes" and that getting them off the market could help revive the nation's devastated construction industry. The plan to unload the unsold homes comes as thousands of houses have been repossessed by banks and their owners evicted because they cannot pay their mortgages. The government last week approved a decree under which evictions would be suspended for two years in specific cases of extreme need.

The country's residency offer would beat others in bailed-out countries such as Ireland and Portugal, where residency papers are offered to foreigners buying houses worth more than €400,000 and €500,000, respectively. However, Latvia on the Baltic coast offers a cheaper deal, with property buyers eligible to receive residency permits if they purchase real estate in the capital Riga worth €140,000 or €70,000 in the countryside.

xchrom

(108,903 posts)Investors appear to have taken Moody's decision to downgrade France's credit rating after the markets closed on Monday night in their stride; but it has intensified the focus on the eurozone's second-largest economy, after the International Monetary Fund warned that the country must undertake radical reforms or face the fate of chronically uncompetitive Spain or Italy.

Finance minister Pierre Moscovici told reporters on Tuesday morning that Moody's decision was a condemnation of the Sarkozy government's policies, not an assessment of the Hollande regime's approach.

That's the classic, kneejerk response of a new government – but the Hollande regime is right not to accept unquestioningly the markets', or the IMF's, prescription for so-called "structural reform" – an anodyne phrase that can disguise wrenching social and economic changes better phased in over years than imposed at the stroke of a pen from the Elysée.

France may be losing ground against Germany, not least because of German workers' masochistic willingness to accept repeated cuts in their real take-home pay in exchange for job security. And there are deep problems with the insider-outsider culture in France that means kids growing up in les banlieues have little chance of breaking through into the economic mainstream.

xchrom

(108,903 posts)Several plausible reactions stalk David Cameron's pledge to put "growth first" and by implication, everything else, like people and the environment, second. Firstly, blaming regulation for holding back what would otherwise be a more dynamic economy, is a neat political distraction from the obstacle represented by the government itself. For example, clinging to George Osborne's loved but laughable strategy of "expansionary fiscal contraction" proved to be a failure.

In slashing spending within the public sphere he failed to understand the degree to which the private sector depended on it. Second, in spite of substantial public ownership of the banks, and even more substantial public financial support, the coalition has failed to make them redesign their lending strategies to support a productive economy.

By criticising the checks and balances that still apply to the market system the government pulls off a perfect political trick. It uses the strategy – employed more readily by economic conservatives since the collapse and public bailout of financial markets in 2008 – of using the very failure of those deregulated markets as an excuse to promote them more deeply into our lives. Evidence appears irrelevant to this case, as few in the private sector put planning problems anywhere near the top of the business snag list.

The second reaction to Cameron's comments is simply: "what's new". Even back in January 2011 the prime minister said: "It is a new year and this coalition government has one overriding resolution, and that is to help drive growth." We've heard the rhetoric of "growth first" for decades, in spite of plenty of evidence that in countries like the UK it long ago failed to deliver higher life satisfaction.

xchrom

(108,903 posts)Housing starts in October unexpectedly climbed to a four-year high, indicating further improvement in U.S. residential construction.

Starts rose 3.6 percent to a 894,000 annual rate, the fastest since July 2008 and exceeding all estimates in a Bloomberg survey, Commerce Department figures showed today in Washington. The median estimate of 82 economists called for starts to fall to a 840,000 pace. Building permits, a proxy for future construction, eased after surging the previous month.

Record-low mortgage rates and a lower risk that property values will keep falling may continue to attract buyers, giving the economy a lift and benefiting companies such as Toll Brothers Inc. (TOL) Federal Reserve Chairman Ben S. Bernanke is among policy makers who have singled out housing as one of the industries to nurture in order to spur the economic recovery.

“Housing is absolutely going in the right direction,” said Harm Bandholz, chief U.S. economist at UniCredit Group in New York, who projected 870,000 starts at an annual rate. “Excess supply has been wound down and there’s a steady increase in demand. That’s good for construction.”

Demeter

(85,373 posts)Allow the desperate to cannibalize the empty housing stock for recyclables, and Voila! Housing shortage! Price Booms! Rising tide lifts all boats.

The TBTF live to spawn (blow??) another bubble.